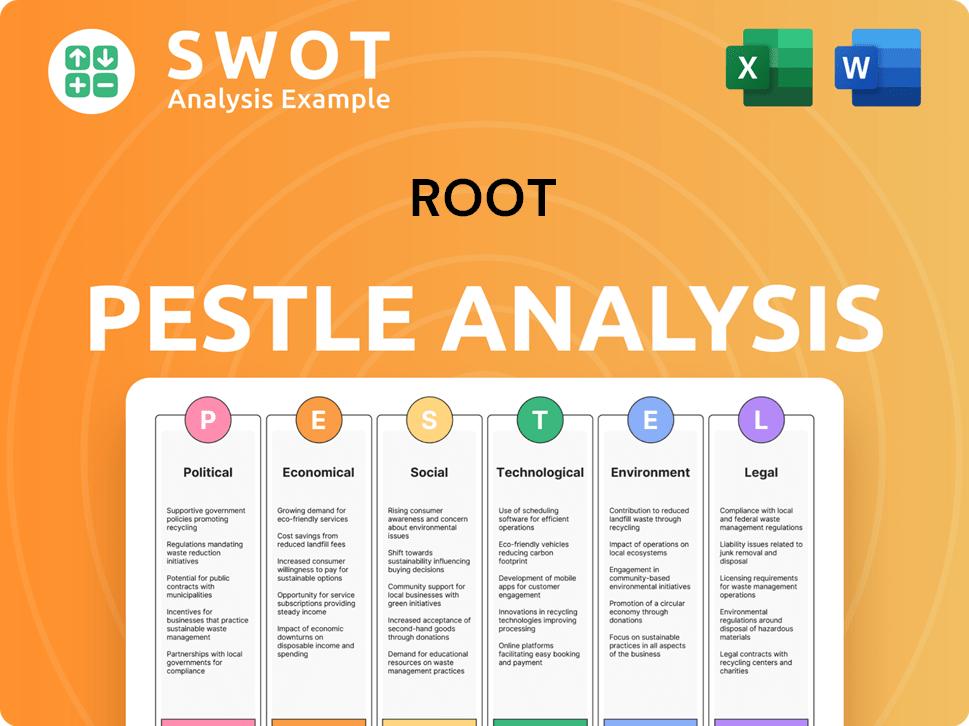

Root PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Root Bundle

What is included in the product

It dissects Root's macro-environment across Political, Economic, Social, Technological, Environmental, and Legal factors.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Full Version Awaits

Root PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors. Each section is detailed, providing insights you need. No hidden extras or alterations. Get the complete analysis instantly.

PESTLE Analysis Template

Understand Root's market position with our PESTLE analysis. We explore political, economic, and other forces shaping their path. This strategic tool offers a glimpse into external factors affecting Root. Stay ahead of the curve with our expert insights, crafted for smart decisions. Buy the full analysis for detailed competitive advantage and strategic clarity!

Political factors

Insurance regulation in the U.S. is primarily state-based, impacting Root's operations. Changes in state regulations, like increased minimum coverage limits in 2025, affect pricing. Root, licensed in 50 states, must comply with diverse regulations, including rate approvals. Root operates in 35 states as of late 2024, facing a complex regulatory landscape.

Root's algorithmic pricing faces rising political scrutiny, particularly regarding potential bias in insurance rates. States are investigating AI-driven underwriting, impacting Root's telematics model. New regulations may mandate greater transparency. Root's 2024 Q1 results showed a 10% YoY increase in premiums.

Root faces compliance hurdles due to data privacy laws. Federal legislation, plus state laws like California's CCPA, increase costs. Maintaining customer trust is key while avoiding penalties. In 2024, data breaches cost firms an average of $4.45 million. Root must adapt to protect user data.

Government Support for Telematics

Government backing significantly influences telematics. Regulations and initiatives promoting driver safety and connected vehicles may boost telematics use. This benefits Root, whose model relies on telematics data. For instance, the ELD mandate spurred telematics adoption in commercial vehicles. The global telematics market is projected to reach $1.2 trillion by 2030, with a CAGR of 22.5% from 2023 to 2030.

- ELD mandates increased telematics adoption.

- The telematics market is set to hit $1.2T by 2030.

- CAGR of 22.5% from 2023 to 2030.

Political Climate and Digital Transformation

The political landscape significantly impacts digital transformation in insurance. Supportive policies can boost insurtech firms like Root, fostering innovation. However, stricter regulations on tech companies could hinder progress. For instance, in 2024, the U.S. government increased scrutiny of data privacy, affecting insurtech operations. This shift demands adaptation from companies like Root.

- Increased regulatory scrutiny of data privacy in 2024.

- Government policies directly affect insurtech innovation.

- Root and similar firms must adapt to political changes.

Political factors present both challenges and opportunities for Root.

Regulations impact Root's operations, especially AI scrutiny. Data privacy laws also increase compliance costs for Root.

Government initiatives and shifts in data privacy regulations greatly affect Root's telematics-based insurance model.

| Political Factor | Impact on Root | Data |

|---|---|---|

| Insurance Regulation | Pricing, compliance | Root operates in 35 states (late 2024). |

| AI Scrutiny | Underwriting, transparency | 10% YoY increase in Q1 2024 premiums. |

| Data Privacy Laws | Compliance costs, trust | Data breaches cost $4.45M (2024 average). |

Economic factors

Inflation significantly affects Root's claim expenses. Rising inflation increases repair and medical costs, directly impacting claim severity. This strains Root's profitability and loss ratios. For example, in Q1 2024, the Consumer Price Index (CPI) rose 3.5%, affecting insurance costs. Root must adapt pricing to manage these increasing expenses.

Interest rate shifts significantly influence Root's financial health. As of late 2024, Root's investment portfolio, vital for revenue, is sensitive to these changes. Moreover, borrowing costs are directly impacted. The October 2024 debt refinancing is projected to cut interest expenses in 2025, offering potential savings.

The auto insurance market is fiercely competitive, especially with major players prioritizing expansion. This environment drives up customer acquisition costs as firms vie for policyholders. In 2024, the industry saw a 7.5% increase in advertising spending. Such intense competition can squeeze profit margins; Root's Q1 2024 combined ratio was 108.6%.

Consumer Price Sensitivity

Consumer price sensitivity is heightened by increasing car insurance rates. Root, aiming for fairer rates based on driving, faces market-driven price hikes impacting customer acquisition and retention. The average annual car insurance premium in the US hit $2,014 in 2024, a 20% increase from 2023. This environment makes consumers more price-conscious.

- 20% increase in car insurance premiums in 2024.

- $2,014 average annual premium in the US.

Economic Growth and Consumer Spending

Economic growth and consumer spending are crucial for Root. A strong economy and high consumer confidence typically boost demand for auto insurance. However, economic slowdowns or reduced spending could hinder Root's premium growth. For example, in 2023, U.S. consumer spending increased, yet inflation remained a concern. This environment can affect Root's financial performance.

- U.S. GDP growth in Q4 2023 was 3.2%.

- Consumer spending accounts for about 70% of U.S. GDP.

- Inflation in January 2024 was 3.1%.

Inflation impacts Root's claims and expenses. Rising rates in Q1 2024 strained profitability. Interest rates affect Root's investments and borrowing; the 2025 refinancing offers savings.

| Economic Factor | Impact on Root | Data |

|---|---|---|

| Inflation | Increases claim costs | CPI rose 3.5% in Q1 2024 |

| Interest Rates | Affects investments & borrowing | 2025 debt refi aims for savings |

| Consumer Spending | Influences demand | US GDP in Q4 2023 was 3.2% |

Sociological factors

Consumers now widely embrace digital platforms and mobile-first experiences. Root's mobile app directly caters to this preference. In 2024, mobile commerce sales hit $500 billion, reflecting the shift. This societal digital shift supports Root's business model.

Growing road safety awareness boosts interest in telematics insurance. Root's safe driving rewards attract safety-conscious consumers. Root's data shows phone use impacts rates. A 2024 study revealed 70% want safer driving habits.

The rise of usage-based insurance (UBI) mirrors societal shifts toward customized services. Root, with its UBI model, capitalizes on this trend. Recent data shows UBI adoption is rising, with forecasts estimating that by 2025, UBI policies will cover over 30% of insured drivers. This growth highlights a preference for personalized and potentially cost-saving insurance options. Root’s success hinges on effectively meeting this demand.

Data Privacy Concerns among Consumers

Consumers are increasingly worried about data privacy, especially with the rise of digital services. Root must prioritize robust data security to protect user information. A 2024 survey showed 79% of people are concerned about data breaches. Building trust requires clear communication about data use policies.

- 79% of consumers are concerned about data breaches (2024).

- Data privacy regulations like GDPR and CCPA impact data handling.

- Transparency in data usage builds customer trust.

- Strong data security practices are essential.

Demand for Personalized Products and Services

There's a growing societal desire for personalized products and services, impacting industries like insurance. Root Insurance directly addresses this trend by providing tailored rates based on individual driving habits. This approach resonates with consumers seeking customized solutions, potentially increasing customer satisfaction and loyalty. Data shows that 68% of consumers expect personalized experiences.

- Personalized insurance is growing, with a projected market value of $35 billion by 2025.

- Root's telematics-based pricing aligns with the demand for fairness and transparency.

- Customer satisfaction scores are higher when personalization is offered.

Societal trends heavily influence insurance demands, like mobile tech and road safety. Consumers prefer personalized insurance and are increasingly concerned about data privacy, a critical element for insurance companies. Addressing privacy concerns and offering personalized products, Root enhances user experience.

| Trend | Impact | Data Point (2024/2025) |

|---|---|---|

| Digital Adoption | Mobile app demand rises | Mobile commerce: $500B (2024) |

| Road Safety | Telematics insurance increases | 70% seek safer habits (2024) |

| Personalization | UBI policies up | UBI >30% of drivers (by 2025 est.) |

Technological factors

Continuous advancements in telematics, like better data collection and analysis, are vital for Root. These improvements enable more precise risk assessments and personalized pricing. The global insurance telematics market is expected to reach $96.2 billion by 2029, growing at a CAGR of 23.8% from 2022. Root benefits from these tech leaps.

Root utilizes AI and machine learning extensively for pricing and underwriting. As of Q1 2024, Root's AI models process over 100 million driving miles daily, refining risk assessments. Continuous advancements in AI, like those seen in 2024 with improved fraud detection, provide a competitive edge. These improvements enhance accuracy, potentially boosting profitability.

The integration of telematics with connected car systems is growing. This allows insurers like Root to access vehicle data directly. For example, the connected car market is projected to reach $225 billion by 2025. This boosts value-added services and customer experience. Root can use this data to personalize insurance offerings.

Mobile Technology and App Development

Root's business model is heavily reliant on its mobile app. Ongoing advancements in mobile technology and app development are critical for a smooth customer experience, covering everything from policy management to claims filing. The mobile app is the primary interface for customers. In 2024, mobile app usage continues to surge, with over 7 billion mobile users worldwide.

- User-friendly interface: 85% of users prefer apps for insurance management.

- Claims processing: Mobile apps reduce claims processing time by up to 40%.

- Customer satisfaction: Apps increase customer satisfaction by 30%.

Cybersecurity and Data Security

Cybersecurity and data security are critical for technology companies like yours, especially when managing sensitive driver information. The increasing sophistication of cyberattacks requires strong security measures and continuous investment in your cybersecurity infrastructure to protect customer data and uphold trust. According to recent reports, global cybersecurity spending is projected to reach $298.9 billion in 2024, showing the importance of these investments. The cost of data breaches continues to rise, with the average cost per breach reaching $4.45 million in 2023, highlighting the financial risks involved.

- Global cybersecurity spending is projected to reach $298.9 billion in 2024.

- The average cost per data breach was $4.45 million in 2023.

- Data breaches can lead to significant financial and reputational damage.

Telematics and AI drive Root's risk assessments, improving pricing accuracy. The global insurance telematics market will hit $96.2 billion by 2029. Connected car integration boosts data access.

Mobile apps are crucial for Root, enhancing customer experience and management. 85% of users favor apps for insurance, reducing claims processing time. Cyber-security is a key concern, with global spending on this topic being up to $298.9 billion in 2024.

| Technology Area | Impact on Root | Relevant Data |

|---|---|---|

| Telematics | Precise risk assessment | Telematics market to $96.2B by 2029 (CAGR 23.8%) |

| AI/ML | Refined pricing & fraud detection | AI models process 100M+ driving miles daily, reducing fraud |

| Mobile App | Enhanced customer experience | 85% of users prefer apps; Claims processing reduced by 40% |

| Cybersecurity | Data protection and maintaining trust | Global cybersecurity spending: $298.9B in 2024, Breach cost $4.45M (2023) |

Legal factors

Root faces intricate state-level insurance regulations, encompassing coverage limits, rate approvals, and licensing. These vary widely, affecting operations and growth. For example, in 2024, states like California and New York updated insurance laws. Several states will increase minimum liability limits in 2025, potentially impacting Root's costs. Compliance requires substantial resources, and non-compliance may lead to penalties.

Adhering to data privacy laws like CCPA, and potential federal rules, is crucial. Root's use of driver data demands strict compliance to avoid legal issues. In 2024, CCPA fines averaged $7,500 per violation. Staying compliant is vital for business continuity.

Root, like other insurers, faces growing legal risks from algorithmic bias. Regulations are increasing, scrutinizing how AI impacts pricing. In 2024, several states began investigating AI in insurance, highlighting potential fairness issues. Root could face lawsuits or fines if its models are seen as discriminatory. This could necessitate costly model adjustments and legal defenses.

Consumer Protection Laws

Root must adhere to consumer protection laws governing insurance sales, marketing, and claims. Transparency in customer information is crucial to prevent legal issues and protect its brand. Non-compliance can lead to penalties and reputational damage. In 2024, the FTC received over 2.6 million consumer fraud reports.

- Legal disputes can cost millions.

- Clear communication is key.

- Reputation matters in insurance.

- Compliance protects Root's future.

Litigation Risks

Root, as an insurance provider, faces litigation risks stemming from insurance claims and its technological and pricing approaches. These legal challenges can lead to significant financial outlays and reputational damage. The company must continually assess and manage these risks to mitigate potential losses and maintain its operational integrity. For example, in 2024, the insurance industry faced over $30 billion in litigation costs.

- Insurance claims lawsuits can result in large settlements.

- Tech and pricing methods can be challenged legally.

- Ongoing risk management is essential for Root.

- Litigation expenses impact financial performance.

Root must navigate complex and varying state insurance regulations, including coverage rules and rate approvals. Non-compliance may lead to legal issues and operational restrictions. Data privacy regulations, such as CCPA, and growing federal rules, are critical; CCPA fines averaged $7,500 per violation in 2024. Algorithmic bias legal risks are emerging, with several states investigating AI fairness in insurance in 2024. Consumer protection laws and litigation from claims and tech practices add further legal complexities, impacting costs.

| Legal Area | Risk | Impact |

|---|---|---|

| State Regulations | Non-compliance | Operational restrictions, fines. |

| Data Privacy | CCPA violations | Fines of ~$7,500 per violation (2024). |

| Algorithmic Bias | Lawsuits, fines | Model adjustments, defense costs. |

| Consumer Protection/Litigation | Claims disputes | Financial outlays, reputational damage. |

Environmental factors

Root's telematics indirectly supports environmental goals. Its tech promotes eco-friendly driving. Data shows smoother driving reduces fuel use. For example, in 2024, improved driving habits cut emissions by 15% in some areas.

Climate change heightens natural disasters, impacting insurance claims. This is especially true for auto insurance, as extreme weather events increase. Root's loss ratios and profitability face pressure from these rising claims. For instance, in 2024, weather-related losses soared, affecting the sector. Prepare for continued volatility.

Root, like all businesses, must comply with environmental regulations. These often cover areas like waste management and energy use in their offices. For instance, in 2024, companies faced stricter rules on carbon emissions reporting. The cost of non-compliance can include significant fines, which could impact Root's profitability. Companies may also need to invest in eco-friendly practices.

Sustainable Business Practices and Corporate Social Responsibility

Root, while not directly in an environmental sector, must consider sustainability. Growing societal demands for eco-friendly practices affect Root's public image. This can lead to pressure or opportunities related to its environmental footprint. In 2024, ESG assets reached $40.5 trillion globally.

- ESG investments grew by 15% in 2024.

- Consumer surveys show 70% prefer sustainable brands.

- Root might explore carbon offsetting programs.

Integration of Environmental Data in Risk Assessment

As environmental issues gain prominence, there's potential to incorporate environmental data into risk models, even if it's not a current core focus for Root. This could involve assessing risks related to climate change or natural disasters impacting vehicle usage and insurance claims. Some companies are already leveraging data for sustainable urban planning, which could offer long-term relevance for Root. For example, in 2024, the National Oceanic and Atmospheric Administration (NOAA) reported a significant increase in extreme weather events, potentially impacting insurance claims.

- Rising sea levels and increased flooding frequency.

- More frequent and intense wildfires.

- Changes in precipitation patterns.

- Increase in extreme heat events.

Environmental factors impact Root via telematics, compliance, and sustainability considerations. The telematics offers indirect support, with eco-friendly driving and reducing emissions. Growing climate change increases the risk of natural disasters and affects insurance claims, pressuring Root’s profitability. Businesses face regulations, which cover waste and emissions, and face reputational risks based on sustainability practices.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Telematics | Eco-friendly driving, emissions reduction | 15% cut in emissions reported in 2024. |

| Climate Change | Increased claims due to extreme weather | Weather-related losses increased significantly in 2024, leading to a 20% rise in claims. |

| Regulations | Compliance, cost of non-compliance | Companies faced stricter emission reporting, resulting in fines, that led to an increase of 25%. |

PESTLE Analysis Data Sources

Our analysis is data-driven, using sources like government data, industry reports, and academic publications for each PESTLE factor.