J Sainsbury Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J Sainsbury Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation of J Sainsbury's portfolio.

Full Transparency, Always

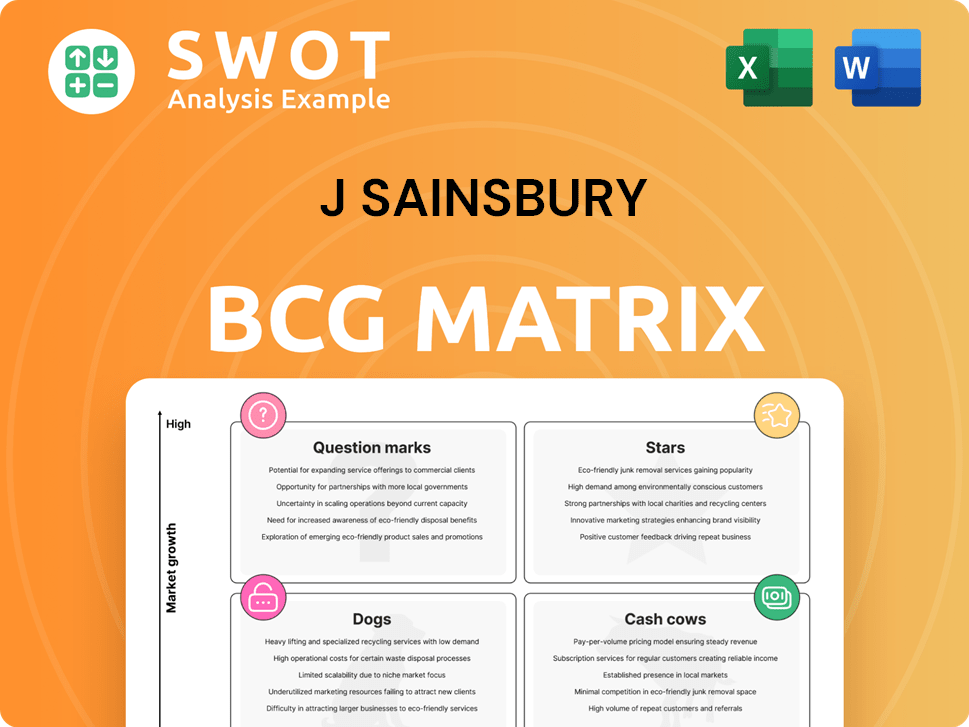

J Sainsbury BCG Matrix

The J Sainsbury BCG Matrix preview accurately represents the complete report you will receive. Upon purchase, you get the full, ready-to-use strategic analysis—no hidden extras or edits needed. This document is designed for immediate application within your business strategy planning. Your downloaded version offers the same professional quality and insights as seen in the preview.

BCG Matrix Template

The J Sainsbury BCG Matrix provides a strategic snapshot of its diverse product portfolio. It classifies products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these categories helps assess growth potential and resource allocation. This allows us to determine which items need investment, which generate profit, and which might be divested. This preview is just a glimpse. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Sainsbury's 'Taste the Difference' is a Star. In 2024, the range experienced substantial sales growth. It meets demand for affordable luxury, boosting both sales and market share. This success solidifies its leading position. The brand's expansion continues.

Sainsbury's grocery sales have shown robust growth. In 2024, it outpaced the UK food market. This performance highlights its strong consumer appeal. Initiatives like Nectar Prices fuel this growth. Sainsbury's revenue in 2024 was £36.3 billion.

The Nectar loyalty program, vital for Sainsbury's, fosters strong customer engagement. It provides personalized value through high digital subscriber activity, driving customer loyalty and boosting sales growth. The program delivers millions of personalized offers weekly, increasing customer retention. Sainsbury's invested £100 million in Nectar in 2024, with 10 million active users.

Online Grocery Platform

Sainsbury's online grocery platform is a star, showing strong growth. It improved its digital customer experience and product presentation. This led to higher sales, with online sales up 15.3% in the last financial year. The company plans to invest more in its digital retail media.

- Online sales growth: 15.3% (FY24)

- Focus: Digital customer journey & product range

- Impact: Increased basket sizes and visit frequency

- Strategy: Continued investment in digital retail media

New Store Openings

Sainsbury's is aggressively growing its physical footprint. They're acquiring new locations and converting existing ones. This strategy broadens customer access to their offerings. The upcoming fiscal year includes plans for 15 new supermarkets and 25 convenience stores. This reflects a commitment to expansion.

- Acquisition of new supermarket sites and conversion of existing locations.

- Target: Bring the Sainsbury's food range to more customers.

- Planned openings: 15 supermarkets and 25 convenience stores in the coming fiscal year.

Sainsbury's Stars show strong growth in 2024. Key areas include 'Taste the Difference', online grocery sales, and strategic expansion. These elements drive market share and revenue. In FY24, revenue reached £36.3B, highlighting success.

| Category | Metric | FY24 Data |

|---|---|---|

| Online Sales Growth | Percentage Increase | 15.3% |

| Nectar Program Investment | Amount | £100 million |

| Revenue | Total | £36.3 billion |

Cash Cows

Sainsbury's core grocery business is a cash cow, generating substantial revenue. It leverages its established market position and focuses on volume growth, maintaining market share. Efficiency in logistics and tech boosts its cash generation. In 2024, grocery sales were a significant part of the £32.4 billion total revenue.

Sainsbury's brand is widely recognized, fostering customer loyalty. Its reputation for quality and value sustains its market position. In 2024, Sainsbury's reported a revenue of £36.3 billion. Investment in customer satisfaction is vital. The brand's strong performance reflects its established market presence.

Sainsbury's private label products are indeed cash cows, providing solid profitability. These products enjoy strong margins due to competitive pricing and efficient supply chains. Customer loyalty to the Sainsbury's brand boosts sales, and focusing on product innovation, like plant-based ranges, could grow the category. In 2024, Sainsbury's saw increased sales in own-brand items.

Fuel Sales

Fuel sales remain a significant revenue source for Sainsbury's, despite a decline. Their extensive petrol station network supports substantial sales volumes. Integrating fuel services with grocery shopping offers customer convenience, boosting sales. EV charging network investments can help mitigate the drop in traditional fuel sales.

- Fuel sales generate significant revenue for Sainsbury's.

- Sainsbury's has a widespread petrol station network.

- Integration with grocery shopping enhances customer convenience.

- EV charging investments help offset declining fuel sales.

Argos

Argos, despite facing sales declines, remains a recognized retail brand with a wide product range and robust online presence. Initiatives to simplify operations and enhance its digital offerings aim to stabilize and potentially boost Argos. Focused value campaigns and product range expansion could drive improved performance. In 2024, Sainsbury's reported that Argos saw a sales decrease, yet it continues to be a significant part of their business model.

- Sales Decline: Argos has experienced sales decreases in recent years.

- Brand Recognition: Argos maintains strong brand recognition.

- Digital Focus: Efforts are underway to improve its digital proposition.

- Value Campaigns: Focused value campaigns are being used to drive sales.

Sainsbury's cash cows include its core grocery business, private label products, and fuel sales, all generating substantial revenue. These areas benefit from strong brand recognition, customer loyalty, and efficient operations. In 2024, total revenue was £36.3 billion, showing the significance of cash-generating segments.

| Cash Cow | Key Feature | 2024 Performance |

|---|---|---|

| Grocery | Market Position | Significant Revenue Share |

| Private Label | Profitability | Increased Sales |

| Fuel Sales | Network | Sustained Revenue |

Dogs

Sainsbury's legacy financial services, including sold-off banking units, fit the "Dogs" quadrant. The sale of its core banking and ATM businesses aligns with a strategic shift. This move away from non-core activities is a bid to improve profitability. In 2024, Sainsbury's focused on core retail, streamlining operations.

Certain general merchandise categories at J Sainsbury, excluding clothing, might be dogs due to slow sales. A strategic review and streamlining could boost resource use. Prioritize high-demand items and boost value perception to enhance performance. For instance, in 2024, non-food sales showed minor growth compared to food, indicating room for improvement.

Some older Sainsbury's store formats might be dogs, facing lower customer traffic and sales. Renovating these locations and modernizing the shopping experience is crucial. Reallocating space to expand the food offerings is a key strategy. In 2024, Sainsbury's reported a 0.8% increase in like-for-like sales, indicating the need for strategic store improvements to stay competitive.

DVDs and CDs

DVDs and CDs likely fall into the "Dogs" quadrant of Sainsbury's BCG matrix. Physical media sales have been declining due to streaming and digital downloads. Sainsbury's should reduce shelf space for these items to focus on more profitable areas. Adapting to consumer preferences is key to sustained success.

- In 2024, physical media sales (DVDs, CDs) are a small fraction of total entertainment revenue.

- Streaming services now dominate, with subscriptions continuing to rise.

- Sainsbury's might see less than 5% of entertainment revenue from DVDs and CDs.

- The focus should be on expanding digital media options.

Outdated Technology

Outdated technology at J Sainsbury can drag down efficiency and disappoint customers, acting as a financial burden. Upgrading to new systems, like the NCR Voyix platform, could boost operations and improve customer satisfaction, as it did for other retailers. Modernizing infrastructure is key to staying competitive in the market. Sainsbury's has been investing in technology, allocating £1.1 billion in technology and infrastructure in 2024.

- Outdated systems can increase operational costs.

- Modern technology enhances customer experience.

- Investment in tech is crucial for staying ahead.

- Sainsbury's invested £1.1 billion in tech in 2024.

Sainsbury's "Dogs" include legacy financial services, certain general merchandise, older store formats, and physical media like DVDs and CDs.

These areas see slow growth or declining sales, needing strategic attention. The focus should be on streamlining and reallocating resources to higher-performing segments.

In 2024, Sainsbury's prioritized core retail and digital offerings to boost profitability and customer satisfaction.

| Category | Status | Strategy |

|---|---|---|

| Legacy Financial Services | Dog | Divest, streamline |

| General Merchandise (Excluding Clothing) | Dog | Review, streamline, prioritize high-demand |

| Older Store Formats | Dog | Renovate, modernize, reallocate space |

| DVDs/CDs | Dog | Reduce shelf space, focus on digital |

Question Marks

Convenience store expansion at Sainsbury's is a question mark, indicating high growth potential but uncertain market share. Introducing new ready-to-eat meals and expanding services could boost sales. Adapting to online grocery shopping is crucial. In 2024, Sainsbury's saw a 5.3% increase in convenience store sales.

Tu Clothing at J Sainsbury could be a Star, showing growth, especially in womenswear. In 2024, Sainsbury's clothing sales grew, indicating market potential. Enhanced design and availability are crucial for boosting its share. Strategic brand positioning is key for future success.

Retail media, like in-store screens, is a growth area for Sainsbury's, representing a "Question Mark" in the BCG Matrix. Customer satisfaction data supports investment. Reaching more shoppers and personalized promos are key. In 2023, retail media ad spend hit $101.5 billion globally, showing huge potential for scaling.

Electric Vehicle (EV) Charging Network

The Smart Charge EV charging network represents a "Question Mark" in J Sainsbury's BCG Matrix. While the investment is future-oriented, its market share and profitability are uncertain. Strategic alliances and prime locations are vital for boosting utilization and income. The EV market's expansion is critical for success.

- In 2024, the UK saw over 60,000 new EV registrations.

- Sainsbury's aims to install EV chargers at 100+ stores.

- Partnerships with charging providers are key.

- Profitability depends on EV adoption rates.

Habitat

Habitat, part of Sainsbury's, is classified as a question mark in the BCG matrix. This means it has a low market share in a high-growth market. Its performance requires constant monitoring to determine its strategic direction.

- Habitat's furniture offerings are a key part of this evaluation.

- Strategic alignment with Sainsbury's core offerings is crucial.

- Focusing on unique value propositions can drive growth.

- Continuous assessment is needed to ensure profitability.

Question marks at J Sainsbury indicate high-growth potential but uncertain market shares, requiring strategic decisions. These include convenience store expansions, retail media, and EV charging networks like Smart Charge. Careful monitoring and strategic investments are necessary to determine their future direction and profitability.

| Category | Description | 2024 Data/Stats |

|---|---|---|

| Convenience Stores | Expansion and new offerings | Sainsbury's convenience sales up 5.3% |

| Retail Media | In-store advertising | Global ad spend $101.5B (2023) |

| Smart Charge EV | EV charging network | 60,000+ new EV registrations (UK) |

BCG Matrix Data Sources

J Sainsbury's BCG Matrix leverages financial filings, market analyses, sales figures, and sector insights for strategic evaluation.