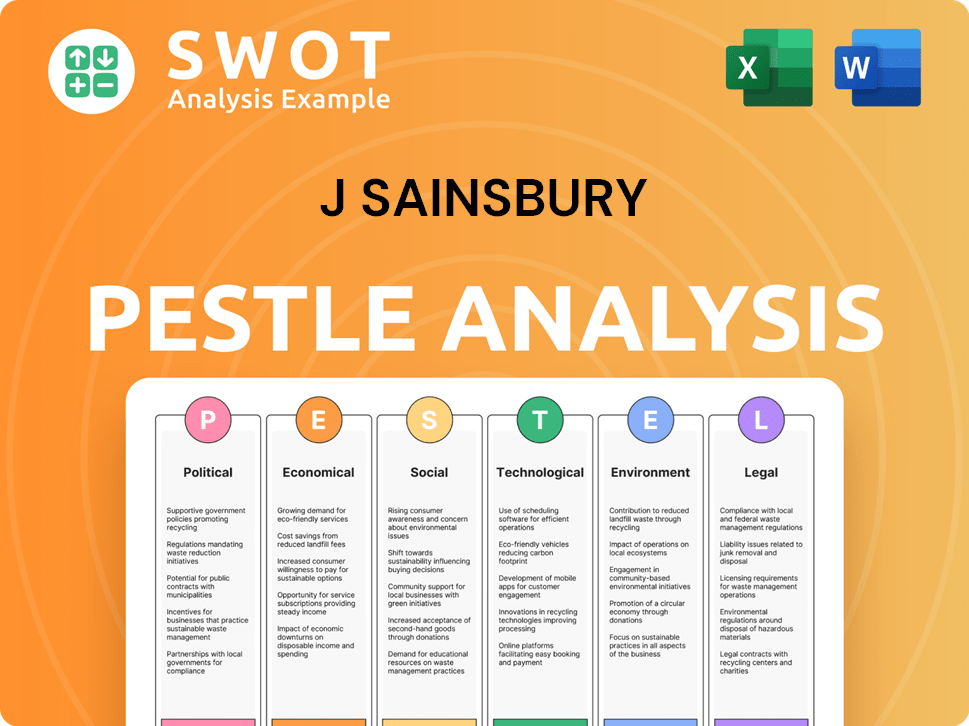

J Sainsbury PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J Sainsbury Bundle

What is included in the product

Examines J Sainsbury through Political, Economic, Social, Technological, Environmental, and Legal lenses.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

J Sainsbury PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Sainsbury's PESTLE analysis assesses Political, Economic, Social, Technological, Legal, and Environmental factors. You'll gain insights into its strategic landscape. Analyze how external forces impact the company directly. Buy with confidence!

PESTLE Analysis Template

Stay ahead of the curve with our exclusive J Sainsbury PESTLE Analysis. Uncover critical insights into the external factors impacting their strategy and performance. Explore political, economic, and social influences shaping their future. Identify opportunities and mitigate risks. Download the complete analysis now to gain a competitive edge.

Political factors

Government policies and regulations, such as taxation and labor laws, substantially affect the retail sector. Sainsbury's must adapt to changes in these policies, which influence costs and pricing. For example, in 2024, the UK's corporation tax rose to 25%, impacting profitability. Strategic planning necessitates staying informed about legislative shifts.

Political stability in the UK, crucial for Sainsbury's, affects its supply chain and import costs. Trade agreement uncertainties can cause sourcing volatility, impacting profits. The UK's trade with the EU, a major supplier, is vital. Sainsbury's must watch political shifts, like the 2024 elections, and their impact on trade deals. In 2024, food inflation in the UK reached 9.2%, influenced by trade factors.

Government initiatives on health and wellness significantly impact Sainsbury's. Regulations on food content and labeling, like those from 2024, require adjustments. Sainsbury's must align its product mix with health-focused campaigns. In 2024, the UK government invested £1.2 billion in public health programs, influencing consumer choices. Sainsbury's needs to adapt its marketing to reflect these initiatives.

Impact of the Autumn Budget

The Autumn Budget and other fiscal policies significantly influence retailers like J Sainsbury. Changes to corporation tax, business rates, and the minimum wage directly impact operating expenses and profitability. For example, the 2024 budget could adjust business rates, affecting Sainsbury's property costs across its vast store network. Analyzing these policies is crucial for accurate financial forecasting and strategic cost management.

- Business rates increases can raise operational costs.

- Minimum wage adjustments impact labor expenses.

- Tax changes affect overall profitability.

Relationship with Regulatory Bodies

J Sainsbury's navigates a complex regulatory landscape, with the Competition and Markets Authority (CMA) playing a crucial role. The CMA's decisions on market competition, mergers, and consumer protection directly impact Sainsbury's. A good relationship with regulatory bodies is essential for strategic planning and market positioning. Sainsbury's must comply with evolving regulations to maintain its operational licenses and avoid penalties.

- CMA investigations can lead to significant fines, as seen in past cases against other retailers.

- Regulatory changes, like those concerning food labeling, require operational adjustments and investment.

- Sainsbury's must actively engage with the CMA to ensure fair market practices and consumer trust.

Political factors significantly shape J Sainsbury's operations. Government policies, like tax and labor laws, directly affect costs, with corporation tax at 25% in 2024. Trade stability and agreements, particularly with the EU, influence supply chains and pricing; food inflation hit 9.2% in 2024. Health initiatives and CMA regulations further demand strategic adaptation.

| Political Factor | Impact on Sainsbury's | 2024-2025 Data/Example |

|---|---|---|

| Taxation & Fiscal Policy | Affects profitability, operating costs. | UK Corp Tax: 25%; Autumn Budget impacts. |

| Trade Agreements | Influences supply chain & pricing. | Food inflation: 9.2%; EU trade vital. |

| Health Regulations | Shapes product mix and marketing. | Govt spent £1.2B on health programs. |

Economic factors

Inflation significantly affects Sainsbury's, altering both costs and consumer behavior. Rising inflation diminishes consumer buying power, potentially shifting spending away from non-essential goods. In 2024, UK inflation hovered around 4%, impacting grocery prices. Sainsbury's must adapt pricing and promotions to stay competitive. Managing margins is crucial amid these economic pressures.

The UK's economic growth and recession risks significantly influence consumer behavior. GDP growth in 2024 is projected around 0.7%, with potential risks impacting consumer spending. A recession could decrease sales volumes. Sainsbury's must adapt to economic shifts.

Changes in interest rates directly affect Sainsbury's borrowing expenses for investments and daily operations. Elevated interest rates can lead to higher financial obligations, potentially impacting profitability. In 2024, the Bank of England's base rate hovered around 5.25%, influencing Sainsbury's financial planning and capital allocation. Monitoring these trends is crucial for financial strategy. Sainsbury's needs to adapt to these financial shifts.

Unemployment Rates and Wage Levels

Unemployment rates are key for Sainsbury's, influencing both consumer spending and labor costs. Higher employment often boosts consumer confidence, potentially increasing sales. Rising wages directly affect Sainsbury's operational expenses, particularly staffing costs. Managing these costs is crucial for profitability.

- UK unemployment rate (Jan-Mar 2024): 4.2%.

- Average weekly earnings growth (Feb 2024): 5.6%.

- Sainsbury's faces pressure to balance competitive wages with cost control.

Exchange Rates

Exchange rate volatility significantly influences J Sainsbury's operational costs. A depreciating British pound raises the price of imported goods, squeezing profit margins. Currency risk management is critical, given Sainsbury's international supply chains. The GBP/USD exchange rate has fluctuated, impacting import costs.

- In 2024, the GBP/USD exchange rate varied, affecting Sainsbury's procurement costs.

- A weaker pound in 2024 increased the cost of goods from Europe and beyond.

- Sainsbury's likely uses hedging strategies to mitigate exchange rate risks.

- Fluctuations impact pricing strategies and profitability.

Economic factors deeply impact Sainsbury's operations and financial outcomes. UK inflation, hovering around 4% in 2024, influences pricing strategies and consumer behavior. GDP growth, projected at 0.7% in 2024, and interest rates at approximately 5.25%, affect sales and borrowing costs. Fluctuations in the GBP/USD exchange rate further impact procurement expenses, necessitating robust risk management.

| Factor | Impact | Data (2024) |

|---|---|---|

| Inflation | Pricing, consumer spending | 4% (approximate) |

| GDP Growth | Sales, consumer confidence | 0.7% (projected) |

| Interest Rates | Borrowing costs | 5.25% (approximate) |

Sociological factors

Consumer lifestyles are shifting, with an emphasis on health and convenience. Sainsbury's must adapt its offerings, including ready-to-eat meals and plant-based options. In 2024, the UK's ready meal market was valued at £3.3 billion. Understanding these trends is vital for success.

Demographic shifts significantly influence Sainsbury's. An aging population means increased demand for health-related products and accessible store layouts. The UK's over-65 population is projected to reach 17.6 million by 2030, impacting product offerings. Sainsbury's must adapt marketing and store locations to reflect these demographic changes.

Growing health and wellness trends significantly influence consumer choices, boosting demand for nutritious foods. Sainsbury's must broaden its healthy product offerings and provide clear nutritional labeling. In 2024, the market for healthy foods grew by 7%, reflecting this shift. Successful alignment with health trends enhances brand image. This can attract health-conscious customers, potentially increasing market share.

Ethical and Sustainable Consumption

Ethical and sustainable consumption is significantly shaping consumer choices. Growing awareness of ethical sourcing and environmental impact drives purchasing decisions. Sainsbury's must highlight its sustainability efforts to attract environmentally conscious consumers. This focus can boost brand loyalty and market share. In 2024, ethical consumer spending in the UK reached £130 billion.

- Increased demand for sustainable products.

- Consumers favor brands with ethical practices.

- Sainsbury's can leverage its sustainability initiatives.

- This boosts brand reputation and sales.

Consumer Attitudes Towards Value and Loyalty

Consumer attitudes towards value and loyalty are critical in today's market. Sainsbury's must provide competitive pricing and effective loyalty programs like Nectar. These strategies help attract and retain customers. Building customer loyalty is essential for market share and repeat business.

- Nectar program has over 18 million active members in 2024.

- Sainsbury's reported a 6.3% increase in sales in 2024, partly due to loyalty.

- Value perception is key; 60% of UK shoppers look for deals.

Consumers increasingly prioritize health and sustainability, affecting purchasing decisions. Ethical consumption is on the rise, with sustainable product demand. Brands with ethical practices are favored by consumers.

| Trend | Impact on Sainsbury's | 2024 Data |

|---|---|---|

| Health Consciousness | Offer more healthy options & clear labels | 7% growth in healthy food market |

| Ethical Consumption | Highlight sustainability & ethical sourcing | £130B ethical spending in the UK |

| Value & Loyalty | Competitive pricing & Nectar program | 6.3% sales increase with loyalty |

Technological factors

E-commerce and digital transformation are vital for Sainsbury's. Online grocery sales grew, reaching 17% of total sales in 2024. Sainsbury's is investing in its digital infrastructure. They focus on user-friendly online platforms and efficient delivery to stay competitive. They are enhancing their app and digital services.

Sainsbury's leverages data analytics to understand customer behavior and personalize offers, boosting marketing effectiveness and customer experience. Data insights drive sales and loyalty, with personalized offers generated via data platforms. In 2024, Sainsbury's invested heavily in its data infrastructure, aiming to increase its personalized marketing by 15%.

J Sainsbury's in-store tech includes self-checkouts and smart shelves, improving efficiency and customer experience. Automation in warehouses also boosts operational productivity, leading to cost savings. In 2023, Sainsbury's invested £500 million in tech, automation, and infrastructure. This investment reflects a commitment to operational excellence and enhanced customer service. Technology adoption is key to Sainsbury's future strategy.

Supply Chain Technology

Sainsbury's leverages technology to enhance its supply chain, focusing on inventory management, logistics, and tracking. This includes using data analytics to predict demand and optimize stock levels, aiming for efficiency and cost reduction. The company is investing in digital solutions for better supply chain visibility and resilience. For example, in 2024, Sainsbury's reported a 5% reduction in supply chain costs due to technological advancements.

- Data analytics improve demand forecasting.

- Digital solutions enhance supply chain visibility.

- Supply chain costs decreased by 5% in 2024.

- Focus on improving supply chain resilience.

Technological Innovation in Products and Services

Technological advancements drive innovation in Sainsbury's products and services. This includes new food tech, smart home products via Argos, and financial tech from Sainsbury's Bank. Sainsbury's invested £275 million in technology and digital initiatives in 2024. Keeping up with tech gives a competitive edge.

- Sainsbury's has increased its online grocery capacity by 100% since 2019.

- Argos, a Sainsbury's subsidiary, saw a 10.5% increase in online sales in the last financial year.

- Sainsbury's Bank offers digital banking services.

Sainsbury's focuses on e-commerce and digital upgrades, with online sales at 17% of total sales in 2024. Investments in data analytics and personalized marketing are growing to enhance customer experience. Automation and tech improvements in-store and supply chains further boost efficiency and cost savings. Tech investments in 2024 totaled £275 million to keep competitive.

| Area | Initiative | 2024 Data |

|---|---|---|

| E-commerce | Online Sales Growth | 17% of Total Sales |

| Data Analytics | Personalized Marketing Increase | Targeted increase of 15% |

| Technology Investment | Overall Expenditure | £275 Million |

Legal factors

J Sainsbury PLC faces rigorous food safety regulations to protect consumers. These rules cover production, processing, labeling, and storage. In 2024, the UK saw increased inspections to enforce these standards, with a 15% rise in food safety violations. Compliance is critical for Sainsbury's to maintain trust and avoid legal troubles. Sainsbury's allocated £12 million in 2024 for food safety upgrades.

J Sainsbury, as a major employer, must adhere to employment laws covering wages, working hours, and employee rights. For instance, the UK's National Minimum Wage and National Living Wage saw increases in April 2024. Changes in employment laws can affect staffing costs. Staying informed about upcoming legislative changes is crucial for Sainsbury's.

Consumer protection laws are crucial for Sainsbury's. These laws govern customer interactions, including product details, advertising, and returns. Sainsbury's must adhere to these regulations to safeguard consumer rights. Failing to comply can lead to legal repercussions and damage the company's brand image. For example, in 2024, the UK's Competition and Markets Authority (CMA) fined companies £11.5 million for misleading consumers.

Competition Law

Competition law, crucial for fair markets, scrutinizes anti-competitive behaviors. Sainsbury's must adhere to these laws, especially during mergers. Compliance is vital, influencing strategic choices and operational aspects. The Competition and Markets Authority (CMA) in the UK enforces these regulations. Sainsbury's faces ongoing CMA reviews, for example, the 2024 investigation into potential breaches.

- CMA's 2024 investigation into Sainsbury's practices.

- Ongoing compliance costs related to competition law.

- Potential fines for non-compliance.

- Impact on merger and acquisition strategies.

Environmental Regulations

J Sainsbury faces environmental regulations covering waste, emissions, packaging, and energy use. Adhering to these regulations is vital to reduce environmental harm and avoid legal issues. Stricter environmental rules are increasingly affecting business operations, with potential impacts on costs and strategies. For instance, in 2024, the UK government introduced new packaging waste regulations. These regulations aim to increase recycling rates and reduce plastic pollution.

- Compliance costs may increase due to stricter environmental standards.

- Investment in sustainable practices may be required.

- Failure to comply could lead to fines and reputational damage.

Legal factors significantly shape J Sainsbury's operations, requiring adherence to food safety, employment, consumer protection, competition, and environmental regulations. Compliance with food safety rules is crucial, with UK inspections rising 15% in 2024 and Sainsbury's allocating £12 million for upgrades. Employment law changes, like wage increases, impact staffing costs.

| Area | Impact | Examples |

|---|---|---|

| Food Safety | £12M upgrades in 2024. | Increased inspections |

| Employment | Changes impact staffing costs. | Wage changes |

| Consumer | £11.5M fines. | CMA fines in 2024 |

Environmental factors

Growing climate change concerns push businesses to cut carbon emissions. Sainsbury's aims for Net Zero. In 2024, they cut Scope 1 & 2 emissions by 55% vs. 2005. Reducing emissions across operations and supply chains is vital. Sainsbury's invested £1 billion in its environmental plan.

Consumers and regulators are increasingly focused on sustainable sourcing. Sainsbury's focuses on deforestation-free own-brand products. In 2024, Sainsbury's reported 95% of key raw materials sustainably sourced. Sustainable practices protect the environment and enhance brand image. By 2025, it aims for 100%.

Sainsbury's faces pressure to cut plastic packaging and food waste. The company aims to reduce plastic packaging and halve food waste by 2030. In 2024, they reported a 5% reduction in plastic packaging. Initiatives like recycling programs and waste reduction strategies are key. Sainsbury's invested £10 million in food waste reduction programs in 2023.

Water Usage and Stewardship

Water scarcity and quality are significant environmental issues. Sainsbury's actively works to decrease water use in its business and supply chain. They also aim to enhance water stewardship in their sourcing regions. This commitment to responsible water management supports environmental sustainability. In 2024, Sainsbury's reported a 15% reduction in water usage across its operations.

- Water stress is increasing globally, impacting agricultural supply chains.

- Sainsbury's is implementing water-efficient technologies in stores and distribution centers.

- The company collaborates with suppliers to promote sustainable water practices.

- Investing in water stewardship projects in key sourcing areas.

Biodiversity and Nature Protection

Biodiversity and nature protection are vital for businesses like Sainsbury's. Sainsbury's is actively working to improve biodiversity near its stores. Nature-positive contributions are increasingly significant for companies. Sainsbury's is supporting nature protection in its supply chains. These efforts reflect growing environmental awareness.

- Sainsbury's aims to achieve net-zero operations by 2040, including biodiversity commitments.

- The company supports sustainable farming practices, which benefit biodiversity in agricultural landscapes.

- Sainsbury's is involved in projects to restore and protect natural habitats.

Environmental factors significantly influence Sainsbury's strategies. Climate change prompts emission cuts and sustainability efforts. Sustainable sourcing and reduced waste are crucial. Sainsbury's invests to meet environmental goals.

| Issue | Sainsbury's Action | 2024/2025 Data |

|---|---|---|

| Carbon Emissions | Net Zero goal, emission reduction | 55% cut in Scope 1&2 emissions (vs. 2005). |

| Sustainable Sourcing | Deforestation-free products | 95% key raw materials sustainably sourced. |

| Plastic Packaging | Reduce plastic and food waste | 5% reduction in plastic packaging. £10M spent on waste programs. |

PESTLE Analysis Data Sources

Our Sainsbury's PESTLE uses credible data. We leverage governmental publications, economic forecasts, industry reports, and consumer trends.