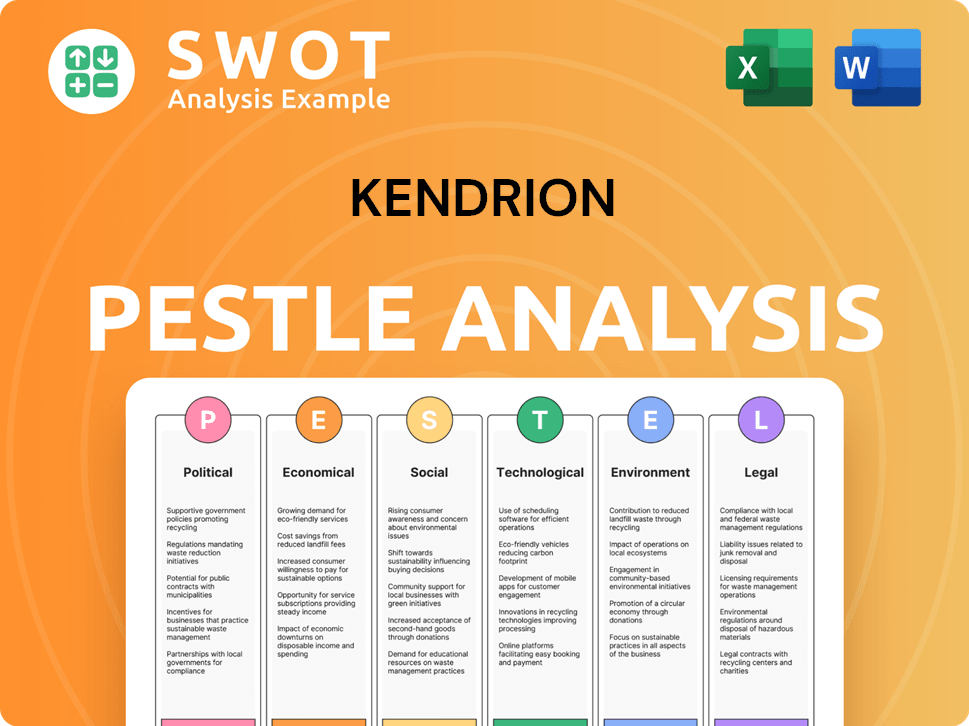

Kendrion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kendrion Bundle

What is included in the product

Explores how external factors affect Kendrion: Political, Economic, Social, Tech, Env, and Legal.

Helps identify market forces that might impact strategic choices, thus enabling a data-backed strategy.

What You See Is What You Get

Kendrion PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Kendrion PESTLE analysis examines Political, Economic, Social, Technological, Legal, and Environmental factors. The insights presented are ready for your strategic use. It's the complete analysis you get!

PESTLE Analysis Template

Navigate Kendrion's landscape with our in-depth PESTLE Analysis. We explore the key external factors impacting their operations, from political shifts to technological advancements. Uncover crucial insights into market opportunities and potential risks. Our analysis equips you with a comprehensive understanding of Kendrion’s strategic environment. Make informed decisions—download the full version now for complete market intelligence.

Political factors

Changes in international trade policies and tariffs significantly affect Kendrion's costs. Anticipated US trade tariffs create global economic uncertainty. For instance, a 10% tariff increase could raise costs substantially. In 2024, global trade tensions impacted supply chains.

Political stability is vital for Kendrion's operations. Regulations changes in manufacturing, trade, or its target sectors, like automotive, impact costs and market access. For instance, the EU's 2024 regulations on emissions directly affect Kendrion. Political risks can hinder supply chains, as seen with trade tensions impacting component costs by up to 10% in 2023.

Government incentives significantly influence Kendrion. Electrification, clean energy, and automation initiatives create opportunities. Support for manufacturing and tech development can boost Kendrion. In 2024, the EU allocated €150 billion for green tech. This funding directly benefits companies like Kendrion.

International Relations and Geopolitics

Geopolitical instability significantly influences Kendrion. Trade wars, like those between the US and China, can increase import costs. The Russia-Ukraine war has disrupted supply chains, particularly for raw materials. These issues can lead to decreased demand in affected regions.

- In 2024, global trade growth slowed to 2.6%.

- The automotive sector, a key Kendrion market, is sensitive to geopolitical risks.

- Supply chain disruptions increased operational costs by 5-10% in 2023.

Political Landscape in Key Markets

The political landscape in Germany, a key market for Kendrion, impacts market confidence and investment. Political stability and policy changes directly affect the automotive and industrial sectors. For example, Germany's automotive industry saw a 1.1% decrease in production in 2024 due to economic uncertainties. These factors influence Kendrion's strategic decisions.

- Germany's GDP growth forecast for 2025 is around 1.2%.

- Government policies on electric vehicles affect Kendrion's automotive segment.

- Political tensions can disrupt supply chains and increase costs.

Political factors significantly impact Kendrion's costs and market access. Global trade slowed to 2.6% in 2024, increasing supply chain disruptions, which raised operational costs by 5-10% in 2023. Government policies on electric vehicles, like the EU's €150 billion green tech fund, directly affect Kendrion's automotive segment. Germany's automotive production decreased by 1.1% in 2024 due to economic uncertainties; in 2025, GDP growth is forecasted around 1.2%.

| Factor | Impact | Data |

|---|---|---|

| Trade Policies | Cost Increase | Supply chain disruption increased costs 5-10% in 2023 |

| Government Incentives | Opportunities | EU allocated €150B for green tech in 2024 |

| Geopolitical Instability | Supply Chain Disruptions | Germany's automotive sector production fell 1.1% in 2024 |

Economic factors

Kendrion's success is tied to global economic health and sector cycles. A downturn reduces demand for its products. In 2024, global GDP growth is projected at 3.2%, a slight increase from 2023. The automotive industry, crucial for Kendrion, saw mixed results, with some regions experiencing growth and others facing challenges.

Rising inflation poses a significant challenge for Kendrion, potentially increasing the costs of raw materials, components, and labor. In 2024, the Eurozone inflation rate was around 2.4%, impacting manufacturing costs. Kendrion's ability to manage these rising costs directly affects its profitability. Effective cost control measures and pricing strategies are therefore critical for navigating inflationary pressures.

Currency exchange rate volatility significantly affects Kendrion's financial outcomes due to its global presence. In 2024, fluctuations in EUR/USD and other key currency pairs influenced its reported revenues. For instance, a strengthening euro could make Kendrion's products more expensive in export markets. Conversely, a weaker euro might boost competitiveness but also raise import costs. These shifts demand careful hedging strategies to protect profit margins.

Interest Rates and Investment

Interest rate fluctuations significantly influence Kendrion's customer investment strategies. Increased interest rates might deter capital expenditure in manufacturing and automation, impacting demand for Kendrion's components. For instance, the European Central Bank held rates steady in April 2024, but future changes could affect investment decisions. This is particularly relevant as the manufacturing sector is sensitive to borrowing costs.

- ECB held rates steady in April 2024.

- Higher rates can slow capital expenditure.

- Manufacturing is sensitive to borrowing costs.

Market Demand in Key Sectors

Kendrion's fortunes are closely linked to sectors such as automation, wind power, robotics, and electric vehicles. These sectors' growth or decline directly affects Kendrion's financial performance. For instance, the global electric vehicle market is projected to reach $823.75 billion by 2030. The robotics market is also experiencing significant growth.

- Electric vehicle market projected to reach $823.75 billion by 2030.

- Robotics market experiencing significant growth.

Economic factors significantly influence Kendrion, affecting its profitability and strategic decisions. Global GDP growth, projected at 3.2% in 2024, is crucial. Inflation and currency fluctuations also play a key role, impacting costs and revenues. The company needs to manage risks associated with these economic shifts.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Affects Demand | Global: 3.2% (proj.) |

| Inflation | Increases Costs | Eurozone: 2.4% (approx.) |

| Currency Volatility | Impacts Revenue | EUR/USD Fluctuations |

Sociological factors

Kendrion's success hinges on skilled labor availability near its facilities. Shifts in demographics and education directly influence its operational efficiency and innovative capacity. For instance, Germany, a key operational area, faces an aging workforce, potentially impacting future labor supply. Data from 2024 indicates a growing need for specialized technical skills. These trends necessitate strategic workforce planning by Kendrion.

Occupational health and safety (OHS) is increasingly crucial in industrial settings. Kendrion's dedication to safe conditions impacts its image and workforce. In 2024, workplace injuries in manufacturing cost the EU €276 billion. Investing in OHS is vital for Kendrion's sustainability.

The quality of Kendrion's workforce is directly influenced by training and education levels. Higher education and vocational training improve the skill sets of potential employees. Kendrion invests in its own training programs to keep its workforce updated. In 2024, Kendrion spent approximately €8 million on employee training. This investment is vital for innovation and staying competitive.

Social Responsibility and Community Impact

Kendrion's sociological profile is significantly shaped by its commitment to social responsibility and community impact. This includes initiatives like environmental sustainability and ethical sourcing. These actions influence stakeholder perceptions and brand value. Kendrion's community engagement efforts, such as supporting local education or charities, also play a role.

- In 2024, Kendrion invested approximately €2 million in various social responsibility projects.

- Kendrion's sustainability report for 2024 highlights a 15% reduction in carbon emissions.

Consumer Trends and Preferences

Consumer preferences significantly shape Kendrion's market, despite its B2B focus. Demand for electric vehicles (EVs) and sustainable products boosts the need for Kendrion's components. This indirect influence requires Kendrion to adapt to these trends. For instance, the global EV market is projected to reach $823.8 billion by 2024, impacting component demand.

- EV sales increased by 31% in 2023.

- Consumer interest in sustainable products is growing.

Kendrion faces sociological impacts including labor availability and educational levels. Employee training is crucial, with approximately €8 million spent in 2024. Societal factors, like sustainability and ethical sourcing, affect its reputation and stakeholder relations.

| Factor | Impact | Data |

|---|---|---|

| Workforce Skills | Influences Operational Efficiency | Germany's aging workforce (2024 data). |

| Training & Education | Improves Employee Skills | €8M spent on employee training (2024). |

| Social Responsibility | Enhances Brand Value | €2M on projects, 15% emission reduction. |

Technological factors

Kendrion heavily relies on tech advancements in electromagnetics and mechatronics. Innovation drives its competitive edge, allowing it to create more efficient products. In 2024, Kendrion invested €24.3 million in R&D, showing its commitment to staying ahead. This investment supports the development of new and improved products.

Automation and robotics are expanding, creating opportunities for Kendrion. Its components are vital for these systems. The industrial robotics market is expected to reach $81.7 billion by 2024. Kendrion's focus on these areas positions it well for growth. This includes components for collaborative robots, which show rapid adoption.

Electrification and clean energy are key. Demand for Kendrion's tech, like in EVs, is growing. The EV market is projected to reach $823.75 billion by 2030. Technological advancements in these sectors are crucial for Kendrion's future.

Integration of Electronics and Smart Solutions

The ongoing integration of electronics and smart solutions is a pivotal technological factor for Kendrion. This trend allows for enhanced product functionalities, increasing their appeal and market value. For instance, the global market for smart components is projected to reach \$180 billion by 2025. Kendrion's focus on these features is crucial for its competitive edge. This strategic direction is supported by a 7% annual growth rate in the industrial automation sector.

- Market for smart components projected to reach \$180 billion by 2025.

- Industrial automation sector growing at 7% annually.

Digitalization and Industry 4.0

Digitalization and Industry 4.0 are reshaping manufacturing, impacting Kendrion's processes. This transformation offers chances for new connected products. In 2024, the global smart manufacturing market was valued at $300 billion, growing annually. Kendrion can leverage these trends for efficiency and innovation.

- Smart factory adoption is projected to increase by 15% annually through 2025.

- Investments in IoT solutions for manufacturing are expected to reach $120 billion by the end of 2025.

- The integration of AI in manufacturing processes is estimated to boost productivity by 20%.

Technological advancements heavily influence Kendrion. Investment in R&D hit €24.3 million in 2024. The smart components market is projected to reach \$180 billion by 2025.

Electrification and smart solutions are important growth areas. Digitalization is also reshaping manufacturing.

| Aspect | Details | Data |

|---|---|---|

| R&D Investment (2024) | Kendrion's R&D Spending | €24.3 million |

| Smart Components Market (2025) | Projected Market Value | $180 billion |

| Smart Factory Adoption (2025) | Annual Growth | 15% |

Legal factors

Kendrion faces legal hurdles by adhering to international trade laws across its global operations, including import/export controls. In 2024, global trade volume reached approximately $32 trillion, indicating a complex regulatory landscape. Non-compliance can lead to significant penalties, such as fines that can range from $10,000 to over $1 million depending on the violation and the jurisdiction.

Kendrion must comply with stringent product safety and standards, crucial for its components in sectors like medical and automotive. In 2024, the company faced increased scrutiny, with product recalls in the automotive segment impacting financials. Failure to meet standards could result in significant fines and damage brand reputation. The company's legal and compliance costs rose by 8% in Q3 2024, reflecting increased regulatory demands.

Kendrion must adhere to environmental regulations in its manufacturing. This includes managing emissions and waste disposal. Increased scrutiny and stricter rules could raise costs. For instance, the EU's Green Deal impacts manufacturing standards. In 2024, companies faced higher fines for non-compliance; up to €100,000.

Labor Laws and Employment Regulations

Kendrion faces legal obligations concerning labor laws and employment regulations across its operational regions. These laws dictate working conditions, including hours, wages, and employee rights, impacting operational costs and compliance efforts. Non-compliance can lead to legal penalties, reputational damage, and operational disruptions for Kendrion. According to recent reports, labor law compliance costs have increased by approximately 7% annually in the European Union, where Kendrion has a significant presence.

- Compliance with labor laws is crucial for operational continuity.

- Non-compliance can result in financial penalties and reputational damage.

- Labor costs are a significant operational expense.

- Employee rights and welfare are legally mandated.

Corporate Governance and Reporting Standards

Kendrion, as a publicly listed entity, rigorously adheres to corporate governance regulations and financial reporting standards to ensure transparency. This includes compliance with International Financial Reporting Standards (IFRS) and the European Single Electronic Format (ESEF). In 2024, Kendrion’s annual report, prepared under these standards, showed a commitment to accurate financial disclosures. These measures are vital for maintaining investor trust and regulatory compliance.

- IFRS compliance ensures comparability of financial statements globally.

- ESEF facilitates easier access to financial data for stakeholders.

- Kendrion's adherence reflects a commitment to ethical business practices.

- Regulatory compliance is essential for maintaining a listing on stock exchanges.

Kendrion navigates a complex legal landscape by adhering to global trade laws and facing fines, which in 2024 could exceed $1 million for violations.

Product safety standards are paramount, particularly in sectors like medical and automotive; non-compliance led to 8% rise in compliance costs in Q3 2024.

The company must meet environmental and labor laws, and faces stricter rules. Labor costs increased 7% annually within the EU, and the EU's Green Deal also had impact.

As a publicly listed entity, Kendrion rigorously adheres to corporate governance regulations, adhering to IFRS.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Trade Laws | Compliance costs | Global trade ~$32T, fines over $1M |

| Product Standards | Product recalls, brand reputation | Compliance costs increased by 8% |

| Environmental | Emission & Waste Control | Fines up to €100,000 |

| Labor & Employment | Working Conditions & Wages | Labor cost increase ~7% in EU |

| Corporate Governance | Financial reporting | IFRS & ESEF compliance |

Environmental factors

Kendrion's environmental footprint, including energy use and emissions, is crucial. In 2024, the firm likely faced increased scrutiny regarding its carbon footprint. Efforts to reduce environmental impact, such as sustainable sourcing, were vital in 2024 and will be essential in 2025. Kendrion's focus on reducing emissions and waste could influence its market position.

The shift towards energy-efficient products is an environmental opportunity for Kendrion. This is especially relevant in automotive and industrial automation. In 2024, the global market for energy-efficient motors reached $35 billion. Kendrion's components can help reduce energy consumption.

Kendrion prioritizes responsible sourcing and supply chain management to reduce environmental impact. In 2024, they aimed to increase the percentage of suppliers assessed for sustainability. The company's 2024 sustainability report highlighted initiatives to minimize carbon footprint across its supply chain. Kendrion's goal is to integrate sustainable practices into all its operations by 2025.

Waste Management and Circular Economy

Waste management and circular economy are increasingly critical for manufacturers. Kendrion must address waste reduction and recycling to comply with environmental regulations and meet stakeholder expectations. The global waste management market is projected to reach $2.4 trillion by 2028, highlighting the significance of these issues. Implementing circular economy principles, such as designing for durability and recyclability, can reduce environmental impact and create new business opportunities.

- Global waste management market projected to reach $2.4 trillion by 2028.

- Emphasis on waste reduction and recycling for compliance.

- Circular economy principles like designing for recyclability.

- Stakeholder expectations and new business opportunities.

Climate Change and Extreme Weather Events

Climate change presents significant indirect risks for Kendrion. Extreme weather events could disrupt supply chains, potentially impacting production and increasing costs. These disruptions might stem from infrastructure damage or logistical challenges. For example, the World Bank estimates that climate change could push over 130 million people into poverty by 2030. This highlights the wide-ranging economic consequences.

- Potential supply chain disruptions due to extreme weather.

- Increased operational costs from weather-related events.

- Economic impacts of climate change could affect consumer demand.

Kendrion's environmental strategy focuses on emission reduction, and energy efficiency, key for market position. The company prioritized sustainable sourcing to reduce its carbon footprint. They aim to integrate sustainable practices throughout all operations.

| Environmental Aspect | 2024 Focus | 2025 Outlook |

|---|---|---|

| Carbon Footprint | Increased scrutiny and reduction efforts. | Continued emphasis on reducing emissions and waste. |

| Energy Efficiency | Leveraging market growth in energy-efficient motors (e.g., $35B in 2024). | Innovation and alignment with sustainability standards. |

| Supply Chain | Assessments for supplier sustainability. | Integration of sustainable practices across the supply chain. |

PESTLE Analysis Data Sources

Our Kendrion PESTLE analysis relies on data from industry reports, financial publications, and government databases.