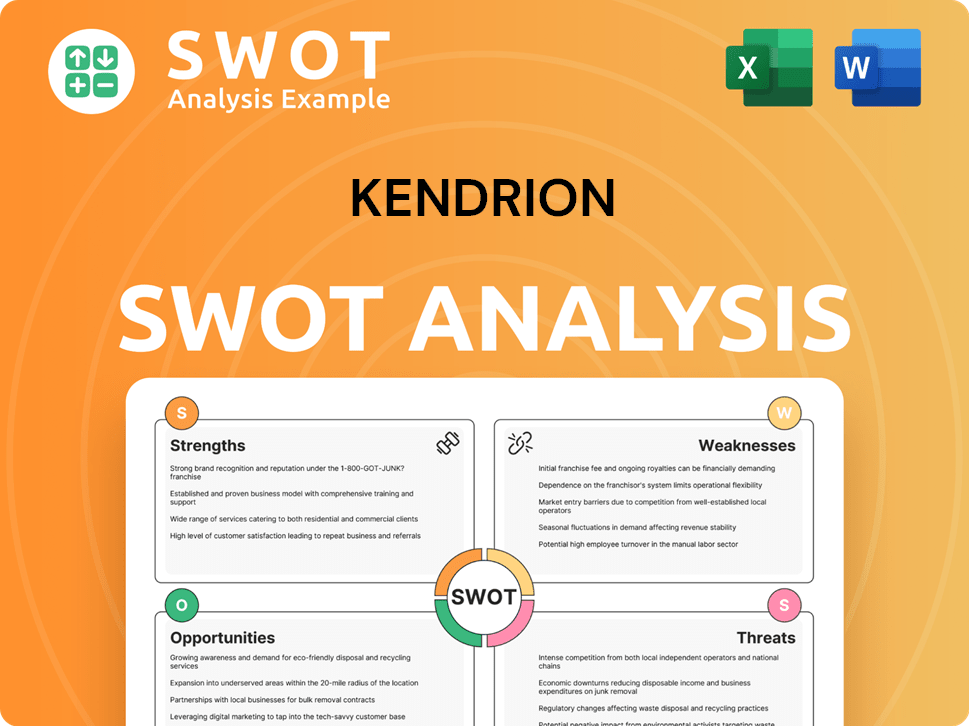

Kendrion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kendrion Bundle

What is included in the product

Maps out Kendrion’s market strengths, operational gaps, and risks.

Facilitates interactive planning with a structured, at-a-glance view.

What You See Is What You Get

Kendrion SWOT Analysis

You are viewing the exact Kendrion SWOT analysis document. The in-depth insights, strategies, and findings within this preview mirror what you'll download. This is the same professionally structured document you will receive. Your purchase grants immediate access to the comprehensive report. No different content!

SWOT Analysis Template

The Kendrion SWOT analysis unveils critical strengths, like their niche market expertise. Weaknesses, such as supply chain vulnerabilities, are also highlighted. Opportunities including sustainable technology integration are identified. Threats from economic shifts get addressed as well. These insights only scratch the surface.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Kendrion's strategic shift to a pure-play industrial focus, finalized by October 2024 with the divestiture of its Automotive business, is a key strength. This strategic move allows for concentrated resource allocation towards higher-growth industrial markets. A streamlined structure is expected to boost organizational effectiveness and profitability. The industrial segment is projected to grow, with an estimated market size of $28.6 billion by 2025.

Kendrion's strength lies in its deep technical expertise in electromagnetic and mechatronic systems, including industrial brakes and actuators. This proficiency allows for innovative, tailored solutions. They have a comprehensive portfolio including spring-applied and permanent magnet brake technologies. Kendrion's net sales in 2023 were €488.8 million, demonstrating the value of its specialized offerings.

Kendrion is well-positioned in growing sectors. Electrification, automation, and clean energy are key. They focus on AGVs, robotics, wind power, and med-tech. This aligns with high-demand markets. In 2024, the industrial automation market was valued at $280B. This supports their sustainable growth goal.

Global Presence and Targeted Strategy

Kendrion's global presence, spanning Europe, China, and the US, provides a strong foundation. This widespread footprint allows them to capitalize on diverse market opportunities and reduce reliance on any single region. Their targeted strategy focuses on specific industrial segments, enabling tailored solutions and competitive advantages in each area. In 2024, Kendrion reported that 60% of its revenue came from Europe, showcasing the importance of this market.

- Geographic diversification reduces risk.

- Targeted strategies improve market penetration.

- Local approach mitigates trade risks.

- Strong presence in key industrial markets.

Profitability Target and Cost Control

Kendrion's focus on profitability is a key strength. The company aims for an EBITDA margin of at least 15% from 2025 onwards, a clear financial objective. Cost reduction programs, fully operational by January 1, 2025, support this goal. These measures are designed to enhance margins and overall financial health.

- EBITDA margin target of 15% from 2025.

- Cost reduction programs fully in place by early 2025.

- Focus on margin improvement and financial performance.

Kendrion benefits from a focused industrial strategy. Its technical expertise boosts innovation. The company targets profitable growth, with an EBITDA margin of 15% by 2025.

| Strength | Details |

|---|---|

| Strategic Focus | Shift to industrial markets completed by October 2024. |

| Technical Expertise | Specialized in electromagnetic systems. |

| Profitability Goals | Aiming for 15% EBITDA margin from 2025 onwards. |

Weaknesses

Kendrion's 2024 financial results revealed a decrease in both revenue and normalized EBITDA versus 2023. The Industrial Brakes and Industrial Actuators and Controls segments reported lower revenues. This downturn suggests difficulties in boosting revenue and preserving profitability.

Kendrion's 2024 financial results revealed a net loss and negative EPS, indicating struggles in converting revenue into profit. This performance signals challenges in operational efficiency and cost management. The negative figures underscore the need for strategic improvements to boost profitability. For the full year 2024, the net loss was €11.8 million.

Kendrion faced subdued market conditions in late 2024, especially in Germany and China. This led to muted industrial revenue trading, as economic slowdowns in these regions decreased demand. For instance, the industrial segment's revenue decreased by 3.2% in the first half of 2024. The ongoing economic challenges negatively impact Kendrion's industrial product sales.

Negative Free Cash Flow in 2024

Kendrion's 2024 financial results revealed a negative normalized free cash flow, a concerning trend. Despite a significant reduction in net debt following the Automotive business divestment, this cash flow situation raises red flags. Persistent negative cash flow can hinder the company's ability to invest in growth opportunities or provide returns to shareholders. In 2024, Kendrion's net debt decreased to €25.9 million.

- Negative free cash flow impacts financial flexibility.

- Reduced investment capacity.

- Potential limitations on shareholder returns.

- The Automotive business divestment was completed in 2024.

Potential Financial Position Risk Identified

In May 2024, Kendrion identified a new risk affecting its financial position. Despite claims of a strong financial state and covenant compliance after divestment, this risk signals potential vulnerabilities. The company's debt-to-equity ratio and cash flow trends require close scrutiny. Analyzing these factors is crucial for assessing the true financial health of Kendrion.

- Increased financial risk perception.

- Need for vigilant monitoring.

- Potential impact on investment decisions.

- Importance of financial ratio analysis.

Kendrion's 2024 financials highlight weaknesses. Revenue and profitability declined, with a net loss of €11.8 million. Subdued industrial market conditions, especially in Germany and China, created economic challenges. Negative free cash flow and identified financial risks add concerns.

| Weaknesses | Impact | Data |

|---|---|---|

| Revenue & Profit Decline | Reduced profitability & investment. | Net loss: €11.8M (2024). |

| Market Downturns | Decreased demand & sales. | Industrial revenue -3.2% (H1 2024). |

| Negative Cash Flow | Limits financial flexibility. | Negative normalized free cash flow (2024). |

Opportunities

Kendrion can capitalize on the global shift to electrification and automation. Its components are vital for electric vehicles, robotics, and automated systems. This trend fuels demand for Kendrion's products. The electric motor market is projected to reach $120 billion by 2025, offering growth opportunities.

Kendrion is strategically focusing on high-growth industrial niches. These include automated guided vehicles (AGVs), wind energy, medical technology, and industrial heating. Targeting these specialized areas enhances market penetration and expansion possibilities. In Q1 2024, Kendrion's industrial segment saw a 7.2% organic revenue increase, driven by these sectors.

Kendrion's strengthened financial position post-divestment opens doors for strategic M&A. The company eyes acquisitions to boost growth in industrial markets. These moves can broaden product lines and increase market share. In 2024, the company had a net financial position of EUR 108.7 million.

Expansion in Key Geographies

Kendrion identifies expansion opportunities in key geographies, particularly China and the US. Focusing on these regions, the company can increase revenues, potentially through capacity expansion or strategic partnerships. This strategy supports Kendrion's goal of global niche leadership. In 2024, the Asia-Pacific region accounted for approximately 20% of Kendrion's sales.

- China's automotive market is projected to grow, offering significant opportunities.

- The US market provides opportunities in industrial and automotive sectors.

- Strategic partnerships may accelerate market entry and growth.

- Geographic expansion aligns with Kendrion's global leadership ambition.

Potential for Market Recovery and Restocking

Early 2024 showed hints of market recovery and restocking, especially in Europe, which could boost demand for industrial components. Kendrion is well-placed to capitalize on this, potentially improving its financial performance. A stronger global economy would likely increase orders, benefiting Kendrion's sales figures. The company could see increased revenues if the market rebounds as anticipated. This presents a chance to boost profitability.

- European industrial production grew by 0.8% in February 2024.

- Kendrion's sales in Europe accounted for 64% of total sales in 2023.

- Analysts predict a 3-5% growth in the industrial components market by late 2024.

Kendrion is primed to leverage electrification and automation, tapping into the $120 billion electric motor market predicted by 2025. High-growth niches like AGVs saw a 7.2% revenue jump in Q1 2024, indicating robust demand. Expansion, particularly in China (20% of 2024 sales in APAC) and the US, along with potential M&A, boosts global growth.

| Opportunity | Details | Data Point |

|---|---|---|

| Electrification Trend | Growth in EV & automation components. | EV market expected to reach $800 billion by 2027 |

| Niche Market Focus | Targeting AGVs, wind, medical, industrial heating | Q1 2024 Industrial segment +7.2% organic revenue |

| Geographic Expansion | China and US offer key growth areas | APAC region approx. 20% of Kendrion sales in 2024 |

Threats

Kendrion faces threats from a murky global economy. The company expects 2025's first half to mirror 2024's tough conditions. Slow economic growth and instability may hurt industrial demand, as seen in a 2% drop in global manufacturing output in late 2024. This could hinder Kendrion's growth ambitions, given that 60% of its revenue comes from industrial markets.

Anticipated US trade tariffs introduce uncertainty to the global economy, potentially affecting Kendrion. Although their local approach offers some protection, supply chain disruptions, increased costs, and reduced demand in impacted markets are risks. These tariffs, an unpredictable external factor, could hinder operations. For example, in 2024, the US imposed tariffs on various goods, causing supply chain issues.

Kendrion faces market cyclicality, particularly affecting revenue. Industrial sector slowdowns, like those in Germany and China, directly impact profitability. In 2024, Kendrion experienced challenges due to these regional economic downturns. Navigating these cycles and maintaining performance is a constant strategic hurdle.

Resource and Talent Scarcity

Kendrion faces threats from resource and talent scarcity, including potential shortages and price fluctuations of essential raw materials, impacting production costs. The scarcity of skilled engineers also poses a risk, potentially hindering innovation and operational efficiency. These challenges can escalate costs and disrupt operations, affecting profitability. For instance, the cost of rare earth materials, crucial for some components, has seen volatility, with prices fluctuating by up to 15% in recent years, as reported by industry analysts.

- Raw material price volatility can increase production costs.

- Shortage of engineers can hamper innovation and operational efficiency.

- Increased costs and operational challenges affect profitability.

Competition and Commoditization

Kendrion faces threats from intense competition in fragmented markets. Some products risk commoditization, potentially squeezing prices and profits. Continuous innovation is crucial for Kendrion to stay competitive and offer value-added solutions. In 2024, the automotive sector, a key market, saw margin pressures due to oversupply.

- Competition from various players in fragmented markets.

- Risk of commoditization leading to price pressures.

- Need for innovation to maintain a competitive edge.

Kendrion is vulnerable to a shaky global economy and regional downturns, as evidenced by the 2% drop in global manufacturing output in late 2024. US trade tariffs introduce economic uncertainty that can disrupt supply chains. Cyclicality in markets, like in Germany and China during 2024, challenges profitability.

| Threat | Description | Impact |

|---|---|---|

| Economic Slowdown | Global and regional downturns | Industrial demand and profitability hit, like in 2024. |

| Trade Tariffs | US tariffs on goods | Supply chain disruption and higher costs. |

| Market Cyclicality | Slowdowns in key markets | Direct impact on revenue and profitability. |

SWOT Analysis Data Sources

This SWOT leverages data from financial reports, market analysis, industry research, and expert perspectives for reliable insights.