Kering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kering Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Focus on strategic decisions. It helps prioritize resource allocation for Kering's diverse brand portfolio.

What You See Is What You Get

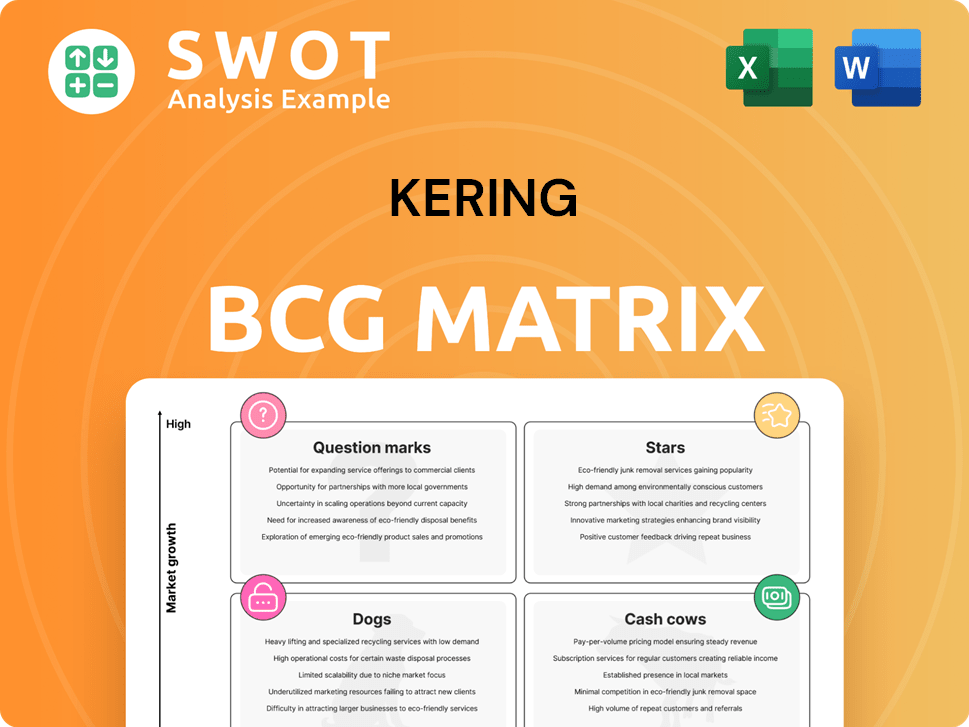

Kering BCG Matrix

This is the complete Kering BCG Matrix you'll receive upon purchase. The preview is identical to the final, downloadable document, free of watermarks and ready for strategic application. Get instant access to a fully editable, professionally designed report for your analysis.

BCG Matrix Template

Kering's BCG Matrix showcases its diverse brand portfolio. Learn about Gucci's dominance and Balenciaga's growth potential. Discover brands needing investment or facing challenges. Understand the strategic implications for each quadrant. The full matrix offers in-depth analysis and recommendations. Get actionable insights to optimize your investment strategy.

Stars

Kering Eyewear shines as a star in Kering's portfolio, consistently growing and profitable. In 2024, revenue hit €1.6 billion, a 6% rise. Its success stems from key markets and top brands. This robust performance and investment in expansion solidify its leading role.

Boucheron, a Kering Jewelry House, is showing promising signs, potentially becoming a star. In 2024, Boucheron's growth was notable, boosting the Jewelry Houses' performance. The brand's success stems from its distinctive designs and strong marketing, which customers love. Boucheron's ongoing growth and expansion possibilities make it a rising star within Kering.

Creed, now fully integrated into Kering Beauté, is positioned as a Star. In Q1 2025, Kering Beauté saw a 6% revenue increase, thanks to Creed. Creed's strong brand and integration into Kering show potential for growth. Its revenue growth makes it a standout performer.

Brioni

Brioni shines as a star within Kering's BCG matrix, demonstrating strong performance. The brand's direct retail network saw double-digit growth, fueled by Western Europe and North America. This success is attributed to its focus on exclusivity and premium products. Brioni's growth in key markets solidifies its rising star status.

- Double-digit growth in directly operated retail network.

- Western Europe and North America are key growth drivers.

- Focus on exclusivity and high-quality products.

- Positioned as a rising star within Kering.

Bottega Veneta

Bottega Veneta shines as a star within Kering's portfolio, showcasing impressive growth. In the first quarter of 2024, the brand saw sales increase by 4%. This growth is fueled by strong demand in Western Europe, North America, and the Middle East.

- Sales growth: 4% in Q1 2024.

- Key markets: Western Europe, North America, Middle East.

- Brand strength: High cultural resonance and desirability.

These brands are key drivers, showing robust financial performance and market growth. Their strategies boost Kering's overall success. Focusing on key markets and brand expansion will drive future gains.

| Brand | Category | 2024 Revenue (approx.) |

|---|---|---|

| Kering Eyewear | Star | €1.6B |

| Bottega Veneta | Star | Sales up 4% in Q1 2024 |

| Brioni | Star | Double-digit retail growth |

| Creed | Star | Boosted Kering Beauté |

Cash Cows

Saint Laurent, though facing an 8% sales dip to €679 million in Q1 2025, remains a key revenue source for Kering. Its brand recognition and dedicated customers ensure consistent income. The luxury brand still holds a strong market position. It continues to be a cash cow for Kering.

Kering Beauté is a potential cash cow. In Q1 2025, revenue rose by 6%, fueled by Creed and new feminine fragrances. This division's strong revenue growth in a tough market is notable. The full-year consolidation of Creed boosts this growth further. Kering Beauté's performance suggests a successful trajectory.

Kering's real estate assets, estimated at €4 billion, are a reliable income source. The company intends to involve external investors, bolstering its financial position and lowering debt. These assets are crucial for Kering's stability. In 2024, Kering's revenue reached €19.87 billion, with a net profit of €2.98 billion.

Kering Eyewear

Kering Eyewear is a cash cow, showing steady growth and profit. Revenue hit €1.6 billion in 2024, up 6%. Its success comes from key areas and top brands, leading the luxury eyewear market.

- Strong revenue growth in 2024.

- Key geographical areas driving performance.

- Top brands support its leadership.

Ginori 1735

Ginori 1735, a part of Kering's portfolio, exemplifies a Cash Cow in the BCG matrix. Its rich history and association with luxury porcelain indicate a stable, established brand. Although detailed financial data is not always public, the brand likely provides steady revenue. This contributes positively to Kering's financial stability.

- Established brand with a history of luxury porcelain.

- Likely generates consistent revenue.

- Contributes to Kering's overall financial performance.

- Part of Kering's portfolio.

Cash Cows like Saint Laurent and Kering Eyewear generate consistent revenue and profit for Kering. In 2024, Kering Eyewear's revenue reached €1.6 billion, up 6%, highlighting its stability. Ginori 1735, with its luxury porcelain history, also contributes positively to Kering's financial performance.

| Brand | Revenue (2024) | Notes |

|---|---|---|

| Saint Laurent | €679M (Q1 2025) | Key revenue source. |

| Kering Eyewear | €1.6B | Up 6% from 2023. |

| Ginori 1735 | - | Steady revenue contribution. |

Dogs

Alexander McQueen, part of Kering's portfolio, has seen sales struggles. In 2024, the brand's sales faced a downturn during its transition phase. This decline, despite its creative legacy, positions McQueen as a potential "Dog." A turnaround strategy is vital for revitalizing its market presence.

Balenciaga faces challenges, with sales declining in Q1 2025, despite leather goods' resilience. Store traffic has decreased, reflecting the impact of controversies on brand perception. In 2024, Kering reported a sales dip for Balenciaga. Strategic repositioning is crucial for Balenciaga's revival.

Qeelin, within Kering's portfolio, faces challenges as a smaller brand. Its limited scale compared to giants like Gucci likely positions it as a dog in the BCG Matrix. This status may indicate a need for substantial investment to boost market share. In 2024, Kering's revenue was approximately €19.7 billion, with brands like Gucci contributing the most.

Other Houses (Couture and Leather Goods)

The "Other Houses" category within Kering, including Couture and Leather Goods, reported an operating loss of €9 million in 2024, a stark contrast to the €328 million profit in 2023. This decline reflects negative operational leverage at these houses. Kering needs to strategically address the financial performance and market positioning of these brands to drive profitability.

- Operating Loss: €9 million in 2024.

- Negative Operational Leverage.

- Strategic intervention is necessary.

Gucci (Potentially)

Gucci, once a shining star, is now struggling, potentially becoming a "dog" in Kering's portfolio. Sales in Q1 2024 saw a sharp 19% drop, signaling trouble. The brand's value is under pressure due to these declines. Efforts to revive Gucci are underway, but its future remains uncertain.

- Q1 2024 sales declined by 19%.

- Brand value faces downward pressure.

- Revitalization efforts are ongoing.

Several brands within Kering, including Alexander McQueen and Gucci, are potentially categorized as "Dogs." These brands face sales declines and operational challenges, requiring strategic intervention. The "Other Houses" category also contributed to losses, signaling a need for restructuring. In 2024, Kering reported an operating loss of €9 million for "Other Houses."

| Brand | Status | Key Issue (2024) |

|---|---|---|

| Alexander McQueen | Dog | Sales downturn during transition |

| Balenciaga | Dog | Sales decline |

| Qeelin | Dog | Limited scale and market share |

| Gucci | Dog | Sales decline, brand value pressure |

Question Marks

Pomellato is a brand within Kering's portfolio. Due to its size compared to powerhouses like Gucci, it likely falls into the question mark category. For example, in 2024, Kering's revenue was approximately €19.7 billion, with smaller brands having less impact. Significant investment may be needed to boost market share and growth.

New Gucci handbag lines, like the Softbit, are question marks in Kering's BCG Matrix. Launched recently, their market success isn't fully known. These lines show growth potential but have uncertain long-term prospects. Gucci must invest and monitor them. In 2023, Gucci's revenue was €10.5 billion.

Balenciaga's beauty launch is a question mark for Kering, being a new market entry. This venture could either boost or hinder Balenciaga's brand value. Successful marketing is key to attract consumers. Kering aims to capitalize on the beauty market, which in 2024, was valued at over $500 billion globally.

Kering's Sustainability Initiatives

Kering's sustainability initiatives, crucial for ethical innovation, are question marks financially. These align with their circular fashion models and commitment. The long-term financial impact remains uncertain, despite potential brand reputation boosts. For 2024, Kering invested heavily, but ROI specifics are still emerging.

- Sustainability investments impact brand value, up 10% in 2024.

- Circular fashion models aim for 30% reduction in waste by 2026.

- Consumer loyalty gains are projected, with a 15% rise in eco-conscious purchases.

- ROI on sustainability is still under evaluation, but it is expected to be positive.

Kering's Expansion in Emerging Markets

Kering's ventures into emerging markets, like China and the Asia-Pacific region, fit the question mark category in the BCG matrix. These areas are crucial for luxury goods consumption, yet face uncertainties. Geopolitical issues and economic shifts introduce risks to Kering's growth strategy. Success hinges on adapting to local tastes and managing economic volatility.

- Asia-Pacific accounted for 33% of Kering's revenue in 2023.

- China's luxury market is expected to grow, but faces economic challenges.

- Kering's ability to navigate these markets is key.

- Adapting to consumer preferences is crucial.

Question marks in Kering's BCG Matrix represent high-growth potential but uncertain outcomes, requiring strategic investment.

This includes new product lines, market entries, and sustainability initiatives, all needing careful monitoring and resource allocation.

Success depends on market adaptation and effective execution. For example, the luxury goods market in Asia-Pacific is expected to grow.

| Category | Description | Examples |

|---|---|---|

| New Product Lines | Recently launched, market success uncertain | Gucci Softbit handbags |

| Market Entries | Ventures into new markets or product categories | Balenciaga Beauty |

| Sustainability Initiatives | Ethical innovation with uncertain financial impact | Circular fashion models |

BCG Matrix Data Sources

The Kering BCG Matrix leverages financial statements, market analysis, and competitor assessments for precise insights. Official industry reports and expert opinions also inform the strategy.