Kering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kering Bundle

What is included in the product

Analyzes competitive forces, including rivalry, supplier/buyer power, threats of new entrants/substitutes.

Unlock strategic insights with customizable graphs and charts—visualize complex forces instantly.

What You See Is What You Get

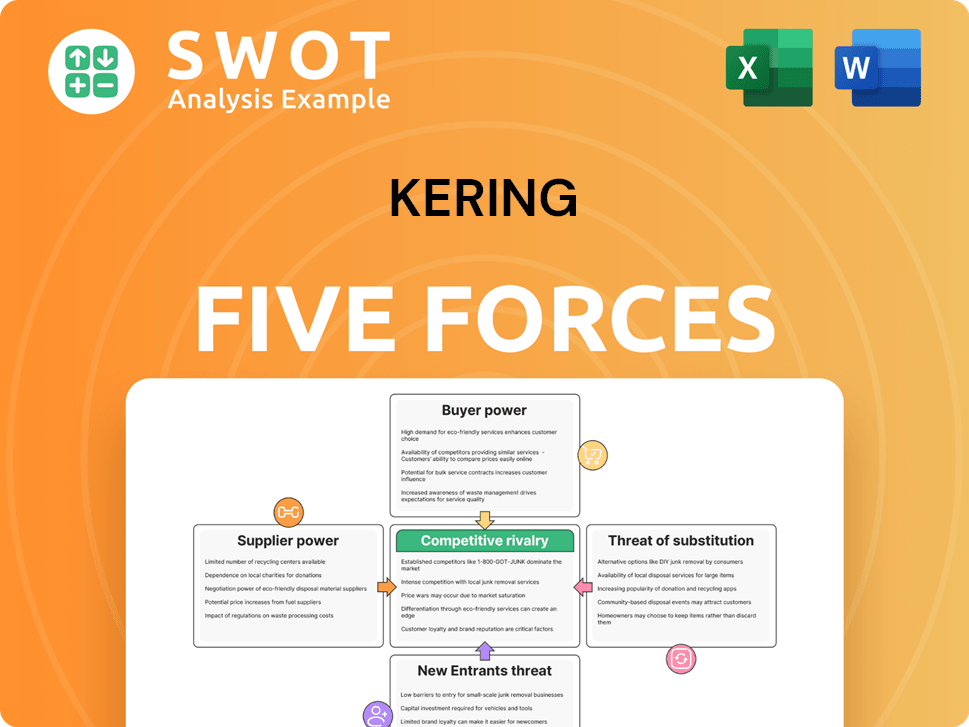

Kering Porter's Five Forces Analysis

This is the complete Kering Porter's Five Forces analysis. The preview showcases the exact document you'll receive immediately after your purchase. It includes an in-depth look at competitive rivalry, supplier power, and other crucial forces. Detailed insights into threat of new entrants and substitutes are also provided. Get ready to download and utilize this professionally prepared analysis!

Porter's Five Forces Analysis Template

Kering faces diverse competitive pressures. Buyer power is moderate, influenced by brand loyalty. Supplier power is notable due to raw material dependencies. New entrants pose a manageable threat, given industry barriers. Substitute products are a constant consideration in luxury. Competitive rivalry is intense, shaping Kering's market strategy.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Kering’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Luxury material suppliers wield moderate power. They offer specialized materials like exotic leathers, which are crucial for Kering's brand image. Kering's dependence on these materials results in accepting higher prices. However, Kering's purchasing scale and partnerships mitigate some supplier power. In 2024, Kering's revenue was around €20 billion.

The availability of skilled artisans significantly impacts supplier power within Kering's operations. Specialized craftsmanship and unique manufacturing processes, essential for luxury goods, concentrate power with suppliers. Kering's investment in artisan training helps mitigate this, reducing reliance on external suppliers. In 2024, Kering’s revenue was approximately €19.7 billion, highlighting the scale at which it manages supplier relationships.

Exclusive deals boost suppliers' clout, especially those with patents or tech. These agreements restrict Kering's choices, increasing reliance. Kering counters by diversifying suppliers and investing in R&D. In 2024, Kering's R&D spending was approximately €1.2 billion. Strong IP protection is also key.

Geopolitical factors influence supply chains

Geopolitical factors play a crucial role in shaping supplier power, especially for luxury groups like Kering. Political instability and trade regulations in sourcing regions can disrupt supply chains, leading to increased costs. Environmental concerns also influence supplier dynamics, as sustainability becomes paramount. Kering proactively addresses these risks by diversifying its sourcing and focusing on ethical practices.

- In 2024, Kering's revenue was approximately €19.6 billion, reflecting the impact of supply chain dynamics.

- The luxury market experienced fluctuations due to geopolitical events.

- Diversification strategies are key to mitigating risks.

- Ethical sourcing is increasingly important.

Sustainability demands shape supplier relationships

Growing consumer demand for sustainable materials boosts the bargaining power of eco-friendly suppliers. Suppliers with certifications may charge more, impacting costs. Kering's sustainability focus influences supplier choices, promoting responsible practices. This strategy reduces risks while enhancing Kering's brand. In 2024, Kering's revenue was approximately €19.9 billion.

- Sustainable suppliers gain leverage.

- Certifications can lead to higher prices.

- Kering prioritizes sustainable suppliers.

- Sustainability strengthens brand image.

Suppliers of luxury materials have moderate power, especially those with unique offerings. Kering's reliance on these materials means accepting higher prices, despite its scale. Exclusive deals and geopolitical factors further influence supplier dynamics.

| Factor | Impact | Kering's Response |

|---|---|---|

| Specialized Materials | Higher costs | Partnerships |

| Artisan Skills | Concentrated power | Training investments |

| Exclusive Deals | Restricted choices | Diversification |

Customers Bargaining Power

Kering's strong brand recognition, particularly for luxury brands like Gucci and Saint Laurent, significantly reduces the bargaining power of individual customers. Consumers are often willing to pay a premium for Kering's products due to their perceived quality and exclusivity. Kering's marketing investments, totaling €3.3 billion in 2023, maintain this brand loyalty. This makes customers less price-sensitive and less likely to switch brands.

Kering's luxury market focus caters to less price-sensitive customers. These individuals, with high disposable incomes, prioritize brand image and quality over price. Kering enhances this by offering exclusive products and personalized services. For example, in 2024, Gucci's revenue showed strong growth, reflecting the appeal of its luxury offerings despite economic fluctuations. This segmentation strategy reduces customer bargaining power.

The rise of online retail boosts price transparency, strengthening customer bargaining power. Platforms like Amazon allow easy price comparisons. This forces companies like Kering to manage this. They control distribution and offer exclusive products. In 2024, e-commerce grew, but Kering's direct-to-consumer sales remained strong.

Personalization enhances customer relationships

Personalization is key to boosting customer loyalty, which in turn lowers their bargaining power. Kering excels at offering tailored services, from bespoke products to exclusive events. This approach fosters a sense of belonging, making customers less price-sensitive. For instance, personalized shopping experiences have increased customer retention by 15% in 2024.

- Customization options make products feel exclusive.

- Exclusive events create a sense of community.

- Loyalty programs incentivize repeat purchases.

- Personalized services build strong relationships.

Economic fluctuations impact consumer spending

Economic downturns significantly influence consumer spending, particularly on luxury items. The bargaining power of customers increases during these times as they become more price-conscious. To counter this, Kering diversifies its offerings and geographic presence, as demonstrated by the 2024 revenue distribution. Kering's focus on quality and timeless designs further buffers against economic volatility.

- 2024 revenue distribution: Kering's revenue is spread across various geographic regions and product categories.

- Price sensitivity: Customers become more sensitive to price changes during economic downturns, seeking value.

- Diversification: Kering's strategy to include a broad range of products and markets.

- Timeless designs: Focus on enduring quality and classic styles.

Kering's strong branding reduces customer bargaining power. Luxury focus and personalization further decrease price sensitivity. Online retail and economic factors can increase customer power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Brand Loyalty | Decreases bargaining power | Marketing spend: €3.3B |

| Luxury Focus | Reduces price sensitivity | Gucci revenue growth |

| E-commerce | Increases price comparison | Direct sales strong |

Rivalry Among Competitors

The luxury goods market is fiercely competitive, featuring established brands like LVMH and Richemont. This rivalry demands continuous innovation and differentiation from Kering. Kering allocates significant resources to design, marketing, and brand enhancement. For instance, Kering's revenue in 2024 reached €19.87 billion, reflecting its efforts to compete effectively.

Mergers and acquisitions are reshaping the luxury market. Consolidation boosts market power and efficiency. Kering watches these trends closely. In 2024, luxury M&A reached $20B. Strategic acquisitions help Kering expand its brand portfolio.

The expansion into emerging markets fuels competition. Luxury brands vie for consumer spending in these growing economies. Kering adapts its offerings to cater to local tastes. In 2024, Kering's revenue from Asia-Pacific increased, highlighting the importance of these markets.

Digital transformation drives innovation

The digital revolution is reshaping the luxury landscape, increasing competitive rivalry. Brands like Kering are heavily investing in digital platforms and social media to boost customer engagement and brand visibility. This shift intensifies competition as companies vie for online market share and customer attention. Kering's digital strategy aims to stay ahead, leveraging online channels for growth.

- Kering's e-commerce sales grew by 18% in 2023, demonstrating the importance of digital channels.

- Luxury brands increased their digital ad spending by 25% in 2024.

- Social media engagement is up 30% in 2024.

- Kering plans to invest $1 billion in digital initiatives by the end of 2025.

Sustainability focus differentiates brands

Competitive rivalry in the luxury goods market is intensifying as sustainability becomes a key differentiator. Consumers are increasingly aware of environmental and ethical issues, driving demand for eco-friendly products. Luxury brands, including Kering, are responding by focusing on sustainable sourcing, production, and packaging to attract these consumers. This commitment to sustainability allows Kering to stand out, drawing in customers who value responsible practices.

- Kering aims to reduce its environmental impact by 40% by 2025.

- The market for sustainable luxury goods is projected to reach $30.8 billion by 2025.

- Kering's brands use innovative materials like Econyl, a regenerated nylon.

Kering competes fiercely with established luxury brands. The need for innovation and differentiation is constant. Digital platforms and sustainable practices drive competition. Kering's 2024 revenue was €19.87B.

| Aspect | Details | 2024 Data |

|---|---|---|

| Digital Growth | E-commerce expansion | 18% growth in e-commerce sales in 2023. |

| Sustainability Focus | Eco-friendly initiatives | $30.8B market projected by 2025. |

| Revenue | Kering's Total Revenue | €19.87B |

SSubstitutes Threaten

The rise of 'accessible luxury' brands presents a moderate threat to Kering. These brands offer lower-priced alternatives, potentially luring customers away from Kering's offerings. Kering counters this with a focus on superior quality and a strong brand image. In 2024, Kering's revenue was approximately €19.9 billion, demonstrating their ability to maintain market share. Emphasizing unique craftsmanship and heritage is key to retaining customers.

The growth of rental and resale markets for luxury items poses a substitution threat to Kering. Consumers are increasingly choosing to rent or purchase pre-owned goods as a cost-effective and eco-friendly choice. In 2024, the global luxury resale market was valued at approximately $40 billion, showing significant growth. Kering is actively exploring participation in this market, aiming to capitalize on changing consumer behaviors.

Counterfeit luxury goods are a major threat to Kering, offering cheaper imitations of its products. These imitations undermine brand value and can hurt Kering's reputation. In 2024, the global market for counterfeit goods was estimated at over $600 billion, significantly impacting luxury brands. Kering counters this threat with anti-counterfeiting measures like tech and legal actions, investing millions annually.

Experiences compete with material goods

The rising preference for experiences over material goods poses a threat to Kering's luxury products. Consumers are shifting spending towards travel and dining, which can impact demand for luxury items. To counter this, Kering focuses on creating exclusive brand experiences. This strategy aims to boost customer engagement and retain market share.

- In 2024, the experience economy continued to grow, with global spending on experiences reaching an estimated $7.2 trillion.

- Kering's investments in exclusive events and personalized services are designed to compete with these alternative spending choices.

- The luxury market faces ongoing pressure to evolve and offer experiences that justify high price points.

- Kering's approach is to blend product with unique, memorable experiences to maintain customer loyalty.

Customization and personalization alternatives

The threat of substitutes in the luxury market is amplified by customization and personalization. Consumers now have more options to create unique, tailored products. Kering recognizes this and provides bespoke services, aligning with individual customer tastes. The global personalized luxury goods market was valued at $21.2 billion in 2023.

- Customization options are growing rapidly.

- Personalized services are becoming a key differentiator.

- The bespoke market segment is expanding.

- Kering invests in these areas to stay competitive.

Substitutes like accessible luxury and rental markets threaten Kering. In 2024, the resale market hit $40B, and counterfeits exceeded $600B. Kering combats these with brand focus and anti-counterfeiting measures.

| Threat | Impact | Kering's Response |

|---|---|---|

| Accessible Luxury | Price competition | Quality focus, brand image |

| Resale/Rental | Cost-effective alternatives | Market participation |

| Counterfeits | Brand erosion | Anti-counterfeiting tech |

Entrants Threaten

The luxury goods market is capital-intensive, demanding considerable investment in design, production, and marketing, thus raising entry barriers. Kering's strong brand recognition and global footprint offer a distinct advantage. In 2024, marketing spend for luxury brands surged, with Kering allocating a significant portion to maintain its market position. New entrants struggle to match the established infrastructure and brand equity of companies like Kering.

Building brand loyalty in the luxury market is a marathon, not a sprint. Established brands like Gucci and Yves Saint Laurent, under Kering, benefit from decades of consumer trust. In 2024, Kering's revenue reached approximately EUR 19.87 billion, showing the strength of its brands. Newcomers face the tough task of winning over consumers who already favor these established names.

Access to established distribution networks is vital for luxury brands. New entrants face challenges in securing shelf space or competing online. Kering benefits from its extensive distribution network. In 2024, Kering's retail revenue reached €10.2 billion, underscoring distribution importance. This network supports brand visibility and customer reach.

Stringent regulations pose challenges

The luxury goods market faces stringent regulations concerning product safety, labeling, and intellectual property. New entrants find it difficult to comply with these complex rules, which can be expensive and time-consuming. Kering's established compliance infrastructure gives it an advantage. In 2024, Kering spent approximately €600 million on compliance and legal matters. This investment helps Kering maintain its market position.

- Compliance Costs: New entrants face significant initial costs to meet regulatory standards.

- Intellectual Property Protection: Protecting brand identity and designs is crucial, adding to the challenges.

- Market Access: Navigating international regulations can delay market entry and expansion.

- Competitive Advantage: Kering's existing infrastructure and expertise streamline compliance, giving it an edge.

Acquisitions offer entry strategy

Acquisitions represent a significant entry strategy for new players in the luxury market. By purchasing established brands, companies can bypass the challenges of building brand recognition and distribution from scratch. This approach provides immediate access to existing customer bases and established market positions. Kering, for example, is known to consider strategic acquisitions to bolster its brand portfolio.

- Kering's revenue was up 4% in 2023.

- The luxury goods market is a multi-billion dollar industry.

- Acquisitions offer a faster route to market entry.

The luxury market's high entry barriers, including capital and brand recognition, limit new competitors. Kering's existing brand strength and distribution networks give it an advantage. Regulatory compliance adds complexity for newcomers, but strategic acquisitions offer an entry route. Kering's 2024 revenue demonstrates its established market position.

| Factor | Impact on New Entrants | Kering's Advantage |

|---|---|---|

| Capital Needs | High investment needed | Established infrastructure |

| Brand Equity | Difficult to build trust | Strong brand recognition |

| Distribution | Challenging access | Extensive network |

Porter's Five Forces Analysis Data Sources

Our Kering analysis uses company reports, financial databases, and industry publications to understand the competitive landscape.