Kindred Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kindred Group Bundle

What is included in the product

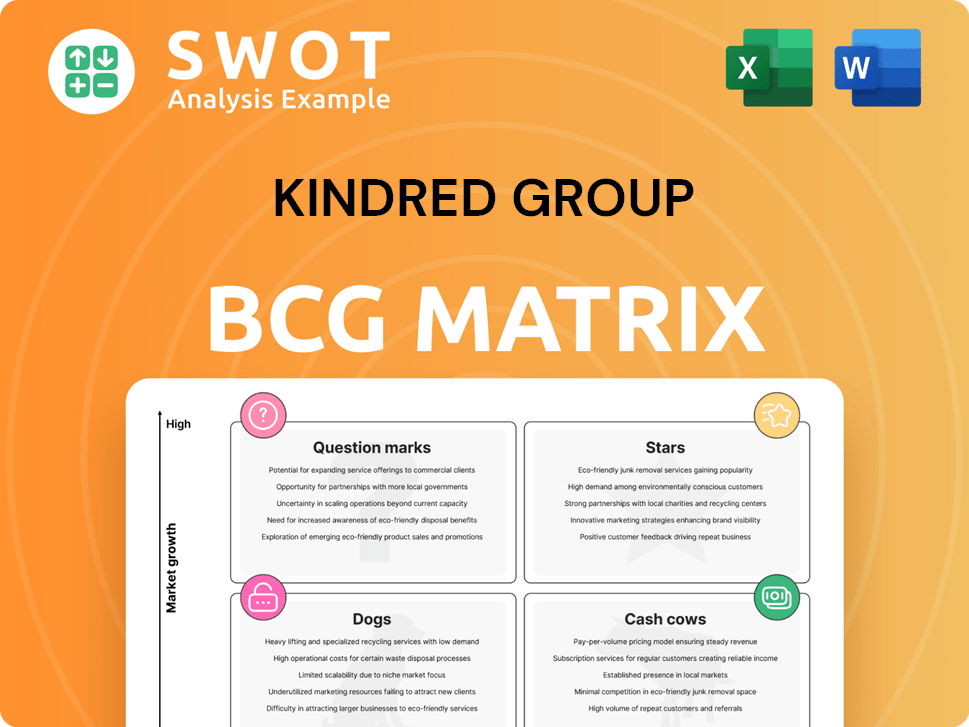

Kindred Group's BCG Matrix analysis: investment, hold, or divest highlights for each business unit.

One-page overview placing each business unit in a quadrant for fast strategic decision-making.

Delivered as Shown

Kindred Group BCG Matrix

The Kindred Group BCG Matrix preview is identical to the purchased document. Expect a fully functional, strategy-focused report ready for immediate use in your analysis. No alterations are necessary; it’s the complete package. Your download delivers the same professional presentation.

BCG Matrix Template

Kindred Group's BCG Matrix offers a snapshot of its diverse portfolio. See how its various products perform in the market. Understand which are stars, cash cows, dogs, or question marks. This overview only scratches the surface.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Online casinos are likely a Star for Kindred, given the expanding global online gambling market and Kindred's strong market position. The online gambling market was valued at $63.5 billion in 2023. Technological advancements and platform accessibility drive this growth. Continued investment in innovation and game variety is key for Kindred.

Sports betting is a Star for Kindred Group, especially in Europe and Australia, driven by substantial growth in active users. This growth is fueled by major sporting events and the rise of live betting. Kindred's strategic focus on regulated markets and continued investment in its Sportsbook Platform (KSP) are key. In 2024, sports betting revenue is expected to increase by 10-15%.

Kindred Group's focus on regulated markets is a Star, reflecting its dedication to responsible gambling. This strategy provides long-term revenue stability and minimizes non-compliance risks. In Q3 2023, 80% of Kindred's revenue came from regulated markets, a significant increase. Exiting unregulated markets is key for future growth.

Mobile Gaming

Mobile gaming presents a stellar opportunity for Kindred Group. Smartphone penetration continues to rise, fueling mobile gaming's growth. Kindred can leverage this by enhancing its mobile platforms. This focus drives user engagement and accessibility across betting categories. Consider that in 2024, the mobile gaming market is estimated to reach $100B.

- Market Growth: The mobile gaming market is projected to reach $100B in 2024.

- User Engagement: Mobile platforms drive user engagement and accessibility.

- Strategic Focus: Kindred should optimize its mobile platforms.

- Technological Advancements: Advancement in mobile gaming technologies boost the market.

Responsible Gambling Initiatives

Kindred Group's responsible gambling efforts are a key Star, boosting its image and ensuring lasting success. These initiatives cover stricter rules, better internal processes, and open reporting on high-risk revenue. Kindred's investment in new tech and research boosts detection capabilities. In Q4 2023, 3.3% of Kindred's revenue came from high-risk customers, a decrease from 4.2% in Q4 2022.

- Focus on early detection and intervention.

- Implementation of advanced AI to identify risky behavior.

- Investment in employee training.

- Collaboration with industry partners.

Kindred's Stars include online casinos, sports betting, and its focus on regulated markets, showing significant growth potential. Mobile gaming is a star due to rising smartphone use, boosting user engagement. Responsible gambling efforts are crucial for long-term success and a positive brand image.

| Area | Key Feature | 2024 Data/Forecast |

|---|---|---|

| Online Casinos | Market expansion, tech-driven | Market value at $67B |

| Sports Betting | Active user growth, live betting | Revenue increase 10-15% |

| Regulated Markets | Revenue stability, reduced risk | 80% revenue from regulated markets |

| Mobile Gaming | Rising smartphone use | Market estimated at $100B |

Cash Cows

Unibet, a key Kindred Group brand, is likely a Cash Cow. It has a strong market presence and brand recognition, ensuring consistent revenue. In Q3 2023, Kindred Group reported a revenue of £246.7 million. Maintaining customer loyalty via strategic marketing is key to sustained profitability.

Kindred Group views Western European markets as Cash Cows, generating significant revenue. These markets, including the UK and Sweden, benefit from high disposable incomes and regulatory stability. In 2023, Kindred's revenue from these regions was substantial, around 70% of total revenue. This strong base supports investment in other areas.

Kindred Group's Casino & Games are a Cash Cow, generating most revenue. They have a large customer base with constant demand. In Q4 2023, these products generated 53.6% of the group's revenue. Focusing on customer retention and game optimization is key.

Relax Gaming (B2B)

Relax Gaming, Kindred Group's B2B arm, is a Cash Cow, offering iGaming products to other operators. This segment ensures a steady revenue stream and diversifies Kindred's income. In 2024, Relax Gaming showed strong growth, with a 30% revenue increase. Expanding its product range is key for boosting profits.

- Revenue Growth: Relax Gaming saw a 30% revenue increase in 2024.

- Business Model: Supplies iGaming products to other operators.

- Strategic Role: Acts as a Cash Cow for Kindred Group.

- Income Diversification: Contributes to Kindred's diversified income sources.

Australia

Australia, a key market for Kindred Group, fits the Cash Cow profile. Its mature gambling market provides consistent revenue. In 2024, Kindred reported strong performance in Australia. Focus on operational efficiency is crucial for sustained profitability. This strategy helps maintain a strong financial position.

- Stable Revenue: Kindred's Australian operations generate consistent income.

- Market Share: Maintaining a strong market presence is a priority.

- Operational Efficiency: Optimizing processes boosts profitability.

- Financial Performance: Key to Kindred’s overall financial health.

Cash Cows are Kindred Group's reliable revenue generators. They have established market positions with steady incomes, like Relax Gaming, which grew 30% in 2024. These segments, including Australia, offer financial stability.

| Segment | Key Feature | Financial Impact |

|---|---|---|

| Relax Gaming | B2B iGaming Products | 30% Revenue Growth (2024) |

| Australia | Mature Gambling Market | Consistent Revenue |

| Casino & Games | Large Customer Base | 53.6% of Q4 Revenue (2023) |

Dogs

Kindred Group's exit from North America signifies a "Dog" status, implying poor returns despite investments. The decision aligns with reallocating resources to core markets. This shift enables focus on profitable, sustainable ventures. In Q1 2024, Kindred reported a 16% revenue decrease, possibly influenced by this strategic move.

Kindred Group's exit from non-locally regulated markets, like .com sites, signals these areas underperformed. These markets often faced regulatory hurdles and lower profits. In 2024, Kindred's focus shifted, with 96% of revenue from regulated markets, showing this strategic shift. This move aligns with their goal of sustainable revenue.

A "Dog" in Kindred Group's portfolio would be a brand with low market share and growth. These brands often struggle, possibly due to strong competition. For example, if a specific brand's revenue declined by 10% in 2024, it could be a Dog. Divestiture is a key strategy.

Poker (potentially)

Kindred Group's online poker operations could be categorized as a Dog within the BCG Matrix. This is because poker might not perform as well as other segments. Slow growth and the need for investment could further hinder its success. If poker doesn't generate sufficient returns, it fits the Dog profile.

- Kindred Group's Q1 2024 report showed a revenue of £286.7 million from online casino, which is a major part of its business.

- The online poker market's growth rate is generally slower compared to sports betting and online casino games.

- Kindred Group's investment in poker may not yield high returns.

- A Dog in BCG Matrix has low market share and low market growth.

Payment & Services

In Kindred Group's BCG Matrix, the "Payment & Services" business unit, with a 2024 revenue of €64.4 million, faces challenges. The recurring EBITDA of -€0.9 million suggests it is a "Dog". This classification implies low market share in a slow-growth industry, indicating potential for divestiture or restructuring.

- Revenue Generation: €64.4 million

- EBITDA: -€0.9 million

- Strategic Implication: Potential divestiture

Dogs in Kindred's BCG Matrix include underperforming segments with low market share and growth. This can be online poker, or Payment & Services with -€0.9M EBITDA in 2024. The strategy often involves divestiture or restructuring to reallocate resources.

| Segment | 2024 Revenue | EBITDA |

|---|---|---|

| Payment & Services | €64.4 million | -€0.9 million |

| Online Poker | Variable | Low |

| North America | Exit | N/A |

Question Marks

Additional hyper-local casino brands represent a question mark for Kindred Group. These new brands have high growth potential, yet they require significant investment to gain market share. Success depends on effective marketing and differentiation. For 2024, Kindred's revenue was £1.2 billion. The online casino market is highly competitive.

Finland, a Question Mark in Kindred Group's BCG matrix, anticipates market liberalization in 2026. This market presents high growth potential, but success hinges on Kindred's strategic investments. Kindred needs tailored offerings to gain market share. The Finnish gambling market was valued at €1.2 billion in 2023.

The Kindred Sportsbook Platform (KSP) is classified as a Question Mark in the BCG Matrix, indicating high investment with uncertain future returns. Kindred Group invested heavily in KSP to reduce third-party dependency. In Q3 2023, Kindred's gross winnings revenue was £299.4 million, showing the stakes. Successful adoption and performance are crucial for KSP's growth.

Expansion into New European Markets

Expansion into new European markets for Kindred Group aligns with the Question Mark quadrant of the BCG matrix. This strategy involves potential growth but also significant upfront investment and risk. Success hinges on navigating diverse regulatory landscapes and understanding local consumer behaviors. Kindred Group's 2023 report showed a focus on market diversification.

- 2023: Kindred Group's revenue from Europe was approximately £1.1 billion.

- 2024: The online gambling market in Europe is projected to reach €38.3 billion.

- A key risk is competition, with several established operators vying for market share.

- Strategic partnerships are essential for market entry and brand building.

AI-Driven Personalization

AI-driven personalization in online gambling represents a Question Mark within Kindred Group's BCG Matrix. This area requires substantial investment in technology and development, focusing on tailoring user experiences. Success hinges on boosting user engagement through effective personalization strategies. Constant adaptation and refinement are vital to capitalize on its potential benefits.

- Investment in AI for personalization is increasing across the gambling industry.

- User engagement metrics are key performance indicators (KPIs) to track success.

- Technological advancements in AI are constantly evolving.

- Personalization can lead to higher customer lifetime value (CLTV).

Kindred Group's Question Marks involve high investment and uncertain returns across various areas. These include new casino brands, expansion into new markets, and the Kindred Sportsbook Platform. AI-driven personalization also falls into this category, requiring significant tech investment. Successful strategies depend on effective marketing, regulatory navigation, and tech adoption.

| Area | Investment | Risk |

|---|---|---|

| New Casino Brands | High, to gain market share | Competition, ROI |

| New European Markets | Substantial, upfront | Regulatory, consumer behavior |

| KSP | Heavy, internal | Adoption, performance |

| AI Personalization | Tech, development | Engagement, tech evolution |

BCG Matrix Data Sources

This Kindred Group BCG Matrix uses financial statements, industry analyses, and market data, combined with expert opinions, to provide an in-depth strategic view.