Kindred Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kindred Group Bundle

What is included in the product

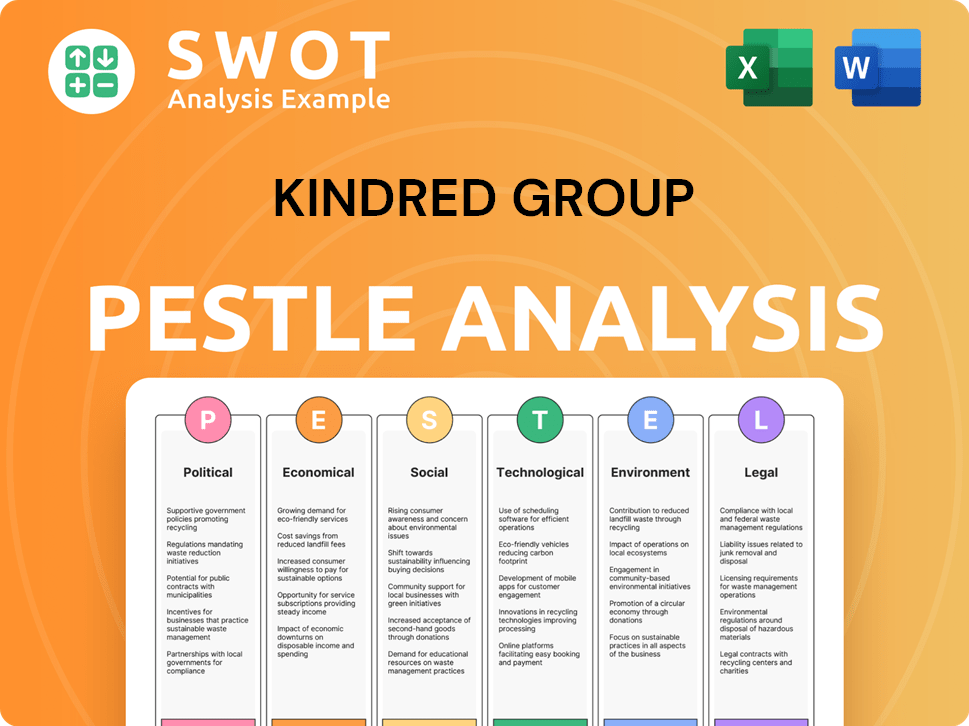

Explores external factors affecting Kindred Group across Political, Economic, etc. to inform executives and identify opportunities.

A clean, summarized version for referencing during meetings and presentations.

What You See Is What You Get

Kindred Group PESTLE Analysis

What you’re seeing here is the exact Kindred Group PESTLE Analysis document you'll receive.

This preview showcases the final formatting, content, and structure.

You will receive the same comprehensive, ready-to-use file upon purchase.

There are no differences; this is the complete document.

Get instant access to this professionally crafted analysis.

PESTLE Analysis Template

Navigate Kindred Group's external environment with precision. Our PESTLE Analysis unveils critical Political, Economic, Social, Technological, Legal, and Environmental factors. Gain a competitive advantage with insights into market risks and opportunities. This analysis is your key to informed strategy. Buy now to unlock in-depth findings!

Political factors

Governments globally are tightening regulations on online gambling, demanding licenses, and setting operational standards. Kindred Group, active in various regulated markets, must comply with these diverse political environments. In 2023, Kindred faced regulatory challenges, including license suspensions in certain jurisdictions. The evolving legal landscape necessitates constant adaptation to maintain market access and operational integrity.

Taxation on gambling winnings and Kindred Group's revenue differs greatly across nations. For instance, the UK's gross gambling yield tax rate is 15%, while Sweden's is 18%. Changes in tax laws can immediately impact Kindred's profits and pricing. The company must stay updated and adjust to tax changes in its operational areas. In 2024, Kindred Group paid £101.5 million in gambling duties.

Kindred Group faces political risks from operating internationally. Instability, government changes, or unrest can disrupt their operations. For example, Brexit created regulatory uncertainty. In 2024, geopolitical events impacted market access. Political risks require careful monitoring for market exits.

Trade Agreements and International Relations

International trade agreements and diplomatic relations significantly shape the online gambling landscape. They directly impact Kindred Group's market access and operational ease. For instance, the UK-Australia Free Trade Agreement, effective from 2023, could influence data flow. Such agreements affect cross-border business. Kindred Group's global strategy must adapt to these political realities.

- UK-Australia FTA: Potential data flow impacts.

- Brexit: Continues to influence EU market access.

- Regulatory changes: Adaptations needed for new laws.

- Diplomatic ties: Affects market entry strategies.

Government Stance on Responsible Gambling

Governments worldwide are intensifying their focus on responsible gambling, influencing Kindred Group's operations. Stricter advertising regulations and enhanced consumer protection measures are becoming more prevalent. For example, the UK's Gambling Commission reported a 12% decrease in problem gambling rates in 2024 due to these measures. These changes directly affect Kindred's marketing and operational strategies.

- Advertising Standards Authority (ASA) in the UK has increased scrutiny on gambling ads.

- Affordability checks are becoming mandatory in several European markets.

- Regulatory fines for non-compliance are on the rise.

Kindred Group faces constant political hurdles. Regulations, taxes, and international agreements shape market access and operations, like Brexit’s effects. Geopolitical events create instability, impacting market entry strategies.

Tax rates vary significantly; in 2024, the company paid £101.5M in gambling duties. Responsible gambling is also under intense scrutiny.

| Aspect | Impact | Example |

|---|---|---|

| Regulations | Compliance, market access | License suspensions in some jurisdictions. |

| Taxation | Profitability, pricing | UK's 15% tax on gross gambling yield. |

| Geopolitics | Market disruptions | Brexit influenced EU market access. |

Economic factors

The global economy's state significantly affects consumer spending. Economic slowdowns can lead to reduced spending on entertainment, impacting Kindred Group's revenue. For example, in 2023, the global online gambling market was valued at approximately $63.5 billion. Projections suggest it could reach $108.2 billion by 2028. This growth is sensitive to economic fluctuations.

Inflation poses a risk to Kindred Group by potentially raising operating costs. In the UK, inflation was 3.2% in March 2024. Interest rate fluctuations impact borrowing costs and investment returns. The Bank of England's base rate stood at 5.25% as of late 2024. These factors significantly influence financial results.

Kindred Group faces currency exchange rate risks due to its international operations. Fluctuating rates can affect reported revenue and expenses across different markets. For instance, a stronger Swedish krona (SEK) against the euro could positively impact reported earnings. The company's financial reports detail these exposures and hedging strategies. In 2024, exchange rate volatility remains a key consideration for Kindred's financial performance.

Market Growth and Opportunity

The online gambling market is booming, fueled by rising internet and smartphone use. This creates chances for Kindred Group to attract more customers and increase profits in expanding markets. The global online gambling market was valued at USD 63.53 billion in 2023 and is projected to reach USD 145.63 billion by 2030. This growth shows significant potential for Kindred.

- Market size: USD 63.53 billion (2023), projected to USD 145.63 billion by 2030.

- Smartphone penetration: Rising worldwide, expanding access to online gambling.

- Internet penetration: Continuous growth, especially in emerging markets.

Consumer Spending Power

Consumer spending power is crucial for Kindred Group, as it directly affects how much people can spend on gambling. Economic factors impacting disposable income in their key markets significantly influence Kindred's business performance. For example, in 2024, the UK's gambling market saw a revenue of £14.2 billion, showing consumer spending's impact. Economic downturns can reduce discretionary spending, potentially lowering gambling revenues. Conversely, economic growth often boosts these revenues.

- UK gambling market revenue in 2024: £14.2 billion.

- Economic growth often boosts gambling revenues.

- Economic downturns can reduce discretionary spending.

Economic conditions greatly influence Kindred's financial performance and market potential. Inflation rates, like the UK's 3.2% in March 2024, impact operational costs. Currency exchange rate risks, and fluctuations directly affect revenues across different markets where the group operates. Growing market size, with projections to USD 145.63 billion by 2030, signals strong prospects.

| Economic Factor | Impact on Kindred | 2024/2025 Data |

|---|---|---|

| Inflation | Increases operational costs | UK Inflation: 3.2% (March 2024) |

| Exchange Rates | Affects reported revenue & expenses | Focus on hedging strategies to mitigate risk |

| Market Growth | Expands customer base & revenue | Global online gambling market value: $145.63B by 2030 |

Sociological factors

Consumer behavior is changing. The online gambling market is influenced by preferences for games and platforms. Mobile gaming is a key trend, with mobile revenue expected to reach $100 billion by 2025. These shifts impact Kindred's strategies.

Public perception and social stigma significantly shape Kindred Group's operations. Negative views of online gambling can harm its brand and customer growth. In 2024, public concern over gambling addiction remains high, with about 2.8% of adults in the UK experiencing problem gambling. Media coverage and societal attitudes are critical factors.

Societal shifts prioritize responsible gambling. Kindred Group faces rising demand for safer tools. In 2024, 75% of Kindred's revenue came from locally licensed markets, highlighting their focus on regulated environments. This focus aligns with customer expectations for ethical practices. Kindred's initiatives, like their 'Journey Towards Zero' campaign, directly address these societal demands.

Demographic Trends

Demographic trends are crucial for Kindred Group. Changes in age, income, and cultural backgrounds impact their audience and marketing. For instance, the global online gambling market is projected to reach $107.08 billion by 2024. Understanding these shifts is key for tailored strategies.

- The online gambling market is expected to grow, reaching $114.09 billion by 2025.

- North America's online gambling market is forecast to hit $15.4 billion by 2025.

- The Asia-Pacific region is also seeing significant growth.

Influence of Social Media and Online Communities

Social media and online communities significantly shape perceptions of gambling, influencing Kindred Group's brand. Platforms disseminate information about operators, affecting reputation and customer engagement. In 2024, 68% of U.S. adults used social media, making it a key channel for feedback.

This impacts customer acquisition and retention. Positive reviews boost trust, while negative ones can lead to reputational damage and financial losses. Kindred Group's marketing strategies must account for this influence.

Customer interactions and feedback are crucial. Monitoring and responding to online conversations is essential for managing brand perception and addressing concerns. This proactive approach is vital for mitigating risks and enhancing customer relationships.

- Social media usage among U.S. adults: 68% in 2024.

- Impact of online reviews on brand reputation.

- Importance of proactive customer engagement strategies.

Societal attitudes towards online gambling, like Kindred Group’s operations, are changing significantly.

Public concern, especially in the UK, with around 2.8% experiencing gambling problems, highlights the need for responsible practices.

Kindred's focus on locally licensed markets, 75% of 2024 revenue, aligns with evolving consumer expectations and demands for ethical conduct and transparent operations.

| Factor | Details | 2024 Data |

|---|---|---|

| Public Perception | Attitudes toward online gambling | UK problem gambling rate ~2.8% |

| Market Focus | Revenue from regulated markets | ~75% of Kindred’s revenue |

| Market Growth | Global market projections | $107.08 billion in 2024 |

Technological factors

Advancements in online gaming tech, like better graphics and interfaces, are vital for Kindred Group. The global gaming market is huge, with revenues expected to hit $268.8 billion in 2024. This growth demands Kindred to stay innovative. New formats and immersive experiences can significantly boost user engagement and market share.

Mobile technology significantly shapes Kindred Group's operations. The surge in smartphone usage globally fuels mobile gambling's expansion. In 2024, mobile accounted for over 75% of online gambling revenue. Kindred must invest in mobile-first platforms for optimal user experiences, ensuring accessibility and engagement.

Kindred Group heavily relies on data analytics and AI. This aids in personalizing user experiences. In 2024, AI-driven insights improved customer engagement. Data analytics also strengthens responsible gambling tools. Kindred invested $20 million in AI initiatives by Q4 2024, boosting operational efficiency by 15%.

Payment Technologies and Security

Payment technologies and security are vital for Kindred Group's online gambling operations. The company must provide seamless and secure payment options to attract and retain customers. This includes adopting the latest encryption and fraud prevention tools. Furthermore, Kindred needs to comply with evolving payment regulations. Recent data shows a 20% increase in online payment fraud attempts in the gambling sector.

- Secure payment gateways are crucial.

- Kindred must prioritize fraud prevention.

- Compliance with payment regulations is necessary.

- Online payment fraud attempts are rising.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical for Kindred Group due to the handling of sensitive customer information and financial transactions. Compliance with regulations like GDPR is essential to avoid hefty fines; in 2024, GDPR fines reached €1.8 billion across the EU. Kindred must invest in advanced security protocols to protect against cyber threats, which are projected to cost businesses globally $10.5 trillion annually by 2025. Failure to protect data can severely damage customer trust and brand reputation.

- GDPR fines in 2024: €1.8 billion.

- Projected global cost of cybercrime by 2025: $10.5 trillion.

Kindred Group must focus on technological advancements for growth. This includes improved graphics and AI-driven user experiences. Mobile-first platforms are crucial, as mobile gambling comprises over 75% of revenue. Furthermore, robust cybersecurity and secure payment gateways are vital.

| Technology Aspect | Impact | Data (2024) |

|---|---|---|

| Online Gaming Tech | Enhances user engagement | Market revenue: $268.8B |

| Mobile Technology | Drives expansion | Mobile gambling revenue: 75%+ |

| Cybersecurity | Protects customer data | GDPR fines: €1.8B |

Legal factors

Kindred Group faces stringent gambling regulations, needing licenses in every operational area. These licenses are crucial for legal operation, with compliance being a key legal factor. The UK Gambling Commission, for example, reported £18.8 million in penalties in 2024. Non-compliance can lead to hefty fines and loss of operating rights. Navigating these complex rules is essential for Kindred's market access and sustainability.

Consumer protection laws, such as advertising standards and fairness in gaming, critically influence Kindred Group's strategies. These laws ensure responsible marketing and fair play. For example, in 2024, the UK's Gambling Commission issued £7.1 million in fines, emphasizing the need for compliance. Handling customer complaints effectively is also crucial. Kindred Group's commitment to these laws affects its brand reputation and operational costs.

Kindred Group faces stringent data privacy rules, like GDPR. These laws mandate how they handle customer data. In 2024, GDPR fines reached billions across various sectors. Compliance costs impact operational budgets.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Kindred Group faces rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules aim to prevent the use of online gambling platforms for illegal activities. Kindred must maintain robust compliance procedures across all operations. Failure to comply can result in significant fines and reputational damage. In 2024, the global AML market was valued at $1.7 billion, projected to reach $3.5 billion by 2029.

- AML/CTF compliance is crucial for Kindred's operations.

- Non-compliance risks substantial financial penalties.

- The AML market is experiencing significant growth.

- Kindred must continuously update its procedures.

Contract Law and Terms and Conditions

Kindred Group operates under strict contract law and terms and conditions to ensure fair dealings with customers. These legal frameworks dictate how services are offered, user rights, and dispute resolution. Compliance is critical, with potential fines reaching up to 4% of annual global turnover for breaches of regulations like GDPR. In 2023, the European gambling market was valued at €92.2 billion, highlighting the stakes.

- GDPR compliance is crucial for data handling.

- Terms must be transparent and easily understood.

- Disputes must be handled fairly and legally.

- Failure to comply can result in significant penalties.

Kindred Group must comply with diverse gambling laws, needing licenses and adhering to consumer protection, like the UK Gambling Commission, which issued £7.1 million in fines in 2024. Data privacy laws, such as GDPR, and anti-money laundering (AML) regulations like the global AML market, valued at $1.7 billion in 2024, affect Kindred's operations and demand robust compliance. Compliance is also critical under strict contract law; failure to comply can lead to significant penalties.

| Legal Area | Regulatory Body | Recent Data (2024/2025) |

|---|---|---|

| Gambling Regulations | UK Gambling Commission | £18.8M penalties issued (2024), strict licensing requirements |

| Consumer Protection | UK Gambling Commission | £7.1M fines (2024) for non-compliance; focus on fair play |

| Data Privacy | GDPR Authorities | Multi-billion Euro fines (various sectors); ongoing compliance costs |

| AML/CTF | Financial Regulators | Global AML market at $1.7B (2024), projected to $3.5B by 2029 |

Environmental factors

Corporate Social Responsibility (CSR) and sustainability are becoming increasingly important. Kindred Group, like all companies, faces expectations regarding its environmental impact. This includes energy use and waste management. In 2024, CSR spending rose by 15% globally.

Climate change indirectly influences Kindred Group. Extreme weather, a climate change effect, can disrupt infrastructure. For example, in 2023, global insured losses from natural disasters totaled $118 billion. This could affect Kindred's operational areas and user access.

Kindred Group, as an online business, has a limited direct environmental impact. However, it must comply with environmental regulations where its offices and data centers are located. In 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) expands sustainability reporting requirements, which may affect Kindred. Specifically, companies with over 250 employees need to report on environmental matters.

Stakeholder Expectations on Environmental Performance

Investors, customers, and employees are increasingly focused on environmental responsibility. Kindred Group faces growing pressure to showcase its sustainability efforts. This includes transparent reporting and concrete actions to reduce its environmental impact. Failure to meet these expectations could affect the company's reputation and investor relations. Consider that in 2024, ESG-focused funds saw significant inflows, indicating the growing importance of environmental performance.

- Increased scrutiny on carbon footprint reduction.

- Demand for sustainable sourcing and operations.

- Growing importance of ESG reporting standards.

- Potential impact on brand reputation and financial performance.

Supply Chain Environmental Impact

Kindred Group's digital nature doesn't eliminate its environmental impact. The supply chain, involving hardware and data centers, poses environmental challenges. There's increasing pressure to evaluate supplier environmental performance. This includes energy consumption and waste management. For example, data centers globally consume about 1-2% of the world's electricity.

- Data center energy use is projected to rise.

- Sustainability reports are increasingly important.

- Supply chain transparency is crucial.

Kindred Group must address growing environmental concerns, focusing on reducing its carbon footprint. It involves sustainable sourcing within its supply chain. Data centers' energy use and sustainability reporting will be crucial. In 2024, global data center energy consumption hit around 1.5% of world's total. The trend suggests rising demand.

| Environmental Aspect | Impact on Kindred | 2024/2025 Data |

|---|---|---|

| Carbon Footprint | Reputation and Compliance | Data centers consume ~1.5% global energy |

| Sustainable Sourcing | Supply Chain Risks | ESG funds saw significant inflows |

| ESG Reporting | Investor Relations | EU CSRD expands reporting |

PESTLE Analysis Data Sources

Kindred Group's PESTLE Analysis uses data from financial reports, regulatory bodies, and market research to inform analysis. Industry reports and government data also fuel the analysis.