Kontoor Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kontoor Brands Bundle

What is included in the product

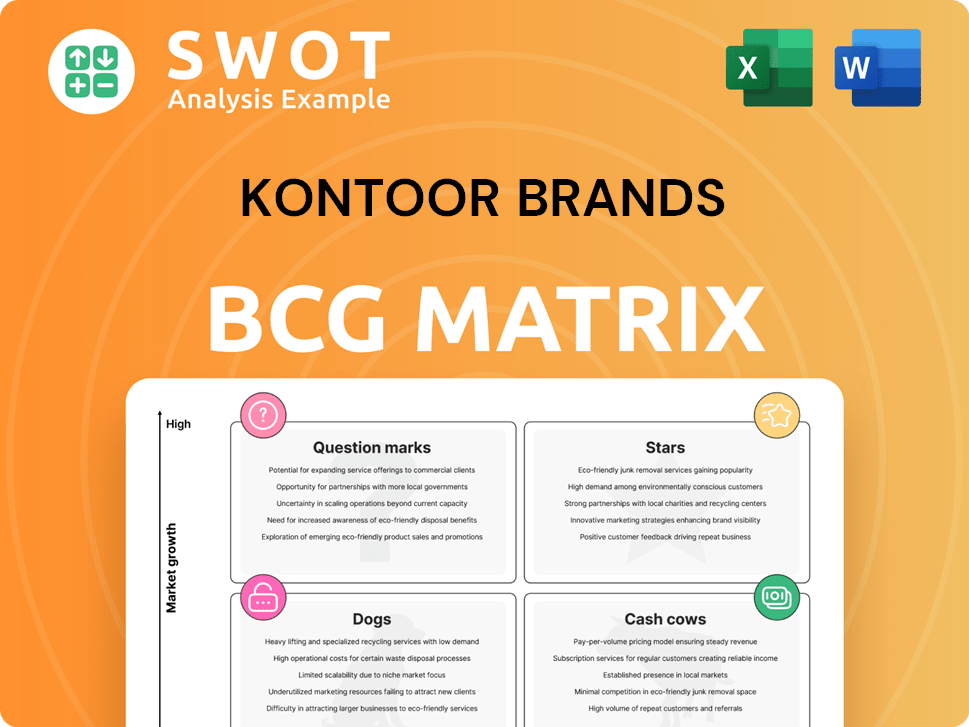

BCG Matrix analysis of Kontoor's brands. Focus on Stars, Cash Cows, Question Marks, and Dogs.

Printable summary optimized for A4 and mobile PDFs, delivering a concise overview of the BCG Matrix.

Delivered as Shown

Kontoor Brands BCG Matrix

The BCG Matrix preview mirrors the final document you receive after purchase. This is the complete, ready-to-use strategic analysis tool, professionally formatted for immediate application in your business strategy. Download it instantly to visualize Kontoor Brands' market positioning.

BCG Matrix Template

Kontoor Brands' portfolio likely features a mix of established and emerging products. This preview hints at the dynamics within its brand lineup. Understanding its Stars, Cash Cows, Question Marks, and Dogs is vital for strategic decisions. This snapshot only scratches the surface of where Kontoor Brands stands. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Wrangler, a Star in Kontoor Brands' BCG Matrix, saw its 2024 revenue rise by 3% to $1.81 billion. This growth reflects its strong market position and successful marketing strategies. The brand's appeal spans various consumer interests, driving continuous market share gains in the US. To sustain this performance, ongoing investment is crucial for Wrangler.

Kontoor Brands' US market is a "Star" in its BCG Matrix, exhibiting robust performance. Revenue in the US rose by 1% in 2024, reaching $2.09 billion. This growth is driven by expanded distribution, market share gains, and strong sales in wholesale and direct-to-consumer channels. The US market's success highlights it as a high-growth, high-share area for Kontoor.

Kontoor Brands' DTC digital sales are a "Star" in its BCG matrix. They saw an 8% rise in the U.S. and a 15% increase internationally in 2024. This shows strong growth and market presence in online sales. Ongoing investment in digital platforms is key to keeping this momentum going. In 2024, digital sales accounted for a significant portion of total revenue.

Project Jeanius Initiatives

Project Jeanius at Kontoor Brands is a standout "star" initiative, a transformation program focused on boosting efficiency and cutting costs. The company anticipates over $100 million in run-rate benefits by 2026, with gains starting to show in its 2025 financial results. This project is vital for improving profitability and operational effectiveness, solidifying its position as a high-growth, impactful area for Kontoor Brands.

- Expected benefits exceed $100M by 2026.

- Benefits are projected to impact the P&L in 2025.

- Focus on enhancing operational efficiency.

- Aims to drive profitability and efficiency.

Helly Hansen Acquisition (Future Star)

The pending Helly Hansen acquisition, slated for Q2 2025, is a strategic advancement for Kontoor Brands. Helly Hansen is anticipated to contribute $680 million in revenue in 2025, broadening Kontoor’s scope into performance apparel. This venture could become a high-growth, high-market-share entity, dependent on effective integration and market reach.

- Acquisition Closing: Q2 2025.

- 2025 Revenue Projection: $680 million.

- Strategic Impact: Diversification into high-performance apparel.

- Success Factors: Integration and market penetration.

Wrangler, the US market, DTC digital sales, and Project Jeanius exemplify Kontoor Brands' Stars, showing high growth. Wrangler's 2024 revenue grew 3% to $1.81B, while the US market rose 1% to $2.09B. Digital sales jumped, and Jeanius promises over $100M benefits by 2026.

| Star | 2024 Revenue/Benefit | Growth/Impact |

|---|---|---|

| Wrangler | $1.81B | 3% Revenue Growth |

| US Market | $2.09B | 1% Revenue Growth |

| DTC Digital | Significant | 8-15% Growth |

| Project Jeanius | >$100M by 2026 | Efficiency, Cost Savings |

Cash Cows

Kontoor Brands' U.S. wholesale business is a cash cow, showing stability. Revenue grew by 1% in 2024. This segment offers a reliable income stream with minimal promotional costs. Focusing on supply chain improvements boosts efficiency and cash flow.

Kontoor Brands' global direct-to-consumer (DTC) channel is a cash cow, demonstrating strong performance. The DTC channel saw a 9% increase in Q4 2024. This channel offers higher margins than wholesale. Maintaining productivity is key for continued financial gains.

Kontoor Brands' "Cash Cows" status is bolstered by cost savings from operational efficiencies. Project Jeanius aims to deliver substantial cost reductions, directly boosting cash flow. In Q3 2024, Kontoor reported a gross margin increase, reflecting these improvements. Streamlining operations will continue to enhance profitability.

Licensing Agreements

Kontoor Brands taps into licensing agreements, generating revenue with minimal effort. This strategy provides a steady income stream, boosting its cash flow. Actively managing these deals ensures consistent returns. In 2024, licensing contributed significantly to overall revenue.

- Licensing revenue provides a reliable income source.

- Minimal investment is required for high returns.

- Active management sustains cash flow.

- Licensing agreements are vital for brand expansion.

Strong Brand Recognition

Kontoor Brands benefits from strong brand recognition for Wrangler and Lee, fostering customer loyalty. This brand equity is vital for maintaining market share, which requires less marketing spending than competitors. In 2023, Wrangler and Lee generated about $2.6 billion in revenue, emphasizing their profitability. Leveraging this brand strength is key to sustaining their cash cow status.

- High brand awareness ensures steady sales.

- Loyal customers provide consistent revenue.

- Reduced marketing costs improve margins.

- Brand equity supports premium pricing.

Kontoor Brands' cash cows, like the U.S. wholesale business and DTC channel, generate steady revenue. Licensing and strong brand recognition enhance financial stability. In 2024, cost-saving initiatives further bolstered profitability.

| Segment | Revenue (2024) | Key Benefit |

|---|---|---|

| U.S. Wholesale | +1% | Stable income |

| DTC Channel | +9% (Q4 2024) | Higher Margins |

| Licensing | Significant Contribution | Steady Income |

Dogs

The Lee brand, categorized within Kontoor Brands' BCG Matrix, faced a challenging 2024. Global revenue for Lee decreased by 6% last year, reflecting difficulties in wholesale and physical retail channels. International markets were particularly affected by these downturns. Strategic reassessment is crucial, as costly turnaround strategies may not yield the desired results.

Kontoor Brands' international wholesale revenue (excluding the U.S.) saw a 4% decrease in 2024, according to recent financial reports. This performance suggests a low-growth market for Kontoor in these international wholesale regions. The BCG matrix would categorize this as a "Dog," indicating both low market share and low growth. To avoid tying up capital, Kontoor might consider divesting or restructuring operations in these areas.

Kontoor Brands' brick-and-mortar locations face challenges. Sales dipped, with a 1% decrease in the U.S. during 2024. These stores may be underperforming, impacting capital efficiency. Evaluate and possibly close underperforming locations for better profitability.

Non-Core Product Lines

Dogs in Kontoor Brands' portfolio, like certain non-core Wrangler and Lee product lines, face low growth and market share. These product lines often barely break even, tying up capital without substantial returns. For example, in 2024, Kontoor Brands might have identified a specific sub-category within Wrangler jeans that saw flat sales and minimal profit. Divesting or reducing investment in these underperforming areas frees resources for faster-growing segments.

- Low growth and market share.

- Consumes cash without generating significant returns.

- Examples are specific sub-categories within Wrangler and Lee.

- Divestment frees resources.

Underperforming International Markets

Certain international markets where Kontoor Brands has a limited presence and low market share are categorized as dogs in the BCG Matrix. These markets demand substantial investment to gain ground, yet yield modest returns, as seen in some regions where Kontoor's market share is under 5%. Reassessing strategy is crucial to prevent cash traps, especially considering the fluctuating economic conditions in 2024. Kontoor Brands' international sales in 2023 accounted for approximately 35% of total revenue.

- Limited market share in specific international regions.

- High investment needs with low returns.

- Risk of becoming cash traps.

- Strategic reassessment is essential.

Dogs in Kontoor Brands' BCG Matrix represent low-growth, low-share segments. These consume cash without significant returns, like underperforming Lee or Wrangler sub-categories. Divestment or restructuring may free resources for growth.

| Characteristics | Impact | 2024 Example |

|---|---|---|

| Low Market Share & Growth | Cash Drain | Lee's 6% Global Revenue Decline |

| High Investment, Low Returns | Strategic Risk | Int'l Wholesale Down 4% |

| Underperforming product lines | Capital inefficiency | Specific Wrangler/Lee sub-categories |

Question Marks

Lee's X and MVP Heritage projects, focused on premium distribution and new consumers, represent Kontoor Brands' question marks. These initiatives, with high growth potential, currently have a low market share. In 2024, Kontoor Brands invested heavily in these projects, allocating approximately $20 million. The strategic decision is whether to significantly increase investments to capture market share or divest if growth stalls.

Lee's expanded women's non-denim line is a Question Mark in Kontoor Brands' portfolio. This category has high growth potential, but a low market share currently. In 2024, the company invested heavily in marketing. If the non-denim range doesn't gain share, it risks becoming a Dog. Further investments are needed to boost its market position.

Shop-in-shops with key retailers are a strategic move to boost Kontoor Brands' presence and improve the customer journey. Although the growth potential is significant, the current market share is low. To avoid becoming a "dog," Kontoor Brands needs to quickly increase its market share. The best course of action is to either invest heavily or consider a sale. In 2024, the retail sales in the US reached $7.1 trillion, highlighting the importance of a strong retail presence.

New Collaborations (Lee)

Lee's new collaborations, such as those with Buck Mason and Paul Smith, represent a "Question Mark" in the BCG Matrix. These partnerships target new consumer segments, aiming for high growth. Currently, these products have a low market share, making their future uncertain. The marketing strategy focuses on rapid market adoption to avoid becoming "Dogs."

- The global denim jeans market was valued at USD 87.98 billion in 2023.

- Lee's revenue in 2023 was approximately $1.1 billion.

- Collaborations aim to increase Lee's market share.

- Failure to gain traction may result in discontinuation.

International Digital Sales Growth

Within Kontoor Brands' BCG matrix, the international digital sales growth segment aligns with the "Question Mark" category. Despite an overall decrease in international revenue, digital sales increased by 15% in 2024. This indicates a high-growth potential in the international market, excluding the U.S., but with a currently low market share. These segments often require significant investment without immediate returns.

- Digital sales grew by 15% in 2024.

- International revenue decreased overall.

- Represents a high-growth, low-share area.

- Requires cash investment.

Question Marks within Kontoor Brands, like Lee's X and MVP projects, represent high-growth potential but low market share. Investments in these areas, such as the $20 million allocated in 2024, are crucial. Digital sales, with a 15% increase in 2024, also fall into this category. The goal is to increase market share or face divestiture, given the risk.

| Category | Description | 2024 Status |

|---|---|---|

| Lee's X/MVP | Premium distribution/new consumers | $20M Investment |

| Women's Non-Denim | High growth potential | Marketing investment |

| International Digital | Digital sales outside US | Up 15% |

BCG Matrix Data Sources

Kontoor Brands' BCG Matrix uses financial statements, market share data, and industry reports, augmented by expert analysis.