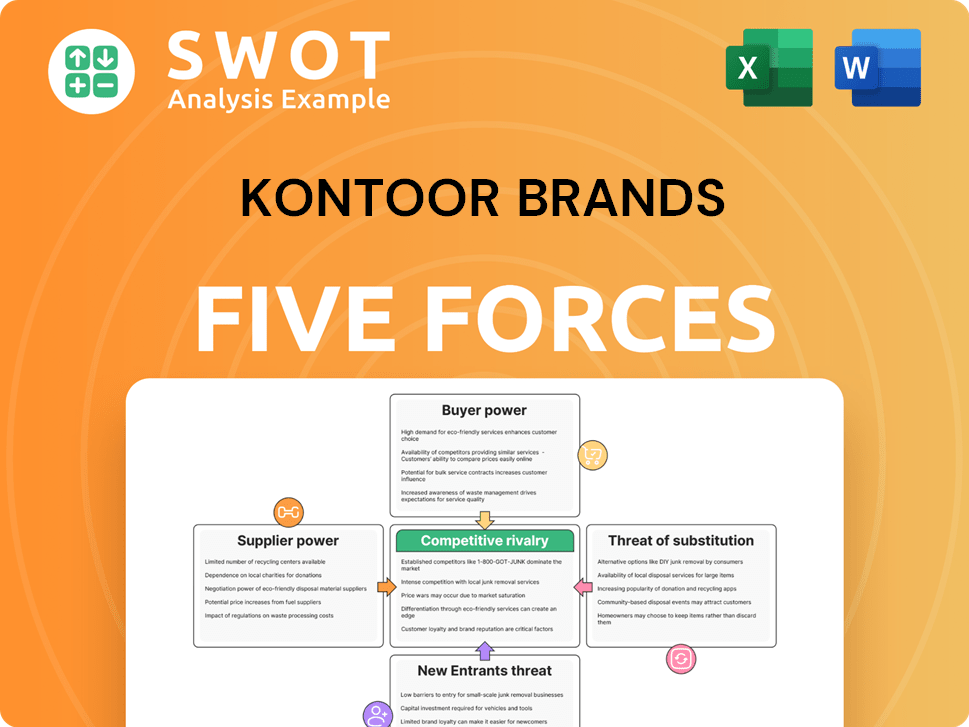

Kontoor Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kontoor Brands Bundle

What is included in the product

Tailored exclusively for Kontoor Brands, analyzing its position within its competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions.

What You See Is What You Get

Kontoor Brands Porter's Five Forces Analysis

This preview offers the complete Kontoor Brands Porter's Five Forces analysis. You're viewing the same in-depth, ready-to-use document available for download immediately after purchase.

Porter's Five Forces Analysis Template

Kontoor Brands faces moderate rivalry, with strong brand recognition. Buyer power is moderate due to consumer loyalty. Supplier power is relatively low, with diversified fabric sources. The threat of new entrants is moderate, given the established market. Substitute products pose a moderate threat. Ready to move beyond the basics? Get a full strategic breakdown of Kontoor Brands’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts Kontoor Brands. A concentrated supplier base, especially for raw materials like cotton, increases supplier power. In 2024, the top five cotton-producing countries accounted for over 70% of global production, potentially affecting Kontoor's costs. This concentration gives suppliers more negotiation leverage.

Kontoor Brands' global sourcing strategy intensifies competition among suppliers, potentially reducing their bargaining power. This approach helps with cost management, crucial for profitability. However, global sourcing introduces risks, including geopolitical instability, tariffs, and supply chain disruptions. In 2024, the company's ability to balance cost efficiencies and supply chain resilience remains vital, especially with ongoing trade uncertainties.

Kontoor Brands' success relies on strong supplier relationships. Building partnerships with key suppliers helps manage risk and stabilize pricing. Long-term deals protect against price swings and ensure material supply. In 2024, responsible sourcing was a key focus, highlighting supplier importance.

Vertical Integration

The bargaining power of suppliers, especially in the cotton industry, is a key aspect for Kontoor Brands. Suppliers integrating vertically can gain more control over pricing and supply, potentially impacting Kontoor. For example, in 2024, cotton prices saw fluctuations due to global supply chain issues. Kontoor's strategy to mitigate supplier power involves a balanced global sourcing approach.

- Vertical integration by cotton suppliers can increase their market power.

- Kontoor manages this through diversified sourcing to reduce dependence.

- In 2024, cotton prices were volatile, highlighting supplier influence.

- A global sourcing strategy helps Kontoor maintain supply stability.

Sustainability Demands

Sustainability demands are reshaping supplier dynamics, potentially increasing their bargaining power. Suppliers offering sustainable and ethically sourced materials gain an advantage, influencing pricing and availability. Kontoor Brands' sourcing strategy prioritizes sustainability, impacting supplier selection and collaboration. In 2023, the global sustainable fashion market was valued at $31.8 billion, reflecting this shift.

- Focus on sustainable materials like recycled denim.

- Compliance with environmental and social standards.

- Partnerships with eco-conscious suppliers.

- Transparency in the supply chain.

Supplier power significantly impacts Kontoor Brands, especially due to cotton's concentrated supply. In 2024, top cotton producers controlled over 70% of global output, affecting costs. Kontoor mitigates this through global sourcing and supplier relationships, aiming for supply stability.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Increased bargaining power | Top 5 cotton producers: 70%+ global share |

| Sourcing Strategy | Cost management, risk mitigation | Global sourcing; focus on responsible sourcing |

| Sustainability | Influences supplier selection | 2023 sustainable fashion market: $31.8B |

Customers Bargaining Power

Customers wield substantial bargaining power in the apparel industry due to extensive choices. With countless brands and retailers, consumers can readily switch if unsatisfied. Kontoor Brands faces pressure to excel and maintain loyalty. In 2024, the apparel market saw over $1.7 trillion in global sales, highlighting competition.

Price sensitivity is heightened, particularly during economic downturns, boosting buyer power. Consumers readily opt for cheaper alternatives if Kontoor Brands increases prices. In 2024, the apparel industry saw significant shifts; for instance, in Q3 2024, overall consumer spending on apparel dipped by 3.2%. Kontoor Brands must carefully balance pricing with perceived value.

E-commerce has significantly amplified customer power, reshaping retail dynamics. Consumers now access diverse choices and can easily compare prices online, fueling competition. In 2024, e-commerce sales are projected to account for over 20% of total retail sales globally. To thrive, Kontoor Brands must prioritize digital investments, aiming to enhance customer experience and broaden market reach.

Brand Loyalty

Kontoor Brands benefits from strong brand loyalty, especially with Wrangler and Lee. This customer loyalty reduces the bargaining power of customers. Established brands like these enjoy customer recognition and trust, boosting repeat purchases. In 2024, Wrangler's global brand revenue reached $2.2 billion, demonstrating this loyalty.

- Wrangler's global brand revenue in 2024 was $2.2 billion.

- Lee's brand revenue contributed significantly, showcasing brand loyalty.

- Brand recognition fosters customer trust and repeat business.

- Kontoor leverages its brand portfolio for a competitive edge.

Demand for Personalization

Consumers' desire for personalized shopping is rising. This impacts their choices. Kontoor Brands can use data analytics and customization. This helps meet individual styles and preferences. In 2024, personalized retail is a $33.5 billion market.

- Personalization drives purchasing decisions.

- Data analytics and customization are key strategies.

- Customer relationships are strengthened through tailored experiences.

- The personalized retail market reached $33.5B in 2024.

Customers influence the apparel market due to vast choices, enhancing their leverage. Price sensitivity is heightened, particularly during economic downturns, boosting buyer power. Kontoor Brands benefits from strong brand loyalty; for instance, in 2024, Wrangler's global brand revenue reached $2.2 billion.

| Factor | Impact on Customer Power | 2024 Data |

|---|---|---|

| Market Competition | High: Many brands & retailers | Apparel market: $1.7T in global sales |

| Price Sensitivity | High: Customers seek alternatives | Q3 2024: Apparel spending dipped 3.2% |

| E-commerce | High: Easy price comparison | E-commerce sales: Over 20% of retail |

Rivalry Among Competitors

The apparel industry is a battlefield. Kontoor Brands faces fierce competition. Rivals like Levi Strauss & Co. and Gap Inc. are constantly battling for consumer dollars. Kontoor must innovate to survive. In 2024, the global apparel market was estimated at $1.7 trillion.

The fast fashion trend intensifies competition, shortening product cycles. Kontoor Brands needs agility to compete. In 2024, fast fashion's market share grew, pressuring established brands. Balancing trends with core brand strength is vital.

Established brands like Levi's, a major competitor, present a formidable challenge due to their substantial market share and deeply ingrained customer loyalty. These competitors boast robust brand recognition and long-standing customer relationships. In 2024, Levi Strauss & Co. reported net revenues of $6.2 billion. Kontoor Brands must capitalize on its own brand legacy and innovation to effectively compete.

Global Market Differentiation

Global market differentiation is crucial for Kontoor Brands due to varied consumer preferences and regional dynamics. Operating in a global market, Kontoor Brands faces diverse consumer segments. Adapting products and marketing strategies to suit regions is vital. In 2024, the apparel market shows this, with Asia-Pacific leading growth. Kontoor must tailor its approach.

- Varying consumer preferences globally require tailored product offerings.

- Adapting marketing strategies is essential to resonate with different regions.

- The Asia-Pacific region is a key growth market for apparel in 2024.

- Success depends on understanding and catering to regional specifics.

Brand Development Investment

Kontoor Brands faces intense competition, necessitating continuous investment in brand development and marketing. In 2024, the fashion industry is shifting focus back to brand marketing from performance marketing. Kontoor's strategy includes allocating resources to product innovation and marketing to strengthen its brands. This approach aims to maintain a competitive advantage in a dynamic market.

- Kontoor Brands' advertising and promotion expenses were approximately $140 million in 2023.

- The company's focus is on digital marketing and direct-to-consumer channels.

- Innovation in product design is also a key factor.

- The company aims to increase brand awareness.

Competitive rivalry in the apparel sector is high, impacting Kontoor Brands. Fast fashion's impact means shorter product cycles, needing agility. Established brands, like Levi's, are strong competitors.

| Aspect | Impact | Data (2024 est.) |

|---|---|---|

| Market Dynamics | Intense competition | $1.7T Global Apparel Market |

| Key Competitors | Levi Strauss | $6.2B Revenue |

| Marketing Focus | Brand development is important | $140M (2023) ad expenses |

SSubstitutes Threaten

The rise of athleisure poses a real threat. Companies like Lululemon and Nike are taking market share. Kontoor Brands needs to offer comfy, versatile clothes. In 2024, the athleisure market is worth billions, showing its impact. This shift challenges traditional casual wear.

The surge in online shopping and digital fashion platforms significantly elevates the threat of substitutes for Kontoor Brands. Consumers now have access to a vast array of online retailers. These retailers provide diverse clothing styles and brands. To remain competitive, Kontoor Brands must improve its online presence and digital customer experience. E-commerce sales in the apparel market reached approximately $169.5 billion in 2024, highlighting the importance of a strong digital strategy.

The rise of sustainable fashion brands presents a significant threat. Consumers are actively seeking eco-friendly options, impacting traditional apparel sales. Kontoor Brands needs to adopt sustainable practices to stay competitive. In 2024, the sustainable apparel market is estimated at over $30 billion, showing this shift.

Versatile Clothing

The threat of substitutes rises as consumers favor versatile clothing. Shoppers now seek adaptable wardrobe choices suitable for diverse scenarios. For instance, a 2024 study revealed a 15% increase in demand for multi-functional apparel. Kontoor Brands can counter this by providing adaptable, multi-purpose clothing. This strategy can help retain market share.

- Consumer preference shift towards versatile clothing.

- Increased demand for adaptable wardrobe solutions.

- Kontoor Brands can offer multi-purpose clothing.

- Strategy to maintain market share.

Thrift and Second-hand

The rising popularity of thrift stores and second-hand markets poses a threat to Kontoor Brands. Consumers are increasingly opting for budget-friendly and eco-conscious choices. In 2024, the global second-hand apparel market was valued at over $100 billion. Kontoor Brands could consider resale initiatives or highlight product durability. This is a smart move.

- Market growth: The second-hand apparel market is expanding rapidly.

- Consumer behavior: Thrift shopping appeals to cost-conscious and environmentally aware buyers.

- Strategic response: Kontoor Brands can explore resale options or emphasize product longevity.

- Financial impact: Adapting to this trend is crucial for maintaining market share.

Consumers increasingly prefer versatile clothing, boosting the threat of substitutes for Kontoor Brands. Multi-functional apparel demand grew by 15% in 2024, signaling the need for adaptable offerings. Kontoor Brands can maintain market share by providing versatile, multi-purpose clothing.

| Substitute | Market Trend | Kontoor Brands Response |

|---|---|---|

| Athleisure | Multi-billion dollar market in 2024 | Offer versatile clothes |

| Online Retail | $169.5B E-commerce apparel sales in 2024 | Enhance online presence |

| Sustainable Fashion | $30B+ sustainable apparel market (2024 est.) | Adopt sustainable practices |

Entrants Threaten

E-commerce entry poses a threat due to low startup costs, facilitated by platforms like Shopify. New entrants can avoid the expenses of physical retail locations, creating price competition. Kontoor Brands, with its global footprint and brand recognition, must use its strengths. In 2024, online sales growth in apparel reached 8%, highlighting the need for Kontoor to strengthen its digital presence.

Established brand loyalty presents a moderate barrier to entry for Kontoor Brands. Wrangler and Lee, with their long histories, enjoy strong customer recognition. New entrants need substantial marketing investments to compete. In 2024, Kontoor Brands' marketing expenses were a notable part of its cost structure, reflecting the need to maintain its brand presence.

New entrants face supply chain hurdles. Building an efficient supply chain needs resources and expertise. Kontoor Brands' established supply chain is a strong advantage. In 2024, global supply chain costs remain elevated. This creates barriers for new competitors.

Capital Requirements

High capital requirements are a significant barrier for new entrants in the apparel industry, including Kontoor Brands. The costs associated with real estate, inventory, and marketing can be prohibitive. Starting a fashion retail business demands substantial financial investment to establish a presence. New companies often struggle to secure the funding needed to compete with established brands effectively.

- Real estate and store setup costs can range from $500,000 to $2 million.

- Inventory investment can vary, but a starting budget of $200,000 to $1 million is common.

- Marketing and advertising expenses can reach $100,000 to $500,000 or more.

- Overall, new entrants need significant capital to cover initial operating expenses.

Digital Innovation

Digital innovation significantly impacts Kontoor Brands, as online retailing reduces entry barriers for new competitors. This allows niche brands to reach consumers directly, increasing competitive pressure. To stay ahead, Kontoor Brands must continually innovate digitally, enhancing its online presence and customer experience. This proactive approach is crucial for maintaining market share and brand relevance in the evolving apparel industry.

- Online apparel sales are projected to reach $980 billion by 2024.

- The global apparel market was valued at $1.5 trillion in 2023.

- Digital marketing spend in the apparel sector is increasing by 8-10% annually.

- E-commerce penetration in the apparel industry is around 35% as of late 2024.

The threat of new entrants to Kontoor Brands is moderate, influenced by various factors. While e-commerce lowers entry barriers, established brands like Wrangler and Lee hold strong customer loyalty, requiring substantial marketing spending to compete. High capital requirements and supply chain complexities create additional hurdles. Digital innovation and changing consumer preferences add further layers of competition, demanding constant adaptation.

| Factor | Impact | Data (2024) |

|---|---|---|

| E-commerce | Lowers barriers | Online apparel sales hit $980B |

| Brand Loyalty | Moderate Barrier | Marketing spend up 8-10% |

| Capital Needs | High Barrier | Start-up costs from $500k |

Porter's Five Forces Analysis Data Sources

Kontoor Brands' Porter's Five Forces analysis utilizes financial statements, market share data, and industry reports to inform competitive insights.