LendLease Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LendLease Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, relieving the pain of clumsy presentations.

What You’re Viewing Is Included

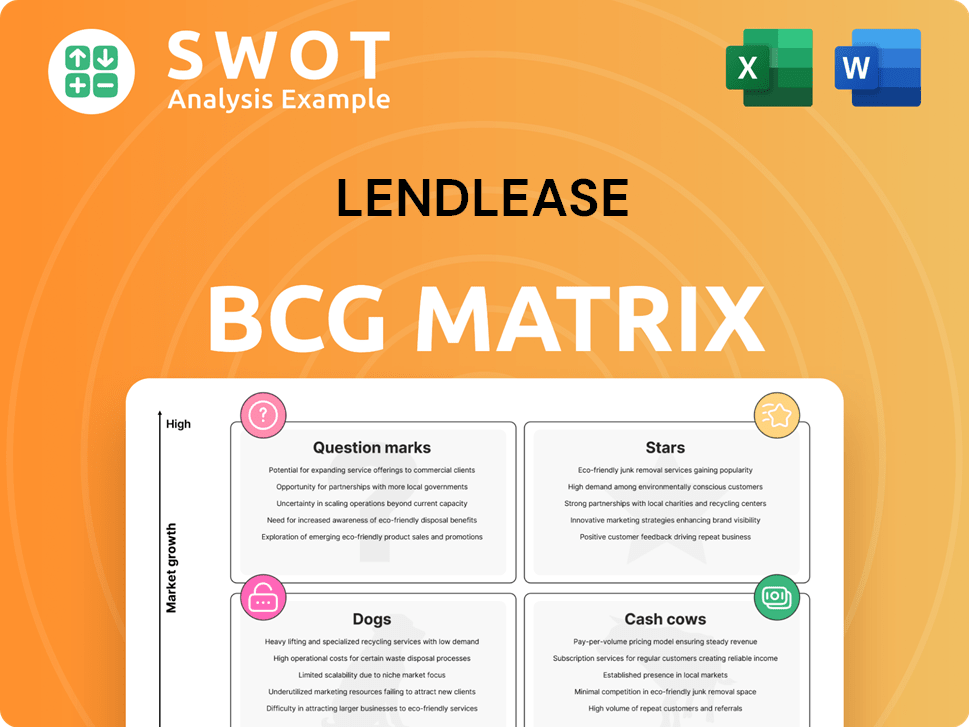

LendLease BCG Matrix

This preview showcases the complete LendLease BCG Matrix you'll receive after buying. It's a fully functional, analysis-ready document with no hidden content or watermarks. Directly download the same strategic tool you're currently examining.

BCG Matrix Template

Lendlease navigates a complex real estate and infrastructure landscape. Analyzing its portfolio through the BCG Matrix reveals key growth drivers. This preview hints at strategic product positions—Stars, Cash Cows, and more. Understand Lendlease's strengths and weaknesses with clear quadrant placements. Gain data-backed insights and strategic recommendations. Ready-to-use formats await in the full BCG Matrix report. Purchase now for competitive clarity and a powerful strategic tool.

Stars

Lendlease excels in urban regeneration, especially in Australia, transforming cityscapes. These complex projects, requiring vast resources, fit the 'Star' profile. Recent data shows a strong focus on sustainable, community-focused developments. For instance, Lendlease's Barangaroo project in Sydney, valued at billions, exemplifies this strategy, driving long-term value.

Lendlease's masterplanned communities, including Yarrabilba and Elliot Springs, are positioned as "Stars" in their BCG Matrix. These developments, combining residential, commercial, and recreational elements, are in high-growth markets. Lendlease's focus on sustainability and community building strengthens their market presence, with projects like Yarrabilba experiencing strong demand. In 2024, these communities continue to drive revenue growth.

Lendlease's international investment platform, a high-growth area, leverages its funds management capabilities. This platform uses real estate expertise to generate investor returns. In 2024, Lendlease's funds under management (FUM) reached $50.3 billion. Sustainability and responsible investment boost appeal, attracting investors.

Sustainable Multifamily Developments

Lendlease excels in sustainable multifamily developments. Their projects, like The Riverie and Habitat, use eco-friendly tech. This approach attracts investors and boosts their market standing. For instance, in 2024, green building projects saw a 10% rise in investment.

- The Riverie in New York and Habitat in Los Angeles are prime examples.

- Features include geothermal systems and solar panels.

- Lower-carbon concrete is also a key component.

- Sustainable development meets rising demand.

Life Science Developments

Lendlease's foray into life sciences, highlighted by projects like Boston's FORUM, shows a strategic pivot. This move taps into the surging demand for specialized research spaces, a lucrative market. These facilities, designed for life science companies, are set to generate steady revenue streams. This expertise solidifies their market position, attracting long-term tenants and investors.

- FORUM project in Boston exemplifies Lendlease's commitment to life science infrastructure.

- Life science real estate market is projected to reach $1.6 trillion by 2028.

- Lendlease's focus aligns with the increasing R&D spending in biotech.

- These projects often feature high occupancy rates and long-term leases.

Lendlease's "Stars" include urban regeneration and master-planned communities, driving significant revenue growth. They also excel in sustainable multifamily and life sciences projects. Their international investment platform and green building focus are key. In 2024, FUM reached $50.3B.

| Category | Examples | 2024 Data |

|---|---|---|

| Urban Regeneration | Barangaroo (Sydney) | Multi-billion dollar value |

| Master-planned communities | Yarrabilba, Elliot Springs | Strong demand, revenue growth |

| International Investment Platform | Funds Management | FUM: $50.3 billion |

Cash Cows

Lendlease's Australian construction business is a cash cow, despite restructuring. It maintains a substantial market share and provides consistent revenue. Its established presence supports stable cash flow, though supplier issues and losses affect performance. In 2024, construction revenue was approximately $5.5 billion AUD.

Lendlease's existing property portfolio, encompassing commercial and residential assets, offers a reliable income stream. These mature assets demand minimal promotional investment. Focusing on active portfolio management and reducing co-ownership enhances efficiency. In 2024, rental income from existing properties constituted a significant portion of Lendlease's revenue, demonstrating their cash cow status.

Melbourne Quarter Tower is a commercial property generating consistent rental income, serving as a cash cow for Lendlease. The tower houses key tenants such as Medibank and Beca, with Seven Network set to join soon. The Melbourne Quarter community is experiencing rapid growth, supporting the tower's stable cash flow. In 2024, Lendlease's commercial property segment saw a solid performance, reflecting the tower's contribution.

Regatta at Collins Wharf

Regatta at Collins Wharf, a 29-story waterfront residential project, represents a "Cash Cow" for Lendlease. This development, with 317 homes, benefits from high buyer interest due to its prime location. The early sales release of residences in the third development, Ancora at Collins Wharf, indicates strong market demand. In 2024, the Australian residential property market saw an average price increase of 5.9%, supporting the project's profitability.

- Type: Waterfront Residential Development

- Units: 317 homes

- Market: High buyer interest

- Status: Second of six developments

Yarrabilba Masterplan

Yarrabilba, a Lendlease masterplan launched in 2012, is a prime example of a cash cow. With 12,000 current residents and essential amenities, it generates consistent revenue. The 2,222ha Priority Development Area is set to house 23,000 homes and 50,000 residents. This ongoing development ensures sustained cash flow and market stability.

- Launched in 2012 by Lendlease.

- Currently has 12,000 residents.

- Offers essential amenities.

- Expected to accommodate 23,000 homes and 50,000 residents upon completion.

Cash cows for Lendlease include established assets that generate steady revenue and require minimal investment.

These assets, like existing property portfolios and specific developments such as Melbourne Quarter Tower and Regatta at Collins Wharf, provide reliable income streams.

Yarrabilba masterplan also exemplifies a cash cow due to its consistent cash flow and market stability.

| Asset | Description | 2024 Performance (Approx.) |

|---|---|---|

| Australian Construction | Established business; steady revenue | $5.5B AUD in revenue |

| Existing Property Portfolio | Commercial and residential assets | Significant rental income |

| Melbourne Quarter Tower | Commercial property with key tenants | Solid commercial segment performance |

Dogs

Lendlease's international construction, especially in the US and UK, struggled, impacting financials. Supply chain issues and cost overruns caused losses. In 2023, Lendlease reported a $1.2 billion loss from these operations. The company is now exiting these markets.

The US Military Housing business, classified as a "Dog" in Lendlease's BCG matrix, was divested. This decision was made due to its non-core status and low returns. In 2024, the business likely underperformed compared to Lendlease's core assets. The divestment aligns with the company's strategy to focus on higher-growth areas.

Lendlease is actively releasing capital from its overseas development projects. The company is exiting international construction. This strategy includes a Capital Release Unit (CRU) to expedite capital recycling. This is part of Lendlease's plan to streamline operations. In 2024, this approach is expected to generate significant financial benefits.

Engineering and Services Operations (Retained)

Lendlease's Engineering and Services Operations, categorized as "Dogs" in the BCG Matrix, faced challenges. Earnings from investments held in CRU and retained were impacted. The CRU, launched on July 1, 2024, aimed to maximize value from on-market assets and divestitures. Engineering and Services operations saw a decrease during the period.

- CRU established July 1, 2024.

- Focus on asset value maximization.

- Divestment of overseas Construction.

- Release of capital from Development.

Retirement Assets

Lendlease's "Dogs" segment, Retirement Assets, includes international operations. These assets encompass overseas construction, development projects, and residual ownership. The US Military Housing and Australian Communities projects also fall under this category. In 2024, this segment may show underperformance.

- Overseas projects can face economic and political risks.

- Residual ownership implies long-term value but also potential liabilities.

- US Military Housing may be stable but growth is limited.

- Australian Communities projects could be affected by market shifts.

The "Dogs" segment in Lendlease’s BCG matrix represents underperforming assets and operations. These include international construction, certain development projects, and the US Military Housing business. In 2024, these segments likely showed limited growth and faced economic challenges. Lendlease is actively divesting these assets to focus on higher-growth areas.

| Segment | Description | 2024 Performance (Estimated) |

|---|---|---|

| International Construction | Overseas projects in the US and UK | Continued losses, exit strategy |

| US Military Housing | Non-core business | Divested due to low returns |

| Engineering and Services | Part of the CRU divestment strategy | Decreased earnings |

Question Marks

Lendlease's focus on new tech, like sustainable materials and smart cities, is a potential game-changer. These innovations could give them an edge and draw in clients. However, these ventures demand substantial investment and come with considerable risk. In 2024, the global smart cities market was valued at $1.7 trillion, offering huge growth potential.

Lendlease, eyeing growth, might expand into new markets, like Asia. This could boost opportunities, but also brings cultural, regulatory, and competitive challenges. Success depends on navigating these hurdles effectively. In 2024, Lendlease's revenue was impacted by market volatility; however, strategic expansions remain a key focus.

Lendlease might venture into new areas like data centers or healthcare facilities. These ventures could boost returns, but they require specific know-how. Specialized projects may face regulatory hurdles. In 2024, the data center market is booming, with investments exceeding $200 billion globally.

Green Building Technologies

Lendlease's green building technologies, specifically targeting LEED Gold certification for its luxury residential project, represent a "Question Mark" in its BCG Matrix. This classification reflects the project's potential for high growth but uncertain market share. The early 2026 completion date and inclusion of affordable housing units, with 22 low-income and seven workforce units, highlight a commitment to sustainability and social responsibility, as stated by Urbanize Los Angeles. The project's focus on studio, one- and two-bedroom layouts aims to capture a diverse market segment.

- LEED Gold certification targets eco-friendly design.

- Early 2026 completion indicates a forward-looking strategy.

- 22 low-income and 7 workforce units for community impact.

- Studio, one- and two-bedroom layouts cater to various needs.

MIND District Project

The MIND District project, part of Lendlease's strategy, aims to be a significant economic driver. A Harvard Business Review report from 2022 indicates that it is expected to boost the national GDP by 877 million euros. This project is designed with sustainability in mind, using eco-friendly materials and renewable energy sources. It's also projected to create approximately 6,090 full-time jobs. This initiative aligns with broader goals of sustainable urban development.

- Economic Impact: Projected to increase GDP by 877 million euros.

- Job Creation: Expected to generate 6,090 full-time jobs.

- Sustainability: Built with sustainable materials and renewable energy.

- Strategic Alignment: Part of Lendlease's broader urban development strategy.

Lendlease’s "Question Mark" ventures, like green building projects, have high growth potential but uncertain market share. These projects, aiming for LEED Gold, face market and execution risks. Success depends on capturing market share and managing risks effectively. In 2024, the green building market saw investments grow by 10%

| Aspect | Details | 2024 Data |

|---|---|---|

| LEED Gold Focus | Eco-friendly design | Investments in green building increased by 10% |

| Market Position | High growth potential | Uncertain market share |

| Key Challenge | Capturing market share | Managing execution risks |

BCG Matrix Data Sources

Lendlease's BCG Matrix uses public financial reports, real estate market analysis, and industry publications.