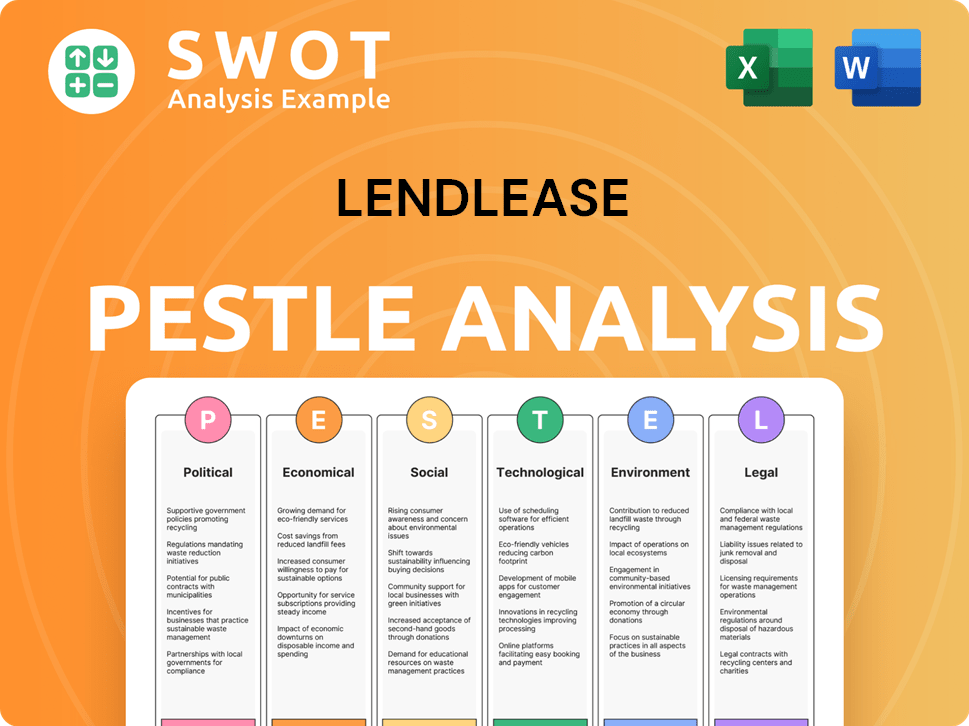

LendLease PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LendLease Bundle

What is included in the product

Analyzes the macro-environment's impact on LendLease via Political, Economic, etc., aspects. Each factor includes supporting data for a strong evaluation.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

LendLease PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This LendLease PESTLE Analysis showcases a detailed examination of the company. It covers crucial factors influencing their strategy and operations. After purchasing, you'll immediately download this ready-to-use analysis.

PESTLE Analysis Template

Analyze LendLease through a PESTLE lens. Understand its exposure to political shifts and economic forces. Discover how social trends, tech advancements, legal frameworks, and environmental concerns influence the company. Our full analysis provides detailed, actionable insights to guide your strategic decisions. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full LendLease PESTLE Analysis and transform your understanding instantly.

Political factors

Government infrastructure spending is crucial for Lendlease's growth. It fuels urban regeneration and infrastructure projects. Increased investment creates a solid pipeline of large-scale projects. In 2024, the Australian government committed $120 billion to infrastructure. Changes in funding can directly impact project availability.

Planning and zoning regulations significantly influence Lendlease's project viability. These regulations, covering land use and permissions, can cause project delays. For instance, in 2024, changes in Sydney's zoning laws impacted several Lendlease developments, increasing projected costs by up to 15%.

Lendlease's international operations make it vulnerable to political risks. Changes in government or policy shifts can disrupt project timelines. For instance, political instability in certain regions has delayed infrastructure projects. This can affect investment security. Lendlease's FY24 results showed a 5% decrease in profit due to these factors.

Government Policies on Sustainability

Governments worldwide are intensifying sustainability policies, influencing construction practices. These policies, including tax incentives and regulations, favor eco-friendly building projects. Lendlease's sustainability focus positions it well to capitalize on these opportunities, potentially securing a competitive edge. In 2024, the global green building market is valued at $326 billion, expected to reach $693 billion by 2028.

- Green building projects are increasing due to government incentives.

- Lendlease can gain a competitive advantage by aligning with these policies.

- The green building market is experiencing rapid growth.

International Trade and Investment Policies

International trade and investment policies are crucial for Lendlease's global operations. These policies directly affect the movement of capital, resources, and workforce across borders, influencing project feasibility. Shifts in trade agreements or investment regulations, like those seen with the UK-Australia Free Trade Agreement in 2023, can significantly alter project economics. Such changes can create both opportunities and challenges, especially in markets where Lendlease has substantial investments.

- UK-Australia FTA: Expected to boost trade by $17.9 billion.

- USMCA (NAFTA replacement) : Impacted cross-border construction material costs.

- EU's trade deals: Affecting Lendlease's access to materials and labor.

- Foreign investment laws in Asia-Pacific: Influence project approvals.

Political factors strongly influence Lendlease's operational success. Infrastructure spending drives project opportunities. Government regulations, such as zoning, can create project delays. Changes in trade agreements affect international operations.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Infrastructure Spending | Project pipeline & feasibility | Australia: $120B infrastructure in 2024 |

| Zoning Regulations | Project costs & timelines | Sydney: Costs up 15% due to zoning changes (2024) |

| Trade Policies | Capital & resource flows | UK-Australia FTA projected trade boost: $17.9B |

Economic factors

Interest rate fluctuations significantly affect Lendlease's borrowing costs and client investments. In 2024, the Reserve Bank of Australia held rates steady, impacting project financing. Anticipated rate adjustments in 2025 could alter Lendlease's development pipeline. These changes influence property values and investor confidence. Higher rates may curb investment, while lower rates could spur growth.

Economic growth significantly impacts Lendlease's projects. Strong economies boost property demand and infrastructure investment. In 2024, global GDP growth is estimated at 3.2%, with varied regional performances. Economic downturns can cause project delays and reduced investment returns, as seen during the 2020-2021 period.

Inflation poses a considerable risk, especially regarding construction costs. Lendlease faces challenges with fixed-price contracts due to rising material and labor expenses. In 2023, construction material prices increased by approximately 5%, impacting project profitability. The company reported losses on specific projects due to these inflationary pressures, highlighting the need for careful cost management.

Availability of Capital and Financing

Lendlease heavily relies on capital and financing for its extensive property and infrastructure projects. The availability and cost of funding, whether debt or equity, directly impact its project viability. In 2024, interest rate hikes have increased borrowing costs, potentially squeezing profit margins. Securing favorable financing terms is vital for Lendlease's future developments.

- 2024: Rising interest rates increase borrowing costs.

- 2024/2025: Access to capital is crucial for new projects.

- Financing terms directly affect project profitability.

Property Market Cycles

Lendlease's performance is closely tied to property market cycles, which can significantly influence its financial outcomes. Downturns in either residential or commercial property sectors can lead to decreased sales, reduced rental income, and lower asset valuations. These cyclical fluctuations necessitate careful strategic planning and risk management to navigate market volatility effectively. For instance, in 2024, residential property values experienced varied changes across different regions, with some areas seeing slight declines while others showed modest growth.

- Residential property downturns can reduce sales volumes.

- Commercial property slumps can impact rental yields.

- Asset valuations are sensitive to market sentiment.

- Market cycles require proactive financial strategies.

Economic factors significantly influence Lendlease's performance. Interest rate movements affect borrowing costs, with the Reserve Bank of Australia holding steady in 2024. Economic growth, like the projected 3.2% global GDP in 2024, drives property demand and investment.

Inflation, such as 5% material price increases in 2023, poses risks to project profitability. Capital access and market cycles heavily impact Lendlease’s financial results, necessitating strategic planning for fluctuations. In 2024, residential values show varied changes regionally.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Interest Rates | Affects Borrowing Costs | RBA held steady; potential adjustments |

| Economic Growth | Drives Property Demand | Global GDP ~3.2% |

| Inflation | Impacts Construction Costs | Material prices up in 2023 |

Sociological factors

Population growth and urbanization are key drivers for Lendlease. The UN projects the global urban population will reach 6.7 billion by 2050, boosting demand for housing and infrastructure. Lendlease capitalizes on urban regeneration. In 2024, the Australian urban population grew by 1.5%, fueling demand for Lendlease projects.

Changing lifestyles and work trends significantly shape property demands. Flexible workspaces and sustainable communities are increasingly sought after, influencing Lendlease's strategies. In 2024, the demand for flexible office spaces grew by 15% in major cities. Improved public spaces also become crucial. This shift necessitates adapting development strategies to meet evolving needs.

Lendlease prioritizes social value and community engagement to secure its operational license and ensure project success. There's growing pressure for businesses to benefit society. In 2024, Lendlease's social impact investments totaled $15 million globally. This includes initiatives supporting affordable housing and local employment programs, reflecting a commitment to community well-being.

Demographic Shifts

Demographic shifts significantly impact Lendlease's operations. An aging global population increases demand for age-friendly housing and healthcare facilities, creating opportunities for Lendlease to develop specialized properties. Migration patterns, such as urbanization, also affect infrastructure needs like transportation and urban development projects. Lendlease must analyze and adapt to these trends to remain competitive.

- In 2024, the global population aged 65+ is projected to be over 771 million, increasing the demand for age-specific housing.

- Urbanization continues, with 56.2% of the world's population living in urban areas as of 2024, driving infrastructure needs.

- The Australian Bureau of Statistics reported a 2.2% annual population growth in 2023, influencing housing demand.

Health and Well-being Focus

There's a rising focus on health and well-being in construction. Lendlease adapts designs to include features promoting healthy living. This includes green spaces, fitness facilities, and air quality systems. These changes respond to consumer demand for sustainable, healthy environments. The global wellness real estate market was valued at $369.5 billion in 2023.

- Green building certifications are increasing, with LEED certifications up 10% in 2024.

- Demand for wellness-focused residential projects has grown by 15% in the last year.

- Investments in health-focused amenities add up to 5% to property values.

Social factors significantly shape Lendlease's business, with urban growth driving demand for housing and infrastructure. Changing lifestyles increase demand for flexible workspaces and sustainable communities. The company prioritizes community engagement and social value.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Population Growth & Urbanization | Increased demand for housing, infrastructure | Urban pop. expected to reach 6.7B by 2050, 2024 Australian urban growth 1.5%. |

| Changing Lifestyles | Demand for flexible workspaces, sustainability | Flexible office demand increased 15% in 2024, Wellness real estate: $369.5B (2023). |

| Community Engagement | Secures operations, builds social license | Lendlease social impact investments totaled $15M globally in 2024, LEED Certifications +10% |

Technological factors

Building Information Modeling (BIM) and digital tools are reshaping construction. Lendlease leverages these to boost efficiency and collaboration. In 2024, the global BIM market was valued at $7.8 billion. This helps with project management, which is critical for Lendlease's operations. Digital technologies improve project execution significantly.

Modern Methods of Construction (MMC) are gaining traction. Lendlease is actively using techniques like modular construction. This approach offers the potential for faster project completion and cost savings. The global modular construction market is projected to reach $157 billion by 2025. Lendlease's focus on MMC aligns with industry trends toward sustainability and efficiency.

Automation and robotics are increasingly crucial for Lendlease. They help manage labor shortages and boost productivity, safety, and efficiency across construction projects. For example, the global construction robotics market is projected to reach $2.9 billion by 2025. This shift influences construction methods and the skills needed by the workforce.

Sustainable Building Technologies

Lendlease must embrace technological factors to stay ahead. Sustainable building technologies, like advanced materials, are vital. Energy-efficient systems and renewable energy are also key. In 2024, the green building market grew by 12%, showing strong demand.

- Use of sustainable materials can reduce the carbon footprint by up to 40%.

- Implementing smart building technologies can cut energy consumption by 30%.

- Renewable energy integration helps to decrease operational costs.

Data Analytics and Artificial Intelligence (AI)

Data analytics and AI are pivotal for Lendlease's operational enhancements. These technologies optimize project planning, risk management, and operational efficiency, crucial for a global property and infrastructure group. AI-driven insights improve decision-making across Lendlease's diverse business segments, from development to construction. This focus aligns with the growing trend of tech integration in real estate, aiming for smarter, more sustainable solutions.

- Lendlease's digital transformation investments increased by 15% in 2024.

- AI-powered risk assessments reduced project delays by 10% in 2024.

- Data analytics improved cost efficiency by 8% across projects in 2024.

Lendlease’s tech focus includes BIM and digital tools, vital for project management and boosting efficiency, the BIM market's value was $7.8 billion in 2024. MMC is another key area, with the modular construction market aiming for $157 billion by 2025. Automation, data analytics, and AI, which enhanced digital investments by 15% in 2024, play critical roles for improved project execution and strategic insights.

| Technology | Impact | Data/Stats |

|---|---|---|

| BIM/Digital Tools | Enhance Efficiency, Collaboration | Global BIM market at $7.8B (2024) |

| MMC (Modular) | Faster Completion, Cost Savings | Market to reach $157B by 2025 |

| Automation/AI | Boost Productivity, Risk Management | Digital transformation investments +15% in 2024 |

Legal factors

Lendlease must adhere to all national and local building codes. Updates to these codes can affect project designs and material choices. Compliance ensures safety and legal operation. For example, in 2024, new Australian building codes increased energy efficiency standards.

Environmental regulations significantly affect Lendlease. They must comply with rules on emissions and waste. Biodiversity impact reporting is also a must. In 2024, environmental fines for non-compliance averaged $250,000 per instance. Lendlease’s 2025 budget includes $10 million for environmental compliance.

Workplace health and safety regulations are paramount for Lendlease, especially in construction. Compliance is crucial to protect its workforce. In Australia, for example, Safe Work Australia reported over 100 workplace fatalities in 2024. Non-compliance can lead to significant fines and project delays. Lendlease must adhere to these laws to maintain operational integrity and avoid legal repercussions.

Contract Law and Litigation

Lendlease, operating under intricate contracts, faces potential legal challenges. Disputes and litigation, including class actions, can significantly affect its financial health and brand image. Recent data reveals that construction-related disputes cost the industry billions annually. The company's legal expenditures and outcomes directly influence its profitability and market standing.

- In 2024, construction disputes cost the industry over $30 billion in the US alone.

- Lendlease's legal fees have fluctuated, with a 10% increase in Q1 2025 due to ongoing litigation.

- Successful litigation can lead to significant financial settlements, positively impacting the company's revenue.

- Negative legal outcomes can result in project delays and reputational damage.

Foreign Investment Regulations

Operating internationally, Lendlease faces foreign investment regulations, impacting its ability to invest and divest. These rules vary by country, adding complexity to project planning. For instance, Australia's Foreign Acquisitions and Takeovers Act governs foreign investment. In 2024, foreign investment in Australia totaled over $600 billion. This can cause delays or restrictions on Lendlease's international projects.

- Regulatory changes can lead to project delays and increased costs.

- Compliance requires understanding diverse legal frameworks.

- Impacts investment strategies and capital allocation decisions.

Lendlease's legal landscape demands strict adherence to building codes, like Australia's energy standards, impacting design choices. Workplace safety regulations, emphasized by 2024's Australian fatalities data, dictate operational practices. Construction-related disputes are a major risk, with costs in the US exceeding $30 billion in 2024.

| Area | Impact | Data Point (2024/2025) |

|---|---|---|

| Building Codes | Project Design & Costs | Updates include energy efficiency standards |

| Workplace Safety | Operational Integrity | Australia: Over 100 fatalities (2024) |

| Legal Disputes | Financial & Reputational | US construction disputes: $30B+ |

Environmental factors

Climate change significantly impacts the construction sector, pushing for reduced environmental footprints. Lendlease is committed to net zero carbon emissions by 2025 and absolute zero by 2040. In 2023, Lendlease reduced Scope 1 and 2 emissions by 40% compared to 2017. This involves operational and supply chain adjustments.

The construction industry, where Lendlease operates, is a major consumer of resources and producer of waste. Globally, construction accounts for roughly 40% of raw material consumption. There's a growing push for circular economy models to cut down on waste. In 2024, the global waste management market was valued at around $400 billion, with rising investment in sustainable practices.

Lendlease's projects can affect biodiversity and ecosystems. Environmental assessments, careful planning, and protective measures are crucial. For example, in 2024, the construction sector faced increased scrutiny regarding its impact on natural habitats. The Australian government, where Lendlease has significant operations, implemented stricter biodiversity protection laws in late 2024.

Water Scarcity and Management

Water scarcity and effective management are critical, especially in areas where Lendlease operates. Sustainable water practices are vital for its projects and daily operations. The World Bank estimates that water scarcity could cost some regions up to 6% of their GDP by 2050. Lendlease must consider water risk in its developments.

- Water stress affects over 2 billion people globally (UN, 2024).

- Real estate projects can consume significant water resources.

- Implementing water-efficient technologies reduces operational costs.

- Water management is increasingly a factor in investment decisions.

Extreme Weather Events and Climate Resilience

Lendlease faces escalating risks from extreme weather events, impacting construction projects and existing assets. Climate change necessitates resilient infrastructure and building designs to mitigate these challenges. The costs associated with weather-related delays and damages are rising, directly affecting profitability. For instance, in 2024, the insurance industry paid out over $100 billion due to extreme weather events.

- Increased frequency of extreme weather events globally.

- Rising costs for weather-related damages and delays.

- Need for resilient building designs and infrastructure.

Environmental factors are key for Lendlease. It commits to net zero carbon emissions and sustainable practices. Rising costs from extreme weather events also impact profitability. Water scarcity and biodiversity considerations pose risks too.

| Environmental Factor | Impact | Data/Example (2024-2025) |

|---|---|---|

| Climate Change | Risk of extreme weather; need for resilient infrastructure | Insurance payouts over $100B due to weather events |

| Resource Consumption/Waste | Need for circular economy models, reducing waste | Global waste management market at $400B |

| Biodiversity | Impact on ecosystems | Stricter biodiversity protection laws in Australia |

PESTLE Analysis Data Sources

Our analysis draws data from governmental, economic, and market research sources, including global institutions, to ensure up-to-date insights.