Lennar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lennar Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Export-ready design for quick drag-and-drop into PowerPoint, allowing seamless integration with existing presentations.

What You’re Viewing Is Included

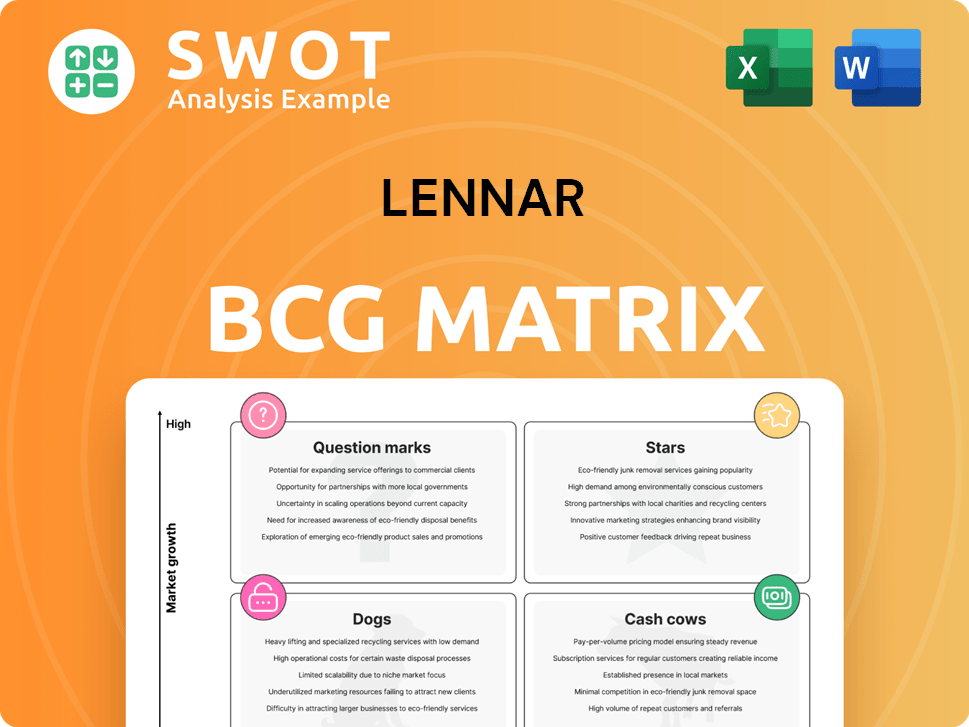

Lennar BCG Matrix

The preview shows the complete Lennar BCG Matrix report you'll get. Download the full, unlocked version instantly, ready to integrate into your strategic planning and market analysis.

BCG Matrix Template

Lennar's BCG Matrix offers a strategic snapshot of its diverse offerings. See which properties shine as "Stars" and which are "Cash Cows." Discover the "Dogs" and "Question Marks" impacting resource allocation. Understand where Lennar aims to invest and grow. Get the full BCG Matrix report for actionable insights and strategic advantages.

Stars

Lennar leads in homebuilding, especially entry-level homes, vital for growth. Innovation and land strategy boost their market position. Q1 2025 shows Lennar's strong market share. Their revenue reached $8.7 billion in Q1 2024, showcasing robust market leadership. This positions them well in the competitive landscape.

Lennar's strategic acquisitions, like Rausch Coleman Homes in February 2025, are designed to fuel growth. This acquisition expands Lennar's reach and adds significant revenue. The move into markets such as Arkansas, Oklahoma, and Kansas/Missouri is a key part of this strategy. In 2024, Lennar's revenue was approximately $34.2 billion, showing the impact of such expansions.

Lennar's "Land-Light Strategy," accelerated by the Millrose Properties spin-off in February 2025, emphasizes homebuilding and financial services. This strategic pivot aims to boost returns and attract investors. The move allows off-balance-sheet land access, mitigating ownership risks. In 2024, Lennar's revenue was approximately $35.1 billion, reflecting this strategic shift.

Financial Services Performance

Lennar's Financial Services segment is a 'Star' in its BCG matrix, demonstrating robust performance. In Q1 2025, operating earnings hit $143 million, a rise from $131 million in Q1 2024. This growth is linked to higher volumes from increased home deliveries. The segment's strong financial contribution bolsters Lennar's overall profitability.

- Operating earnings in Q1 2025: $143 million

- Operating earnings in Q1 2024: $131 million

- Growth driver: Higher home deliveries

Strong Cash Flow and Liquidity

Lennar's strong cash flow and liquidity are key strengths in its BCG Matrix positioning. The company's solid financial footing allows for strategic moves. By the close of 2024, Lennar had $4.7 billion in cash. This financial health supports Lennar's growth plans, offering flexibility.

- Significant cash reserves provide financial flexibility.

- Low debt-to-capital ratio enhances financial stability.

- Strategic acquisitions and investments are supported.

- Strong liquidity benefits shareholder returns.

Lennar's Financial Services segment is a 'Star', showing impressive growth and profitability. In Q1 2025, the segment's operating earnings were $143 million, up from $131 million in Q1 2024. This increase is mainly due to a rise in home deliveries. The financial services segment provides substantial contributions to Lennar's overall success.

| Financial Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Operating Earnings (Financial Services) | $143 million | $131 million |

| Revenue (2024) | $34.2B - $35.1B (approx.) | N/A |

Cash Cows

Lennar's established homebuilding operations are a cash cow, consistently generating revenue. Operating in 26 states, Lennar benefits from strong brand recognition and high demand. The focus on quality and value reinforces its reputation. In Q4 2023, Lennar reported $8.7 billion in revenue from home sales.

Lennar's Financial Services segment, including mortgage and title services, is a cash cow due to its consistent profitability. In Q4 2024, this segment generated operating earnings of $154 million, supported by Lennar's homebuyers. This segment enjoys a steady revenue stream, thanks to its integration with homebuilding operations.

Lennar's vast scale provides significant cost advantages. Their size allows efficient construction, boosting profit margins. In 2024, Lennar's gross margins were around 22%. They negotiate favorable supplier terms, enhancing profitability. Efficient land acquisition and cost control further support their cash flow.

Strategic Land Management

Strategic land management is key for Lennar's cash flow. Effective land inventory control and optioned homesites guarantee buildable lots. This supports consistent homebuilding and cash generation. Lennar's land-light strategy, centered on options, reduces capital tied to land. This approach boosts cash flow and return on invested capital.

- In Q4 2023, Lennar's land and land development revenues were $906.9 million.

- Lennar's land-light strategy aims to improve capital efficiency.

- The company focuses on optioned homesites to manage land risk.

- This strategy directly impacts cash flow and profitability.

Everything's Included Program

Lennar's "Everything's Included" program is a key cash cow. It offers high-end features and smart home tech standard, boosting sales. This simplifies buying and adds value, setting Lennar apart. In 2024, this strategy helped Lennar achieve a 21% gross margin.

- Attracts buyers and supports sales volume.

- Simplifies the buying process.

- Differentiates Lennar from competitors.

- Offers popular features in the base price.

Lennar's cash cows include homebuilding, financial services, and strategic land management. These operations generate consistent revenue and profitability. This is supported by scale, cost advantages, and the "Everything's Included" program. These strategies enhance cash flow and returns.

| Segment | Q4 2024 Revenue/Earnings | Key Strategy |

|---|---|---|

| Homebuilding | $8.7B in Revenue (Q4 2023) | Brand Recognition, High Demand, Quality |

| Financial Services | $154M Operating Earnings (Q4 2024) | Integrated with Homebuilding, Steady Revenue |

| Land | $906.9M Revenue (Q4 2023) | Land-Light Strategy, Optioned Homesites |

Dogs

Lennar's Multifamily segment, categorized as a "Dog" in its BCG Matrix, has faced profit consistency challenges. In Q1 2024, the segment reported an operating loss of $16 million. Breakeven performance was achieved in Q1 2025. Market volatility and competition continue to pressure profitability.

LenX's technology investments have faced challenges. The Lennar Other segment, including LenX, showed an $89 million operating loss in Q1 2025, driven by tech investment losses. These ventures are susceptible to market fluctuations. In 2024, Lennar’s Other segment reported some losses.

Lennar might face challenges in specific geographic markets. These areas could show lower sales or margins compared to the company average. Local competition and economic conditions often play a role. For example, in 2024, certain regions might have reported slower growth. Addressing these underperforming markets is vital for overall financial health.

Legacy Land Holdings

Legacy Land Holdings, consisting of owned homesites yet to adopt the land-light strategy, might be categorized as "Dogs" if returns are insufficient. Lennar's move to an asset-light model aims to reduce capital tied up in land. Focusing on optioned homesites enhances cash flow and return on invested capital. This shift is crucial for optimizing resource allocation and profitability.

- In 2024, Lennar aims to reduce land ownership.

- The company's land-light strategy improves financial flexibility.

- Optioned homesites contribute to better cash flow management.

- Lennar's focus is on increasing return on invested capital.

Older Product Lines

Outdated Lennar product lines, or those not matching current buyer tastes, can face reduced demand and profitability. Lennar's need to adapt is reflected in its innovative approach to home designs and offerings, constantly evolving to meet customer demands. Regular evaluation and updating of product lines are vital for staying competitive in the market. This includes phasing out less popular models. In 2024, Lennar's focus on innovation is evident in its efforts to meet changing market needs.

- Older homes may struggle against newer, more efficient designs.

- Lennar aims to refresh its offerings to boost appeal and sales.

- Product line reviews are critical for market relevance.

- Focus on innovation to stay ahead of the curve.

Lennar identifies "Dogs" as underperforming segments. This includes the Multifamily segment, with a $16 million operating loss in Q1 2024. LenX's tech investments, also classified as Dogs, had an $89 million operating loss in Q1 2025. Legacy land and outdated product lines are other potential Dogs.

| Segment | Q1 2024 Performance | Q1 2025 Performance |

|---|---|---|

| Multifamily | $16M Operating Loss | Breakeven |

| LenX (Other) | Losses | $89M Operating Loss |

| Legacy Land | Underperforming (Potential Dog) | N/A |

Question Marks

New geographic markets, like those from the Rausch Coleman Homes acquisition, are 'Question Marks.' Lennar entered markets such as Birmingham and Kansas City. The success of these markets hinges on integration and leveraging existing operations. In Q4 2023, Lennar reported a 17% increase in new orders, indicating growth potential in new areas. Lennar's gross margin improved to 23.8% in Q4 2023.

Lennar's SFR investments are 'Question Marks' due to market shifts. Demand is up, but profits are uncertain. In Q4 2023, SFR revenue was $865.9 million. Success hinges on efficient management. The SFR sector's future is still developing.

Millrose Properties, recently spun off, is a 'Question Mark' in Lennar's BCG matrix. Its success hinges on generating income from monthly option payments and effective land asset management. This unique transaction's long-term impact is still unfolding. In 2024, Lennar reported $34.2 billion in revenue, showing its scale. The REIT's performance will be closely watched.

Technology Initiatives

Lennar's "Technology Initiatives" fall under the "Question Mark" category in a BCG matrix due to the inherent uncertainties of new ventures. The company is actively investing in property technology (PropTech) via LenX, aiming to boost operational efficiency and customer experience. These investments present both opportunities and risks, as success depends on effective technology implementation. In 2024, Lennar invested $300 million in LenX.

- LenX investments aim to improve efficiency.

- PropTech investments carry inherent risks.

- Lennar invested $300M in LenX in 2024.

- Technology's success hinges on effective use.

Sustainable and Energy-Efficient Homes

Sustainable and energy-efficient homes are a 'Question Mark' in Lennar's portfolio, as the company gauges demand and profitability. This area presents an opportunity to differentiate itself given the growing consumer interest in eco-friendly living. However, Lennar must carefully manage the costs and complexities of sustainable construction to ensure profitability. In 2024, the demand for energy-efficient homes continues to rise, with potential for increased sales.

- Rising consumer interest in sustainable living presents an opportunity for Lennar to differentiate itself.

- The costs and complexities associated with sustainable construction need careful management.

- Demand for energy-efficient homes continues to rise in 2024.

Question Marks in Lennar's BCG matrix face uncertainty. These include new markets, SFR investments, spun-off properties, tech initiatives, and sustainable homes. Their success depends on strategic execution and market adaptation. Lennar's 2024 investments totaled billions.

| Category | Example | Key Consideration |

|---|---|---|

| New Markets | Rausch Coleman Homes | Integration, leveraging operations |

| SFR Investments | Rental Properties | Market shifts, profitability |

| Spin-off | Millrose Properties | Income generation from payments |

| Technology | LenX | Implementation & Efficiency |

| Sustainability | Energy-Efficient Homes | Demand, cost management |

BCG Matrix Data Sources

Lennar's BCG Matrix uses financial data, market analyses, and expert evaluations. Data sources include reports & market trends.