loanDepot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

loanDepot Bundle

What is included in the product

Tailored analysis for loanDepot's product portfolio, identifying optimal investment strategies.

Optimized for C-level presentation, this offers a clean, distraction-free view.

What You See Is What You Get

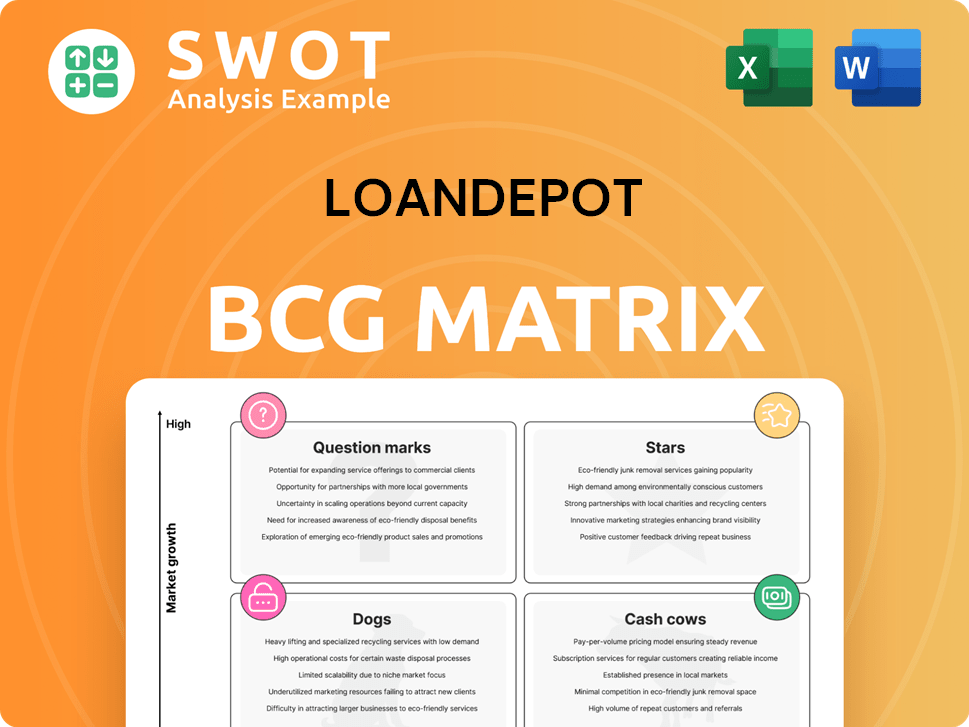

loanDepot BCG Matrix

The loanDepot BCG Matrix preview displays the complete document you receive upon purchase. This ready-to-use file is identical to the full, strategic analysis tool you'll download. Access the in-depth insights and apply them immediately to your strategic planning. No hidden content, just the complete, professionally formatted report.

BCG Matrix Template

loanDepot's BCG Matrix offers a snapshot of its diverse product portfolio. This analysis helps to categorize products based on market share and growth rate. Stars, Cash Cows, Dogs, and Question Marks are revealed, offering strategic implications. Understanding the quadrant placement is vital for informed decision-making. See how loanDepot strategically positions itself. This is just a glimpse into the company's landscape.

Stars

Strategic joint ventures, exemplified by loanDepot's collaborations, position them as potential stars. Partnerships with homebuilders such as Smith Douglas Homes and Onx Homes aim to streamline the homebuying experience. For instance, the Onx X+ Mortgage initiative targets growth in the purchase mortgage market. In 2024, purchase originations are expected to be around $1.4 trillion. Success depends on effective execution and market acceptance.

loanDepot's melloNow digital underwriting engine accelerates loan approvals. It analyzes credit, detects fraud, and validates income. This results in swift conditional approvals, often in minutes. In 2024, loanDepot aimed to increase melloNow adoption to boost efficiency.

loanDepot's equityFREEDOM offers HELOCs and home equity loans (10, 20, 30 years). Homeowners can access equity, which is a strategic move. In 2024, home equity hit record levels. Effective marketing is key for this to shine as a star.

Refinance Consumer Direct Recapture Rate

loanDepot's organic refinance consumer direct recapture rate is a bright spot, indicating strong customer retention. The preliminary organic refinance consumer direct recapture rate for Q4 2024 climbed to 76%. This increase suggests effective strategies in maintaining customer loyalty. Successfully managing and growing this rate could significantly boost revenue and strengthen customer connections.

- Q4 2024 preliminary organic refinance consumer direct recapture rate: 76%

- Focus on customer retention drives revenue

- Strategy effectiveness is key

Investments in Technology Platforms

loanDepot's "Stars" category includes investments in technology and AI, crucial for Project North Star. These initiatives focus on speeding up loan processes and enhancing customer service. Success hinges on effective implementation, leading to better customer satisfaction and operational efficiencies. These investments aim to boost growth and improve overall performance.

- loanDepot invested $24.2 million in technology and marketing in Q3 2023.

- Project North Star aims to cut loan cycle times by 15-20%.

- Increased customer satisfaction scores are a key performance indicator (KPI).

- Operational efficiency improvements include automated underwriting.

loanDepot's "Stars" are strategic growth areas. Investments in tech, like melloNow, aim for efficiency gains. Focus is on cutting loan cycle times by 15-20% via Project North Star, with $24.2M invested in tech/marketing by Q3 2023. This drives customer satisfaction, a key KPI.

| Metric | Data | Implication |

|---|---|---|

| Project North Star Goal | Reduce cycle times by 15-20% | Faster approvals, better customer experience |

| Q3 2023 Tech & Marketing Investment | $24.2 million | Supports growth initiatives and innovation |

| Customer Satisfaction | Increased scores | Improved customer loyalty and retention |

Cash Cows

loanDepot's conventional mortgages cater to many homebuyers and homeowners. These products are well-established and widely accepted, generating consistent revenue. In 2024, the average 30-year fixed mortgage rate hovered around 7%. Competitive rates and fees are vital for their cash cow status. loanDepot's loan origination volume in Q3 2024 was $4.6 billion.

loanDepot's FHA and VA loans target first-time buyers and veterans, representing a steady customer base. These government-backed loans ensure a reliable stream of business. In 2024, FHA loans saw a 10% increase in originations. Managing these loans efficiently is crucial for profitability.

loanDepot's servicing portfolio, holding an $114.9 billion unpaid principal balance (UPB) as of September 30, 2024, is a cash cow, providing servicing fee income. Retaining and efficiently managing this portfolio is crucial for sustained profitability. Enhancing customer service and utilizing technology to improve the servicing experience are key strategies. Maintaining this status is vital for loanDepot's financial health.

Jumbo Loans

loanDepot's Jumbo Loans target high-value properties, boosting revenue through larger loan amounts. These loans are a key part of their strategy. Managing risk and offering competitive rates are critical to success here. In 2024, the average Jumbo loan was over $750,000.

- Jumbo loans provide significant revenue.

- They focus on high-end real estate.

- Risk management is vital for profitability.

- Competitive pricing is crucial.

Retail Lending Network

loanDepot's retail lending network, including physical branches and an online platform, is a key cash cow. This dual presence allows for diverse customer acquisition and service strategies. In 2024, loanDepot focused on streamlining these channels for better efficiency. The goal is to enhance customer experience and boost profitability.

- loanDepot operates both physical and online lending channels.

- The focus is on operational efficiency and customer satisfaction.

- This strategy aims to maximize the network's profitability.

loanDepot's Cash Cows are established products like conventional, FHA/VA loans, and servicing. These generate consistent revenue with relatively low investment needs. Jumbo loans also contribute significantly to the cash flow. Retail lending network provides a strong customer base.

| Product | Description | 2024 Data |

|---|---|---|

| Conventional Mortgages | Widely accepted products. | Avg. 30-yr rate: 7%; Q3 Origination: $4.6B |

| FHA/VA Loans | Target first-time buyers/veterans. | Originations up 10% |

| Servicing Portfolio | Provides servicing fee income. | $114.9B UPB (Sept. 30, 2024) |

Dogs

loanDepot's exit from wholesale lending occurred in mid-2022. This segment, now a 'dog,' no longer contributes revenue. The focus should be on divesting any remaining assets. In Q1 2023, loanDepot's total revenue was $270.5 million, reflecting strategic shifts.

loanDepot's outdated tech infrastructure fits the "Dogs" category. These systems likely face high upkeep expenses and have limited capabilities. In 2024, such systems could be costing them significantly. Upgrading is crucial to boost efficiency. For example, legacy systems can increase operational costs by up to 30% annually.

loanDepot may struggle with unprofitable branch locations, facing high operating costs and low loan origination volumes. In 2024, the company might have evaluated underperforming branches, potentially impacting its overall profitability. Closing or consolidating these locations could be a strategic move to enhance financial performance. For example, reducing physical locations by 10% could save millions in operational expenses.

Products with Low Adoption Rates

loanDepot could have launched loan products or services that didn't resonate with customers. These "Dogs" demand marketing and support but bring in minimal revenue. In 2024, such products might represent underperforming segments. Discontinuing these underachievers can streamline operations and improve profitability.

- Products with low adoption rates often lead to financial losses.

- Marketing expenses for these products can be disproportionately high.

- Re-evaluating these offerings could free up resources.

- Focusing on core, successful products is a strategic move.

High-Risk Loan Products

loanDepot's "Dogs" include high-risk loan products, potentially leading to increased delinquencies. These products might have provided short-term revenue but now pose long-term financial risks. To ensure stability, reducing or eliminating these products is crucial. In 2023, loanDepot faced challenges, with a net loss of $309.7 million.

- High-risk loans contribute to instability.

- Short-term gains vs. long-term risks.

- Focus on risk reduction strategies.

- 2023 net loss: $309.7 million.

loanDepot's "Dogs" represent underperforming segments, including wholesale lending exited in 2022. Outdated tech and unprofitable branches also fall into this category. High-risk loans further contribute to the "Dogs" classification.

| Category | Examples | Financial Impact |

|---|---|---|

| Wholesale Lending | Exit in 2022 | No longer generates revenue |

| Outdated Tech | Legacy systems | High upkeep, limited capabilities |

| Unprofitable Branches | Low loan volumes | High operating costs |

Question Marks

The collaboration with home builders, like Smith Douglas Homes and Onx Homes, is a key part of loanDepot's strategy. These partnerships aim to boost loan volume by tapping into the home purchase market. The success of these ventures is still up in the air, depending heavily on housing market trends and how well the partnerships perform. In 2024, the mortgage origination market saw fluctuations; therefore, the impact of these partnerships is vital to monitor.

loanDepot's foray into new geographic markets aligns with a question mark in its BCG matrix. Success depends on grasping local market specifics and effectively challenging existing competitors. A cautious strategy, coupled with close performance tracking, is crucial. In 2024, loanDepot's market share fluctuated; expansion carries inherent risk.

loanDepot's digital lending solutions are a question mark within its BCG matrix. These solutions, designed to enhance the customer experience and streamline lending, require significant investment. Their success hinges on user adoption rates and how effectively they stand out against competitors. As of Q3 2024, loanDepot reported a 15% increase in digital loan applications, yet overall profitability remained a challenge. This segment's future is uncertain until its market position is established.

First-Time Homebuyer Programs

For loanDepot, first-time homebuyer programs are a question mark in their BCG matrix. This segment presents both growth potential and considerable risks. Success hinges on creating suitable products and reaching this specific market effectively. The fluctuating interest rates in 2024, hovering around 7%, significantly impact affordability for first-time buyers.

- In 2024, the average down payment for first-time homebuyers was approximately 6-7%.

- First-time homebuyers made up about 29% of all home purchases in 2024.

- Refinancing activity is expected to remain low in 2024 due to high interest rates, impacting loanDepot's revenue.

AI-Driven Loan Products

loanDepot's foray into AI-driven loan products positions it as a "question mark" in its BCG matrix. The company aims to integrate AI for enhanced loan processing and product development. While AI promises to boost efficiency and cut expenses, the success of these tech implementations is still uncertain. This area needs careful monitoring, as the impact is yet to be fully realized in the financial results.

- loanDepot's AI initiatives are in the early stages.

- Uncertainty surrounds the actual benefits and returns.

- The company needs to prove the effectiveness of its AI strategies.

- Success will hinge on seamless technology integration.

New product and market entries categorize loanDepot's question marks. Success is contingent on strategic execution. 2024 market share fluctuations present risk.

| Category | Description | Status |

|---|---|---|

| Partnerships | Homebuilder collaborations | Uncertain. Depends on market and partnership performance. |

| Geographic Expansion | Venturing into new markets | Risky. Success hinges on market understanding and competition. |

| Digital Lending | Enhancing customer experience | Uncertain. Requires investment and high adoption. |

BCG Matrix Data Sources

The loanDepot BCG Matrix utilizes financial statements, market analysis, and industry reports to support its strategic recommendations.