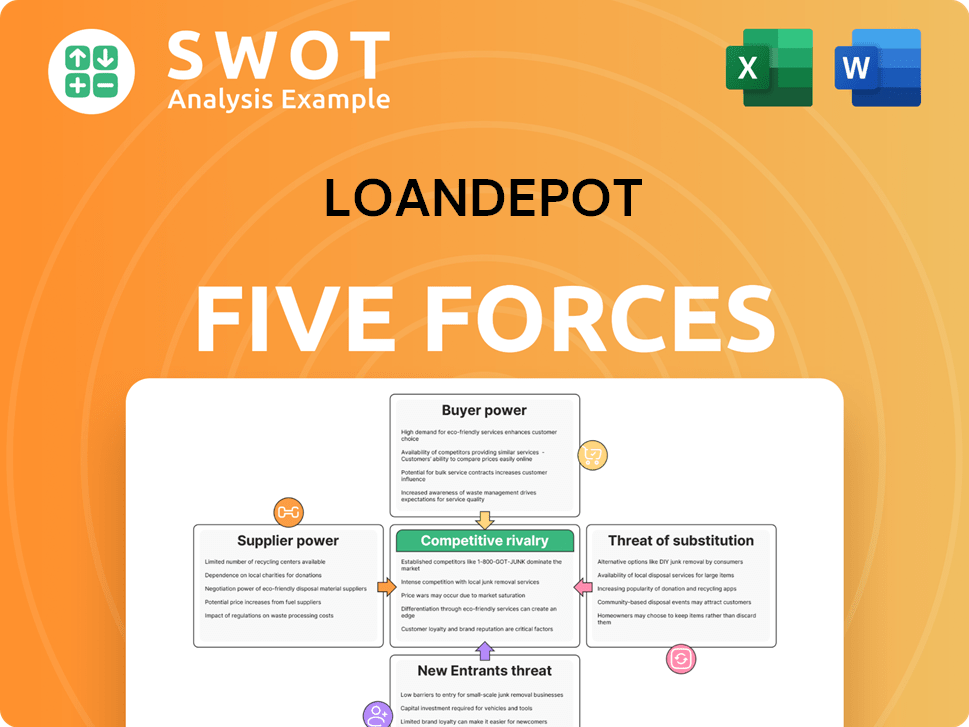

loanDepot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

loanDepot Bundle

What is included in the product

Tailored exclusively for loanDepot, analyzing its position within its competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions.

Same Document Delivered

loanDepot Porter's Five Forces Analysis

You're viewing the full loanDepot Porter's Five Forces analysis. This detailed examination of competitive forces is ready for immediate download.

Porter's Five Forces Analysis Template

Analyzing loanDepot reveals a complex market. Buyer power is substantial due to mortgage options. Rivalry is fierce with many competitors. The threat of new entrants is moderate. Supplier power from lenders varies. Substitute threats include rentals.

Ready to move beyond the basics? Get a full strategic breakdown of loanDepot’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of suppliers is significantly influenced by lender concentration. A limited number of reliable mortgage lenders boosts their influence, allowing them to dictate terms. As of 2023, the top 10 lenders controlled about 70% of the market. This concentration gives lenders substantial leverage, impacting loanDepot's negotiation capabilities.

Rising interest rates bolster lenders' influence. When the Federal Reserve hikes rates, mortgage rates follow, affecting borrower affordability. For example, in late 2024, average 30-year mortgage rates hovered around 7%, up from about 3% in early 2022. This can pressure loanDepot's business volumes.

loanDepot can lessen supplier power through partnerships with diverse lenders. This strategy reduces reliance on any single supplier, mitigating risk. As of Q3 2023, loanDepot's total loan origination volume was $4.8 billion, showcasing the scale at which supplier relationships are vital. Flexibility and competitive pricing are key benefits of this approach.

Technology provider influence

Mortgage technology providers significantly influence the industry through their platforms. LoanDepot's reliance on specific vendors for loan origination and servicing software gives these suppliers considerable leverage. This dependence can impact pricing and service terms. Diversifying technology partnerships and maintaining in-house capabilities are crucial for mitigating this risk.

- Loan origination system (LOS) providers like Ellie Mae (now ICE Mortgage Technology) and Blend have substantial market presence.

- In 2024, the mortgage technology market is estimated to be worth over $8 billion, with continued growth projected.

- Dependence on a single provider can lead to higher costs and less flexibility.

- Diversification and in-house development can reduce supplier power.

Data and analytics providers

Data and analytics providers significantly influence loanDepot's operations. Market insights are vital for loanDepot, giving these suppliers leverage. Access to real-time data is crucial for competitive decision-making. For instance, in 2024, the demand for predictive analytics in the mortgage sector grew by 15%. Negotiating advantageous contracts or building internal analytics can reduce this dependency.

- Importance of market insights for loanDepot's decisions.

- Demand for predictive analytics in the mortgage sector grew by 15% in 2024.

- Negotiating favorable contracts to reduce reliance.

- Developing internal data analytics capabilities.

Supplier bargaining power varies. Lender concentration gives suppliers leverage, especially with rising rates. Strategic partnerships and tech diversification can reduce this power.

| Factor | Impact on loanDepot | Mitigation Strategy |

|---|---|---|

| Lender Concentration | Influences pricing & terms. | Diversify partnerships |

| Rising Interest Rates | Pressures business volumes. | Enhance operational efficiency |

| Tech Dependency | Impacts costs & flexibility. | Diversify tech vendors |

Customers Bargaining Power

Borrowers benefit from multiple mortgage lender options, which enhances their power. They can compare rates and terms, diminishing individual lenders' influence. This competitive landscape lets customers switch easily if deals are poor, affecting loanDepot's retention. In 2024, mortgage rates fluctuated significantly, giving borrowers considerable leverage to seek better terms. The average 30-year fixed mortgage rate was around 7% in late 2024.

Lenders significantly influence rates and terms, particularly during high demand periods, enhancing their bargaining power. In 2024, mortgage rates saw fluctuations, with the average 30-year fixed rate around 7% by late 2024, reflecting lender control. This dynamic allows lenders to adjust terms, impacting loanDepot's competitiveness. Changes in lender policies and market conditions further affect loan terms.

Greater transparency in loan terms and fees empowers borrowers, a trend fueled by digital tools. Informed borrowers can readily compare offers; in 2024, online mortgage applications surged, with 60% of borrowers researching rates online. loanDepot must ensure clear communication to maintain customer trust and competitiveness. The company's 2024 financial reports reflect this shift, emphasizing transparent pricing models to retain market share.

Refinance options

Borrowers gain significant power through refinance options, especially when interest rates fall. In 2024, the Mortgage Bankers Association reported a notable increase in refinance applications as rates fluctuated. This allows borrowers to switch to more favorable terms, increasing competition among lenders like loanDepot. To stay competitive, loanDepot must provide attractive refinance deals.

- Refinancing gives borrowers leverage to negotiate.

- Rate drops directly influence refinance activity.

- loanDepot must offer competitive refinance terms.

- Borrowers can switch to better loan conditions.

Customer service expectations

High customer service expectations significantly amplify borrower power within the mortgage industry. Borrowers today anticipate exceptional service and a streamlined, user-friendly loan process. To stay competitive, loanDepot must prioritize investments in customer service and cutting-edge technology to meet these rising expectations. Failure to do so could lead to customer dissatisfaction and a loss of market share. In 2024, customer satisfaction scores are increasingly linked to loan origination volume.

- Customer service satisfaction scores influence market share.

- Technology investments are crucial for process efficiency.

- Borrower expectations include digital and personalized experiences.

- Poor service leads to churn and negative reviews.

Borrowers hold considerable power. They can compare terms and rates across lenders. Refinancing options and service expectations further boost borrower influence. loanDepot must adapt to maintain competitiveness.

| Factor | Impact | 2024 Data |

|---|---|---|

| Rate Comparisons | Empowers Borrowers | 60% online rate shopping |

| Refinancing | Increases Leverage | Refinance app increase |

| Service Expectations | Influences Choice | Customer sat. impacts volume |

Rivalry Among Competitors

The mortgage industry is fiercely competitive, with many lenders fighting for customers. This competition can trigger price wars, squeezing profit margins. loanDepot competes with banks and other non-bank lenders. In 2024, mortgage rates fluctuated, intensifying the fight for borrowers. The Mortgage Bankers Association reported that the average 30-year fixed-rate mortgage reached nearly 8% in October 2024.

The mortgage industry features a concentration of market share, with giants like Rocket Mortgage and Wells Fargo dominating. In 2024, Rocket Mortgage held a substantial market share, reflecting its strong position. loanDepot, as a smaller player, must compete fiercely. Differentiation through better service or pricing is key for loanDepot's survival.

Technology adoption is crucial in the mortgage industry, acting as a key differentiator. Firms are heavily investing in digital platforms and automation to boost efficiency and customer service. loanDepot needs continuous innovation and technology adoption to stay competitive. In 2024, mortgage tech spending is projected to reach $12 billion, highlighting the competitive pressure to modernize.

Marketing and branding

Effective marketing and branding are pivotal for attracting and retaining customers in the competitive mortgage industry. Companies allocate significant resources to advertising and brand awareness campaigns to stand out. loanDepot must sustain a robust brand presence to compete effectively against established and emerging rivals. In 2024, the U.S. advertising spend is projected to reach $368.3 billion, indicating the scale of investment in brand visibility.

- Marketing spend is a significant cost for lenders.

- Brand recognition influences customer choice.

- loanDepot's marketing efforts directly affect its market share.

- Advertising strategies evolve with digital trends.

Regulatory compliance

Regulatory compliance significantly impacts the competitive landscape of the mortgage industry, adding both complexity and expense. Lenders, including loanDepot, face stringent regulations and compliance standards, increasing operational costs. loanDepot must allocate substantial resources to ensure compliance, protect its reputation, and avoid financial penalties. In 2024, the Consumer Financial Protection Bureau (CFPB) issued penalties totaling over $100 million against mortgage lenders for compliance violations.

- Compliance costs can represent a significant portion of a lender's operating budget.

- Failure to comply can lead to hefty fines and legal battles.

- Maintaining compliance is crucial for preserving a lender's reputation and customer trust.

- Regulatory changes require continuous adaptation and investment.

Competitive rivalry in the mortgage sector is intense, with firms vying for market share. Pricing and service are key battlegrounds, impacting profitability. loanDepot contends against larger players; in 2024, this pressure increased.

| Aspect | Details |

|---|---|

| Market Share Concentration | Rocket Mortgage and Wells Fargo dominate; loanDepot is smaller. |

| Technological Impact | Tech spending projected at $12B in 2024. |

| Marketing and Branding | U.S. advertising spend $368.3B in 2024. |

SSubstitutes Threaten

Alternative financing options like personal loans and credit lines pose a threat to loanDepot. These alternatives can substitute mortgages, especially for those seeking flexibility. In 2024, personal loan originations reached $187 billion, signaling a significant shift. loanDepot must underscore mortgages' benefits to stay competitive.

The rental market poses a threat to loanDepot. High home prices and mortgage rates make renting appealing. In 2024, the median rent in the US was around $1,379. loanDepot must highlight homeownership advantages. It needs to address affordability for potential buyers.

Government programs, such as those from the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), can be a threat because they offer subsidized or guaranteed loans, potentially providing more affordable financing options for specific borrowers. In 2024, FHA-insured loans made up about 15% of all mortgages. loanDepot should consider partnering with these programs. This would allow it to offer tailored solutions, attracting eligible customers and mitigating the threat from these government-backed alternatives.

Delayed purchases

Delaying home purchases acts as a substitute for loanDepot's services, particularly when economic uncertainty looms. Potential homebuyers may choose to postpone their decisions, impacting loan demand. loanDepot must offer compelling incentives and build market confidence to encourage timely purchases. For example, in 2024, the average 30-year fixed mortgage rate fluctuated, influencing buyer behavior.

- Rising rates often lead to decreased demand, as seen in late 2023 and early 2024.

- Economic forecasts and consumer sentiment significantly affect purchase decisions.

- loanDepot's ability to offer competitive rates and terms is crucial.

- Marketing strategies must focus on building trust and addressing buyer concerns.

Alternative housing options

Alternative housing options, such as tiny homes and co-living arrangements, present a threat to traditional mortgages. These options are increasingly attractive, especially for those prioritizing affordability and a minimalist lifestyle. loanDepot needs to consider these alternatives to stay competitive. Adapting product offerings is crucial to cater to these changing preferences.

- Tiny homes' market is growing, with sales up 10% in 2024.

- Co-living spaces increased by 15% in major cities in 2024.

- Mortgage applications decreased by 5% in Q4 2024.

The threat of substitutes includes personal loans and credit lines, which can replace mortgages, with originations reaching $187B in 2024. Rental markets also pose a risk due to high home prices and rates; the median rent was $1,379 in 2024. Alternative housing options, such as tiny homes and co-living, further challenge loanDepot, with tiny home sales up 10% in 2024.

| Substitute | 2024 Data | Impact on loanDepot |

|---|---|---|

| Personal Loans | Originations: $187B | Increased competition |

| Rental Market | Median Rent: $1,379 | Reduced demand for mortgages |

| Tiny Homes | Sales up 10% | Diversion of potential buyers |

Entrants Threaten

The mortgage industry demands substantial capital. New entrants encounter high costs for funding, tech, and compliance. In 2024, loanDepot's total assets were approximately $10.7 billion, highlighting the capital intensity. This financial hurdle impedes rapid market entry for new firms, creating a significant barrier to entry.

Stringent regulations and licensing requirements present a significant barrier for new mortgage lenders. The process of acquiring licenses and adhering to regulatory standards is both expensive and time-intensive. loanDepot leverages its existing infrastructure and compliance expertise, giving it a competitive edge. The mortgage industry faces evolving regulatory landscapes, as seen with the 2024 updates to the Home Mortgage Disclosure Act (HMDA), which require more detailed reporting. This benefits established players like loanDepot.

Established brands often benefit from robust customer loyalty, a significant barrier for new entrants. Existing players like loanDepot have cultivated trust and recognition over years. New competitors face substantial marketing and branding costs to attract customers. This brand advantage gives loanDepot a competitive edge; in 2024, loanDepot's brand recognition remained strong, despite market fluctuations.

Technology infrastructure

Technology infrastructure is crucial for loanDepot's operations, especially in attracting new competitors. New entrants must invest significantly in digital platforms, data analytics, and robust cybersecurity measures to compete. loanDepot's proprietary mello platform offers a key competitive advantage, streamlining the mortgage process. The company's tech spending in 2024 was approximately $110 million, reflecting its commitment to digital innovation.

- Significant investment in technology is required for new entrants.

- loanDepot's mello platform provides a competitive edge.

- Cybersecurity and data analytics are critical components.

- loanDepot's tech spending in 2024 was around $110 million.

Access to funding

For loanDepot, a significant threat comes from new entrants, particularly concerning their access to funding. Securing funding and warehouse lines of credit is vital for lending operations, which can be a hurdle for newcomers. loanDepot benefits from established relationships with financial institutions, providing a stable funding base that new competitors may struggle to replicate.

- New entrants face challenges securing funding and warehouse lines of credit.

- loanDepot's existing relationships with financial institutions provide a competitive advantage.

- The ability to obtain favorable financing terms is crucial for lending operations.

- Established lenders often have an edge due to their history and reputation.

New mortgage lenders face high capital costs. Regulations and brand recognition create entry barriers. LoanDepot's tech and funding advantages limit new threats.

| Factor | Impact on New Entrants | loanDepot's Advantage |

|---|---|---|

| Capital Requirements | High costs for funding, tech, and compliance. | $10.7B in total assets in 2024, financial stability. |

| Regulatory Burden | Expensive and time-consuming licensing. | Existing compliance infrastructure, HMDA compliance. |

| Brand and Loyalty | High marketing costs to build brand recognition. | Established brand recognition, customer trust. |

Porter's Five Forces Analysis Data Sources

We leverage loanDepot's SEC filings, industry reports, and financial news to assess competitive dynamics.