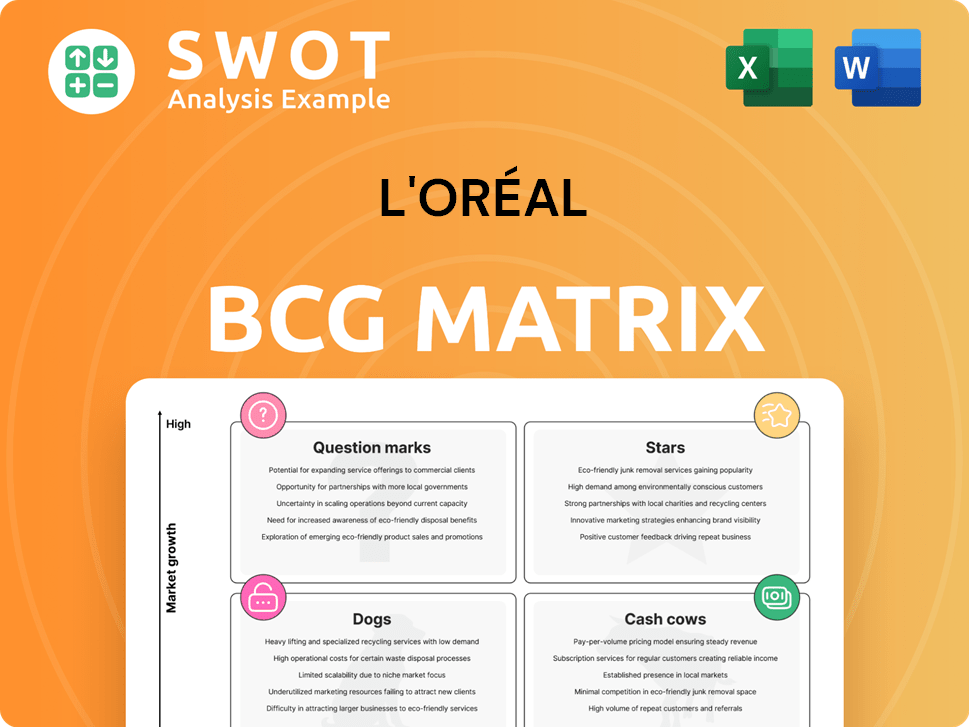

L'Oréal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

L'Oréal Bundle

What is included in the product

L'Oréal's BCG Matrix spotlights investment, hold, or divest decisions for its diverse beauty brands.

Quickly assess L'Oréal's portfolio with a printable summary optimized for easy A4 and mobile PDF sharing.

Delivered as Shown

L'Oréal BCG Matrix

The L'Oréal BCG Matrix preview showcases the final, purchased document. Get the same, fully functional file upon purchase: analysis-ready, no hidden content. Download and use it instantly for strategic insights.

BCG Matrix Template

L'Oréal's diverse brand portfolio spans various market segments. Their "Stars," like some skincare lines, show high growth and market share. "Cash Cows" are likely their established makeup brands, generating steady revenue. "Question Marks" could include newer acquisitions needing strategic investment. "Dogs" might be underperforming lines requiring attention. This glimpse only scratches the surface.

Get the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

L'Oréal Luxe's fragrance category, including Yves Saint Laurent and Prada, shows high growth and market share, especially in Europe and North America. These fragrances benefit from rising luxury beauty demand. In 2024, the luxury fragrance market is valued at approximately $20 billion. Continued marketing and innovation are key.

Kérastase, part of L'Oréal's Professional Products, shines as a Star in the BCG Matrix. Its premium haircare, including Gloss Absolu, fuels rapid growth. Strong in Europe and emerging markets, it targets the high-growth segment. In 2024, the Professional Products division saw significant sales growth, reflecting Kérastase's success.

SkinCeuticals, a Star in L'Oréal's portfolio, excels in the Dermatological Beauty division. It's experiencing significant growth, fueled by products like P-Tiox. In 2024, the Dermatological Beauty division saw a 30.6% like-for-like growth. SkinCeuticals' focus on science-backed skincare is key. Strategic R&D investments will boost its market leadership.

SAPMENA-SSA Emerging Markets

The SAPMENA-SSA region is a star for L'Oréal, showing strong growth in beauty product demand. L'Oréal's success is fueled by rising sales and product mix improvements. This region's potential is huge, and L'Oréal can boost its position with tailored products and strategic partnerships. In 2024, L'Oréal saw significant growth in these markets, with sales up by 15% in the first half of the year.

- High growth rates in SAPMENA-SSA, driving sales.

- L'Oréal's strong market position through volume and mix.

- Opportunities for tailored products to meet local needs.

- Strategic distribution partnerships for market penetration.

Beauty Tech Innovations

L'Oréal's Beauty Tech innovations, such as AI-powered skincare and virtual try-on tools, are boosting its digital market share. These technologies improve customer experience by offering personalized product recommendations. L'Oréal's focus on AI and digital advancements strengthens its leadership in the beauty tech sector. In 2024, L'Oréal invested significantly in tech, with digital sales now over 40% of total revenue.

- Digital sales represent over 40% of L'Oréal's total revenue in 2024.

- L'Oréal's investment in beauty tech has increased by 15% in 2024.

- Virtual try-on tools have increased customer engagement by 25% in 2024.

- AI-powered skincare solutions have boosted personalized product sales by 20% in 2024.

L'Oréal's "Stars" show strong growth. They have a high market share in expanding markets. This success is due to smart investments and innovation.

| Category | Growth Rate (2024) | Market Share |

|---|---|---|

| Luxe Fragrances | High | Significant |

| Kérastase | Strong | Growing |

| SkinCeuticals | 30.6% | Leading |

Cash Cows

L'Oréal Paris, a leading brand, dominates the mass-market beauty sector. It generates substantial revenue, serving as a cash cow for L'Oréal. In 2024, the Consumer Products division saw strong growth, fueled by brands like L'Oréal Paris. Continuous marketing and innovation support its market position. The brand's consistent performance contributes significantly to L'Oréal's overall financial health.

Maybelline, a cornerstone of L'Oréal's Consumer Products, excels as a Cash Cow. Its accessible cosmetics, targeting a broad audience, generate steady revenue. In 2024, Maybelline's sales contributed significantly, reflecting its strong market position and consistent cash flow.

Garnier, a key part of L'Oréal's portfolio, excels in natural skincare and haircare. It boasts a high market share, particularly among consumers valuing sustainability. In 2024, the global skincare market was valued at over $150 billion, with Garnier capturing a significant portion. Its eco-friendly practices and accessible prices solidify its cash cow position. Investments in sustainable packaging are crucial.

Professional Products Division in Europe

L'Oréal's Professional Products Division in Europe is a cash cow, showcasing solid market share and consistent performance. This is fueled by strong salon partnerships and premium haircare products. The division's established presence and loyal customer base ensure a reliable cash flow stream. In 2024, this division saw a revenue of €4.6 billion, demonstrating its financial stability.

- Revenue in 2024: €4.6 billion

- Strong market share in Europe

- Driven by salon partnerships

- Focus on premium haircare

Dermatological Beauty Division in North Asia

L'Oréal's Dermatological Beauty division in North Asia is a Cash Cow. It holds a strong market share, especially in China, with brands like La Roche-Posay and CeraVe. The division benefits from steady growth due to consumer demand for science-backed skincare. Strategic investments can further solidify its position.

- China's skincare market is booming, with sales reaching $16.5 billion in 2024.

- La Roche-Posay and CeraVe are key drivers, contributing significantly to division revenue.

- North Asia's dermatological skincare segment shows consistent growth.

- Marketing and distribution investments are vital for sustaining market leadership.

Cash Cows are key for L'Oréal, generating steady revenue and high market share. Brands like L'Oréal Paris, Maybelline, and Garnier consistently perform well. The Professional Products and Dermatological Beauty divisions also contribute significantly, especially in Europe and North Asia.

| Brand/Division | Key Region | 2024 Revenue/Market |

|---|---|---|

| L'Oréal Paris | Global | Mass-market leader |

| Maybelline | Global | Steady sales in the mass market |

| Garnier | Global | Skincare: $150B+ market |

| Professional Products | Europe | €4.6B |

| Dermatological Beauty | North Asia | China skincare: $16.5B |

Dogs

Atelier Cologne, part of L'Oréal, was removed from the North American market in 2022, signaling low market share and growth limitations there. Its relaunch targeting China highlights a strategic shift, with the Asia-Pacific region contributing 35.2% to L'Oréal's sales in 2023. Without substantial improvements, it risks remaining a 'Dog' in certain markets.

The North American makeup market, particularly bold shades, faces headwinds due to changing consumer tastes. L'Oréal's makeup brands in this region may be considered "dogs" in its BCG matrix. The category's growth lags compared to other segments. In 2024, the color cosmetics segment in the US saw a -3% decline. Targeted strategies are essential for rejuvenation.

Dogs represent L'Oréal's underperforming products. These lines have low market share and demand. They require investments with poor returns. For example, some older skincare ranges might fit this. Divestiture or reformulation are potential strategies. In 2024, L'Oréal might look at discontinuing some lines to boost profits.

Brands Facing Intense Competition

Brands in the "Dogs" category, facing fierce competition and shrinking market share, demand immediate attention. These brands, like some in L'Oréal's portfolio, might struggle in regions where competitors offer similar products at lower prices. They often need substantial investment in marketing and product innovation to survive. For example, in 2024, a specific L'Oréal skincare line saw a 5% decrease in sales in a highly competitive Asian market.

- Intense competition erodes market share.

- Requires significant marketing and innovation.

- May struggle without strategic intervention.

- Specific product lines face headwinds.

Discontinued or Divested Brands

Brands L'Oréal discontinued or divested due to poor performance are "Dogs" in its BCG matrix. These brands have low market share in slow-growth markets, impacting revenue. Strategic decisions are crucial for these underperforming assets. For example, in 2023, L'Oréal divested some non-core brands.

- Divestitures help refocus on core, high-growth brands.

- Dogs drain resources and hinder overall company performance.

- Portfolio optimization is a continuous process.

- L'Oréal regularly assesses brand contributions.

Dogs in L'Oréal's portfolio struggle with low market share and growth. These underperformers need strategic intervention, like reformulation or divestiture. Competition and evolving consumer preferences further challenge these brands. L'Oréal strategically manages these assets. In 2024, some "Dog" brands saw revenue drops, prompting restructuring.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Low Market Share | Reduced revenue, investment drain | Skincare line: -5% sales in Asia |

| Slow Growth | Limited future potential | Color cosmetics in US: -3% |

| Strategic Response | Divestiture, reformulation | Non-core brand divestitures |

Question Marks

Dr. G, acquired by L'Oréal in December 2024, fits the 'Question Mark' category. The Korean skincare market, valued at $13.9 billion in 2024, offers high growth potential. Dr. G's market share is currently low, demanding strategic investments. L'Oréal aims for a significant market share increase by 2026.

Amouage, a luxury fragrance brand, is categorized as a 'Question Mark' within L'Oréal's BCG Matrix. L'Oréal acquired a minority stake in February 2024. The niche fragrance market is experiencing high growth, with a projected global market size of $68 billion by 2024. However, Amouage holds a relatively small market share. Strategic investments could elevate its status.

L'Oréal's new sustainable product lines are question marks in its BCG matrix. They are in the high-growth sustainable beauty market, yet have a small market share. To succeed, they need increased consumer awareness and strategic marketing. In 2024, the sustainable beauty market is projected to grow significantly, potentially reaching billions of dollars.

AI-Powered Beauty Tech Platforms

L'Oréal's AI-powered beauty tech platforms, like personalized skincare tools, are question marks. These platforms are in the high-growth digital beauty market, yet have a low market share. Their success hinges on innovation and strategic partnerships. For instance, L'Oréal's digital sales grew by 25.7% in 2023, showing market potential.

- Digital sales represented 40.6% of L'Oréal's total sales in 2023.

- L'Oréal invested €1.5 billion in Research & Innovation in 2023.

- Partnerships with tech companies are key for growth.

- Market share needs to increase to become a star.

Expansion in Emerging Markets (Specific Brands)

Brands expanding in emerging markets, like those in L'Oréal's portfolio, often find themselves in the question mark quadrant of the BCG matrix. These brands are in high-growth regions but have lower market shares compared to established local competitors. Success hinges on adapting products to local preferences and building effective distribution networks. Strategic partnerships are vital for navigating these markets.

- L'Oréal's sales in emerging markets grew by 12.6% in 2023, demonstrating significant expansion potential.

- Tailoring products: L'Oréal adapts its products for local markets, such as offering specific skincare lines in Asia.

- Distribution: Partnerships with local retailers and e-commerce platforms are key for reaching consumers.

Question Marks represent high-growth markets but low market share. L'Oréal strategically invests in these to boost their position. Success depends on strategic marketing, innovation, and adapting to local preferences. They require significant investment for growth.

| Characteristic | Implication | Action |

|---|---|---|

| High Market Growth | Opportunities for significant revenue | Targeted investments & innovation |

| Low Market Share | Requires strategic efforts | Increase consumer awareness & market penetration. |

| Strategic investments | Potential for growth | Partnerships and local adaptations. |

BCG Matrix Data Sources

L'Oréal's BCG Matrix uses annual reports, market share data, and competitor analyses to categorize each brand. The analysis incorporates market growth forecasts.