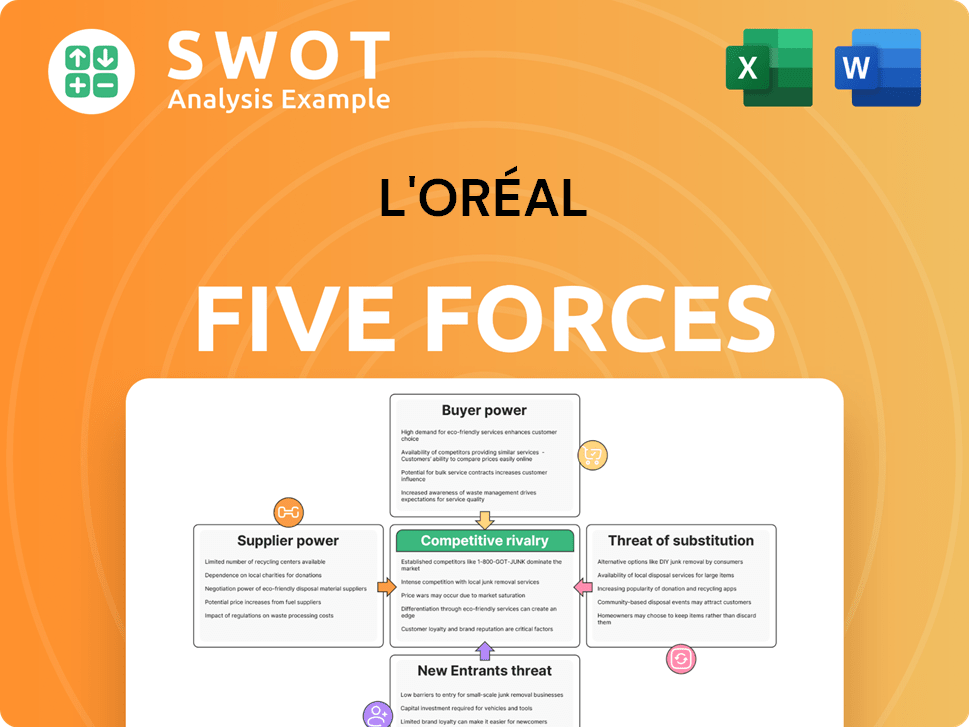

L'Oréal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

L'Oréal Bundle

What is included in the product

Analyzes L'Oréal's competitive environment, assessing threats and opportunities in the beauty industry.

Instantly identify competitive threats and opportunities within L'Oréal's market landscape.

Preview the Actual Deliverable

L'Oréal Porter's Five Forces Analysis

This preview offers L'Oréal's Porter's Five Forces analysis. It covers industry rivalry, supplier power, buyer power, threat of substitutes, and new entrants. You're examining the complete analysis. Once purchased, this exact document is immediately available.

Porter's Five Forces Analysis Template

L'Oréal faces a complex competitive landscape, shaped by the interplay of five key forces. Supplier power, particularly from raw material providers, presents a notable factor. Buyer power varies across distribution channels, influencing pricing strategies. The threat of new entrants, while moderated by high barriers, remains a consideration. Substitute products, ranging from generics to emerging beauty trends, pose ongoing challenges. Competitive rivalry, driven by industry giants and niche players, is intense.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of L'Oréal’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

L'Oréal's fragmented supplier base for raw materials, like chemicals and packaging, limits supplier power. This structure allows L'Oréal to easily switch suppliers. In 2024, L'Oréal sourced from thousands of suppliers globally. The wide availability of similar materials boosts L'Oréal's bargaining strength, keeping costs down.

L'Oréal benefits from standardized raw materials like oils and pigments. This lack of differentiation among suppliers boosts L'Oréal's bargaining power. Competition among suppliers for L'Oréal's business is intense. In 2024, L'Oréal's cost of sales was about 30% of revenue, showcasing effective cost management. This allows favorable terms.

L'Oréal's dedication to sustainable sourcing might boost the power of compliant suppliers. They're aiming for 100% sustainable raw materials by 2030. This could mean strong alliances with eco-friendly suppliers. In 2023, 60% of raw materials were sustainably sourced.

Strategic Partnerships

L'Oréal strategically partners with suppliers, impacting their bargaining power. These partnerships aim for supply chain reliability and innovation. Such collaborations can increase supplier power through closer ties. For instance, partnerships with sustainable ingredient suppliers provide access to unique, ethically sourced materials. L'Oréal's 2023 annual report highlighted a 12% increase in sustainable sourcing initiatives.

- Strategic partnerships foster mutual dependence, altering supplier power dynamics.

- Collaborations with innovative suppliers grant access to unique resources.

- L'Oréal's commitment to sustainable sourcing is growing.

- Supplier power can fluctuate based on partnership terms and market conditions.

Supplier Decarbonization Initiatives

L'Oréal actively supports supplier decarbonization through initiatives like the Solstice fund, which initially invested €50 million. This fund helps suppliers, including small and medium-sized enterprises (SMEs), finance decarbonization projects. By aiding suppliers, L'Oréal strengthens relationships and aligns them with its sustainability objectives. This support potentially increases the long-term value and influence of these suppliers.

- Solstice fund initially invested €50 million.

- Supports SMEs in accessing finance for decarbonization.

- Strengthens supplier relationships and aligns with sustainability goals.

L'Oréal generally has strong bargaining power over suppliers due to its size and the availability of raw materials. The company's diverse supplier base and strategic partnerships further enhance this advantage. However, L'Oréal's sustainability goals and support for supplier decarbonization could shift this balance. As of 2024, L'Oréal continues to manage costs effectively while fostering innovation.

| Aspect | Details | Impact on Supplier Power |

|---|---|---|

| Supplier Base | Thousands of suppliers globally; fragmented. | Reduces supplier power. |

| Raw Materials | Standardized chemicals, oils, and pigments. | Increases L'Oréal's bargaining power. |

| Sustainable Sourcing | 60% sustainably sourced in 2023; aiming for 100% by 2030. | Could increase power for compliant suppliers. |

| Strategic Partnerships | Focus on reliability and innovation. | Can increase supplier power. |

| Decarbonization Support | Solstice fund initially invested €50 million. | Strengthens relationships and aligns with sustainability goals. |

Customers Bargaining Power

Customers in the beauty industry, like those buying L'Oréal products, demand high quality, efficacy, and safety. L'Oréal must meet these expectations to retain brand loyalty and market share. Informed consumers now expect products to deliver on promises and align with their values. In 2024, L'Oréal's consumer products division saw strong growth, reflecting its ability to satisfy these demands. L'Oréal's investments in research and development are key to meeting these expectations.

Brand loyalty significantly influences customer bargaining power in the beauty sector. L'Oréal benefits from high brand loyalty across its portfolio. Strong brand recognition reduces customer propensity to switch to rivals. L'Oréal's 2024 revenue reached €41.18 billion, reflecting brand strength. Continuous innovation and quality sustain this advantage.

Price sensitivity significantly impacts L'Oréal's diverse consumer base. Mass-market customers are highly price-sensitive, often opting for more affordable options. Luxury consumers exhibit less price sensitivity, prioritizing brand and product features. In 2024, L'Oréal's mass-market segment faced pressure from competitors like Unilever, impacting sales growth. L'Oréal's multi-brand strategy helps manage price sensitivity.

Demand for Transparency

Consumers are pushing for more transparency about product ingredients, sourcing, and ethical standards. L'Oréal must offer clear, easily accessible information to satisfy these demands. This openness builds trust, significantly impacting consumer choices, especially for those prioritizing sustainability. In 2024, the global market for ethical beauty products is valued at over $15 billion.

- Ingredient disclosure is key for building consumer trust.

- Ethical sourcing practices are becoming more important.

- Transparency boosts brand loyalty and purchasing decisions.

- Consumers are increasingly willing to switch brands based on transparency.

E-commerce and Social Media Influence

E-commerce and social media significantly boost customer power, offering easy access to product details, reviews, and comparisons. Consumers can rapidly research items and share experiences, shaping others' choices. L'Oréal uses digital platforms to interact with customers, collect feedback, and handle issues. However, it must vigilantly manage its online image.

- In 2024, e-commerce sales accounted for roughly 30% of L'Oréal's total revenue, highlighting the importance of digital channels.

- Over 70% of consumers consult online reviews before purchasing beauty products.

- L'Oréal's social media engagement saw a 20% increase in 2024.

Customer bargaining power for L'Oréal hinges on quality, brand loyalty, and price sensitivity. Ethical sourcing and ingredient transparency are increasingly critical. E-commerce and social media amplify consumer influence, making digital engagement vital.

| Factor | Impact | 2024 Data |

|---|---|---|

| Brand Loyalty | Reduces switching | Revenue: €41.18B |

| Price Sensitivity | Affects sales | Mass market pressure from Unilever |

| Digital Influence | Boosts power | E-commerce ~30% revenue |

Rivalry Among Competitors

The beauty industry is fiercely competitive, with L'Oréal battling established and emerging brands globally. In 2024, the market saw over $500 billion in sales, highlighting the scale of rivalry. Key competitors like Estée Lauder and Unilever continuously innovate, intensifying the pressure. L'Oréal must adapt its strategies to stay ahead. This includes pricing, marketing, and new product development.

Innovation is key to staying ahead in the beauty industry's competitive landscape. L'Oréal's significant R&D investment fuels new products and technologies. In 2024, L'Oréal's R&D spending hit €1.39 billion. Clinical claims and efficacy testing are vital, as consumers increasingly seek science-backed solutions.

The cosmetics market is highly saturated. L'Oréal and its competitors fiercely compete for market share. In 2024, the global cosmetics market was valued at over $500 billion. Established brands like L'Oréal hold significant brand loyalty. New entrants face high barriers.

Consolidation and Acquisitions

The beauty industry is marked by significant consolidation via mergers and acquisitions. L'Oréal actively engages in this strategy, aiming to broaden its brand portfolio and market presence. This approach grants access to fresh markets, innovative technologies, and diverse consumer groups, bolstering its competitive edge. In 2024, L'Oréal acquired several brands, enhancing its global footprint.

- Acquisitions strengthen market positions.

- L'Oréal expands its portfolio.

- New markets and technologies are accessed.

- Consumer segments are diversified.

Digital Transformation

The beauty industry faces fierce competition due to digital transformation. E-commerce and social commerce are driving the need for brands to adapt quickly. Online engagement is crucial, and social selling is a key sales channel. Retailers need to be active on platforms like TikTok and Instagram to stay competitive.

- L'Oréal's e-commerce sales grew by 25.7% in 2023.

- Social commerce is projected to reach $79.6 billion in the U.S. by 2025.

- TikTok's advertising revenue is expected to hit $26.9 billion in 2024.

- Instagram's ad revenue totaled approximately $59.4 billion in 2023.

Competitive rivalry in beauty is intense, with L'Oréal facing global brands. Market sales in 2024 exceeded $500B. Innovation and digital strategies are key to success.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | Global Beauty Market | $500B+ |

| L'Oréal R&D Spend | Investment in Innovation | €1.39B |

| E-commerce Growth | L'Oréal's Online Sales (2023) | 25.7% |

SSubstitutes Threaten

The threat of substitutes for L'Oréal is moderate. Consumers can switch to cheaper skincare routines or DIY alternatives. This is supported by the fact that the global skincare market was valued at $145.5 billion in 2024. L'Oréal combats this with a diverse product range and various price points. L'Oréal's 2024 sales reached over €41 billion, showcasing its ability to adapt.

L'Oréal's strategy centers on a strong price-performance ratio, which acts as a barrier against substitutes. The company works to provide quality products at competitive prices. In 2024, L'Oréal's sales reached €41.18 billion, showing its ability to balance value with premium positioning. However, economic pressures can make budget alternatives appealing.

Consumer awareness of chemicals in personal care is rising, boosting demand for natural alternatives. Clean beauty brands are growing; the global market reached $54.5 billion in 2023. L'Oréal invests in natural formulations and sustainable supply chains to meet this shift. For instance, L'Oréal's sales in the "dermatological beauty" division increased by 29.8% in 2023.

'Cleanical' Beauty Trend

The 'cleanical' beauty trend poses a threat to L'Oréal, as consumers increasingly seek products blending sustainability with scientific efficacy. This shift is driven by rising consumer awareness and demand for transparency in ingredients and production. Brands focusing on clinical claims and eco-friendly practices are gaining traction, potentially substituting L'Oréal's offerings. To counter this, L'Oréal must highlight its commitment to sustainable practices.

- In 2024, the global clean beauty market was valued at approximately $60 billion.

- Consumer interest in 'cleanical' products has increased by 25% in the last year.

- L'Oréal's sustainability report showed a 10% increase in eco-friendly product sales in 2024.

- Companies emphasizing clinical testing saw a 15% rise in market share.

Impact of Beauty Services

Beauty services pose a threat as substitutes for L'Oréal's products. Consumers might opt for professional treatments over at-home applications, impacting product sales. This shift is visible; the global beauty services market was valued at $258 billion in 2024. L'Oréal mitigates this by offering professional-grade products for home use and collaborating with salons. These partnerships help promote their products.

- Beauty services market size: $258 billion (2024)

- Consumer preference shift towards professional treatments.

- L'Oréal's strategy: home-use professional products.

- Collaboration: partnerships with salons and spas.

The threat of substitutes for L'Oréal is moderate, shaped by accessible alternatives like DIY skincare and budget-friendly brands. Clean beauty's growth, with a 2024 market of around $60 billion, poses a challenge. L'Oréal responds by diversifying product lines and emphasizing value.

| Category | Details | 2024 Data |

|---|---|---|

| Clean Beauty Market | Market size | $60 billion |

| L'Oréal Sales | Total Revenue | €41.18 billion |

| Eco-Friendly Product Sales | Increase | 10% |

Entrants Threaten

The beauty industry's high entry barriers are a significant threat. Established brands like L'Oréal benefit from strong consumer loyalty, making it tough for new competitors. Entering this market requires substantial capital for marketing and distribution. L'Oréal's 2024 revenue reached approximately €41.18 billion, showcasing its market dominance. New entrants struggle with brand recognition and securing shelf space.

L'Oréal's size gives it economies of scale in production, marketing, and distribution, creating a barrier for new entrants. Its massive marketing budget, which in 2023 reached €3.5 billion, and global supply chains, allow L'Oréal to offer products at competitive prices. New companies struggle to match these cost advantages. This makes it challenging for smaller firms to enter the market effectively.

Access to technology and innovation is vital in beauty. L'Oréal's R&D gives it a competitive edge. They invested €1.3 billion in R&D in 2023. New entrants find it hard to match L'Oréal's investment in innovation. This leads to cutting-edge product development.

Distribution Channel Access

Gaining distribution channel access is a significant hurdle for new beauty brands. L'Oréal, with its established retail relationships and robust online presence, holds a distinct advantage. Securing shelf space in mass-market retailers and department stores is challenging. E-commerce and social media offer alternative routes, yet established brands maintain a competitive edge.

- L'Oréal reported €38.3 billion in sales for 2023, demonstrating its market power.

- E-commerce accounted for 30.7% of L'Oréal's sales in 2023, showcasing its strong online presence.

- New brands face high marketing costs to compete with established brands' advertising budgets.

Potential for Disruption

The beauty industry, despite its high entry barriers, faces disruption from innovative entrants. Start-ups focusing on niche markets or personalized products can gain traction. These newcomers can quickly capture market share by leveraging digital platforms and direct-to-consumer models. L'Oréal actively mitigates this threat through continuous innovation and adaptation to evolving consumer preferences.

- In 2023, the global beauty market was valued at approximately $580 billion.

- Direct-to-consumer beauty brands have shown significant growth, with some increasing their market share by up to 15% annually.

- L'Oréal invested €3.9 billion in Research & Development in 2023 to stay ahead of innovations.

- The rise of clean beauty and personalized skincare is a key trend, with a projected market growth of 10% per year.

L'Oréal faces a moderate threat from new entrants due to high entry barriers. Established brands, like L'Oréal, benefit from consumer loyalty and economies of scale. New firms struggle with brand recognition and distribution, despite innovative disruption. The global beauty market was valued at around $580 billion in 2023.

| Factor | L'Oréal's Advantage | Impact on New Entrants |

|---|---|---|

| Brand Recognition | Strong global brand with high consumer trust. | New brands require huge marketing spendings. |

| Economies of Scale | Large-scale production and distribution. | Challenges in matching cost structures. |

| R&D and Innovation | €1.3 billion R&D investment in 2023. | Difficulties in competing on product innovation. |

Porter's Five Forces Analysis Data Sources

Our analysis employs L'Oréal's financial reports, industry publications, market research, and competitive intelligence platforms for a robust overview.