Lowe's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lowe's Bundle

What is included in the product

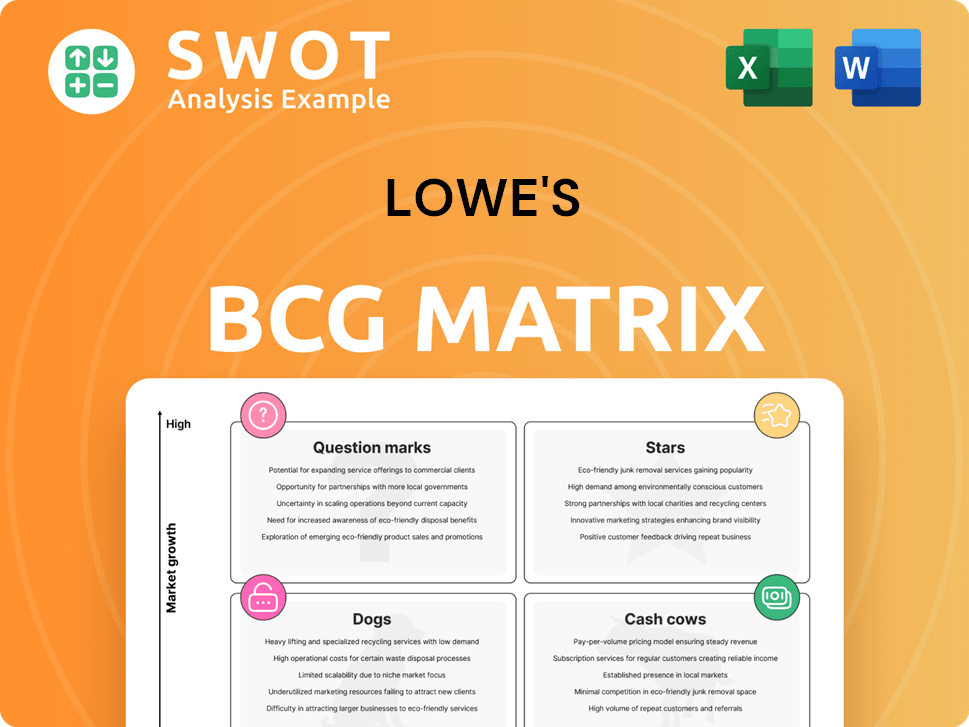

Lowe's BCG Matrix: strategic evaluation of product categories. Investment, hold, or divest units identified.

Focus your strategy! Lowe's BCG Matrix, a quick visual tool for efficient resource allocation and prioritization.

What You’re Viewing Is Included

Lowe's BCG Matrix

The BCG Matrix you see is the document you'll receive after purchase. It's a fully functional, professionally crafted report. No alterations or hidden content; download and begin using it right away.

BCG Matrix Template

Lowe's faces fierce competition. This sneak peek highlights their potential "Stars" like appliances and "Cash Cows" such as core hardware. Identifying "Dogs" and "Question Marks" is key for strategic decisions. Understand their product portfolio’s positioning in the market. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Lowe's is aggressively pursuing growth in its Pro customer segment, which makes up 30% of sales. The company plans to double the market's growth rate in this area. They're investing in services, inventory, and jobsite delivery to attract and retain Pro customers. This strategic focus aims to increase the Pro customer's spending share.

Lowe's is aggressively boosting online sales, expanding its digital offerings to meet customer demands. They've launched the first home improvement product marketplace in the U.S. In 2024, online sales grew, contributing significantly to overall revenue. This strategic move allows Lowe's to offer a vast product range without the inventory burden.

Lowe's is aggressively expanding its home services, positioning it as a "Star" in the BCG Matrix. This involves significant investments like the $1.325 billion acquisition of Artisan Design Group (ADG). This strategic move aims to tap into the $50 billion fragmented market. The expansion is fueled by the need for 18 million new homes in the U.S. by 2033, driving growth.

AI-Driven Customer Experience

Lowe's is using AI to boost customer experience, a "Star" in its portfolio. This involves personalized shopping and quicker in-store service, improving customer satisfaction. The company is collaborating with tech leaders like NVIDIA, OpenAI, and Palantir to develop new AI solutions. This approach aims to streamline shopping for both DIY customers and professionals.

- Lowe's saw a 1.3% increase in comparable sales in Q4 2024, partly driven by enhanced digital experiences.

- The company has invested significantly in AI, with plans to expand its AI-driven initiatives in 2024.

- Customer satisfaction scores have shown a positive trend, reflecting the impact of AI-driven improvements.

- Lowe's reported total sales of $18.6 billion in Q4 2024.

Store Expansion in High-Growth Areas

Lowe's is aggressively expanding its physical presence in high-growth areas, aiming to capture a larger share of the DIY and Pro customer markets. This strategy involves opening 10-15 new stores annually in the U.S., capitalizing on successful recent store launches. The expansion is designed to boost brand recognition and increase both sales and return on invested capital.

- Lowe's aims to open 10-15 new stores annually in high-growth markets.

- The expansion strategy builds on the success of recent new store openings.

- Enhanced space productivity initiatives are being leveraged.

- The goal is to strengthen brand position and increase sales.

Lowe's is leveraging AI to boost customer experience, which is a "Star" in its portfolio, evidenced by recent initiatives. Customer satisfaction scores improved, reflecting the impact of AI enhancements. In Q4 2024, total sales reached $18.6 billion, partly driven by digital growth.

| Initiative | Impact | 2024 Data |

|---|---|---|

| AI-Driven Improvements | Enhanced Customer Experience | 1.3% increase in comparable sales in Q4 |

| Digital Expansion | Increased Online Sales | $18.6B Total Sales in Q4 |

| Customer Satisfaction | Positive Trend | Investment in AI expansion plans |

Cash Cows

Lowe's thrives on its DIY customer base, a steady revenue source. Homeowners' consistent needs for maintenance ensure stable sales. In 2024, DIY projects drove significant revenue, especially for core products. Marketing keeps Lowe's connected with this key segment. This solid foundation supports Lowe's financial health.

Lowe's boasts robust brand recognition and customer loyalty, a legacy of its decades in the home improvement market. This strong brand equity is a key competitive advantage, drawing in repeat customers and ensuring steady sales. In 2024, Lowe's generated approximately $86.4 billion in sales, demonstrating the effectiveness of its brand strength. The company strategically invests in its brand through marketing campaigns and community involvement, solidifying its market position.

Lowe's supply chain is highly optimized for consistent product flow. This efficiency cuts costs and boosts availability, supporting profitability. Lowe's uses its size to get good deals from suppliers. In 2024, Lowe's reported a gross margin of approximately 34.3% due to supply chain effectiveness. The company's inventory turnover rate was around 4.6 times.

Real Estate Portfolio

Lowe's real estate portfolio, encompassing over 1,700 stores, is a key cash cow. These physical assets offer a reliable, steady stream of value. The company strategically manages its store network to boost space productivity. In 2024, Lowe's invested in store improvements.

- Over 1,700 store locations.

- Ongoing evaluation for optimization.

- Focus on space productivity.

- 2024 investments in store upgrades.

Dividend King Status

Lowe's, a Dividend King, has raised its dividend annually for 61 consecutive years, a testament to its financial health. This impressive streak highlights Lowe's dedication to shareholder returns and its ability to navigate market fluctuations. The company's dividend payout ratio is healthy, suggesting room for future dividend hikes.

- Dividend Yield (2024): Approximately 2.2%

- Consecutive Years of Dividend Increases: 61

- Dividend Payout Ratio (2024): Around 30%

- Revenue (2023): $86.4 billion

Lowe's generates substantial, steady cash flow. This is due to its strong market position, efficient operations, and robust brand recognition. Its status as a Dividend King further underscores its financial stability and investor appeal.

| Feature | Details |

|---|---|

| Revenue (2024) | Approximately $86.4 Billion |

| Dividend Yield (2024) | Around 2.2% |

| Dividend Payout Ratio (2024) | About 30% |

Dogs

Some Lowe's product categories might struggle due to shifting consumer tastes or tougher competition. These areas need scrutiny, possibly leading to sales or revamped strategies for better profits. Spotting underperforming products is key for Lowe's. In 2024, Lowe's saw a slight dip in certain categories, like seasonal goods, impacting overall sales figures.

Lowe's faces challenges with outdated store formats, potentially hindering efficiency and customer appeal. Older stores may need renovations or closures to enhance the shopping experience. In 2024, Lowe's invested heavily in modernizing stores, allocating significant capital for upgrades. Continuous evaluation of store networks is vital to meet evolving consumer demands. The company's strategic adjustments aim to boost space productivity and maintain its competitive edge.

Lowe's faces low market share in some areas. These regions need focused marketing. Improving operations is also essential. In 2024, Lowe's aimed to boost sales in underperforming regions. Understanding local dynamics is key.

Slow-Moving Inventory

Lowe's, as a "Dog," may struggle with slow-moving inventory. This is especially true in seasonal or trend-sensitive areas. Efficient inventory management is key to cutting costs and avoiding losses. Lowe's needs to refine its inventory levels and improve forecasting.

- In Q3 2024, Lowe's inventory turnover rate was 3.3x, showing how often inventory is sold.

- Slow-moving items can lead to higher carrying costs, potentially impacting profitability.

- Lowe's has implemented various strategies to improve inventory management and optimize its supply chain.

- The company aims to reduce the amount of time it takes to sell its inventory.

Commoditized Products

In Lowe's BCG matrix, "Dogs" represent products like basic building materials. These items face intense price competition, leading to lower profit margins. Lowe's must use strategic sourcing and pricing. Differentiation through services and innovation is key. For example, in 2024, gross profit margin was approximately 34.2%.

- Commoditized products struggle with low margins.

- Price wars are common, squeezing profits.

- Strategic sourcing is vital for cost control.

- Innovation and services help differentiate.

Lowe's "Dogs" include product categories with low growth and market share. These areas often have poor profitability due to high competition. Effective strategies include strategic sourcing. In 2024, some "Dog" categories saw reduced sales.

| Category | Market Share | Profit Margin (2024) |

|---|---|---|

| Basic Lumber | Low | ~15% |

| Seasonal Goods | Variable | ~20% |

| Commodity Hardware | Low | ~18% |

Question Marks

Smart home tech is a question mark for Lowe's, a growing market with high potential but uncertain returns. Lowe's offers smart home products, yet faces innovation and market share challenges. The company must educate consumers and ensure seamless integration and support. In 2024, the smart home market is projected to reach $147.1 billion globally.

Eco-friendly products represent a question mark for Lowe's in the BCG Matrix. Demand is rising, but market share is uncertain. Lowe's must expand its eco-friendly offerings. In 2024, energy-efficient appliance selection grew 25%. This aligns with consumers' environmental focus.

Lowe's home services platform is a Question Mark in its BCG Matrix. This initiative, aiming to connect homeowners with contractors, is a high-growth, yet uncertain market. In 2024, the home services market was valued at over $500 billion, showing potential. Lowe's must invest strategically to ensure user-friendliness and attract both customers and providers. Success hinges on effective execution and market adoption.

Rural Market Expansion

Lowe's expansion into rural markets, with plans to extend assortments to 150 more stores, fits the "Question Mark" quadrant of the BCG matrix. This strategy is high-growth but carries uncertain market share. Success hinges on understanding rural customer preferences and optimizing product offerings.

- Lowe's aims to capture a larger share of the $75 billion home improvement market in rural areas.

- The company's rural stores saw a 5% sales increase in 2023.

- Lowe's is investing $500 million in its rural market expansion.

AI-Powered Customer Service

AI-powered customer service is positioned as a question mark for Lowe's in the BCG Matrix. The company is investing in AI tools, such as chatbots and virtual assistants, to enhance customer satisfaction and cut expenses. However, the tools' effectiveness in handling complex issues remains uncertain. Lowe's is piloting solutions to improve the in-store experience.

- Lowe's is relaunching its Pro loyalty program in early 2025.

- The success of AI in customer service is still being evaluated.

- Customer acceptance and the ability to manage complex inquiries are key uncertainties.

- The focus is on empowering frontline associates.

The relaunch of Lowe's Pro loyalty program in early 2025 falls under the "Question Mark" category. The program aims to enhance customer satisfaction, a high-growth, yet uncertain market. The success of AI tools in customer service is under evaluation.

| Aspect | Details | 2024 Data |

|---|---|---|

| Pro Loyalty Program | Relaunching in 2025 | Customer satisfaction key focus |

| AI in Customer Service | Implementing AI tools | Effectiveness still being evaluated |

| Customer Acceptance | Key to AI success | Focus on empowering frontline associates |

BCG Matrix Data Sources

This BCG Matrix relies on financial data, industry reports, market research, and competitor analyses to guide insights.