Lowe's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lowe's Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

Customize pressure levels based on new data or evolving market trends.

Preview the Actual Deliverable

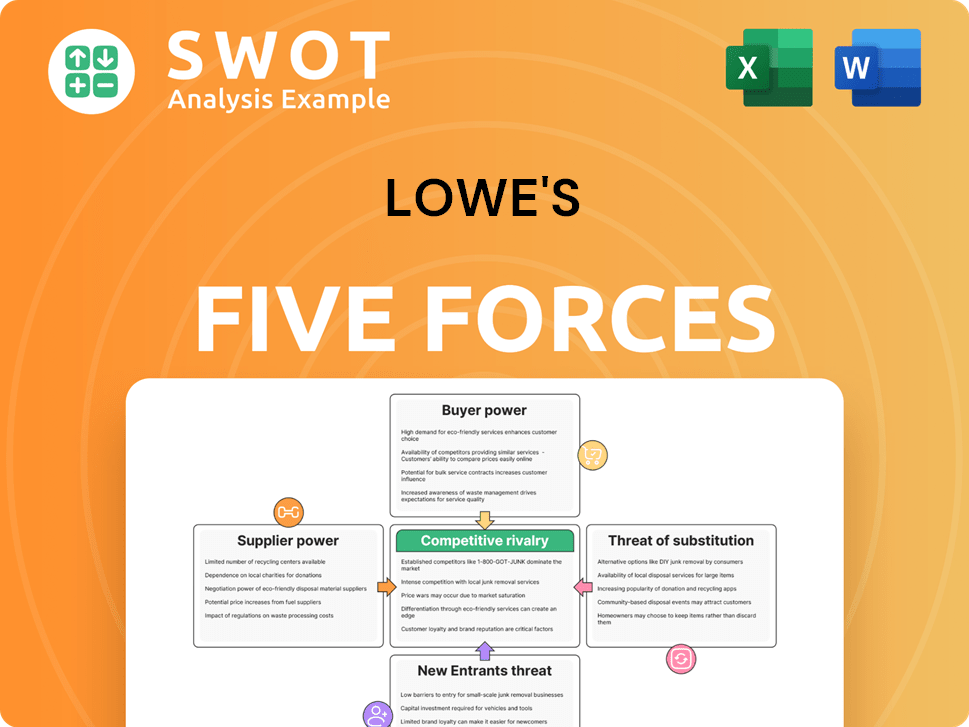

Lowe's Porter's Five Forces Analysis

This preview of Lowe's Porter's Five Forces analysis showcases the complete document. You're viewing the final, ready-to-use version. No editing needed – it's professionally formatted. Download the same file instantly after purchase.

Porter's Five Forces Analysis Template

Lowe's faces diverse competitive forces. Buyer power is moderate due to consumer choice and bargaining power. Supplier power is limited, with diverse suppliers. New entrants face high barriers. Substitute products pose a moderate threat. Competitive rivalry is intense.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lowe's’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Lowe's. Some suppliers, like major appliance brands, hold considerable market share, boosting their bargaining power. In contrast, suppliers of commodity products may have less leverage. Lowe's can switch suppliers, which limits supplier power. This power affects Lowe's input costs and profitability; in 2024, Lowe's cost of sales was around $48 billion.

Suppliers of differentiated, specialized products hold more sway; commodity suppliers less. Lowe's, like other retailers, has private label brands, which impacts supplier power. Product differentiation influences Lowe's negotiation strength. In 2024, Lowe's reported a gross margin of approximately 34%. This is impacted by supplier negotiations.

Switching suppliers for Lowe's involves moderate costs like new contracts and logistics adjustments. These costs don't significantly boost supplier power. Lowe's can negotiate better terms because of this. In 2024, Lowe's spent roughly $95 billion on goods, highlighting its bargaining leverage. This flexibility impacts Lowe's supply chain.

Supplier's threat of forward integration is low

The threat of suppliers entering the retail market and competing with Lowe's is generally low. Forward integration by suppliers, like manufacturers, could disrupt Lowe's established supply chain. This would involve suppliers bypassing Lowe's to sell directly to consumers. Currently, Lowe's benefits from strong supplier relationships, which mitigate this risk.

- Lowes reported $23.6 billion in revenue in Q3 2024.

- The company has a diverse supplier base, reducing the impact of any single supplier.

- Forward integration requires significant investment and retail expertise.

- Lowe's can leverage its scale to negotiate favorable terms with suppliers.

Impact of supplies on Lowe's product differentiation is high

Lowe's product differentiation is significantly impacted by its suppliers. The quality and uniqueness of supplies directly affect Lowe's ability to stand out. High-quality and innovative supplies boost Lowe's competitive edge. Standardized supplies offer less differentiation. The quality of supplies influences Lowe's brand image. In 2024, Lowe's reported a gross margin of approximately 34.2% reflecting the impact of its supply chain.

- Unique or superior supplies allow Lowe's to offer exclusive or high-quality products.

- Standardized supplies limit Lowe's ability to differentiate its offerings.

- Supply quality directly impacts customer satisfaction and brand perception.

- Lowe's gross margin is affected by supplier costs and the quality of goods.

Lowe's supplier bargaining power is moderate, with diverse suppliers limiting the impact of any single entity. The company leverages its scale to negotiate terms, impacting its cost of sales, which in 2024 was about $48 billion. Switching suppliers is feasible, further reducing supplier influence.

| Factor | Impact on Lowe's | Data (2024) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Cost of Sales: ~$48B |

| Product Differentiation | Differentiated products enhance supplier power | Gross Margin: ~34.2% |

| Switching Costs | Low switching costs reduce supplier power | Revenue in Q3: $23.6B |

Customers Bargaining Power

Lowe's customer base is broad, encompassing homeowners, renters, and contractors. No single customer contributes a substantial portion of Lowe's revenue. This low customer concentration limits the bargaining power of individual customers. The diverse customer base helps stabilize Lowe's financial performance. In 2024, Lowe's reported strong sales, indicating a healthy customer base.

Customers can readily switch to competitors like Home Depot or online retailers, increasing their bargaining power. This is because switching costs are low. Lowe's, therefore, must offer competitive pricing and excellent service to retain customers. Customer convenience significantly influences store choice. Ultimately, low switching costs compel Lowe's to prioritize customer experience. In 2024, Home Depot's market share was slightly higher than Lowe's, which underscores this dynamic.

Lowe's faces moderate product differentiation. Many products are available at competitors like Home Depot, decreasing Lowe's unique advantage. Strong branding and loyalty programs are vital for customer retention. Product selection significantly impacts how customers view Lowe's. This differentiation level affects Lowe's pricing ability. In 2024, Lowe's reported $86.3 billion in sales.

Price sensitivity is moderate to high

Customers' price sensitivity in home improvement is moderate to high, especially given project costs. Economic fluctuations significantly affect customer spending; for example, in 2024, rising interest rates influenced home improvement spending. Lowe's adjusts promotional strategies based on price sensitivity, offering sales and discounts. Value perception, influenced by price and quality, guides customer purchase decisions. This price sensitivity drives Lowe's competitive pricing strategies.

- Home improvement projects are often large investments, making customers budget-conscious.

- Economic downturns or inflation can reduce discretionary spending on home improvements.

- Promotional offers, like seasonal sales, are crucial for attracting price-sensitive customers.

- Perceived value influences whether customers choose Lowe's over competitors like Home Depot.

Availability of information is high

Customers possess significant bargaining power due to readily available information. They can easily compare Lowe's prices and products against competitors online and in-store, which influences their choices. Transparency in pricing and product details further empowers customers, enabling informed decisions. Online reviews significantly affect Lowe's sales, compelling a focus on customer service. This environment drives Lowe's to prioritize transparency and competitive pricing.

- Price comparison websites and apps enable real-time comparisons.

- Customer reviews heavily influence purchasing decisions, with 84% of consumers trusting online reviews as much as personal recommendations.

- Lowe's faces pressure to match competitor pricing to retain customers.

- The DIY and home improvement market size was valued at $903.8 billion in 2023.

Customer bargaining power at Lowe's is moderate to high due to factors like low switching costs and readily available information. Customers can easily compare prices, and this influences Lowe's pricing strategies. Price sensitivity, influenced by economic conditions, also affects purchasing decisions. In 2024, the home improvement market was valued at $911.8 billion.

| Factor | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low, enabling customer choice | Home Depot slightly higher market share than Lowe's. |

| Price Sensitivity | Moderate to high, impacting sales | Rising interest rates affected spending. |

| Information Availability | High, empowering customers | DIY and home improvement market: $911.8B. |

Rivalry Among Competitors

The home improvement retail sector is intensely competitive, dominated by giants like Home Depot. This rivalry fuels price wars and frequent promotional campaigns. These battles for market share can squeeze profit margins. Lowe's, facing this pressure, must prioritize efficiency and innovation to stay competitive. Lowe's reported net sales of $23.7 billion in Q3 2023.

Lowe's competes with Home Depot and many smaller rivals. This extensive competition intensifies rivalry within the home improvement sector. With numerous competitors, Lowe's must differentiate its offerings to succeed. Analyzing these competitors is crucial for Lowe's strategic planning. This competitive landscape significantly impacts Lowe's market positioning and financial performance. In 2024, Home Depot had over 2,300 stores, and Lowe's had around 1,700, highlighting their direct rivalry.

The home improvement industry's moderate growth rate fuels competition for market share. In 2024, the sector grew, but slower expansion heightens competitive pressures. This influences investment strategies, with Lowe's prioritizing market share gains. For example, in Q3 2024, Lowe's reported a 2.9% decrease in sales.

Product differentiation is moderate

Lowe's faces moderate product differentiation, as many items resemble those of rivals. This similarity often drives competition based on price and customer service. Moderate differentiation requires robust branding and efforts to foster customer loyalty to stand out. Lowe's must carefully manage its product assortment to gain a competitive edge. Marketing strategies are crucial to highlight any unique aspects.

- In 2024, Lowe's reported a net sales decrease of 2.9% compared to 2023, reflecting the impact of competitive pressures.

- Lowe's focuses on differentiating through services like installation and Pro customer programs.

- The home improvement market is highly competitive, with players like Home Depot vying for market share.

- Lowe's invests heavily in digital marketing and online presence to reach consumers.

High exit barriers

Lowe's faces high exit barriers due to substantial investments in physical stores and infrastructure. These significant commitments make it challenging for Lowe's to quickly leave the market. High exit barriers intensify the competitive landscape, as firms are compelled to compete fiercely to maintain market share. Lowe's strategic flexibility is impacted by its dependence on physical stores, which influences long-term planning. In 2024, Lowe's reported over 1,700 stores across North America, highlighting its considerable fixed asset investments.

- Significant investments in infrastructure and real estate restrict easy market exits.

- High exit barriers intensify competitive pressures among rivals.

- Commitment to physical stores reduces strategic flexibility.

- Exit barriers play a crucial role in long-term strategic planning.

Lowe's faces intense competition, especially from Home Depot. Price wars and promotions are common, squeezing profit margins. Differentiation through services and customer loyalty is key. In 2024, Lowe's net sales decreased, reflecting these challenges.

| Metric | Lowe's (2024) | Home Depot (2024) |

|---|---|---|

| Net Sales Growth | -2.9% | +1.5% |

| Number of Stores | ~1,700 | ~2,300+ |

| Market Share (Est.) | 20% | 30% |

SSubstitutes Threaten

Online retailers, such as Amazon, present a moderate threat by offering substitute home improvement products. The ease of online shopping increases the competitive pressure on Lowe's. To counter this, Lowe's has focused on its omnichannel strategy, aiming to integrate online and in-store experiences. E-commerce growth is reshaping traditional retail, with online sales in the U.S. home improvement market reaching $76.4 billion in 2024. To stay competitive, Lowe's continues to invest in its online presence.

Customers might substitute buying tools with renting them. Rental services, like those offered by Home Depot, provide a cheaper option for infrequent use. This affects sales of tools and equipment at Lowe's. In 2024, the tool rental market was valued at approximately $47 billion, showing its impact. Rental availability thus influences customer choices.

Customers can opt for contractors or handymen instead of DIY projects. Professional services provide convenience and expertise, impacting Lowe's DIY sales. The availability of these services shapes customer behavior, creating competition. In 2024, the home services market is estimated to be worth over $500 billion, highlighting the threat of substitutes.

DIY alternatives exist

The threat of substitutes for Lowe's is significant, primarily due to the prevalence of DIY alternatives. Customers increasingly opt to repair or repurpose items, reducing the need for new purchases. This shift influences demand for products traditionally sold by retailers. The DIY movement, fueled by online tutorials and communities, impacts consumer behavior and spending habits. DIY projects provide cost-saving options, potentially diverting spending away from Lowe's.

- The global home improvement market was valued at $945.5 billion in 2023.

- Approximately 60% of U.S. homeowners engage in DIY projects.

- Online platforms like YouTube have billions of DIY-related views annually.

- The average DIY project saves consumers roughly 30% compared to professional services.

Impact of economic conditions

Economic conditions significantly affect Lowe's, as downturns prompt customers to delay projects. Spending habits shift with economic cycles, influencing the demand for home improvement goods. Economic factors directly impact Lowe's revenue and profitability, making them crucial. For example, in 2023, Lowe's reported a 2.7% decrease in comparable sales, reflecting economic pressures.

- Recessionary periods lead to project postponements.

- Consumer confidence levels are key indicators.

- Interest rates influence borrowing for projects.

- Economic growth supports higher spending.

Lowe's faces a substantial threat from substitutes, especially in the DIY market and with online retailers. Consumers often choose alternatives like renting tools or hiring professionals, affecting sales. The home services market, valued at over $500 billion in 2024, is a strong competitor.

| Substitute | Impact on Lowe's | 2024 Data |

|---|---|---|

| Online Retailers | Erosion of Market Share | $76.4B Online Home Improvement Sales (U.S.) |

| Tool Rental | Reduced Tool Sales | $47B Tool Rental Market |

| Professional Services | Decreased DIY Sales | $500B+ Home Services Market |

Entrants Threaten

Entering the home improvement retail market demands substantial capital for real estate, inventory, and infrastructure. High capital requirements significantly deter new entrants, posing a barrier to market entry. Capital intensity directly impacts market accessibility, favoring established players. Financial resources are crucial for new market entrants; consider that in 2024, Lowe's reported over $86 billion in total assets, underscoring the scale needed.

Lowe's and Home Depot benefit from significant brand loyalty, making it tough for newcomers. Strong brand recognition acts as a major barrier to entry. Customers often choose familiar, trusted brands. Brand loyalty directly affects a new entrant's ability to gain market share. Lowe's reported $23.6 billion in sales for Q3 2023.

Lowe's leverages economies of scale in purchasing, distribution, and marketing, creating cost advantages. These efficiencies affect competitive pricing, making it tough for new entrants to compete. Lowe's benefits from its massive size. For example, in 2024, Lowe's had over $86 billion in sales. New entrants find it challenging to match these cost-leadership advantages.

Stringent regulations

Stringent regulations pose a significant barrier to new entrants in the home improvement retail sector. Compliance with safety, zoning, and environmental regulations escalates the initial investment and operational costs. These requirements increase operational complexity, demanding specialized expertise and resources. New entrants face higher fixed costs, impacting their profitability compared to established players. For example, in 2024, the EPA imposed stricter rules on the handling of hazardous materials, raising compliance expenses by an estimated 10% for new stores.

- Safety regulations: Ensuring compliance with building codes and safety standards.

- Zoning laws: Navigating local ordinances for store location and operations.

- Environmental compliance: Adhering to regulations on waste disposal and hazardous materials.

- Compliance costs: Higher expenses impacting profitability for new entrants.

Limited access to suppliers

New home improvement retailers face difficulties due to limited access to suppliers. Established companies like Lowe's have well-established relationships with suppliers. These relationships are crucial for product availability and pricing. Strong supply chains also affect operational efficiency. Securing dependable supply chains poses a significant challenge for new entrants.

- Lowe's generated $86.3 billion in revenue in 2023.

- Lowe's has a vast network of suppliers to ensure product availability.

- New entrants struggle to match the scale and supplier relationships of established firms.

- Supply chain efficiency is critical for cost management and competitiveness.

New entrants face formidable barriers in the home improvement retail sector, including high capital needs for stores and inventory. Brand loyalty towards established players like Lowe's creates another hurdle for newcomers to gain market share. The presence of stringent regulations further complicates market entry. Lowe's reported over $86 billion in sales in 2024, showcasing its market dominance.

| Barrier | Impact | Lowe's Data (2024) |

|---|---|---|

| Capital Requirements | High initial investment | $86B+ in assets |

| Brand Loyalty | Customer preference | $23.6B Q3 2023 sales |

| Regulations | Increased costs | Compliance costs +10% |

Porter's Five Forces Analysis Data Sources

Our analysis is built on data from financial reports, industry studies, market share data, and competitive analysis to assess Lowe's' market position.