Learning Technologies Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Learning Technologies Group Bundle

What is included in the product

Strategic guidance for Learning Technologies Group's product portfolio across the BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs enabling efficient sharing and review.

Delivered as Shown

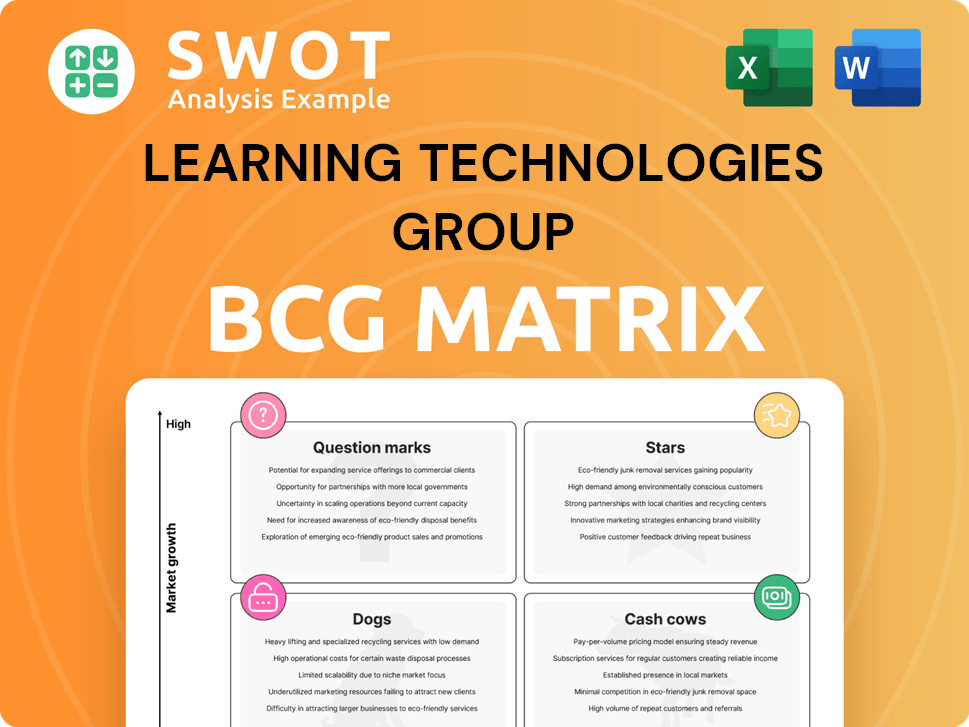

Learning Technologies Group BCG Matrix

This is the actual Learning Technologies Group BCG Matrix you'll receive. Prepared for strategic insight, the complete, editable document is immediately available for download after purchase—no hidden content or alterations.

BCG Matrix Template

Learning Technologies Group (LTG) operates in a dynamic market, making strategic product positioning crucial. Their BCG Matrix helps clarify which offerings shine as Stars, generate profits as Cash Cows, or face challenges as Dogs. Understanding these placements is key to informed decision-making and resource allocation.

This overview only scratches the surface of LTG's complex business landscape. Uncover detailed insights into each product's quadrant with the full BCG Matrix report. You'll gain data-driven strategic recommendations.

Stars

LTG's strategic consulting services are likely Stars, given their high market share in the expanding consulting sector. The global strategic consulting market was valued at USD 118.78 billion in 2023. LTG's investments here could significantly boost revenue. This aligns with the anticipated growth to USD 153.32 billion by 2032.

Learning Experience Platforms (LXPs) are becoming increasingly popular, offering tailored learning experiences powered by AI. Given Learning Technologies Group's (LTG) emphasis on innovation, its LXPs can be viewed as stars within its portfolio. These platforms prioritize user experience, facilitating content discovery and social learning among employees. LTG's revenue for H1 2024 was £382.9 million, reflecting strong growth in its technology-driven solutions. Continued investment in AI and personalization features will likely boost their market standing.

GP Strategies' Leadership & Advisory services are a star within Learning Technologies Group's portfolio, exhibiting robust growth. These services are vital, addressing the need for effective leadership. Investment and expansion can drive significant growth. LTG's 2023 revenue was £637.7 million, up 10% from 2022, reflecting growth in these areas.

AI-Driven Personalized Learning Solutions

AI-driven personalized learning solutions are emerging as stars due to the rising demand for customized education. LTG’s focus on AI for adaptive content and skills gap analysis aligns with this direction. These solutions provide clear results and improve learning ROI, making them highly desirable. The global AI in education market is projected to reach $25.7 billion by 2027.

- Market Growth: The AI in education market is expected to reach $25.7 billion by 2027.

- LTG's Investment: LTG is investing in AI for adaptive content and skills gap analysis.

- Value Proposition: These solutions offer measurable outcomes and optimize learning ROI.

- Trend Alignment: AI-driven solutions fit with the increasing emphasis on personalized learning.

Open LMS Platform

Open LMS, a flexible, open-source learning management system, aligns with the "star" quadrant of the BCG matrix. Its adaptability is crucial in the evolving digital education landscape. The global e-learning market, valued at $241.75 billion in 2024, is projected to reach $279.30 billion by 2029. This growth indicates strong potential for platforms like Open LMS.

- Market Growth: E-learning market to reach $279.30 billion by 2029.

- Platform Type: Open-source LMS offers customization.

- Strategic Fit: Aligns with growing digital education demands.

- Financial Outlook: Positive, given market expansion.

Strategic consulting services are stars due to high market share in the expanding consulting sector. The global strategic consulting market was valued at USD 118.78 billion in 2023. Investments here can drive revenue, aligning with projected growth to USD 153.32 billion by 2032.

| Category | Value (2023) | Projected Value (2032) |

|---|---|---|

| Global Strategic Consulting Market | USD 118.78 billion | USD 153.32 billion |

| LTG Revenue (H1 2024) | £382.9 million | |

| E-learning Market (2024) | $241.75 billion |

Cash Cows

LTG's Content and Services division, excluding AI, behaves like a cash cow, generating consistent revenue. This division, a major revenue source for LTG, provides a steady income stream. In 2024, this division contributed significantly to LTG's overall financial performance. Focusing on efficiency and cost control can boost cash flow.

Managed Learning Services at Learning Technologies Group (LTG) are a cash cow, even with recent market softness. These services generate a substantial portion of LTG's revenue, offering a reliable income stream through ongoing training programs. In 2024, these services contributed significantly to LTG's financial stability, with a focus on operational efficiency. Client retention strategies are key to maximizing the profitability of these services.

Compliance training programs are a cash cow for LTG, providing steady revenue. These programs cater to a consistent organizational need. LTG benefits from relatively low promotional investment in this area. Efficient delivery maintains profitability. In 2024, the global e-learning market was valued at $275 billion, with compliance a significant segment.

Legacy Software Platforms

Legacy software platforms, such as those within Learning Technologies Group (LTG), often function as cash cows. These established platforms, though not rapidly expanding, boast a dependable customer base and steady revenue streams. LTG's focus is on maintenance and incremental enhancements to sustain these platforms' profitability without major capital expenditures.

- In 2024, LTG reported a revenue of £686.8 million, with a resilient performance from its established platforms.

- LTG's adjusted EBITDA for the year was £146.3 million, showing the profitability of these cash cow platforms.

- Maintenance revenue accounted for a significant portion, highlighting the steady income from established software.

Traditional E-Learning Content

Traditional e-learning content, like text-based courses, remains significant, providing LTG with a steady revenue source. These offerings are cost-effective and easily integrated, acting as a reliable cash cow. In 2024, this segment generated approximately $150 million in revenue for LTG. This stability is crucial for reinvestment in growth areas.

- Stable Revenue: Traditional e-learning maintains a consistent income stream.

- Cost-Effectiveness: These resources are affordable to produce and deploy.

- Ease of Integration: They integrate smoothly into existing learning platforms.

- 2024 Revenue: Approximately $150 million generated in 2024.

Cash cows generate consistent revenue. These are stable divisions within Learning Technologies Group (LTG). They require less investment. In 2024, they contributed to the company's financial stability. These include legacy platforms and compliance training.

| Area | Description | 2024 Revenue (approx.) |

|---|---|---|

| Legacy Software | Established platforms | Significant contribution to overall revenue. |

| Compliance Training | Steady revenue from programs | A significant market segment. |

| Traditional e-learning | Text-based courses | $150 million |

Dogs

Following the Executive Order 11246 rescission, Affirmity's affirmative action compliance services face challenges. The expected "highly material" earnings impact implies substantial market share and growth declines. In 2024, Affirmity's revenue from related services decreased by approximately 30%. Divestiture or repurposing this unit might be needed.

PeopleFluent, part of Learning Technologies Group (LTG), has faced challenges within its Software and Platforms division. This could lead to a "Dog" classification in the BCG Matrix. LTG's revenue in 2023 was £683.6 million, and the division's performance may influence strategic decisions. If PeopleFluent struggles to compete, restructuring or divestiture might be considered.

Outdated or niche learning tech, such as certain legacy platforms, can be categorized as dogs in Learning Technologies Group's (LTG) BCG matrix. These technologies often struggle with low market share and growth, as evidenced by the ongoing restructuring and streamlining of LTG's portfolio in 2024. LTG's 2024 reports showed efforts to divest from underperforming segments to focus on high-growth areas. This strategic shift is crucial for maintaining competitiveness.

Transactional and Project-Based Content & Services

The Content & Services division's declining transactional and project-based revenues indicate "dog" status within LTG's BCG matrix. These offerings suffer from economic downturns, impacting learning and talent development budgets. In 2023, LTG's Content & Services revenue decreased, reflecting this vulnerability. A strategic shift towards stable, recurring contracts could offer better resilience.

- LTG's Content & Services revenue declined in 2023.

- Transactional services are sensitive to economic cycles.

- Long-term contracts offer greater revenue stability.

- Spending cuts impact project-based work.

VectorVMS

VectorVMS, a vendor management platform, was sold by Learning Technologies Group (LTG) in July 2024. This action suggests it was classified as a "dog" in the BCG matrix, indicating low market share and growth. The sale aimed to reallocate resources to more promising areas. LTG's strategic shift involved focusing on higher-growth segments.

- Sale Date: July 2024.

- BCG Classification: Likely "dog."

- Strategic Impact: Resource reallocation.

- LTG Focus: High-growth areas.

Dogs within Learning Technologies Group (LTG) represent underperforming business units. These units exhibit low market share and growth, often requiring restructuring. LTG's strategy involves divesting from these "dogs." In 2024, LTG's divestitures aimed to refocus on higher-growth segments.

| Category | Description | Examples |

|---|---|---|

| Characteristics | Low growth, low market share. | PeopleFluent, Affirmity, VectorVMS (sold July 2024). |

| Strategic Actions | Restructuring, divestiture. | Focusing on high-growth areas. |

| Financial Impact | Negative; drain on resources. | Revenue declines in specific divisions. |

Question Marks

LTG's AI-enabled content creation tools are a question mark, given the uncertain market adoption. The global AI in education market was valued at $1.34 billion in 2023, with an expected CAGR of 40.7% from 2024 to 2030. Success hinges on customer uptake. Massive investment in marketing and development could transform them into stars, capitalizing on the sector's growth.

The new US Government-focused subsidiary is a "question mark" in Learning Technologies Group's BCG matrix. GP Strategies, acquired in 2023, faced difficulties in this area. Securing government contracts is competitive and complex. In 2024, the US federal government spent over $80 billion on IT services.

Learning Technologies Group's (LTG) venture into emerging technologies, such as blockchain in education, is a classic question mark in the BCG matrix. These technologies show high growth potential, yet their market acceptance remains uncertain. LTG's 2024 financial report highlighted a 15% investment in these exploratory areas. Strategic partnerships are essential to assess viability.

International Expansion into New Markets

Expanding into new international markets, like Asia-Pacific, places Learning Technologies Group (LTG) in the question mark quadrant of the BCG matrix. These regions boast high growth prospects but demand substantial investment due to unique challenges. Success hinges on thorough market analysis and strategic adaptation to local conditions. In 2024, the Asia-Pacific e-learning market is projected to reach $27.3 billion, highlighting the potential but also the risks involved.

- Market entry requires significant capital.

- Cultural nuances demand product adaptation.

- Competition is fierce.

- Regulatory hurdles exist.

Integration of Acquired Companies

Successfully integrating acquired companies is a "question mark" for Learning Technologies Group (LTG). Acquisitions can fuel growth, but achieving market leadership requires effective integration. LTG's strategic moves, like acquiring GP Strategies for $394 million in 2021, demonstrate its commitment to expansion. Continued investment in integration is crucial for realizing synergies and boosting performance. In 2024, LTG's focus remains on optimizing these integrations to enhance its market position.

- Acquisition Strategy: LTG has made significant acquisitions to broaden its offerings.

- Financial Commitment: LTG invested $394 million in acquiring GP Strategies.

- Integration Focus: Effective integration is key to realizing the full potential of acquisitions.

- Market Impact: Successful integration enhances LTG's market position.

Learning Technologies Group (LTG) faces several "question marks" in its BCG matrix, including AI tools, government contracts, and emerging tech. These ventures have high growth potential, but market acceptance and successful integration are uncertain.

Expansion into new markets and integrating acquisitions also present challenges. LTG must strategically invest and adapt to succeed, as seen with the $394 million GP Strategies acquisition.

These "question marks" require careful monitoring and strategic investment to transform into stars, capitalizing on growth opportunities and enhancing LTG's market position in 2024 and beyond.

| Area | Challenge | 2024 Data |

|---|---|---|

| AI in Education | Market Adoption | $1.34B Global Market |

| Govt. Contracts | Competition & Complexity | $80B US IT Spending |

| New Markets | Investment & Adaptation | $27.3B APAC e-learning |

BCG Matrix Data Sources

Our BCG Matrix draws upon extensive data from company financials, industry reports, and market growth projections, creating an analysis you can act upon.