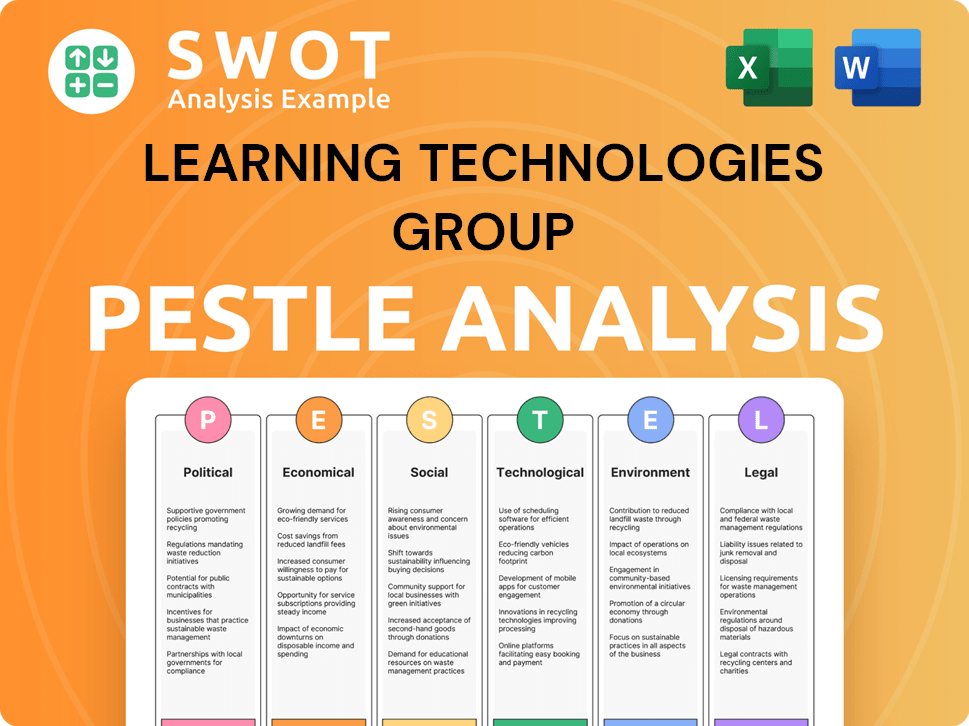

Learning Technologies Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Learning Technologies Group Bundle

What is included in the product

Analyzes Learning Technologies Group through PESTLE dimensions, revealing external factors' impact across multiple areas.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Full Version Awaits

Learning Technologies Group PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Learning Technologies Group PESTLE Analysis is ready to download immediately after purchase.

PESTLE Analysis Template

Uncover the forces shaping Learning Technologies Group with our PESTLE Analysis. We explore political, economic, and technological impacts, revealing key market dynamics. Our analysis provides actionable insights, perfect for strategic planning and investment decisions. Download the full report and unlock a deeper understanding of LTG's environment. Make smarter choices and gain a competitive edge today! Purchase now!

Political factors

Government policies greatly affect learning tech demand. Policies on education, skills, and jobs influence LTG. Funding shifts in training programs or mandated employee training create opportunities or challenges. In 2024, governments globally spent billions on education and workforce development. For example, the U.S. allocated over $100 billion for education initiatives.

Learning Technologies Group (LTG) faces political instability risks due to its global presence. Geopolitical events can disrupt operations and affect revenue. For example, political instability in regions like Eastern Europe, where LTG may have clients, could impact sales. LTG's revenue in 2024 was £730.4 million. This figure underscores the importance of navigating global political landscapes.

LTG's global presence makes it vulnerable to trade policies and international relations. For example, the UK's trade with the EU post-Brexit has seen some adjustments. In 2024, the UK-EU trade was valued at around £800 billion. Diplomatic shifts can also impact market access and operational costs.

Government Spending on Public Sector Training

Government spending significantly impacts Learning Technologies Group (LTG), especially in its public sector dealings. Changes in budgets for employee training directly influence LTG's revenues from government contracts. For instance, in 2024, U.S. federal spending on workforce training reached $2.7 billion. Fluctuations in these allocations can create uncertainty for LTG's financial planning.

- 2024 U.S. federal spending on workforce training: $2.7 billion.

- Public sector is a key consumer of LTG's services.

- Budget shifts affect LTG's revenue streams.

Impact of Specific Political Decisions

Recent political shifts significantly influence Learning Technologies Group (LTG). For instance, alterations to affirmative action policies in the US may affect the demand for DEI training, a service offered by LTG's subsidiaries. These policy changes can reshape market dynamics and client needs. This necessitates LTG to adapt its strategies.

- US DEI training market valued at $12 billion in 2024.

- LTG's revenue from DEI solutions grew by 15% in 2023.

- Changes in political climate can shift demand by up to 20%.

- Anticipated market growth for LTG in 2025 is 10%.

Political factors deeply influence Learning Technologies Group (LTG). Government spending shifts in education and workforce development affect LTG's revenue; U.S. spending reached $2.7 billion in 2024. Global political instability poses operational risks, and trade policies also matter.

| Factor | Impact on LTG | Data (2024) |

|---|---|---|

| Government Spending | Influences public sector contracts | U.S. workforce training: $2.7B |

| Political Instability | Disrupts operations & revenue | LTG's revenue: £730.4M |

| Trade Policies | Affects market access/costs | UK-EU trade: ~£800B |

Economic factors

Economic growth significantly impacts corporate training investments. In 2024, global GDP growth is projected at 3.2%, influencing learning tech budgets. Conversely, recessions, like the 2020 downturn, can cause training budget cuts. For instance, during recessions, tech spending often decreases by 10-15%.

Inflation poses a risk to Learning Technologies Group (LTG), potentially raising labor and tech costs. In 2024, the UK's inflation rate fluctuated, impacting operational expenses. Higher interest rates, influenced by inflation, could increase borrowing costs for LTG and its clients. The Bank of England's base rate changes directly affect LTG's financial strategy and client investment in learning solutions. For instance, a 0.25% rate hike in 2024 could influence project financing.

Unemployment rates greatly influence LTG's prospects. High unemployment, although providing a larger talent pool, may signal a weak economy, reducing training investments. In contrast, low unemployment boosts demand for upskilling. The U.S. unemployment rate in April 2024 was 3.9%, while the Eurozone's was 6.5%. These figures directly affect LTG's market opportunities.

Currency Exchange Rates

Learning Technologies Group (LTG), operating globally, faces currency exchange rate risks. Fluctuations can significantly affect reported financial results. The impact is pronounced when translating revenues and profits from various foreign currencies into the company's base currency. In 2024, the GBP/USD exchange rate saw considerable volatility.

- LTG's international revenue is vulnerable to exchange rate changes.

- Currency fluctuations can lead to either gains or losses in financial statements.

- Hedging strategies are crucial to mitigate exchange rate risks.

Disposable Income and Business Confidence

Consumer disposable income and business confidence directly impact learning technology investments. Strong consumer spending and optimistic business outlooks often lead to increased spending on employee training and development programs. In 2024, U.S. real disposable income rose by 2.1%, reflecting consumer spending resilience. However, business confidence, as measured by the Conference Board, showed fluctuating trends.

- Increased disposable income often boosts training budgets.

- High business confidence encourages long-term investments in staff.

- Economic downturns usually lead to reduced training investments.

- Government policies on economic stimulus can affect these factors.

Economic factors like GDP growth directly shape training investments; the projected 2024 global GDP of 3.2% influences LTG's budget. Inflation in 2024, with rates fluctuating, affects operational costs and potentially increases borrowing expenses for LTG. Unemployment rates also play a role, with low rates boosting demand for upskilling, while exchange rates and business confidence pose further risks and opportunities.

| Economic Indicator | Impact on LTG | 2024 Data/Forecast |

|---|---|---|

| GDP Growth | Training budget influence | Global: 3.2% (Projected) |

| Inflation | Cost increases, borrowing | UK: Fluctuating, US: 3.3% (April) |

| Unemployment | Upskilling demand | US: 3.9%, Eurozone: 6.5% (Apr) |

Sociological factors

The workforce is changing, with shifts in age, diversity, and cultural backgrounds. These changes affect learning and talent solutions. LTG must offer solutions for diverse learners. In 2024, 58% of U.S. workers were from diverse backgrounds, impacting training needs.

Modern employees favor flexible, digital, and personalized learning. LTG must offer engaging digital solutions to meet these evolving expectations. In 2024, the global e-learning market reached $275 billion, highlighting the demand. LTG's success hinges on adapting to these preferences. Digital learning is expected to grow 10% annually through 2025.

Societal attitudes significantly influence LTG's prospects. Growing emphasis on lifelong learning boosts demand for their offerings. The value society places on learning directly affects investment in training. In 2024, 70% of companies increased their L&D budgets. This trend is expected to continue through 2025.

Work-Life Balance and Remote Work Trends

The increasing focus on work-life balance and the rise of remote work significantly influence how employees access learning. In 2024, it's crucial for Learning Technologies Group to provide flexible and easily accessible learning solutions. This adaptability is key, as a recent study showed 60% of professionals prefer hybrid work. This trend demands anytime, anywhere learning options.

- 60% of professionals prefer hybrid work models.

- Flexible learning solutions are crucial.

- Accessibility is key for remote workers.

Diversity, Equity, and Inclusion (DEI) Focus

Societal emphasis on Diversity, Equity, and Inclusion (DEI) is increasing, creating demand for related training. Learning Technologies Group (LTG) meets this need with offerings like PDT Global. This aligns with evolving workplace expectations and legal mandates. The DEI training market is projected to reach $15.4 billion by 2025.

- DEI training demand is driven by societal trends.

- LTG offers DEI solutions through various subsidiaries.

- Market forecasts show significant growth in DEI training.

- Compliance and ethical concerns fuel DEI training needs.

Societal shifts, like DEI focus and work-life balance demands, shape LTG's market. Flexible, accessible learning is crucial, mirroring hybrid work preferences of 60% professionals. DEI training is expected to reach $15.4B by 2025, and this drives demand.

| Factor | Impact | Data |

|---|---|---|

| DEI Emphasis | Increased Demand | $15.4B market by 2025 |

| Work-Life Balance | Demand for Flexibility | 60% prefer hybrid work |

| Lifelong Learning | Increased L&D Spending | 70% companies boosted L&D spend in 2024 |

Technological factors

Advancements in AI, VR, and AR are reshaping learning. LTG needs to adopt these to stay ahead. The global AR and VR market is projected to reach $78.3 billion in 2024. LTG's focus on innovation is crucial. By 2025, AI in education is set to be a $25.7 billion market.

The surge in mobile and cloud tech profoundly impacts Learning Technologies Group (LTG). LTG must ensure its platforms are mobile-friendly, supporting diverse devices and cloud environments. This is critical, as approximately 7.5 billion mobile subscriptions were active globally as of 2024. Cloud computing spending reached $670 billion in 2024, showcasing the need for scalable solutions. LTG's focus on cloud-based learning solutions, like those offered by its subsidiary, GP Strategies, aligns with this trend, ensuring accessibility and adaptability.

Data analytics advancements allow for enhanced tracking and personalization of learning. LTG uses these technologies to provide insightful analytics, a key differentiator. The global data analytics market is projected to reach $650.8 billion by 2029, growing at a CAGR of 24.4% from 2022. This growth reflects the increasing importance of data-driven insights in all sectors.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount for Learning Technologies Group (LTG) due to its handling of sensitive employee data. Strong security measures are vital for maintaining client trust and adhering to stringent regulations. The global cybersecurity market is projected to reach $345.7 billion by 2024, highlighting the significance of these investments. LTG must navigate evolving data privacy laws like GDPR and CCPA. Breaches can lead to significant financial and reputational damage.

- Cybersecurity market expected to hit $345.7B in 2024.

- Data breaches can cause substantial financial losses.

- Compliance with GDPR and CCPA is essential.

Automation and AI in Talent Management

Automation and AI are transforming talent management, a trend Learning Technologies Group (LTG) can capitalize on. These technologies streamline recruitment, onboarding, and performance reviews. By incorporating AI, LTG can enhance its platform's capabilities and offer more efficient solutions to clients. The global AI in HR market is projected to reach $3.8 billion by 2025.

- AI-driven tools for personalized learning paths.

- Automated candidate screening and assessment.

- AI-powered performance analytics for better insights.

- Improved efficiency and reduced costs in talent processes.

Learning Technologies Group (LTG) faces significant technological shifts.

AI, VR, and AR innovations, like the $25.7B AI in education market by 2025, require adaptation. Mobile and cloud tech are critical; 7.5B mobile subscriptions and $670B cloud spending in 2024 necessitate scalable solutions.

Data analytics, with a $650.8B market by 2029, and cybersecurity (projected $345.7B in 2024) are crucial for LTG's success, and its future talent management.

| Technology Area | Impact | Data Point (2024/2025) |

|---|---|---|

| AI in Education | Enhances learning personalization | $25.7B market (2025) |

| Mobile & Cloud | Ensures accessibility & scalability | 7.5B mobile subscriptions; $670B cloud spend (2024) |

| Cybersecurity | Protects data & ensures trust | $345.7B market (2024) |

Legal factors

LTG faces scrutiny from data protection regulations, including GDPR and others worldwide. These laws dictate how LTG handles personal and employee data. Compliance is a constant effort, requiring updates. In 2024, data breach fines rose; companies like Meta faced billions in penalties.

Learning Technologies Group (LTG) must navigate diverse employment laws. Regulations often mandate employee training, notably compliance. This fuels demand for LTG's solutions. For example, in 2024, the global e-learning market reached $275 billion, reflecting the impact of such mandates. Compliance training is a significant driver.

Learning Technologies Group (LTG) heavily relies on intellectual property (IP) to protect its assets. Securing patents, copyrights, and trademarks for its learning platforms, content, and technologies is essential. This IP protection safeguards LTG's competitive edge in the market. In 2024, LTG's investment in IP protection totaled $15 million, reflecting its commitment.

Accessibility Standards

Legal factors significantly influence Learning Technologies Group (LTG), especially regarding accessibility. Digital accessibility regulations mandate that LTG's platforms and content are usable by people with disabilities. This ensures LTG can serve a wide range of clients. Failure to comply can lead to legal issues and reputational damage.

- In 2024, global spending on accessible technology reached $70 billion.

- The U.S. Department of Justice has increased enforcement of digital accessibility.

- Companies failing to meet accessibility standards face potential lawsuits and fines.

Contract Law and Client Agreements

Learning Technologies Group (LTG) operates through client contracts that are fundamental to its business model. Any shifts in contract law or disagreements over contractual terms can significantly impact LTG's legal and financial standing. For example, in 2024, contract disputes cost businesses an average of $1.5 million each. These issues can range from service level breaches to intellectual property rights.

- Recent legal changes impact how digital services are delivered and protected.

- LTG must ensure its contracts comply with current data protection regulations like GDPR.

- Intellectual property rights are essential for its training content.

- Contractual disputes can lead to significant legal expenses and operational disruptions.

Learning Technologies Group (LTG) faces complex legal landscapes. Data privacy rules, like GDPR, require strict compliance in 2024/2025. IP protection through patents, is critical. Accessibility laws, with $70B in 2024 spending, shape LTG's products.

| Legal Factor | Impact on LTG | 2024/2025 Data |

|---|---|---|

| Data Privacy | Compliance & Data Security | Meta faced billions in fines. |

| Employment Laws | Training Mandates | E-learning market reached $275B in 2024. |

| Intellectual Property | IP Protection | LTG invested $15M in IP in 2024. |

| Accessibility | Platform Usability | $70B spent on accessible tech in 2024. |

| Contracts | Legal & Financial Risk | Avg. dispute cost $1.5M in 2024. |

Environmental factors

Corporate Social Responsibility (CSR) and sustainability are increasingly important. Businesses are now more carefully choosing suppliers, including those for learning technologies. LTG must show its commitment to environmental responsibility. In 2024, sustainability-linked loans grew, reflecting this trend.

Digital learning's impact includes reduced travel but increases energy consumption from data centers and devices. Data centers' energy use is significant; globally, they consumed about 2% of electricity in 2023. This is expected to grow, potentially reaching 3% by 2025. The carbon footprint of these technologies needs careful management to minimize environmental impact.

The digital learning sector, including Learning Technologies Group (LTG), indirectly impacts e-waste through the use of electronic devices. Globally, e-waste generation is projected to reach 82.6 million metric tons by 2025, according to the UN. Though not a direct operational factor for LTG, the environmental impact of devices used for accessing its platforms is a crucial consideration.

Climate Change and Business Continuity

Climate change poses indirect risks to Learning Technologies Group (LTG). Extreme weather could affect LTG's or client operations, though less directly than other sectors. The insurance industry, for example, faced $100 billion in insured losses in 2023 due to climate-related events. LTG could see disruptions in supply chains or client services.

- Potential supply chain disruptions.

- Client service interruptions.

- Increased operational costs due to climate impacts.

Client Demand for Sustainable Solutions

Clients are increasingly prioritizing sustainability. They often favor suppliers showing environmental commitment. LTG should emphasize the eco-friendly aspects of its digital solutions. This includes reducing travel for training, aligning with current market trends. The global green technology and sustainability market is projected to reach $61.9 billion by 2025.

- Emphasis on sustainable practices can attract environmentally conscious clients.

- Digital solutions reduce carbon footprints compared to traditional methods.

- Highlighting these benefits can boost LTG's market position.

- The growing demand for green tech offers significant opportunities.

LTG faces environmental impacts like increased energy consumption from digital learning and e-waste generation from related devices. Climate change poses indirect risks, potentially disrupting supply chains and client services. The green technology and sustainability market is expected to reach $61.9 billion by 2025, making sustainable practices crucial.

| Environmental Aspect | Impact | Data/Fact (2024/2025) |

|---|---|---|

| Energy Consumption | Data centers increase energy use. | Data centers globally used ~2% of electricity in 2023, expected to reach 3% by 2025. |

| E-waste | Devices used for digital learning. | Global e-waste projected to hit 82.6 million metric tons by 2025 (UN). |

| Sustainability Market | Demand for eco-friendly solutions. | Green tech/sustainability market expected to reach $61.9 billion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis relies on credible sources like industry reports, governmental data, and economic forecasts to inform insights.