Marathon Digital Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

What is included in the product

Analysis of Marathon Digital's Bitcoin mining in BCG matrix, identifying investment & divestment strategies.

Concise visuals, eliminating confusion. This clean layout eases understanding of Marathon's investments.

Full Transparency, Always

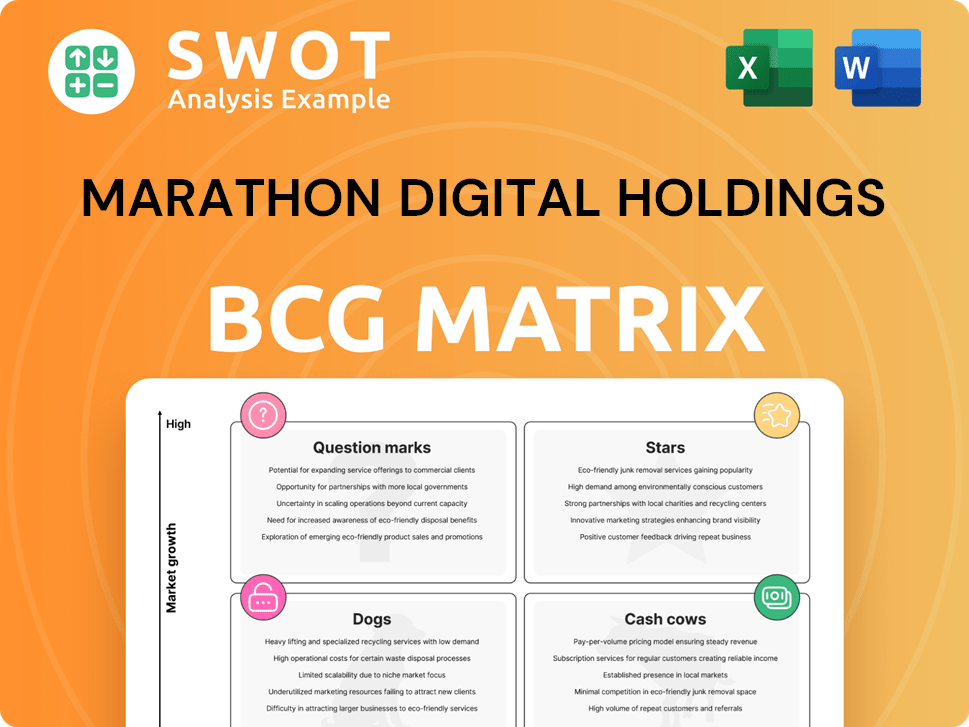

Marathon Digital Holdings BCG Matrix

The preview shows the complete Marathon Digital BCG Matrix you'll receive. This is the final, ready-to-use document, providing instant strategic insights post-purchase. It offers a clear overview, formatted for easy analysis and professional presentations. The purchased version allows full editing and immediate implementation, supporting your business needs.

BCG Matrix Template

Marathon Digital Holdings operates in the volatile world of Bitcoin mining, with its revenue streams likely segmented into mining hardware and mined Bitcoin. Its "Stars" might include high-performing mining operations, while less efficient segments could be "Dogs." "Cash Cows" could be established, profitable mining rigs. The "Question Marks" could be exploring new technologies. Understanding its quadrant placements offers crucial insights.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Marathon Digital is a dominant Bitcoin mining operation, with a significant infrastructure investment. By the close of 2024, their energized hashrate hit 53.2 EH/s. This strong capacity allows them to secure the Bitcoin blockchain, generating substantial revenue. They project 54.3 EH/s by March 2025.

Marathon Digital's vertical integration is a significant strength. This involves acquiring data centers and boosting energy capacity. They're focusing on renewable sources, which helps lower costs. In 2024, Marathon mined 8,525 Bitcoin. This strategic move aims for better capital efficiency.

Marathon Digital strategically manages its Bitcoin holdings, using methods like lending BTC to generate more returns. By March 2024, the company held approximately 17,800 BTC, a substantial asset. This active management approach boosts financial stability and allows for capitalizing on market changes. In Q1 2024, they produced 2,195 BTC, increasing their holdings.

Record-Breaking Financial Performance

Marathon Digital Holdings demonstrated stellar financial results in 2024. Revenue increased by 69% year-over-year, reaching $656.4 million. Net income soared to $528.3 million in Q4, alongside an adjusted EBITDA of $794.4 million. This performance highlights effective operational strategies and financial strength.

- Revenue: $656.4 million (69% YoY increase)

- Net Income: $528.3 million (Q4)

- Adjusted EBITDA: $794.4 million

- Strong financial position enabling strategic investments.

Expansion into AI Inference Compute

Marathon Digital's expansion into AI inference compute is a strategic move. This initiative leverages their existing infrastructure. It aims to diversify revenue streams by tapping into the AI market. Pilot projects are planned for 2025, showcasing their commitment.

- Marathon's 2023 revenue: $388.4 million.

- AI market growth: projected to reach $1.8 trillion by 2030.

- Pilot projects in 2025 will test AI capabilities.

- High-performance computing expertise is a key asset.

Marathon Digital shines as a "Star" in the BCG Matrix, indicating a high-growth, high-market-share position. The company's revenue increased 69% YoY in 2024, reaching $656.4 million, driven by substantial Bitcoin mining and strategic AI expansion. This strong performance is backed by significant infrastructure and financial results.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue | Year-over-year increase | 69% |

| Total Revenue | $656.4 million | |

| Net Income (Q4) | $528.3 million |

Cash Cows

Marathon Digital's efficient energy management, including owned sites and renewable energy, positions it as a cash cow. Their 2024 direct energy cost was $28.8K per Bitcoin from owned sites. This cost control boosts profit margins. It also generates strong cash flow.

Marathon Digital's vertical integration boosts efficiency. Owning data centers and energy infrastructure provides operational control. This approach enhances margins and cash flow. In 2024, Marathon mined 5,220 Bitcoin. Their operational hash rate capacity reached 29.8 EH/s.

Marathon Digital's high Bitcoin (BTC) yield per share, reported at 62.9% for 2024, showcases efficient Bitcoin production. This suggests the company generates substantial BTC value per share. Efficient production boosts cash flow. For example, in Q1 2024, Marathon mined 2,195 BTC.

Strategic Asset Management

Marathon Digital's strategic Bitcoin management, like lending BTC for returns, is a cash cow. This active asset management boosts financial performance and cash flow. Their proactive approach strengthens financial stability. In Q4 2023, Marathon mined 4,281 Bitcoin. They are using this strategy to enhance their position.

- Cash cow strategy maximizes financial performance.

- Active asset management generates additional cash flow.

- Proactive approach enhances overall financial stability.

- Q4 2023: Marathon mined 4,281 Bitcoin.

Proven Mining Expertise

Marathon Digital Holdings' proven Bitcoin mining expertise positions it as a cash cow, generating consistent revenue. The company's established experience ensures efficient mining operations and a deep understanding of the Bitcoin ecosystem. This expertise translates into a reliable cash flow, supporting its financial stability. In 2024, Marathon mined 2,195 Bitcoins.

- Mining Efficiency: Marathon's hashrate reached 25.7 EH/s in December 2024.

- Bitcoin Production: Marathon mined 1,886 Bitcoin in Q4 2024.

- Revenue: Marathon's Q4 2024 revenue was $156.8 million.

- Operational Capacity: Marathon has 28,000 miners deployed at Compute North in December 2024.

Marathon Digital is a cash cow due to its efficient Bitcoin mining and strategic financial moves. This is evident in their robust 2024 performance, including a high BTC yield. Their proactive asset management further boosts cash flow and strengthens financial stability.

| Metric | Q4 2024 | 2024 Total |

|---|---|---|

| Bitcoin Mined | 1,886 | 5,220 |

| Revenue ($ millions) | $156.8 | - |

| Hashrate (EH/s) | 25.7 (Dec) | 29.8 |

Dogs

Marathon Digital's profitability is heavily influenced by Bitcoin's price volatility. As a Bitcoin miner, its revenue directly correlates with Bitcoin's value. In 2024, Bitcoin's price fluctuations significantly impacted Marathon's earnings. For instance, a 10% drop in Bitcoin's price could drastically affect their financial results.

Marathon Digital faces regulatory risks as cryptocurrency rules shift. New crypto regulations might complicate operations and raise costs. Regulatory uncertainty hurts Marathon's long-term outlook. For example, in 2024, the SEC increased scrutiny of crypto firms. This could affect Marathon's profitability.

Marathon Digital Holdings faces fierce competition in Bitcoin mining, potentially impacting its market share and profitability. The industry is crowded, with many firms competing for rewards. In 2024, Marathon's hashrate grew, but so did competitors', affecting margins. Competition intensifies as more miners enter, lowering profit margins. For example, in Q4 2023, Marathon mined 1,853 BTC.

Potential for Rapid Cash Burn

Marathon Digital Holdings faces a significant challenge: rapid cash burn. InvestingPro data highlights this concerning trend, impacting long-term financial stability. Despite achieving record revenue in 2024, the company's cash outflow remains high. This situation could become critical if Bitcoin prices fall or operational issues emerge.

- Marathon Digital's cash burn rate is a major concern.

- High spending despite revenue growth is a potential risk.

- Bitcoin price fluctuations could worsen the situation.

- Operational challenges could further strain finances.

Unrealized Losses on BTC Purchases

Marathon Digital Holdings experienced unrealized losses on its Bitcoin holdings in 2024. Market pullbacks contributed to these losses. The company's substantial Bitcoin investment, including 22,065 coins at an average price of $87,205, led to a $220 million unrealized loss. This situation underscores the volatility of Bitcoin investments.

- Unrealized Losses: $220 million

- Average Purchase Price: $87,205 per coin

- Number of Coins: 22,065

- Risk: Bitcoin market volatility

In the BCG matrix, Dogs are low-growth, low-share business units. For Marathon, these could be aspects like older mining equipment or less efficient operations. Identifying and addressing Dogs is critical for improving overall performance.

| Category | Description | Impact |

|---|---|---|

| Older Mining Equipment | Less efficient hardware | Reduced profitability |

| Inefficient Operations | Higher operating costs | Lower profit margins |

| Low Hashrate Efficiency | Lower Bitcoin mining output | Decreased revenue |

Question Marks

Marathon Digital's foray into AI inference compute is a question mark. It's a fresh, untested sector for them. They plan to use their infrastructure, but success isn't assured. This move demands substantial investment and carries risks. As of Q1 2024, Marathon's AI compute plans are still developing, with no immediate revenue impact.

Marathon Digital's international expansion, targeting 50% international energy capacity by 2028, places it in the "Question Mark" quadrant of the BCG matrix. This ambitious strategy presents both opportunities and risks. The company aims to increase its Bitcoin mining capacity to 50 EH/s in 2024. Success hinges on effectively managing global regulatory hurdles and operational challenges.

Marathon Digital's embrace of liquid immersion cooling and proprietary firmware is a question mark. These technologies aim to boost efficiency, yet their success is unproven. This requires substantial investment, with the risk of becoming outdated. In Q1 2024, Marathon reported $12.8 million in digital asset revenue.

Integration of Acquired Assets

Marathon Digital's integration of acquired assets, such as data centers, is a question mark in its BCG matrix. Successfully merging these assets is key for expanding capacity. However, it presents operational challenges, including tech compatibility. Effective management and strategic coordination are essential for a smooth integration.

- Acquired Compute North data centers in 2022.

- The company aims to increase its hash rate capacity.

- Integration challenges include infrastructure, and operational adjustments.

- Successful integration boosts efficiency and output.

Long-Term Impact of Bitcoin Halving

The long-term impact of Bitcoin halvings on Marathon Digital Holdings represents a question mark in its BCG matrix. Halvings, which slash Bitcoin mining rewards, directly affect Marathon's revenue stream. While Marathon actively pursues strategies like enhanced energy efficiency and cost management to offset these impacts, the ultimate financial outcome remains uncertain.

- Bitcoin halving reduces mining rewards by 50%.

- Marathon focuses on energy efficiency and cost reductions.

- Uncertainty surrounds the future financial performance.

- The next Bitcoin halving is expected in April 2024.

Marathon's AI compute venture, international expansion, technology adoption, asset integration, and Bitcoin halving responses all fall under the "Question Mark" category. These areas involve significant investment and uncertain outcomes. Key to success are effective execution and strategic adaptation. Marathon Digital's Q1 2024 report showed digital asset revenue of $12.8 million.

| Aspect | Description | Status |

|---|---|---|

| AI Compute | New venture | Developing |

| International Expansion | 50% intl. capacity by 2028 | Ongoing |

| Tech Adoption | Liquid cooling, firmware | Unproven |

| Asset Integration | Data center acquisitions | Ongoing |

| Bitcoin Halving | Reward reduction | Impacting |

BCG Matrix Data Sources

This BCG Matrix leverages official company filings, financial analyses, and market research reports for rigorous insights.