Marathon Digital Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

What is included in the product

Analyzes Marathon Digital's external macro-environment, spanning political to legal factors.

Helps support discussions on external risk during planning sessions.

Full Version Awaits

Marathon Digital Holdings PESTLE Analysis

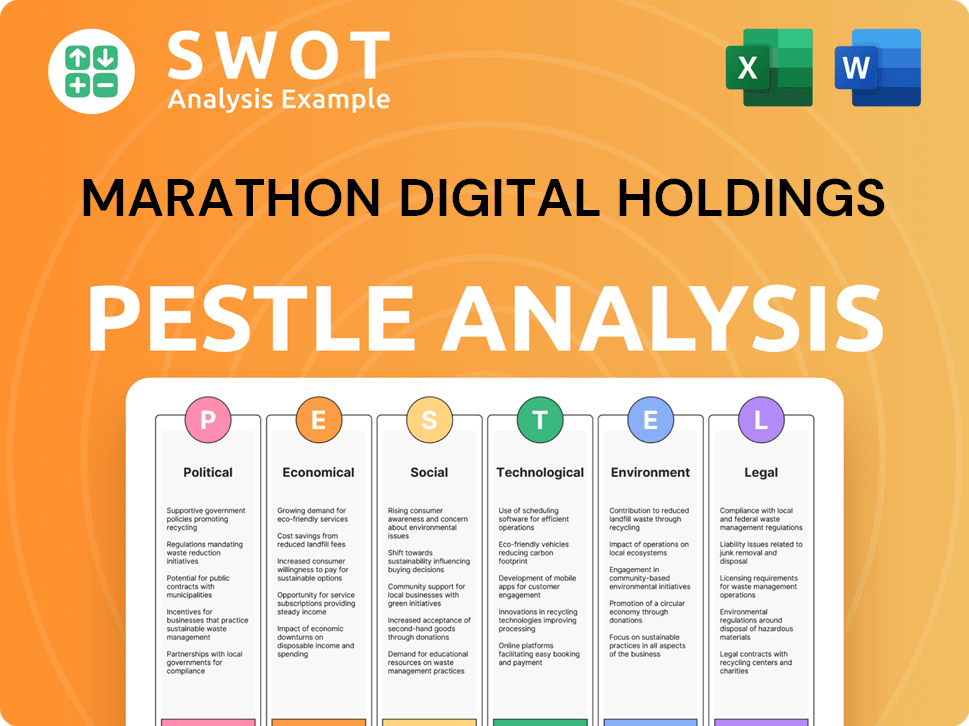

The preview illustrates Marathon Digital Holdings' PESTLE analysis.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors.

It offers key insights into the company's operating environment.

The layout and content here mirror what you'll receive post-purchase.

The download you receive is fully structured.

PESTLE Analysis Template

Marathon Digital Holdings operates in a dynamic environment. Political regulations on cryptocurrency mining are evolving, creating both opportunities and challenges. Economic factors like Bitcoin's price directly affect their profitability. Technological advancements continuously impact mining efficiency. Social trends, including crypto adoption, play a crucial role.

Legal frameworks around digital assets present evolving risk. Environmental concerns influence their sustainability strategies. Don't get left behind; gain a comprehensive edge with our detailed PESTLE analysis—crafted for Marathon Digital Holdings. Download the full version for immediate strategic insights.

Political factors

The U.S. government is increasing its oversight of cryptocurrency mining, focusing on energy use and environmental impact disclosures. These regulations could alter Marathon Digital Holdings' operations and strategies significantly. The political climate surrounding cryptocurrency remains crucial for the company. In 2024, the U.S. has seen varied state-level actions, affecting mining operations. Regulatory uncertainty can impact investment and operational decisions.

Marathon Digital Holdings heavily depends on importing mining hardware, especially from China. This reliance makes the company vulnerable to international trade policies. For example, tariffs could increase hardware costs. In 2024, China's influence on global crypto mining hardware supply chains remained significant. Such policies can disrupt operations.

Marathon Digital operates mainly in the U.S. and North America, benefiting from political stability, which supports predictable regulatory environments. This is crucial for long-term investment and operational planning. Considering past regulatory shifts, like China's crypto crackdowns, demonstrates how crucial political stability is. In 2024, the U.S. government continued to clarify crypto regulations, offering Marathon a stable operational foundation.

Government Attitude Towards Cryptocurrency

Government stances on cryptocurrency, ranging from supportive to restrictive, directly influence the market and Marathon's operations. Political instability or economic downturns can trigger significant digital asset sell-offs, impacting their value. For instance, in 2024, regulatory actions in the US and Europe shaped crypto trading conditions. The US has proposed stricter rules, while Europe has implemented the Markets in Crypto-Assets (MiCA) regulation. These developments create market volatility.

- US regulatory proposals could limit crypto activities.

- MiCA in Europe sets clear crypto asset standards.

- Political or economic crises can lead to crypto sell-offs.

- These factors influence Marathon's business.

Strategic Crypto Reserves

Announcements about national strategic crypto reserves can significantly impact market confidence. Such moves can influence Bitcoin prices and, by extension, the stock value of Marathon Digital Holdings. For example, in 2024, El Salvador's Bitcoin holdings, which were around 2,381 BTC, influenced market perceptions. Any governmental adoption or divestment strategy will be reflected in trading volumes.

- El Salvador held approximately 2,381 BTC in 2024.

- Bitcoin's price has shown volatility, affecting Marathon's stock.

US crypto mining regulations evolve, impacting Marathon. International trade policies, especially hardware tariffs, are a key concern, as in 2024. Government crypto stances influence market confidence. MiCA and other governmental actions create market volatility.

| Factor | Details | Impact on Marathon |

|---|---|---|

| US Regulatory Environment | Increased scrutiny on energy use & environmental impact; proposals to limit crypto activities. | Operational adjustments and cost implications; potentially affecting growth. |

| International Trade | Reliance on Chinese hardware suppliers; potential tariffs & trade restrictions. | Increased costs & supply chain disruptions. |

| Government Crypto Stance | Supportive to restrictive; announcements about strategic reserves. | Market volatility, affecting Bitcoin price, impacting Marathon's stock value. |

Economic factors

Marathon Digital's profitability is heavily influenced by the volatile nature of cryptocurrency values. Bitcoin's price swings directly affect the company's revenue. For instance, in Q1 2024, Bitcoin's price influenced Marathon's financial results. The company's performance is closely tied to these market fluctuations. As of May 2024, Bitcoin's price volatility remains a key risk factor.

Marathon Digital Holdings faces intense competition. The Bitcoin mining sector's total hash rate affects mining difficulty and profitability. Competitors' market share is crucial. As of May 2024, the Bitcoin network hash rate is around 600 EH/s. Marathon's market share and efficiency are vital.

Electricity expenses are substantial for Bitcoin mining operations like Marathon Digital. Marathon's profitability is significantly impacted by energy price fluctuations and the capacity to obtain affordable, efficient energy. In 2024, Bitcoin miners focused on optimizing energy consumption amid volatile energy markets. The break-even electricity cost is vital for sustained profitability.

Global Financial Conditions

Global financial unease, especially in regions like Southeast Asia, can significantly impact crypto stocks like Marathon Digital. Economic downturns or instability can lead to decreased investment in riskier assets. For example, the MSCI Emerging Markets Index showed volatility in 2024, reflecting broader market anxieties. This uncertainty can lead to a sell-off in crypto-related stocks.

- MSCI Emerging Markets Index volatility in 2024.

- Southeast Asia's economic conditions affect crypto investments.

- Economic downturns decrease investment in riskier assets.

Operational Costs and Profit Margins

Operational costs significantly impact Marathon Digital Holdings. Maintaining positive profit margins is tough due to Bitcoin price volatility and high operational expenses. If costs surpass revenue, financial strain increases. In Q1 2024, Marathon's cost of revenue was $146.3 million.

- Bitcoin price fluctuations directly affect profitability.

- Energy costs are a substantial operational expense.

- Hardware maintenance and upgrades add to costs.

- Competition in the mining sector impacts margins.

Economic volatility significantly affects Marathon Digital. Bitcoin price swings directly impact Marathon's revenue and profitability, as seen in Q1 2024. Global economic unease and downturns reduce investment in riskier assets like crypto, increasing financial strains. These factors make Marathon's operational success challenging.

| Factor | Impact | Data (2024) |

|---|---|---|

| Bitcoin Price Volatility | Direct Revenue Impact | Q1 Revenue fluctuation |

| Economic Downturns | Decreased Investment | MSCI Emerging Markets Index volatility |

| Operational Costs | Profit Margin Pressures | Q1 Cost of Revenue: $146.3M |

Sociological factors

Public perception heavily influences cryptocurrency adoption, impacting Marathon Digital Holdings. Positive views can increase demand for Bitcoin and other digital assets. As of May 2024, Bitcoin's market capitalization reached over $1.3 trillion, reflecting growing acceptance. Negative perceptions, however, may hinder growth and investment in mining operations.

Investor sentiment plays a crucial role in Marathon Digital's performance. Regulatory clarity and market stability significantly influence investor confidence in crypto. In 2024, market volatility and regulatory uncertainty affected investor participation. For instance, Bitcoin's price fluctuations in early 2024, influenced investor confidence.

The influx of institutional investors into the crypto space, especially in 2024 and 2025, intensifies the focus on service quality. These investors, managing substantial assets, demand top-tier service, transparency, and responsive customer support. Marathon Digital Holdings must meet these elevated expectations to secure investments and maintain a competitive edge. Data from 2024 shows institutional crypto investments reached $40 billion, highlighting the need for Marathon to prioritize service improvements.

Standardized Offerings and Customer Loyalty

In the cryptocurrency mining sector, where offerings are often standardized, customer loyalty faces challenges. Marathon Digital Holdings must find ways to stand out to retain customers and reduce churn. Building strong customer relationships is crucial in this environment. According to recent reports, the average churn rate in the crypto mining industry hovers around 10-15% annually.

- Differentiation through superior customer service or unique product features is key.

- Loyalty programs and personalized services can enhance customer retention.

- Marathon’s ability to innovate and adapt will influence its market position.

- Building trust and transparency can foster long-term customer relationships.

Awareness of Financial Fraud and Scams

The rise in financial fraud and scams, especially in the crypto world, impacts public confidence and market participation. Marathon Digital Holdings faces this challenge directly. For example, in 2024, the Federal Trade Commission reported over $10 billion in losses due to fraud. Marathon has actively warned against scams falsely using its name. This issue can deter potential investors and affect Marathon's reputation.

- FTC reported over $10B in fraud losses in 2024.

- Marathon Digital has issued warnings about fraudulent activities.

Public sentiment significantly affects Marathon Digital. Positive views boost crypto adoption, seen in Bitcoin's $1.3T+ market cap in May 2024. Investor confidence hinges on market stability and clear regulations, as volatile prices influence participation. Fraud poses a threat, with FTC reporting $10B+ in 2024 losses.

| Factor | Impact | Data |

|---|---|---|

| Public Perception | Influences Adoption | Bitcoin's market cap exceeding $1.3T (May 2024) |

| Investor Sentiment | Key to Performance | Market Volatility (2024) affected investor confidence |

| Fraud & Scams | Impacts Confidence | FTC reported over $10B losses (2024) |

Technological factors

Marathon Digital faces constant pressure to upgrade its mining hardware to stay competitive. Advances in Application-Specific Integrated Circuit (ASIC) technology directly impact profitability. For instance, newer ASICs can offer significantly higher hash rates, like those exceeding 300 terahashes per second. This leads to increased Bitcoin production and reduced operating costs, which are crucial for survival in a volatile market.

Marathon Digital Holdings actively participates in the evolution of blockchain technologies, with its mining operations supporting the Bitcoin network's expansion. The blockchain market is projected to reach $94 billion by 2024, signaling significant growth. This expansion aligns with the increasing adoption of blockchain across various industries, enhancing Marathon's strategic positioning.

Marathon Digital invests heavily in R&D to enhance mining technology. In Q1 2024, they deployed 1,450 next-gen miners. This boosts efficiency, as seen with their 2024 Q1 hash rate of 26.6 EH/s, a 30% rise year-over-year. These upgrades cut energy use, vital for cost control and sustainability.

Integration with Energy Ecosystems and AI

Marathon Digital is strategically integrating its mining operations within wider energy ecosystems, focusing on grid stabilization and the use of surplus energy. This integration is crucial for cost-effectiveness and sustainability. Furthermore, AI is being adopted to enhance operational efficiency and meet evolving environmental standards. These technological advancements are pivotal for long-term growth and compliance.

- In 2024, Marathon Digital increased its operational hash rate by 55% through strategic infrastructure upgrades.

- AI-driven predictive maintenance has reduced downtime by 18% in select mining facilities.

- Marathon Digital's energy consumption efficiency improved by 12% due to AI and energy management systems.

Leveraging Digital Asset Compute for Energy Transformation

Marathon Digital Holdings is strategically using digital asset compute to aid the energy transition, with a focus on AI inference compute opportunities. This initiative involves expanding into energy and digital infrastructure. The company is actively exploring how its digital asset compute capabilities can support the energy sector's transformation. In Q1 2024, Marathon produced 2,195 Bitcoin. The company aims to increase its hash rate capacity to 50 EH/s by the end of 2024.

- Marathon produced 42,829 Bitcoin in 2023.

- Marathon's Q1 2024 revenue was $165.2 million.

- Marathon's market cap as of May 2024 is approximately $5.7 billion.

- Marathon has over 230,000 miners deployed.

Technological factors significantly influence Marathon Digital's profitability through hardware upgrades and innovation. The firm consistently updates its infrastructure; for example, in Q1 2024, 1,450 next-gen miners were deployed. This enhancement led to a 30% increase in the hash rate to 26.6 EH/s. Furthermore, AI and energy management have increased energy efficiency by 12%.

| Factor | Impact | Data (2024) |

|---|---|---|

| Hash Rate | Production & Efficiency | Up 30% to 26.6 EH/s |

| AI Integration | Efficiency, reduced downtime | 18% downtime reduction |

| Energy Efficiency | Cost reduction, sustainability | Improved by 12% |

Legal factors

Marathon Digital Holdings faces legal hurdles from government and quasi-government bodies. Regulations on Bitcoin and digital assets directly affect its operations. For example, the SEC's scrutiny of crypto firms impacts Marathon. In 2024, regulatory actions increased, influencing market confidence and stock prices.

Marathon Digital Holdings operates in a sector with evolving securities laws. The company has navigated scrutiny from regulatory bodies, including the SEC. In 2024, the SEC's focus on crypto firms intensified. Legal risks are inherent due to the industry's regulatory landscape. Marathon Digital's compliance efforts are crucial.

Cryptocurrency firms like Marathon Digital must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. These regulations are becoming stricter. In 2024, the Financial Crimes Enforcement Network (FinCEN) continued to enforce AML compliance. Penalties for non-compliance can reach millions.

Market Integrity Regulations

Market integrity regulations are increasingly vital for Marathon Digital Holdings. These regulations, like those curbing insider trading and market manipulation, aim to safeguard investors and foster fair crypto markets. The U.S. Securities and Exchange Commission (SEC) has increased enforcement actions, with a 2024 budget of $2.3 billion, reflecting the growing regulatory focus. This includes scrutiny of crypto firms.

- SEC's 2024 budget: $2.3 billion.

- Increased enforcement actions in crypto.

Legal Disputes and Litigation

Marathon Digital Holdings faces legal challenges that could affect its finances and image. These include shareholder lawsuits and contract disputes. Such cases may lead to substantial financial losses and operational disruptions. The outcomes of these legal battles can significantly influence investor confidence and the company's future.

- Shareholder lawsuits can lead to considerable financial penalties.

- Breach-of-contract claims may disrupt operational efficiency.

- Legal outcomes can affect Marathon's stock price.

Marathon Digital Holdings encounters legal challenges shaped by crypto regulations and increased SEC scrutiny. These include compliance with AML/KYC rules enforced by FinCEN, with potential for significant penalties for non-compliance. Furthermore, shareholder lawsuits and contract disputes can lead to financial and operational impacts.

| Legal Issue | Regulatory Body | Financial Impact |

|---|---|---|

| AML/KYC Compliance | FinCEN | Penalties potentially in the millions. |

| Shareholder Lawsuits | Courts | Significant financial penalties. |

| Breach of Contract | Courts | Operational disruption and financial loss. |

Environmental factors

Bitcoin mining is energy-intensive, leading to environmental concerns. Marathon Digital's operations face scrutiny due to high electricity use and carbon emissions. In 2024, Bitcoin mining consumed ~100 TWh annually. Public and regulators are increasingly focused on miners' environmental impact.

Environmental factors are significantly influencing Marathon Digital Holdings. A key trend is the push for sustainable, energy-efficient mining. This shift is fueled by environmental impact concerns. For instance, in 2024, the demand for renewable energy in crypto mining surged by 40%.

Marathon Digital Holdings is increasing its use of renewable energy. The company is using sources like solar and wind to power its Bitcoin mining. In 2024, Marathon expanded its renewable energy capacity, aiming for lower costs and environmental responsibility. This aligns with the growing trend of sustainable practices in the crypto industry.

Electronic Waste from Mining Hardware

Marathon Digital Holdings faces environmental challenges from electronic waste generated by its mining hardware. The specialized equipment has a relatively short lifespan, leading to disposal concerns. This contributes to the growing global e-waste problem. Consider that, in 2023, the world generated 62 million tons of e-waste. This is a significant issue for the company.

- E-waste from mining hardware poses an environmental risk.

- Short lifespan of equipment increases waste volume.

- Global e-waste is a growing concern.

- Marathon Digital must address disposal practices.

Environmental Regulations and Public Pressure

Growing public concern about crypto mining's environmental effects and upcoming regulations are key. Marathon Digital faces pressure to cut its carbon footprint and embrace sustainability. Stricter environmental rules could raise operational expenses and impact profitability. For example, the US government is looking into crypto mining's energy use.

- The EPA is monitoring crypto mining's energy use and emissions.

- Marathon Digital's ESG scores are under scrutiny.

- Regulatory changes could affect mining profitability.

Marathon Digital confronts environmental hurdles tied to energy and e-waste, driving the firm to adopt renewable power solutions. A surge in green energy use for mining has been noted, reflecting rising industry demands for sustainability, exemplified by a 40% climb in renewable energy in 2024. Electronic waste disposal, due to the brief life of mining hardware, introduces additional difficulties.

| Environmental Aspect | Impact on Marathon Digital | 2024/2025 Data |

|---|---|---|

| Energy Consumption | High electricity usage and carbon emissions; potential regulatory risks | Bitcoin mining ~100 TWh annually; Demand for renewable energy rose 40% |

| E-waste | Generation from hardware requiring disposal. | 62 million tons of global e-waste generated in 2023. |

| Sustainability Initiatives | Increased adoption of renewable energy sources. | Expansion of renewable capacity in 2024; ESG scores under scrutiny. |

PESTLE Analysis Data Sources

The Marathon Digital Holdings PESTLE relies on verified data from financial reports, government policies, and technology publications. It integrates insights from crypto market analyses and energy consumption studies.