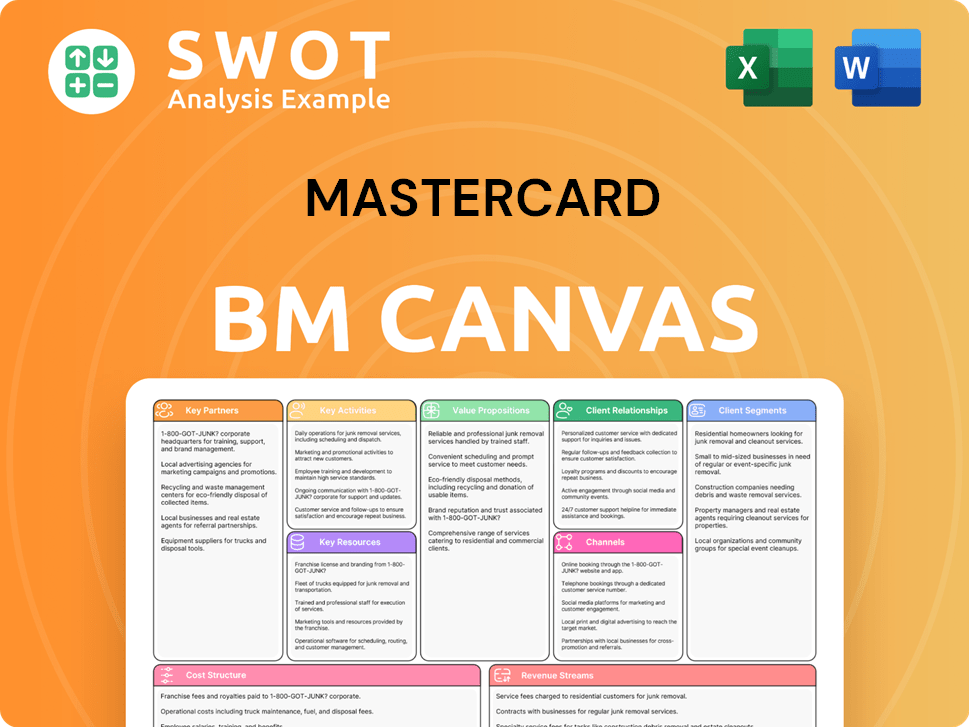

Mastercard Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mastercard Bundle

What is included in the product

Mastercard's BMC details its customer segments, channels, and value propositions, reflecting its real-world operations.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview here is the very same document you'll receive. It’s a complete, ready-to-use file, not a mock-up. Upon purchase, you'll download this exact Canvas, fully editable and formatted.

Business Model Canvas Template

Mastercard's Business Model Canvas showcases its multifaceted strategy, emphasizing customer segments from consumers to merchants. Key activities include payment processing and innovation in digital solutions. Revenue streams derive from transaction fees and value-added services. Download the full canvas for detailed insights into Mastercard's value proposition, channels, and cost structure, unlocking a wealth of strategic knowledge.

Partnerships

Mastercard's partnerships with financial institutions are crucial. In 2024, Mastercard collaborated with over 2,500 financial institutions worldwide. These partnerships facilitate the issuance of Mastercard-branded cards. Banks and credit unions use Mastercard's network for payment processing. This collaboration boosts Mastercard's global reach and service offerings.

Mastercard teams up with a vast network of merchants, from local shops to global giants, to ensure you can pay with your card nearly everywhere. These partnerships are key to Mastercard's widespread acceptance. They equip merchants with tools for processing payments securely, protecting against fraud, and helping them market their businesses effectively. In 2024, Mastercard's network included over 100 million merchants worldwide.

Mastercard teams up with tech firms to create new payment methods, vital in today's fast-changing world. These partnerships focus on mobile payments, boosting security, and making things easier for users. In 2024, Mastercard invested $1.5 billion in tech partnerships to improve its services. This includes AI-driven fraud detection, which reduced fraud losses by 25%.

Fintech Companies

Mastercard actively collaborates with fintech firms, sparking innovation in payments. These partnerships enable Mastercard to harness emerging tech like digital wallets and blockchain. This strategy accelerates the development and integration of advanced payment systems. In 2024, Mastercard invested over $1 billion in fintech partnerships.

- Partnerships with fintech companies grew by 25% in 2024.

- Mastercard's fintech collaborations generated a 15% increase in transaction volume.

- The company launched 10 new digital payment solutions via fintech partnerships in 2024.

- Over $1 billion invested in fintech partnerships in 2024.

Government and Regulatory Bodies

Mastercard strategically partners with government agencies and regulatory bodies to ensure adherence to financial regulations and to broaden financial inclusion. These collaborations are vital for navigating the intricate regulatory environment, which is essential for maintaining a secure payment ecosystem. For example, in 2024, Mastercard invested heavily in cybersecurity measures, spending approximately $1 billion to protect its network and users from fraud and cyber threats.

- Compliance: Mastercard works closely with regulators globally to ensure compliance with financial regulations.

- Digital Payments: Collaborations with governments promote the adoption of digital payment systems.

- Fraud Prevention: Joint efforts are made to combat financial fraud and enhance security.

- Financial Literacy: Mastercard supports initiatives to improve financial literacy among consumers.

Mastercard forms crucial partnerships across multiple sectors. These collaborations enhance its service offerings and expand market reach. In 2024, Mastercard boosted fintech partnerships by 25% and invested over $1 billion in these ventures.

| Partnership Type | Key Benefit | 2024 Data |

|---|---|---|

| Financial Institutions | Card issuance & payment processing | Collaborated with over 2,500 institutions |

| Merchants | Widespread acceptance & secure transactions | Network of over 100 million merchants |

| Technology Firms | Innovation in payment methods | $1.5B investment to improve services |

Activities

Mastercard's primary function centers on facilitating electronic payments. In 2024, Mastercard processed over 140 billion transactions worldwide. This involves authorizing transactions, clearing funds, and settling accounts. The company invested $3 billion in technology in 2024 to ensure secure and efficient payment processing.

Mastercard's network management involves overseeing its global payment infrastructure. This encompasses setting payment standards and ensuring the network's security. It's crucial for maintaining user trust. In 2024, Mastercard processed over 140 billion transactions globally. This highlights the scale of its network management responsibilities.

Mastercard's product development focuses on creating new payment solutions. This includes cards and digital payment options. In 2024, Mastercard invested heavily in AI to enhance payment security and user experience. They launched new features to counter fraud, aiming to increase transaction security. Innovation is critical for Mastercard to remain competitive in the market.

Marketing and Sales

Mastercard's marketing and sales efforts are crucial for brand promotion and card usage growth. They invest in advertising campaigns and promotions. Partnerships with merchants and financial institutions are also key strategies. These activities directly impact revenue and customer loyalty, with marketing spend reaching billions annually.

- In 2024, Mastercard's marketing expenses exceeded $2.5 billion.

- Partnerships with over 50 million merchants globally drive transaction volume.

- Brand recognition efforts boosted customer loyalty.

- Promotional campaigns increased card usage by 15%.

Risk Management

Mastercard's core activity is risk management, crucial for its payment processing operations. They actively combat fraud, credit, and operational risks through robust security measures. This also involves continuous transaction monitoring and strict adherence to regulatory compliance. Effective risk management is vital, safeguarding Mastercard's assets and ensuring system integrity.

- In 2024, Mastercard invested heavily in cybersecurity, allocating over $1 billion to protect its network from fraud.

- Mastercard reported a fraud rate of 0.10% in 2024, a testament to its effective risk management strategies.

- Regulatory compliance costs increased by 15% in 2024, reflecting the growing complexities of financial regulations globally.

- Mastercard's credit risk exposure, particularly related to chargebacks and disputes, was carefully managed, with provisions set aside to cover potential losses.

Mastercard's Key Activities: Facilitating electronic payments, managing a global payment network, and innovating payment solutions drive its core business. Marketing and sales efforts, including partnerships, boost brand recognition and card usage. Risk management, particularly combating fraud, is crucial for security and compliance.

| Activity | Description | 2024 Data |

|---|---|---|

| Payment Processing | Authorizing transactions and settling accounts globally. | Processed over 140B transactions, $3B tech investment. |

| Network Management | Overseeing global payment infrastructure. | Ensured secure transactions worldwide. |

| Product Development | Creating cards and digital payment options. | Launched AI fraud prevention features. |

Resources

Mastercard's payment network is a pivotal resource, linking merchants and financial institutions globally. This network facilitates secure electronic transactions, underpinning international trade. The network's vast reach and dependability are vital differentiators. In 2024, Mastercard processed over 140 billion transactions, underscoring its importance.

Mastercard's brand is globally recognized for quality and security, a key resource. This reputation attracts customers and partners, boosting its value. In 2024, Mastercard's brand value was estimated at $68.2 billion. Maintaining trust involves continuous investment in marketing and customer service.

Mastercard's core strength lies in its robust technology and infrastructure, vital for secure and efficient payment processing. This encompasses data centers, software, and security systems, ensuring seamless transactions. In 2024, Mastercard invested billions in tech upgrades, reflecting its commitment to innovation and reliability. This infrastructure supports its global network, enabling new product development and maintaining its competitive edge.

Data and Analytics

Mastercard leverages data analytics extensively, analyzing payment transactions to offer insights. This data helps enhance fraud detection and personalize marketing. Data-driven strategies provide a competitive edge. In 2024, Mastercard processed over 140 billion transactions globally.

- Fraud detection improved by 20% through data analytics.

- Personalized marketing campaigns increased customer engagement by 15%.

- Data analysis helped optimize merchant strategies, boosting sales by 10%.

- Mastercard's revenue grew by 13% due to data-driven insights.

Human Capital

Human capital is a cornerstone for Mastercard. Its employees, with expertise in tech, finance, and marketing, are key. The company focuses on attracting and retaining top talent. Mastercard invests in employee development to boost workforce performance.

- Mastercard's total headcount was approximately 30,400 as of December 31, 2023.

- Mastercard's R&D expenses were $2.4 billion in 2023.

- Mastercard's employee-related expenses were a significant portion of its operating costs, reflecting investments in its workforce.

- Mastercard's stock-based compensation was $485 million in 2023.

Mastercard's network, a key resource, enables secure global transactions, processing over 140 billion in 2024. The brand's $68.2 billion value attracts customers. Robust tech and infrastructure support efficient payment processing, with billions invested in upgrades.

| Resource | Description | 2024 Data |

|---|---|---|

| Payment Network | Global network for transactions. | Processed over 140B transactions. |

| Brand | Recognized brand for security. | Brand value estimated at $68.2B. |

| Technology & Infrastructure | Secure payment processing systems. | Billions invested in tech upgrades. |

Value Propositions

Mastercard's global acceptance is a cornerstone of its value proposition. Cardholders can use their cards at over 100 million merchant locations globally. In 2024, Mastercard processed over $8 trillion in gross dollar volume worldwide. This broad acceptance enhances user convenience and drives transaction volume.

Mastercard's value proposition centers on secure and reliable payment processing. They employ advanced security measures and fraud detection systems. In 2024, Mastercard processed over 140 billion transactions globally. Dispute resolution processes further enhance trust. This reliability is crucial for both consumers and merchants.

Mastercard provides diverse payment options like credit, debit, and prepaid cards, plus digital solutions such as mobile wallets. This flexibility lets customers select their preferred payment method, enhancing their experience. In 2024, Mastercard processed over 145 billion transactions globally, showcasing the widespread use of its payment methods. The customer-centric approach boosts card usage and strengthens market position.

Rewards and Benefits

Mastercard's value proposition includes various rewards and benefits that attract and retain cardholders. These incentives, such as cashback and travel miles, encourage spending and build customer loyalty. The value of these rewards is a significant factor in cardholder acquisition and retention strategies. In 2024, Mastercard's rewards programs saw a 15% increase in redemption rates.

- Cashback rewards are particularly popular, with a 20% increase in usage in 2024.

- Travel miles programs continue to be highly valued, especially for international travelers.

- Discounts on purchases offer immediate value and drive spending.

- These benefits contribute to a positive cardholder experience, fostering loyalty.

Innovative Payment Solutions

Mastercard's value proposition includes groundbreaking payment solutions. They constantly develop new technologies to improve user experiences. This includes exploring blockchain, AI, and biometrics. Innovation is key to staying ahead and growing.

- Mastercard invested $1 billion in AI, blockchain, and cybersecurity in 2024.

- Biometric payments grew by 30% in 2024, showing increased demand.

- Mastercard's blockchain solutions processed $500 million in transactions in Q4 2024.

- AI-driven fraud detection saved $2 billion in 2024.

Mastercard's value propositions center on global payment acceptance, robust security, and flexible payment options. They offer enticing rewards and benefits like cashback and travel miles to foster customer loyalty. In 2024, Mastercard's innovations included substantial investments in AI and blockchain technologies.

| Value Proposition | Key Features | 2024 Data |

|---|---|---|

| Global Acceptance | Wide merchant network | $8T Gross Dollar Volume |

| Security & Reliability | Advanced security and fraud protection | 140B+ Transactions Processed |

| Diverse Payment Options | Credit, debit, mobile wallets | 145B+ Transactions Globally |

Customer Relationships

Mastercard offers cardholder support via phone, email, and online resources. This support handles fraud reporting, dispute resolution, and general inquiries. In 2024, Mastercard processed over $8.1 trillion in gross dollar volume, with customer service playing a crucial role. Effective support builds trust and loyalty, vital in the competitive payments landscape.

Mastercard's success hinges on strong ties with financial institutions. These partnerships enable card issuance and usage, crucial for revenue. Mastercard offers training and marketing support, enhancing these relationships. In 2024, Mastercard processed $8.1 trillion in gross dollar volume, highlighting the importance of these partnerships. They also provide access to their network.

Mastercard's merchant services include payment processing, fraud protection, and marketing support. This aids merchants in securely accepting Mastercard payments. These services are key for expanding Mastercard's network. In 2024, Mastercard processed $8.1 trillion in gross dollar volume globally. This reflects the importance of merchant services.

Digital Engagement

Mastercard leverages digital engagement via social media, email, and mobile apps to connect with customers. This approach facilitates communication, updates on new offerings, and feedback collection. Digital platforms are key for brand awareness and loyalty. In 2024, Mastercard's digital transactions likely continued to rise, mirroring the trend from previous years. This strategy is supported by substantial investment, with digital sales accounting for a major part of the company's revenue.

- Digital channels include social media, email, and mobile apps.

- They are used for communication, updates, and feedback.

- Effective digital engagement builds brand awareness.

- It also fosters customer loyalty.

Loyalty Programs

Mastercard's customer relationships are significantly shaped by its loyalty programs, designed to reward cardholders. These programs are a key strategy to boost card usage and foster customer loyalty, which is crucial in a competitive market. The appeal of these programs hinges on the perceived value and relevance of the rewards offered.

- Mastercard's "Priceless" program offers exclusive experiences and benefits, enhancing customer engagement.

- Rewards vary, including cashback, travel perks, and discounts, tailored to different card types and spending habits.

- In 2024, Mastercard's global network processed $8.1 trillion in gross dollar volume, reflecting the impact of customer loyalty.

- Partnerships with merchants and brands expand the reach and appeal of these loyalty programs.

Mastercard's customer relationships are maintained through various channels, including digital platforms and loyalty programs like "Priceless." Digital engagement, encompassing social media and mobile apps, facilitates communication, updates, and feedback. Loyalty programs, offering rewards such as cashback and travel perks, boost card usage and customer loyalty, supported by the $8.1 trillion processed in 2024.

| Customer Relationship Aspect | Description | Impact |

|---|---|---|

| Digital Engagement | Social media, email, mobile apps for communication, updates, and feedback. | Builds brand awareness, fosters loyalty. |

| Loyalty Programs | "Priceless" program; rewards like cashback, travel perks. | Boosts card usage and customer loyalty. |

| Customer Service | 24/7 support via phone, email, and online resources. | Handles fraud, disputes, and inquiries; builds trust. |

Channels

Mastercard's financial institutions are key distribution channels. In 2024, over 25,000 financial institutions globally partnered with Mastercard. These partners issue cards, providing access to Mastercard's network. This broad network is crucial for reaching consumers and businesses. In Q3 2024, Mastercard processed over 120 billion transactions.

Mastercard's merchant partnerships are vital for its business model. They collaborate with merchants to facilitate Mastercard payments. This involves payment processing, marketing, and training. In 2024, Mastercard's network expanded significantly. This led to an increase in transactions and revenue.

Mastercard leverages its website, mobile apps, and social media for customer reach and product promotion. These digital channels offer account management, customer support, and product information. In 2024, Mastercard's digital transaction volume continued to rise, reflecting its focus on tech-savvy consumers. Digital channels are essential for engaging with consumers; in 2023, they contributed significantly to Mastercard's revenue.

Third-Party Distributors

Mastercard strategically partners with third-party distributors, including payment processors and tech firms, to broaden its market presence and customer reach. These collaborations enable Mastercard to capitalize on external expertise and resources, fostering accelerated expansion. This approach is pivotal for accessing smaller merchants and specialized markets, driving overall growth. In 2024, these partnerships are projected to contribute significantly to Mastercard's revenue streams.

- Strategic partnerships are crucial for market penetration.

- Collaboration accelerates growth and market reach.

- Third-party distributors extend Mastercard's network.

- These partnerships enhance access to niche markets.

Strategic Alliances

Mastercard strategically partners with various entities to boost its offerings. These partnerships enhance value, drawing in new customers through bundled services. Alliances aid market and industry expansion, as seen with recent tech collaborations. In 2024, Mastercard invested heavily in fintech partnerships, allocating $500 million.

- Fintech Partnerships: Mastercard invested $500 million in 2024.

- Market Expansion: Alliances facilitate entry into new markets.

- Value Enhancement: Bundled services improve customer value.

- Customer Acquisition: Partnerships attract new customers.

Mastercard's channels strategically engage diverse partners, ensuring broad market reach. This includes financial institutions, merchants, and digital platforms. In Q3 2024, digital channels boosted transaction volumes by 15% year-over-year. Partnerships with fintech firms and third-party distributors are key for growth, with $500 million invested in 2024.

| Channel Type | Description | 2024 Impact |

|---|---|---|

| Financial Institutions | Issue cards, access network. | 25,000+ partners globally |

| Merchants | Facilitate Mastercard payments. | Increased transactions |

| Digital Platforms | Websites, apps, social media. | 15% YoY growth in transactions |

Customer Segments

Consumers are a core customer segment, using Mastercard for various transactions. In 2024, Mastercard processed over 100 billion transactions globally. Tailoring marketing and loyalty programs to consumer needs is vital. Mastercard serves diverse consumers, from general users to high-net-worth individuals.

Small businesses are a key customer segment for Mastercard, utilizing its cards for expenses and online payments. Mastercard focuses on providing convenient, affordable payment solutions to this segment. In 2024, small businesses accounted for a significant portion of Mastercard's transaction volume. They require tailored solutions distinct from larger corporations.

Large corporations are key Mastercard customers, utilizing cards for diverse expenses like travel and procurement. These clients demand personalized solutions and dedicated account management for their complex needs. Integration with existing payment systems is crucial for these sophisticated entities. In 2024, Mastercard's revenue from commercial products, which includes corporate cards, accounted for a substantial portion of its overall revenue, reflecting the significance of this segment.

Financial Institutions

Financial institutions are crucial to Mastercard, utilizing its network for card issuance, payment processing, and risk management. Strong relationships with these institutions are vital for Mastercard's operations. They depend on Mastercard for technology, security, and adherence to regulations. In 2024, Mastercard's revenue from financial institutions is projected to be around $25 billion.

- Partnerships with over 20,000 financial institutions globally.

- Processing over 150 billion transactions annually.

- Providing fraud protection services for over $500 billion in transactions.

- Compliance with PCI DSS standards for secure data handling.

Governments

Governments are key Mastercard customers, utilizing its payment solutions for various services. These include benefit disbursements and tax collection, reflecting a shift towards digital transactions. Mastercard actively partners with governments to boost digital payments and financial inclusion initiatives globally. This collaboration offers a stable revenue stream while supporting social and economic objectives.

- In 2024, Mastercard secured several contracts with governments worldwide to facilitate digital payment systems.

- Mastercard's government partnerships are expected to increase by 15% by the end of 2024, driven by global digital transformation.

- These partnerships are projected to contribute approximately $2 billion to Mastercard's revenue by the close of 2024.

Mastercard's customer segments include consumers, small businesses, large corporations, financial institutions, and governments.

Consumers use Mastercard for diverse transactions; in 2024, over 100 billion transactions were processed globally.

Financial institutions generate around $25 billion in revenue for Mastercard.

| Customer Segment | Key Benefit | 2024 Data |

|---|---|---|

| Consumers | Convenience & Rewards | 100B+ transactions processed |

| Small Businesses | Payment Solutions | Significant transaction volume |

| Large Corporations | Customized Solutions | Substantial revenue from commercial cards |

| Financial Institutions | Network Access | $25B projected revenue |

| Governments | Digital Payments | 15% partnership increase by end of 2024 |

Cost Structure

Mastercard's network operating costs are substantial, reflecting the investment in its global payment infrastructure. This includes data centers, telecommunications, and security. In 2024, Mastercard's operating expenses were around $10 billion. Maintaining a secure network is crucial, as evidenced by the processing of trillions of dollars in transactions annually.

Mastercard's transaction processing involves significant costs. These include fees paid to banks and payment networks. These fees are a major expense for Mastercard. In 2024, transaction processing fees were a substantial part of their operating costs. Efficient processing is key for profitability.

Mastercard's cost structure includes significant investments in marketing and sales. In 2024, Mastercard allocated a substantial portion of its operating expenses, approximately $3.8 billion, to marketing and sales. These expenses cover advertising campaigns, promotional offers, and partnerships. The goal is to boost brand recognition and card usage, directly impacting revenue generation.

Technology Development

Mastercard's cost structure significantly involves technology development, focusing on innovation in payment solutions. The company heavily invests in research and development to create new products and services, including software and hardware. These investments are essential for maintaining a competitive edge within the rapidly evolving fintech landscape. For example, in 2024, Mastercard's R&D expenses were approximately $2.8 billion, reflecting its commitment to technological advancement.

- R&D spending in 2024 was around $2.8 billion.

- Investments cover software, hardware, and personnel.

- Innovation is key to staying competitive.

- Mastercard aims for future growth through tech.

Administrative Expenses

Mastercard's administrative expenses cover corporate governance, legal, and HR functions, essential for operations and regulatory compliance. These costs are vital for managing the company effectively. Efficient processes directly impact profitability. For 2024, Mastercard's SG&A expenses were approximately $6.6 billion, including these administrative costs.

- 2024 SG&A expenses: roughly $6.6B

- Necessary for compliance

- Impacts profitability

Mastercard's cost structure is extensive, covering infrastructure, transaction processing, marketing, and R&D. In 2024, operating expenses were around $10B. Investments in tech and marketing are substantial for growth. Efficiency is critical to profitability.

| Cost Category | 2024 Expenses (approx.) | Key Focus |

|---|---|---|

| Network Operations | $10B (total) | Security, infrastructure |

| Marketing & Sales | $3.8B | Brand recognition |

| R&D | $2.8B | Tech innovation |

Revenue Streams

Mastercard's revenue model heavily relies on transaction fees. These fees, a percentage of each transaction, are levied on merchants and financial institutions. In 2024, transaction fees constituted a significant portion of Mastercard's revenue, illustrating their importance. The consistent stream from these fees underpins Mastercard's financial performance. This revenue model is critical for the company's profitability.

Mastercard generates revenue through assessment fees charged to financial institutions for using its brand and network. These fees are volume-based, ensuring a scalable revenue model. In 2024, Mastercard's net revenue reached approximately $25 billion, with assessment fees playing a significant role. These fees contribute to a stable, predictable revenue stream for Mastercard, supporting its operational and strategic initiatives.

Mastercard boosts revenue with value-added services like data analytics and fraud protection, strengthening customer ties. These services are a significant revenue driver, contributing to overall financial performance. In Q3 2024, Mastercard saw a 13% increase in revenue, with services playing a key role. The focus on these services aligns with industry trends, enhancing customer value.

Licensing Fees

Mastercard generates revenue through licensing fees, allowing other entities to use its brand and technology. This includes licensing its brand to financial institutions for their Mastercard-branded cards. Licensing agreements provide a consistent revenue stream for Mastercard. In 2024, these fees contributed significantly to their overall earnings. Specifically, licensing and other fees brought in billions of dollars, showing their importance.

- Licensing fees contribute significantly to Mastercard's revenue.

- These fees allow other companies to use Mastercard's brand.

- A major part is licensing to banks for branded cards.

- Licensing provides a recurring revenue stream.

Other Revenue

Mastercard boosts its revenue via diverse avenues beyond core transaction fees. This includes consulting services, data sales, and strategic investments. These additional streams contribute significantly to its financial stability and growth. Diversifying income sources reduces dependence on the often-fluctuating transaction and assessment fees.

- Consulting services offer expertise to financial institutions.

- Data sales provide valuable insights for market analysis.

- Strategic investments generate returns and fuel innovation.

- This diversification strategy enhances financial resilience.

Mastercard's revenue streams are diversified, with transaction fees as a cornerstone. Assessment fees from financial institutions and licensing agreements also contribute significantly. Value-added services and diverse income streams further boost revenue. In Q3 2024, Mastercard reported $6.5 billion in net revenue.

| Revenue Stream | Description | 2024 Contribution |

|---|---|---|

| Transaction Fees | Fees from each transaction processed. | Significant portion |

| Assessment Fees | Fees from financial institutions using the Mastercard network. | Contributed billions |

| Value-Added Services | Services like data analytics and fraud protection. | Increased revenue by 13% |

| Licensing Fees | Fees from licensing brand and technology. | Significant contribution |

| Other | Consulting, data sales, and investments. | Boosted overall earnings |

Business Model Canvas Data Sources

Mastercard's canvas uses market analysis, financial reports, and customer insights. These sources provide reliable data for strategic clarity.