Mastercard PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mastercard Bundle

What is included in the product

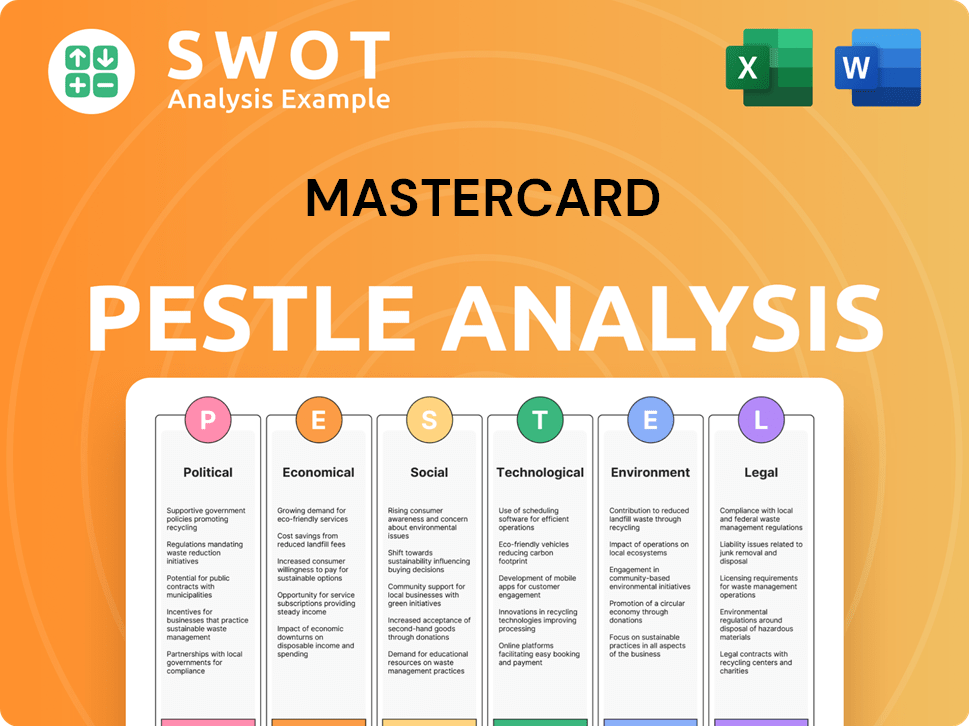

Examines how global factors impact Mastercard, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Helps pinpoint critical market trends, enabling Mastercard to refine strategies & identify new growth avenues.

What You See Is What You Get

Mastercard PESTLE Analysis

We’re showing you the real product. The Mastercard PESTLE Analysis preview displays the exact document you will receive after your purchase.

No content changes—it's fully formatted. The structure is identical. Download this valuable resource instantly.

PESTLE Analysis Template

Navigate the dynamic world of payments with our concise PESTLE analysis of Mastercard. Uncover key political and economic forces influencing its global reach. Explore social trends impacting consumer behavior and Mastercard's brand image. Identify legal and environmental factors shaping the company's future. Understand the technological advancements poised to revolutionize the industry. Download the full report for in-depth insights and strategic advantage!

Political factors

Mastercard navigates a complex regulatory landscape. It must adhere to diverse banking and financial rules globally. Compliance with AML, CTF, and data protection, such as GDPR, is crucial. In 2024, Mastercard's legal and compliance expenses totaled $780 million, reflecting the significant investment needed to meet these requirements.

Trade policies significantly shape Mastercard's global footprint. Tariffs and restrictions directly affect cross-border transactions, which are central to Mastercard's business model. For instance, changes in trade agreements, like those seen in 2024/2025, can ease or complicate international service provision. As of early 2024, Mastercard reported that 57% of its revenues came from outside the U.S., showing its dependence on international trade.

Political stability is vital for Mastercard's global success. Instability can disrupt payment systems and international transactions. For example, the Russia-Ukraine war significantly impacted Mastercard's operations. In 2024, Mastercard's international revenues were closely tied to geopolitical stability. Any escalation in conflicts could negatively affect its financial performance.

Government Initiatives

Government initiatives can be a game-changer for Mastercard. Financial inclusion and digital payment adoption are key areas. Policies pushing away from cash boost digital payment use. For example, in 2024, India saw digital transactions rise by 50% due to government support.

- Policy changes can rapidly expand Mastercard's market.

- Increased digital payments boost transaction volumes.

- Government backing adds credibility to digital systems.

- Mastercard benefits from infrastructure investments.

Government Scrutiny of Cross-Border Transactions

Mastercard's global operations are subject to government oversight of cross-border transactions, increasing compliance demands. This includes stringent regulations against money laundering and counter-terrorism financing, which elevate operational expenses. The company invests significantly in transaction monitoring systems to comply with these regulations. In 2024, Mastercard's compliance costs are estimated to have increased by 7% due to these factors.

- Increased regulatory burden impacts operational costs.

- Significant investment in transaction monitoring technologies.

- Compliance with global anti-money laundering (AML) and counter-terrorism financing (CTF) rules.

- Ongoing scrutiny from various international government bodies.

Political factors profoundly affect Mastercard's operations, from regulatory compliance to trade policies. Government initiatives that promote digital payments can significantly boost Mastercard's transaction volumes and market expansion. In 2024, geopolitical stability continues to be crucial to sustain the growth, impacting revenue generated by Mastercard.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Regulatory Compliance | Increases operational costs; affects market entry. | Compliance costs rose 7%; legal/compliance expenses totaled $780 million in 2024. |

| Trade Policies | Direct impact on cross-border transactions and revenue | 57% of revenues from outside the U.S. (early 2024); Changes in trade affect operations |

| Political Stability | Essential for operational success, ensuring cross-border payment feasibility. | Significant impact on international revenue generation |

Economic factors

Global economic health significantly affects consumer spending, directly impacting Mastercard's transaction volumes. Strong economic growth typically boosts spending, while recessions can decrease it. For instance, in Q1 2024, Mastercard's gross dollar volume rose 11% globally, indicating robust consumer activity. Economic conditions in major markets like the U.S., Europe, and Asia heavily influence demand for payment services.

Inflation significantly shapes consumer behavior. As of early 2024, inflation rates are moderating in many regions. However, wage growth versus price increases will dictate consumer spending habits. For example, in the U.S., inflation was at 3.1% in January 2024, impacting spending decisions.

Interest rate fluctuations significantly influence consumer borrowing and spending habits, with impacts felt across various sectors. As of early 2024, the Federal Reserve held its benchmark interest rate steady, but anticipated rate cuts later in the year. For example, the Federal Reserve maintained the federal funds rate between 5.25% and 5.50% in early 2024. Lower interest rates could boost consumer spending.

Currency Exchange Rates

Mastercard's global operations mean it constantly faces currency exchange rate risks. These rates directly affect the profitability of transactions across different countries. For example, in Q1 2024, currency fluctuations negatively impacted Mastercard's net revenues by approximately 1%.

Currency volatility can increase the cost of cross-border payments for both consumers and merchants. The company uses hedging strategies to mitigate these risks, but they don't eliminate them entirely. The strength of the U.S. dollar, where Mastercard is based, also plays a significant role.

- Impact of currency fluctuations on net revenue in Q1 2024: approximately -1%.

- Hedging strategies used to manage currency risk.

- Importance of the U.S. dollar's strength.

Consumer Spending Patterns

Consumer spending patterns are crucial economic indicators, significantly impacting Mastercard's performance. In 2024, consumer confidence is expected to remain a critical factor, influencing spending behaviors. Consumers are becoming increasingly value-conscious, seeking deals and prioritizing their purchases. According to recent reports, consumer spending in the U.S. grew by 2.5% in Q1 2024, signaling cautious optimism.

- Consumer confidence levels directly affect transaction volumes.

- Value-driven purchasing may shift spending towards essential categories.

- Promotional activities and discounts become more important.

Economic conditions strongly influence Mastercard's performance, affecting spending and transaction volumes. Inflation trends and interest rate changes directly impact consumer behavior and spending patterns. Currency fluctuations, like the approximately -1% impact on net revenue in Q1 2024, pose risks.

| Factor | Impact on Mastercard | Data/Example (Early 2024) |

|---|---|---|

| Economic Growth | Boosts transaction volumes | Q1 2024: Gross dollar volume up 11% globally |

| Inflation | Influences spending decisions | U.S. inflation in Jan 2024: 3.1% |

| Interest Rates | Affect borrowing and spending | Fed rate held steady (5.25%-5.50%) |

Sociological factors

Societal trends show a significant shift towards digital payments. Convenience and security drive this change. Mastercard responds by enhancing its digital payment solutions. In Q1 2024, Mastercard saw a 13% increase in gross dollar volume. Digital payments are now the norm.

Consumer expectations are shifting, with growing demand for sustainability and corporate social responsibility. Younger consumers are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, impacting purchasing decisions. In 2024, a study showed that 70% of consumers are willing to pay more for sustainable products. Mastercard's brand image is thus closely tied to its ESG performance.

Financial inclusion is a key focus, especially in developing nations. Mastercard actively works to include the unbanked in the digital economy. As of 2024, Mastercard has expanded access to digital financial tools for over 500 million people globally. This promotes economic growth and reduces inequality, aligning with societal goals.

Changing Consumer Behavior

Consumer behavior is evolving, with a focus on value. People are carefully weighing costs against what they truly need. This shift impacts spending habits, potentially changing the balance between buying goods and investing in experiences. According to recent reports, spending on experiences has increased by 15% in 2024.

- Increased demand for sustainable products.

- Growing interest in personalized services.

- Focus on health and wellness.

- Emphasis on ethical sourcing.

Trust in Digital Transactions

Trust in digital transactions is vital for Mastercard. Consumer trust hinges on secure and reliable systems. Data privacy and security breaches can erode confidence in digital payments. In 2024, global e-commerce sales reached $6.3 trillion, highlighting the importance of trust.

- Data breaches cost businesses an average of $4.45 million in 2024.

- 79% of consumers are concerned about online data privacy.

- Mastercard processed 143.7 billion transactions in 2024.

Societal shifts towards digital payments and ESG factors significantly impact Mastercard. Digital transactions grew, with 13% volume increase in Q1 2024. The focus on financial inclusion is key; Mastercard aids 500M+ globally, fostering economic growth.

| Factor | Impact | Data |

|---|---|---|

| Digital Payments | Increased Usage | 13% GDV growth (Q1 2024) |

| ESG Focus | Consumer Preferences | 70% willing to pay more for sustainable products (2024 study) |

| Financial Inclusion | Access Expansion | 500M+ people with access to tools (2024) |

Technological factors

Continuous innovation in digital payment technologies, like mobile wallets and blockchain, offers Mastercard chances to enhance its products and stay ahead. Contactless payments are growing; in Q1 2024, Mastercard saw a 21% increase in global contactless transactions. Blockchain could streamline cross-border payments, potentially reducing costs. These advancements require Mastercard to invest in technology and partnerships. Mastercard's 2024 technology budget is projected to be $3 billion, reflecting its commitment to these areas.

Mastercard faces escalating cybersecurity threats, requiring ongoing investment in protection. In 2024, cybercrime costs are projected to reach $9.5 trillion globally. AI enhances fraud detection. Mastercard's 2023 security spending was substantial. The firm continues to adapt.

Mastercard heavily invests in AI and machine learning. For instance, in 2024, Mastercard's AI-powered fraud detection system prevented $2.5 billion in fraudulent transactions. These technologies enhance efficiency and open new avenues. Mastercard plans to invest over $1 billion in AI initiatives by the end of 2025. This includes expanding AI applications in areas like customer service and data analytics.

Digital Transformation

Mastercard is deeply engaged in digital transformation, integrating AI, IoT, cloud computing, and big data to improve its operations and service offerings. This includes using AI for fraud detection, which saved $1 billion in 2023. Mastercard has invested heavily in cloud infrastructure, with cloud spending reaching $1 billion in 2024. These efforts aim to create new revenue streams and increase efficiency.

- AI-powered fraud detection saved $1B in 2023.

- Cloud infrastructure spending hit $1B in 2024.

Development of New Payment Flows

Technological factors are significantly shaping payment flows, with Mastercard at the forefront of innovation. Real-time account-based payments and enhanced cross-border solutions are expanding its market presence and service offerings. This evolution is fueled by advancements in areas like blockchain and AI, which optimize transaction speed and security. Mastercard's investments in these technologies reflect a proactive approach to meet evolving consumer and business demands.

- Mastercard processed 149.8 billion transactions in 2023.

- Cross-border volume grew 18% in 2023.

- Mastercard is investing heavily in AI for fraud detection.

Mastercard is leveraging technology extensively. AI-powered fraud detection is a major focus. Investment in AI will surpass $1B by 2025.

| Technology Area | 2023 Data | 2024 Projected Data |

|---|---|---|

| AI Fraud Detection Savings | $1B | $2.5B |

| Cloud Infrastructure Spending | N/A | $1B |

| Contactless Transaction Growth | N/A | 21% (Q1) |

Legal factors

Mastercard faces stringent financial regulations worldwide. These regulations cover payments, banking, and consumer protection. Compliance costs are substantial, impacting profitability. For example, in 2024, Mastercard's operating expenses rose due to regulatory compliance efforts. The regulatory landscape is constantly evolving, requiring ongoing adaptation.

Mastercard faces stringent data protection laws globally. The GDPR in Europe and CCPA in California mandate strict data handling practices. Compliance necessitates significant investments in data security and privacy measures. In 2024, Mastercard spent $800 million on cybersecurity and data privacy. These laws influence how Mastercard designs and operates its services.

Mastercard's market dominance attracts antitrust scrutiny globally. Regulators assess interchange fees and competition levels. In 2024, the EU capped interchange fees at 0.2% for debit and 0.3% for credit cards. The DOJ is investigating card network practices, impacting Mastercard's operations. Legal challenges and settlements may alter its fee structure and business practices.

Consumer Protection Regulations

Consumer protection regulations significantly influence Mastercard's operations, particularly regarding credit card rewards and unfair practices. These regulations, like the CARD Act in the U.S., dictate how fees are charged and how interest rates are calculated. In 2024, Mastercard faced scrutiny over its interchange fees, with regulators globally examining their impact on merchants and consumers. The European Commission, for example, continues to monitor these fees to ensure fair competition.

- Interchange fees contribute a substantial portion of Mastercard's revenue, approximately 40% in 2024.

- The CARD Act in the U.S. has limited certain fees and increased transparency in credit card terms.

- Ongoing regulatory reviews in Europe and other regions could lead to changes in fee structures.

Cross-Border Transaction Regulations

Mastercard faces intricate legal hurdles due to cross-border transaction regulations. These regulations, encompassing anti-money laundering (AML) and counter-terrorism financing (CTF) rules, significantly affect its global operations. Compliance demands substantial resources, potentially impacting profitability and operational efficiency. The Financial Crimes Enforcement Network (FinCEN) reported over $2.6 billion in AML penalties in 2024.

- AML/CTF compliance costs are increasing, with a 7% rise in 2024.

- Cross-border transaction scrutiny is intensifying, particularly in high-risk jurisdictions.

- Regulatory fines related to non-compliance can reach billions of dollars.

- Evolving data privacy laws add another layer of legal complexity.

Legal factors significantly shape Mastercard's operations, impacting its profitability and market practices. Stricter financial regulations worldwide, along with consumer protection laws and cross-border transaction rules, necessitate extensive compliance efforts. In 2024, Mastercard spent nearly $1 billion on legal and compliance activities, a 15% increase from the prior year.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Regulatory Compliance | Increased Operating Expenses | $1B+ spent on legal and compliance |

| Data Protection | Investment in Security | $800M+ on cybersecurity |

| Antitrust Scrutiny | Potential Fee Structure Changes | EU interchange fee cap |

Environmental factors

Mastercard is tackling climate change with bold environmental targets. They aim for net-zero emissions by 2040, focusing on reducing their operational and supply chain emissions. In 2023, Mastercard's operational emissions were 19,000 metric tons of CO2e. They invested $200 million in sustainable initiatives.

Mastercard is focused on decreasing the environmental footprint of its cards. They are setting standards for cards made from sustainable materials. This includes recyclable and bio-sourced plastics. In 2024, Mastercard aimed to increase the use of recycled materials in card production by 10%. The company plans to have a completely sustainable card portfolio by 2030.

Mastercard actively works to minimize its environmental impact. The company aims for 100% renewable electricity across its global operations. They also integrate sustainability into marketing and production. In 2023, Mastercard reduced emissions by 12%.

Consumer Demand for Sustainable Practices

Consumers are increasingly prioritizing sustainability, influencing business strategies. This shift prompts companies like Mastercard to adopt eco-friendly practices and products. Mastercard's initiatives reflect this trend, enhancing their brand image. The demand for sustainable options is growing rapidly.

- In 2024, 73% of global consumers would pay more for sustainable products.

- Mastercard's ESG bond issuance reached $1.5 billion by Q4 2024.

Innovations for Environmental Sustainability

Mastercard is actively innovating for environmental sustainability. They offer tools for consumers to track carbon footprints, promoting eco-conscious spending. Initiatives also support natural resource preservation, aligning with global sustainability goals. In 2024, Mastercard invested $500 million in climate-related programs.

- Carbon footprint tracking tools for consumers.

- Investments in natural resource preservation.

- $500 million invested in climate programs (2024).

Mastercard targets net-zero emissions by 2040, a crucial environmental goal. They are reducing operational and supply chain emissions; in 2023, 19,000 metric tons of CO2e were emitted. Sustainable cards using recycled materials and eco-friendly practices enhance brand image and meet consumer demand.

| Initiative | Target/Achievement | Data (2024/2025) |

|---|---|---|

| Emissions Reduction | Net-zero by 2040 | 12% emissions reduction in 2023 |

| Sustainable Cards | Increase use of recycled materials | Aiming for 100% sustainable cards by 2030 |

| Sustainability Investments | Climate-related programs | $500 million invested in 2024 |

PESTLE Analysis Data Sources

Mastercard's PESTLE analysis uses financial reports, industry publications, regulatory databases, and market research to inform its analysis.