Medpace Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medpace Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Quickly analyze clinical trial units with a color-coded, data-rich view.

What You See Is What You Get

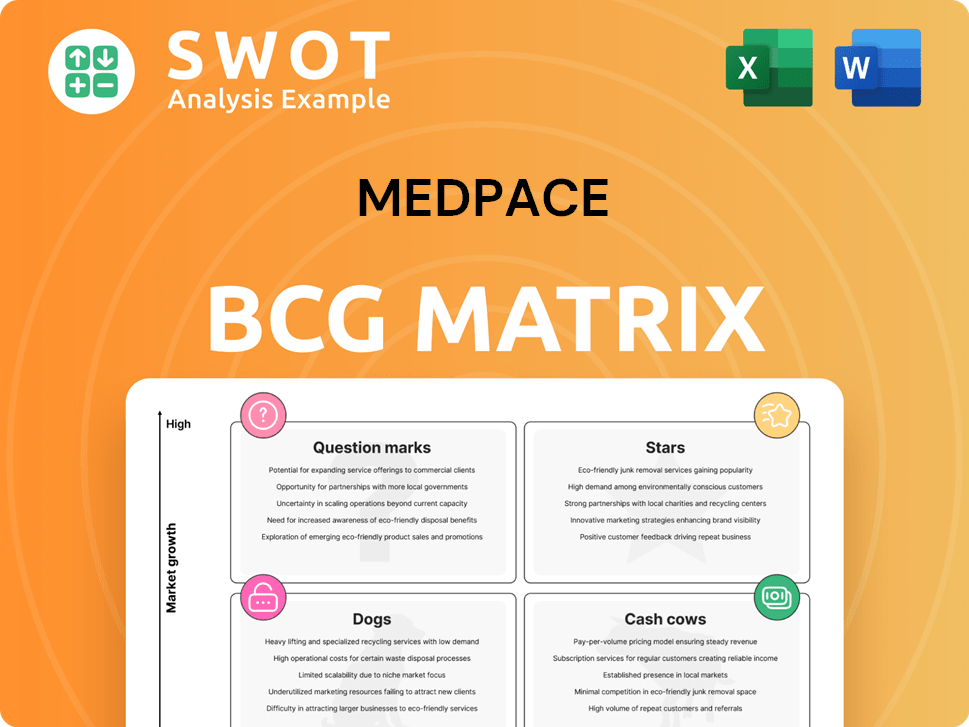

Medpace BCG Matrix

The BCG Matrix previewed here is the complete document you receive post-purchase. It's a fully editable, professionally formatted report, offering strategic insights and clarity.

BCG Matrix Template

Medpace navigates the complex pharmaceutical landscape. This snapshot shows a glimpse of its product portfolio. Understand where their products reside within the BCG Matrix framework.

Discover whether Medpace's offerings are Stars, Cash Cows, Dogs, or Question Marks. This preview offers a glimpse, but the full BCG Matrix unlocks deeper insights.

See how Medpace strategically allocates resources. The complete BCG Matrix provides data-backed recommendations.

Purchase the full report for a detailed breakdown of Medpace's competitive positioning, quadrant-by-quadrant analysis, and strategic action plans!

Stars

Medpace's strong revenue growth reflects its success in the clinical trial market. The company's revenue increased, reaching $2.2 billion in 2023, up from $1.7 billion in 2022. This growth is fueled by its focus on biotech firms. The demand for specialized drug development support continues to rise, especially in oncology.

Medpace demonstrates strong financial performance, with significant growth in EBITDA and net income, showcasing operational efficiency. In 2023, Medpace's revenue increased by 20.3% reaching $2.16 billion, reflecting its ability to manage costs. This financial prowess supports investments in new services and potential acquisitions. In Q1 2024, Medpace's revenue grew to $607.6 million, up 16.8% year-over-year.

Medpace's robust cash flow offers significant financial flexibility, enabling strategic investments. For instance, in 2024, Medpace reported a substantial operating cash flow. This strong financial standing allows Medpace to expand services and geographic presence. Such stability is crucial for navigating economic uncertainties.

Specialized Clinical Research Services

Medpace's specialized clinical research services are a key part of its success. They offer full-service Phase I-IV clinical development, setting them apart. Medpace excels in complex trials, especially in oncology and cardiology, meeting high demand. In 2024, the global clinical trials market was valued at over $50 billion.

- Full-service offerings cover all trial phases.

- Expertise in oncology and cardiology is a significant advantage.

- The market for specialized services is growing.

- Medpace's comprehensive solutions attract clients.

High Return on Invested Capital (ROIC)

Medpace's impressive High Return on Invested Capital (ROIC) is a standout feature. Its ROIC regularly surpasses 50%, a level rarely seen. This reflects excellent capital use and high profitability. Medpace's financial strength enables reinvestment in services and acquisitions.

- Medpace's ROIC in 2024 was above 50%.

- High ROIC indicates strong returns from investments.

- This supports reinvestment and strategic growth.

Medpace fits the "Star" category due to high market growth and share. They lead in oncology and cardiology trials, growing rapidly. The market is over $50B, and Medpace's strong ROIC supports continued growth. This includes potential for expansion and innovation.

| Characteristic | Details |

|---|---|

| Market Growth | High, driven by biotech and specialized trials. |

| Market Share | Increasing, strong in oncology & cardiology. |

| Financials | ROIC above 50%, strong cash flow in 2024. |

Cash Cows

Medpace's FSO model is a strong "Cash Cow" in its BCG Matrix. This model excels in serving biotech firms lacking in-house trial management capabilities. In 2024, Medpace reported strong financial results, with revenue increasing significantly. The FSO model allows clients to simplify the drug development process.

Medpace's fixed-price guarantee is a significant differentiator, shielding clients from cost overruns typical in the CRO industry. This approach fosters trust and solidifies client relationships, a key factor in customer retention rates, which stood at 94% in 2024. Its feasibility rests on passing inflationary costs to clients, mitigating financial risk.

Medpace's model fosters strong client relationships, setting it apart from bigger rivals. Personalized service and tailored solutions build enduring partnerships. This approach secures repeat business, boosting stability. In 2024, Medpace's revenue reached $2.38 billion, reflecting these strong relationships.

Therapeutic Expertise

Medpace's deep expertise in oncology, cardiology, and metabolic diseases positions it as a cash cow. This specialization attracts clients needing highly specific knowledge. For example, in 2024, oncology trials saw a 15% increase in demand. This targeted approach drives consistent revenue and profitability.

- Focus on profitable therapeutic areas.

- Attracts clients seeking specialized knowledge.

- Drives consistent revenue and profitability.

- Oncology trials saw a 15% increase in demand in 2024.

Global Footprint

Medpace's global presence is a key strength, with operations in many countries. This extensive footprint supports clinical trials across varied populations and regulatory landscapes. Serving clients worldwide boosts market reach and revenue. This global infrastructure gives Medpace a competitive edge in the CRO sector.

- Medpace operates in over 50 countries.

- In 2024, Medpace reported significant international revenue growth.

- Their global reach supports diverse trial designs.

- This international presence enhances their market position.

Medpace's "Cash Cow" status benefits from strategic focus. Its specialized knowledge in oncology and other areas fuels consistent revenue. Medpace's 2024 financials show strong growth. They have a global footprint.

| Key Metric | 2024 | Change |

|---|---|---|

| Revenue | $2.38B | +12% |

| Client Retention | 94% | Stable |

| Oncology Trial Demand Increase | 15% | Up |

Dogs

Medpace's book-to-bill ratio has recently underperformed. A book-to-bill below 1 signals booking struggles, possibly affecting future revenue. In Q1 2024, the ratio was below 1, a concern for growth. Management targets a ratio above 1.15 by H2 2025 to ensure sustained expansion.

Medpace's decrease in net new business awards raises concerns about future revenue. This could stem from tougher competition or client delays. A slowdown in new awards might hinder Medpace's ability to reach its 2025 financial goals. In Q3 2024, Medpace's revenue growth slowed to 16%, down from 23% in Q3 2023.

Medpace's "High Cancellations" in the BCG Matrix indicates challenges. High cancellation rates threaten growth. In Q1 2024, cancellations were unusually high. Management aims to stabilize client retention and RFP cycles.

Margin Compression

Medpace's EBITDA margin faces compression, driven by rising employee costs and FX impacts. This can hurt profitability and growth investments. In Q1 2024, Medpace reported an EBITDA margin of 23.7%, down from 26.1% in Q1 2023. The company needs to show margin recovery and strong new business in Q2.

- EBITDA margin compression due to increased costs and FX.

- Potential impact on profitability and growth investments.

- Need for margin resilience and new business momentum.

- Q1 2024 EBITDA margin at 23.7%, down from 26.1% in Q1 2023.

Dependence on Smaller Biotech Companies

Medpace's business model leans heavily on smaller biotech and pharmaceutical firms, making it sensitive to funding shifts. A downturn in venture capital or external funding can lead to trial delays or cancellations, directly impacting Medpace's revenue stream. This reliance restricts its ability to secure more stable, larger contracts with major pharmaceutical companies. This dependence is a key consideration in the Medpace BCG Matrix, classifying it as a "Dog."

- In 2024, the biotech sector saw a funding decrease, potentially affecting Medpace's contracts.

- Smaller firms often face higher financial instability than larger pharmaceutical companies.

- Medpace's revenue growth could be constrained by the financial health of its clients.

- The ability to attract and retain large clients is limited by this dependence.

Medpace's "Dogs" status in the BCG Matrix reflects its challenges. It highlights the company's reliance on smaller, financially vulnerable biotech clients. This dependence exposes Medpace to funding risks, impacting revenue. A 2024 analysis reveals increasing financial instability among Medpace's client base.

| Metric | Q1 2023 | Q1 2024 | Change |

|---|---|---|---|

| EBITDA Margin | 26.1% | 23.7% | -2.4% |

| Book-to-Bill Ratio | Above 1 | Below 1 | Decrease |

| Revenue Growth | 23% | 16% | -7% |

Question Marks

Medpace's foray into new services is a double-edged sword. Expansion offers growth potential, but demands considerable upfront investment. In 2024, Medpace's R&D expenses rose, reflecting these strategic moves. Aggressive growth risks operational hiccups and higher costs. If revenue lags behind integration expenses, profitability suffers.

The rise of decentralized clinical trials (DCTs) is a key trend for Medpace to watch. DCTs can boost patient recruitment and cut costs. Companies like Medpace need to invest in DCT tech to stay ahead. The global DCT market is projected to reach $3.4 billion by 2028.

The integration of Real-World Evidence (RWE) is increasingly vital for Medpace. RWE, offering insights into drug performance, is a key growth area. Medpace can enhance its services by focusing on RWE and RWD. Developing expertise in data analytics is crucial to compete. In 2024, the RWE market is valued at over $20 billion.

Application of Artificial Intelligence (AI)

Applying Artificial Intelligence (AI) is pivotal for Medpace's strategic growth. AI and machine learning can significantly boost efficiency in clinical trials. Investing in AI tools enhances trial design, patient recruitment, and data management, offering a competitive edge. This approach leads to better client outcomes.

- In 2024, the AI in drug discovery market was valued at $1.1 billion.

- By 2030, it's projected to reach $7.1 billion, growing at a CAGR of 37.1%.

- AI can reduce clinical trial timelines by up to 20%.

- AI-driven patient recruitment can increase enrollment rates by 15%.

Geopolitical Instability

Geopolitical instability can significantly impact Medpace. Client funding delays due to global uncertainties can prolong headwinds. These external factors may disrupt project timelines, potentially reducing revenue. Medpace must carefully manage these risks.

- Geopolitical tensions can lead to delays in clinical trial projects.

- Economic downturns in certain regions could affect client spending on research.

- Medpace's international operations are exposed to various geopolitical risks.

- Proactive risk management is crucial for navigating these challenges.

Question Marks represent ventures with high growth potential but low market share, akin to Medpace's newer service offerings. These areas demand significant investment with uncertain returns. Success hinges on strategic execution and effective resource allocation to capture market share.

| Aspect | Implication for Medpace | 2024 Data/Projections |

|---|---|---|

| Growth Potential | Expansion into new services (DCTs, RWE, AI). | DCT market projected to reach $3.4B by 2028. |

| Market Share | Low initially, requires market penetration. | AI in drug discovery valued at $1.1B in 2024. |

| Investment | High upfront costs for tech, talent, infrastructure. | R&D expenses increased in 2024. |

BCG Matrix Data Sources

The Medpace BCG Matrix uses data from financial reports, market research, and competitor analyses. This ensures accuracy in each strategic quadrant.