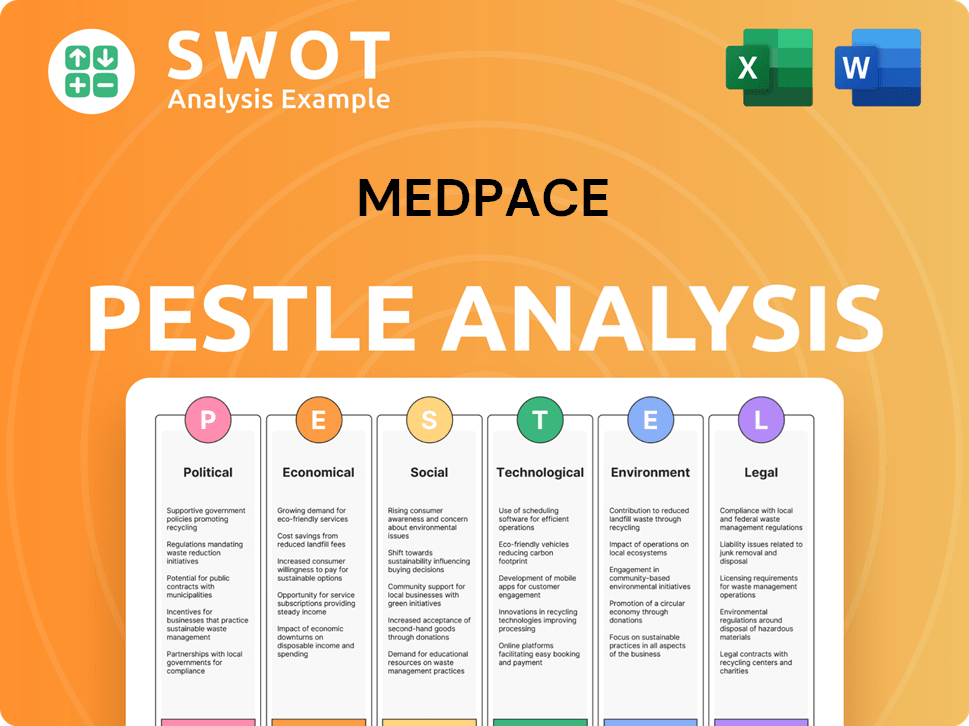

Medpace PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medpace Bundle

What is included in the product

Assesses external factors impacting Medpace across six areas: Political, Economic, Social, etc., for strategic planning.

The Medpace PESTLE analysis supports risk discussions during planning sessions and enhances market positioning insights.

Preview Before You Purchase

Medpace PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Medpace PESTLE Analysis includes comprehensive sections on political, economic, social, technological, legal, and environmental factors. Expect a detailed, well-organized, and ready-to-use document upon purchase. The provided preview mirrors exactly what you'll download instantly.

PESTLE Analysis Template

Navigate Medpace's future with our expert PESTLE analysis. We break down key external factors influencing its strategy.

Uncover political, economic, social, technological, legal, and environmental forces impacting Medpace.

Gain actionable insights into market trends and competitive landscapes. This in-depth report is perfect for investors and business strategists alike.

Make informed decisions based on comprehensive data, not guesswork. Download the complete PESTLE analysis now for immediate access.

Empower your strategic planning and stay ahead of the curve by understanding Medpace's market position.

Political factors

Government healthcare spending and policy shifts significantly influence clinical research demand. Initiatives targeting specific therapeutic areas can benefit Medpace, as seen with increased focus on oncology. However, budget cuts might reduce R&D spending, affecting Medpace's revenue, which reached $1.96 billion in 2024. Political stability in operating regions is also crucial; for example, the European Union's healthcare spending in 2023 was over €1 trillion.

Political factors significantly shape the regulatory landscape for clinical trials. Changes in FDA or EMA regulations can increase trial costs and complexity, directly impacting Medpace. For example, in 2024, the FDA updated its guidance on clinical trial diversity. Streamlined regulations could accelerate timelines; however, this is subject to political influence. This necessitates Medpace's expertise in regulatory navigation.

Medpace, as a global CRO, is significantly impacted by international relations and trade policies. Changes in tariffs or trade agreements can alter the cost of multinational clinical trials. For instance, a 10% tariff hike on pharmaceutical imports could increase Medpace's operational expenses. Geopolitical instability, like the ongoing conflicts, can disrupt trials and business operations. In 2024, geopolitical risks led to a 5% delay in trials in certain regions.

Political Stability in Operating Regions

Political stability is vital for Medpace's operations, especially where clinical trials occur. Unrest or significant political changes can disrupt trials. This can affect patient recruitment. Medpace must navigate diverse and possibly unstable political environments. The World Bank reports that political stability and absence of violence are key for economic growth. The Global Peace Index 2024 indicates varying levels of peace across countries where Medpace operates.

- Political instability can delay trial completion and increase costs.

- Adverse political events may lead to trial abandonment.

- Medpace's adaptability to political risks is crucial for success.

Government Support for Biotechnology and Pharmaceuticals

Government backing for biotechnology and pharmaceuticals significantly impacts Medpace. Supportive policies, like R&D tax incentives and research funding, boost industry growth. Increased clinical trial activity, fueled by government support, directly benefits CROs such as Medpace. The U.S. government allocated $48.6 billion to the National Institutes of Health in 2024, fostering innovation. These factors create opportunities for Medpace.

- Tax incentives for R&D.

- Funding for medical research.

- Initiatives to foster innovation.

- Increase in clinical trial activity.

Government policies impact healthcare and R&D spending, affecting Medpace's revenue. Regulatory changes by agencies like the FDA can influence trial costs and timelines. International relations and geopolitical events create both risks and opportunities.

| Political Aspect | Impact on Medpace | Data (2024-2025) |

|---|---|---|

| Healthcare Spending | Direct impact on demand for clinical trials | US healthcare spending in 2024 reached $4.8 trillion. |

| Regulatory Changes | Affect trial costs, complexity | FDA updated clinical trial guidance in 2024; EMA had similar updates. |

| Geopolitical Risks | Potential disruptions, cost increase | Ongoing conflicts led to 5% trial delays in certain regions in 2024. |

Economic factors

Global economic health critically impacts Medpace's clients in biotech and pharmaceuticals. A recession could slash R&D budgets, affecting CRO service demand. In 2023, global R&D spending reached nearly $2.2 trillion, a key indicator. Strong economies boost these sectors, increasing CRO outsourcing. The projected global pharmaceutical market size is estimated to reach $1.9 trillion by 2025.

Medpace's focus on small to mid-sized biopharma clients makes it sensitive to funding trends. Biotech funding dipped in 2023, with Q4 venture capital at $3.9B, a 36% YoY decrease. This impacts trials, affecting Medpace's new business. A tough funding climate slows revenue growth.

Inflation poses a risk to Medpace's expenses, particularly personnel and trial supplies. The company's cost management is crucial for profitability. Medpace has improved EBITDA margins. In Q1 2024, Medpace's EBITDA margin was 20.4%, showing efficiency.

Currency Exchange Rate Fluctuations

Medpace faces currency exchange rate risks due to its global operations. Fluctuations affect revenue and expenses converted to its reporting currency. For instance, a stronger U.S. dollar can decrease reported revenue from foreign markets. Conversely, a weaker dollar may boost reported earnings. This can impact financial results significantly.

- In 2023, currency fluctuations had a moderate impact on Medpace's reported revenue.

- The company uses hedging strategies to mitigate currency risks.

- Exchange rate volatility is a continuous factor in financial planning.

Outsourcing Trends in the Biopharmaceutical Industry

Outsourcing R&D is a major economic factor for Medpace. Pharma and biotech firms increasingly rely on CROs due to drug development costs and complexity. Specialized expertise and efficiency are driving this trend. The global CRO market is projected to reach $128.1 billion by 2025. Continued growth in outsourcing is directly beneficial to Medpace.

- Market growth: The CRO market is forecast to grow significantly.

- Cost pressures: Rising drug development costs push outsourcing.

- Efficiency gains: CROs offer specialized expertise.

- Medpace benefit: Growth in outsourcing directly boosts Medpace.

Economic conditions significantly impact Medpace's business. Global economic health influences R&D budgets in the biotech and pharma industries, which are Medpace's primary clients. A strong global economy and rising outsourcing trends support Medpace’s growth; the CRO market is forecast to hit $128.1B by 2025.

| Economic Factor | Impact on Medpace | 2024/2025 Data |

|---|---|---|

| Global Economy | Affects R&D spending | R&D spend nearly $2.2T in 2023; CRO mkt est. $128.1B by 2025 |

| Funding Environment | Influences trial starts | Biotech VC Q4'23: $3.9B (-36% YoY) |

| Inflation | Impacts operational costs | Q1 2024 EBITDA margin was 20.4% |

Sociological factors

An aging global population and the rise of chronic diseases are key sociological factors. This trend boosts demand for new medical treatments. In 2024, the global population aged 65+ reached 771 million, fueling R&D in pharma and biotech. This increase leads to more clinical trials, benefiting CROs.

Sociological factors significantly influence patient participation in clinical trials. Awareness of trials, trust in medical research, and access to healthcare facilities are key. Medpace must effectively recruit and retain diverse patient populations. In 2024, diverse trial representation remains critical for regulatory approvals. Data shows diverse trials improve drug efficacy understanding.

Public perception significantly influences the pharmaceutical and biotech sectors. Negative views on drug pricing or safety concerns can hinder clinical trial recruitment. In 2024, public trust in pharma remains moderate, with 40% expressing high trust. Ethical considerations, like data privacy, also shape public opinion, impacting regulatory support and potentially affecting Medpace's operations and client success.

Workforce Availability and Talent Acquisition

The life sciences sector's workforce availability significantly influences Medpace. The competition for skilled clinical researchers and medical staff is intense. Attracting and retaining qualified employees is crucial for high-quality clinical trials. This directly impacts Medpace's operational capabilities and project timelines.

- In 2024, the global clinical trials market was valued at $57.6 billion.

- The industry faces a talent shortage, with a projected need for 250,000 more professionals by 2030.

- Medpace's employee count was approximately 6,000 in 2023.

Focus on Patient-Centricity in Clinical Trials

Patient-centricity is increasingly vital in clinical trials, emphasizing patient needs for better outcomes. This shift affects recruitment, retention, and overall trial experiences. CROs like Medpace must adapt to meet these evolving demands. A 2024 study showed patient-centric trials have 20% higher retention rates.

- Improved patient engagement boosts trial success.

- Adaptation includes flexible trial designs.

- Focus on patient feedback for better trials.

Sociological factors influence clinical trials significantly. An aging population and increased chronic diseases boost the demand for new treatments. Public perception and patient-centricity play critical roles. In 2024, global trials faced talent shortages.

| Factor | Impact | 2024 Data/Insight |

|---|---|---|

| Aging Population | Increased demand for medical treatments | Global 65+ population: 771 million |

| Patient-Centricity | Improved trial retention | Patient-centric trials have 20% higher retention rates. |

| Public Perception | Influences trial recruitment, industry trust | 40% express high trust in pharma (moderate) |

Technological factors

Advancements in data analytics and AI are reshaping clinical research. These tools speed up drug discovery, refine trial designs, and boost data analysis efficiency. In 2024, AI's market value in healthcare reached $17.6 billion, showing rapid growth. Medpace must integrate these technologies to remain competitive.

The rise of Decentralized Clinical Trials (DCTs) is a key tech trend, using tech for remote patient participation. DCTs boost access, recruitment, and retention, vital for Medpace. In 2024, the DCT market was valued at $8.3 billion, expecting to reach $22.3 billion by 2030. Medpace must offer DCT support to meet client demands and stay competitive.

Medpace leverages Electronic Data Capture (EDC) systems for clinical trial data. This tech ensures data integrity and regulatory compliance. In 2024, EDC adoption rates in clinical trials hit 95%. Medpace's investment in EDC is vital for operational efficiency. Secure systems are key, with cybersecurity spending in the healthcare sector projected to reach $14.5 billion by 2025.

Technological Infrastructure and Cybersecurity

Medpace heavily relies on a robust technological infrastructure to manage and protect sensitive clinical trial data. Cybersecurity is a top priority, with the company needing to safeguard against threats and ensure patient data privacy. Investments in IT security are essential, given the potential for data breaches and regulatory non-compliance. For instance, in 2024, the healthcare industry saw a 53% increase in ransomware attacks. This necessitates continuous upgrades and vigilance.

- Data breaches in healthcare cost an average of $10.9 million in 2024, highlighting the financial risks.

- Medpace's IT budget likely includes significant allocations for cybersecurity measures and data protection.

- Compliance with regulations like GDPR and HIPAA demands strong technological safeguards.

Integration of Wearable Devices and Remote Monitoring

The integration of wearable devices and remote monitoring is transforming clinical trials, enabling continuous data collection. This shift provides a more detailed view of patient responses, enhancing trial quality. Medpace's proficiency in handling data from these technologies is crucial. The global remote patient monitoring market is projected to reach $1.7 billion by 2025.

- Data from wearables offers real-time insights.

- Medpace can improve trial efficiency.

- Market growth is driven by tech integration.

- Enhances patient safety and data accuracy.

Medpace must embrace AI and data analytics to stay ahead, as AI in healthcare was worth $17.6B in 2024. The adoption of Decentralized Clinical Trials (DCTs), a market worth $8.3B in 2024, is essential. Strong cybersecurity and EDC systems, adopted in 95% of clinical trials, are also vital.

| Technology Factor | Impact on Medpace | 2024/2025 Data |

|---|---|---|

| AI and Data Analytics | Enhances efficiency and accelerates research. | AI in healthcare: $17.6B (2024) |

| Decentralized Clinical Trials (DCTs) | Improves patient access and trial efficiency. | DCT market: $8.3B (2024), $22.3B (2030 est.) |

| Cybersecurity & EDC Systems | Ensures data integrity, compliance and security. | EDC adoption: 95% (2024); Healthcare cyber cost: $10.9M (avg. breach, 2024) |

Legal factors

Medpace navigates a complex web of regulations, crucial for its clinical trial operations. Compliance with FDA, EMA, and other global agencies is non-negotiable. In 2024, regulatory scrutiny intensified, impacting timelines. The company's ability to secure approvals directly affects its revenue, which reached $2.2 billion in 2024.

Medpace faces heightened scrutiny due to strict data privacy rules. GDPR and similar laws globally affect data handling. Compliance requires significant resources and ongoing vigilance. Non-compliance can lead to hefty fines and reputational damage. Staying updated on these laws is crucial for Medpace.

Medpace's success relies on protecting its unique methods and tech. They use patents, trademarks, and confidentiality agreements to safeguard their IP. Key trademarks include "Medpace" and "ClinTrak." In 2024, intellectual property litigation costs for similar firms averaged $2.5 million. This protection is vital for maintaining a competitive edge.

Contract Law and Client Agreements

Medpace's operations heavily rely on contracts with its clients. These agreements with biotechnology, pharmaceutical, and medical device companies define the scope, timelines, and payments for clinical trials. Contract law, including intellectual property rights, is fundamental to Medpace's operations. In 2024, the company reported approximately $2.2 billion in revenue, directly tied to these contractual arrangements.

- Contractual disputes can impact revenues.

- Intellectual property clauses are critical.

- Adherence to regulatory standards is essential.

- Payment terms significantly affect cash flow.

Anti-Corruption Laws

Medpace, as a global entity, must adhere to anti-corruption laws, including the Foreign Corrupt Practices Act (FCPA). Compliance is crucial to prevent legal issues and safeguard its reputation worldwide. The U.S. Department of Justice and the Securities and Exchange Commission actively enforce these regulations. In 2024, FCPA enforcement actions resulted in over $1 billion in penalties.

- FCPA violations can lead to severe financial and legal repercussions.

- Companies must implement rigorous compliance programs.

- Due diligence is essential when operating internationally.

- Medpace's global presence requires constant vigilance.

Medpace's legal landscape requires navigating strict regulations for clinical trials. Data privacy, like GDPR, demands robust compliance to avoid fines. Protecting intellectual property through patents and trademarks is crucial, with litigation costs hitting $2.5M for some in 2024. Contracts, the lifeblood of Medpace, impact revenue.

| Legal Area | Key Aspect | 2024 Impact/Data |

|---|---|---|

| Regulatory Compliance | FDA, EMA, global standards | Revenue of $2.2B |

| Data Privacy | GDPR, other global laws | Compliance is resource intensive |

| Intellectual Property | Patents, trademarks | Litigation costs avg. $2.5M (firms) |

Environmental factors

Medpace must adhere to environmental regulations for its labs and facilities. These rules cover waste disposal, handling of hazardous materials, and emissions. In 2024, the EPA reported that environmental compliance costs for the pharmaceutical industry averaged $1.2 billion annually.

Environmental sustainability and corporate responsibility are increasingly important. Clients and investors assess a company's environmental impact. Medpace's Corporate Responsibility Report highlights its environmental commitments. In 2024, ESG-focused funds saw over $100 billion in inflows. Companies with strong ESG ratings often have better financial performance.

Climate change poses indirect risks to clinical trials. Extreme weather events, like the 2023-2024 floods in Europe, can disrupt trial sites. These disruptions may affect patient access. Such events may require contingency plans. The World Bank estimates climate change could push 100 million into poverty by 2030.

Management of Clinical Waste and Biological Samples

Medpace faces environmental scrutiny regarding clinical waste and biological sample management. Proper handling, storage, and disposal of biohazardous materials are essential. Compliance with global regulations, such as those set by the EPA and WHO, is paramount. Effective waste management minimizes environmental impact and potential health risks.

- The global medical waste management market was valued at $14.5 billion in 2023 and is projected to reach $20.6 billion by 2028.

- Improper disposal can lead to environmental contamination and legal penalties.

- Best practices include waste segregation, secure packaging, and incineration or autoclaving.

Energy Consumption and Resource Utilization

Medpace's operations involve energy consumption and resource utilization, primarily within its clinical research facilities. These factors are crucial for assessing Medpace's environmental impact. Strategies like energy-efficient equipment and waste reduction are vital. The company’s sustainability initiatives should aim at minimizing its footprint. In 2024, the healthcare sector saw a push for green practices, with potential cost savings.

- Energy-efficient buildings reduce operational costs.

- Waste reduction programs improve environmental performance.

- Sustainable sourcing enhances corporate responsibility.

- Compliance with environmental regulations is essential.

Medpace navigates strict environmental rules, like waste disposal and emissions, to avoid penalties. Sustainability and ESG focus impact investment. Extreme weather and climate change create risks to clinical trials and could disrupt studies.

Effective waste handling is key due to growing market demands. Facilities’ energy use requires a commitment to sustainability. Reducing impact through resourcefulness is essential.

| Environmental Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Regulations | Compliance costs | Pharma industry's $1.2B compliance spending. |

| Sustainability | Investor & client perception | ESG funds saw over $100B inflows. |

| Climate Risks | Trial disruptions | 2023-2024 floods caused study delays. |

PESTLE Analysis Data Sources

Our PESTLE Analysis employs global economic data, industry reports, and regulatory updates to ensure informed, precise assessments. Key factors leverage reputable market research and governmental portals.