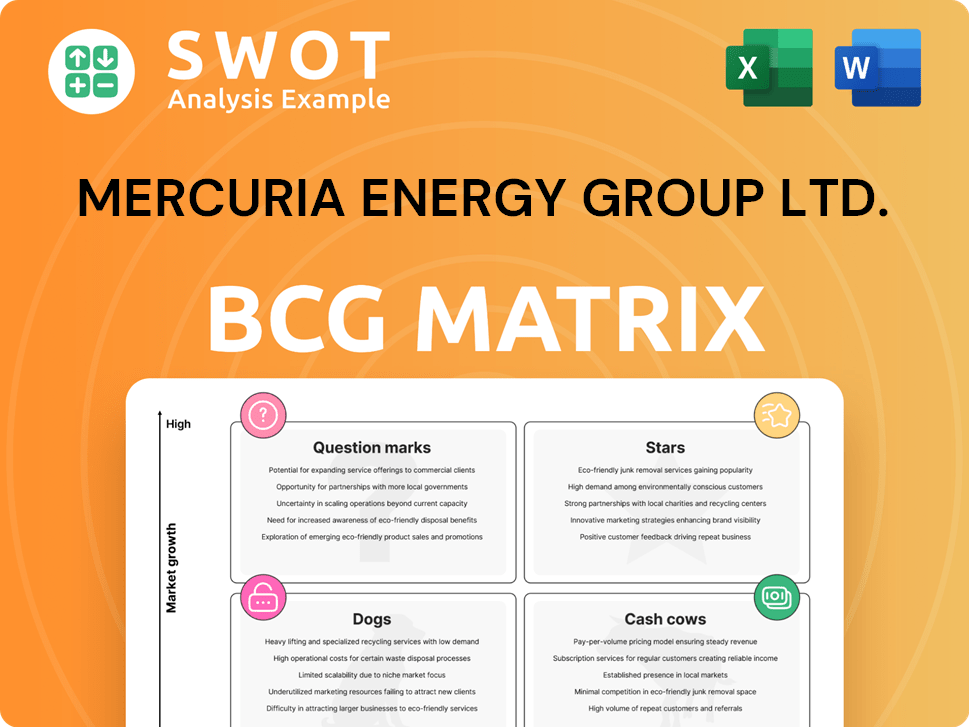

Mercuria Energy Group Ltd. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mercuria Energy Group Ltd. Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs to quickly assess the Mercuria Energy Group Ltd. BCG Matrix.

What You’re Viewing Is Included

Mercuria Energy Group Ltd. BCG Matrix

The provided preview showcases the complete Mercuria Energy Group Ltd. BCG Matrix report you'll receive. This is the final, downloadable document, prepared for detailed strategic assessment and insightful analysis. It’s ready to use, mirroring precisely what's available after purchase.

BCG Matrix Template

Mercuria Energy Group Ltd.'s BCG Matrix provides a snapshot of its diverse portfolio. This analysis reveals which commodities fuel growth and which require strategic attention. See how key products fit into Stars, Cash Cows, Dogs, and Question Marks. This initial view offers a glimpse into their strategic resource allocation. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Mercuria Energy Group Ltd.'s expansion into metals, including copper, aligns with a high-growth strategy, potentially placing it in the "Star" quadrant of a BCG Matrix. In 2024, copper prices fluctuated, but the long-term outlook remains positive due to increasing demand from electric vehicles and infrastructure. Mercuria's partnership with Zambia supports its ambitious goal to trade substantial volumes of metals. This strategic move diversifies Mercuria's revenue streams and capitalizes on growing market opportunities.

Mercuria's ambitious goal to channel half its investments into sustainable energy by 2025 highlights its "Star" status in the BCG matrix. This strategy involves significant capital allocation towards renewable power projects, energy storage technologies, and grid modernization efforts. In 2024, the global renewable energy market is projected to reach $881.7 billion, underscoring the substantial growth potential. This focus positions Mercuria at the forefront of the energy transition.

Mercuria Energy Group Ltd. has been actively involved in strategic partnerships across Africa. Their participation in financing, like the $650 million deal with Oando in Nigeria, highlights their dedication to the continent's energy sector. These partnerships play a crucial role in fostering economic growth and sustainable development.

LNG Portfolio Expansion

Mercuria's LNG portfolio expansion, including a deal with Oman LNG for 800,000 metric tonnes annually, positions it as a Star in the BCG Matrix. This strategic move capitalizes on rising LNG demand, projected to increase significantly by 2030. The expansion boosts Mercuria's market share and revenue potential in the energy sector. This growth aligns with global efforts to enhance energy security.

- Oman LNG's export capacity is approximately 10.4 million metric tonnes per year.

- Global LNG demand is forecast to reach 600 million tonnes by 2030.

- Mercuria's revenue in 2024 was around $175 billion.

- The LNG market is expected to grow at a CAGR of 4-6% through 2029.

AI-Driven Optimization

Mercuria Energy Group Ltd. leverages AI for strategic market operations. Their use of Stem's PowerBidder Pro in ERCOT highlights this, optimizing renewable asset performance. This technology-driven approach boosts returns and refines risk management in dynamic market environments. For 2024, the renewable energy sector saw a 15% increase in AI adoption for operational efficiency.

- PowerBidder Pro's role in enhancing asset performance.

- AI's impact on improving financial returns.

- Risk management improvements within volatile markets.

- 2024 data showing increased AI adoption in renewables.

Mercuria's metals and sustainable energy ventures position it as a "Star." Copper's fluctuating 2024 prices and renewable energy's $881.7B market potential support this. Strategic LNG deals and AI integration further boost its status.

| Area | Metric | Value (2024) |

|---|---|---|

| Revenue | Total | $175B |

| LNG Market | CAGR (2024-2029) | 4-6% |

| Renewables | AI Adoption | 15% increase |

Cash Cows

Mercuria Energy Group's crude oil and petroleum products trading is a reliable cash cow. In 2024, the sector generated billions in revenue, fueled by global demand. Mercuria's extensive network and trading experience ensure consistent profits. This segment remains vital for the company's financial stability.

Mercuria Energy Group Ltd.'s natural gas trading, including LNG, is a strong cash generator. In 2024, natural gas prices fluctuated but maintained profitability. Their infrastructure supports steady demand. Mercuria's market access stabilizes cash flow.

Mercuria's strategic asset investments, like energy infrastructure, are cash cows. These investments offer stable, predictable returns, bolstering financial health. For example, in 2024, Mercuria invested significantly in storage, boosting its resilience. This provides a reliable income stream, supporting the company's overall stability. These investments are crucial for steady revenue.

Global Business Hubs

Mercuria Energy Group Ltd. strategically positions itself within key global business hubs, reflecting a "Cash Cow" status in the BCG Matrix. Its strong presence in major trading hubs like Geneva, London, and Singapore solidifies its market dominance. These hubs provide efficient trading platforms and access to a wide array of commodity markets. In 2024, Mercuria's revenue reached $147 billion.

- Geneva: Serves as a central hub for trading and financial activities.

- London: Facilitates significant trading volumes, especially in oil and gas.

- Singapore: Acts as a key gateway to the Asian commodity markets.

- Revenue: Mercuria's revenue in 2024 was approximately $147 billion.

Financial Expertise

Mercuria Energy Group Ltd. leverages its financial expertise to maintain its cash cow status. This includes structuring financial packages and attracting international capital, essential for securing favorable deals. Their financial acumen allows them to capitalize on market opportunities and build strong partnerships. In 2024, Mercuria's revenue was approximately $150 billion, reflecting its robust financial performance.

- Financial prowess enables Mercuria to secure beneficial deals.

- Attracting international capital is crucial for its cash cow status.

- Revenue in 2024 was around $150 billion.

Mercuria's global presence in key hubs like Geneva and Singapore generates substantial revenue. Their financial expertise and strategic investments consistently yield strong returns. Mercuria's 2024 revenue reached approximately $150 billion, solidifying its "Cash Cow" status, according to BCG Matrix.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total Income | ~$150 Billion |

| Key Hubs | Strategic Locations | Geneva, London, Singapore |

| Financial Strategy | Capital Management | Attracting international capital |

Dogs

Underperforming legacy assets within Mercuria Energy Group, like older facilities, could be categorized as dogs. These assets might not align with the energy transition, potentially facing reduced demand. For example, if an oil refinery owned by Mercuria struggles, it would be a dog. In 2024, Mercuria's financial reports would show the performance of such assets.

Failed ventures like certain Mercuria Energy Group Ltd. investments fit the "Dogs" quadrant of a BCG Matrix. These investments, which underperformed or were divested, represent assets that consumed resources without generating sufficient returns. For example, divested assets in 2024 might have contributed to a reported loss of $150 million. Such ventures typically detract from overall profitability.

Mercuria's ventures in tightly regulated markets may face headwinds. These environments, with limited growth, could hinder profitability. For example, in 2024, stricter EU regulations impacted energy trading margins. This could affect Mercuria's strategic positioning and returns. These conditions may pose challenges to Mercuria's performance.

Low-Margin Trading Activities

Low-margin trading activities at Mercuria Energy Group Ltd. might be categorized as dogs, especially if they consistently yield low profits while incurring high operational costs. These activities may drain valuable resources without generating significant financial returns. For example, in 2024, certain low-margin oil trading contracts faced profitability challenges due to volatile market conditions and rising logistical expenses. Such scenarios highlight the need for strategic adjustments or potential divestment.

- High operational costs can include storage, transportation, and hedging expenses.

- Low-profit margins may result from intense competition or unfavorable contract terms.

- Resource drain refers to capital, personnel, and time allocated to these activities.

- Strategic adjustments might involve renegotiating contracts or streamlining operations.

Geographic Regions with Limited Growth

Mercuria Energy Group Ltd. might struggle in regions with political instability or economic woes. These conditions can disrupt operations, potentially leading to financial setbacks. For instance, in 2024, political unrest in certain African nations impacted energy projects, causing delays and cost overruns. These issues can affect Mercuria's ability to meet targets.

- Political instability can lead to supply chain disruptions, impacting the delivery of energy resources.

- Economic downturns can reduce demand for energy, affecting Mercuria's revenue.

- Currency fluctuations in unstable regions can erode profits.

- Regulatory changes due to political shifts can create operational uncertainties.

Dogs in Mercuria's BCG Matrix represent underperforming assets or ventures. These include legacy assets like oil refineries, failed investments, and ventures in tightly regulated markets, potentially facing reduced demand and profitability challenges. For example, in 2024, divested assets may have caused a $150 million loss. Low-margin trading activities and operations in politically unstable regions also fit this category.

| Category | Example | 2024 Impact |

|---|---|---|

| Legacy Assets | Oil Refinery | Reduced demand |

| Failed Ventures | Divested Assets | $150M loss |

| Low-Margin Trading | Oil contracts | Profitability challenges |

Question Marks

Mercuria's biodiesel ventures sit in the "Question Mark" quadrant of the BCG Matrix. Demand and regulations create uncertainty. To succeed, the company must strategically position itself. The global biodiesel market was valued at $38.4 billion in 2024, with projected growth.

Mercuria's move into carbon trading, a high-growth sector, is marked by significant potential, yet it's also exposed to regulatory and market volatility. The success hinges on Mercuria's ability to effectively manage these risks and gain a solid foothold. In 2024, the global carbon market was valued at over $900 billion, signaling substantial growth. Their strategic positioning is critical.

Mercuria's critical minerals recycling investments are a question mark in its BCG Matrix. Technological and logistical hurdles make returns uncertain, even though the market is expected to grow. For example, the global critical minerals market was valued at $19.9 billion in 2023, with significant growth projected. If Mercuria leverages its expertise, this could become a star. The potential is there, given the rising demand and the need for sustainable sources.

Black Bayou Energy Hub Investment

The Black Bayou Energy Hub, a Mercuria Energy Group Ltd. investment, is categorized as a question mark within the BCG Matrix. This designation reflects the uncertainty surrounding its future, as the project is an underground salt dome energy storage venture. The project's success hinges on the robust development of critical energy infrastructure, which is still evolving. The Black Bayou Energy Hub is estimated to have a storage capacity of 5 million barrels.

- The project's success depends on reliable energy infrastructure.

- Mercuria's investment faces market uncertainty.

- The Hub can store up to 5 million barrels.

- Underground storage is a growing field.

Partnership with Zambia

Mercuria's joint venture with Zambia to trade copper is categorized as a question mark in the BCG Matrix. This classification stems from the inherent uncertainties of entering a new market. The success of this venture hinges on Mercuria's ability to overcome these challenges, potentially transforming it into a star. The copper market presents both opportunities and risks.

- Market Entry: Venturing into a new market like Zambia introduces complexities.

- Expertise Leverage: Mercuria's expertise is crucial.

- Potential Transformation: The venture could become a star.

- Copper Market: The copper market offers opportunities and risks.

The joint venture with Zambia to trade copper is a question mark for Mercuria, given new market complexities. Mercuria’s success hinges on leveraging its expertise to navigate challenges and seize opportunities in the copper market. The copper market's volatility needs careful management to turn the venture into a star. The global copper market reached $235.6 billion in 2024.

| Aspect | Challenge | Opportunity |

|---|---|---|

| Market Entry | New market risks | Copper demand |

| Mercuria's Role | Leveraging expertise | Market growth |

| Future | Market volatility | Star status |

BCG Matrix Data Sources

The BCG Matrix leverages financial filings, market data, industry reports, and expert analyses, providing comprehensive insights into Mercuria's portfolio.