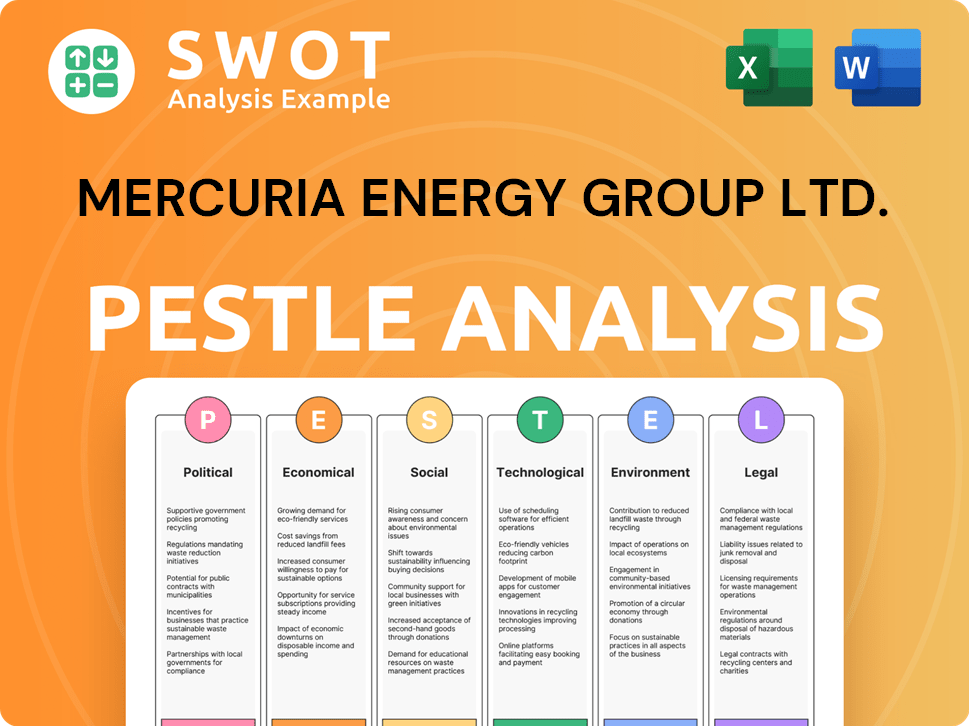

Mercuria Energy Group Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mercuria Energy Group Ltd. Bundle

What is included in the product

This PESTLE analysis dissects how external factors impact Mercuria across political, economic, social, tech, environmental & legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

What You See Is What You Get

Mercuria Energy Group Ltd. PESTLE Analysis

The content you're viewing—a Mercuria Energy Group Ltd. PESTLE Analysis—is the final deliverable. The layout and structure visible are what you get after purchasing.

PESTLE Analysis Template

Mercuria Energy Group Ltd. navigates a complex global landscape. Our PESTLE analysis unpacks the external forces at play. Uncover political risks, economic opportunities, and tech advancements. Explore social shifts, legal impacts, and environmental challenges. Stay ahead with this crucial strategic tool. Gain actionable insights for informed decision-making. Download the complete PESTLE analysis today!

Political factors

Mercuria Energy Group faces geopolitical risks. Political instability can severely affect oil prices and supply chains. The war in Ukraine, for instance, has caused significant market volatility. The company’s global presence requires it to adapt to changing political environments. In 2024, geopolitical events influenced energy prices.

Mercuria's global trading is heavily affected by international trade laws. Adherence to regulations, such as the EU's GSP, is critical. Non-compliance risks severe penalties, potentially impacting billions. Government energy, trade, and finance policies directly shape Mercuria's market. For example, in 2024, changes in U.S. energy policies influenced trading strategies.

Mercuria Energy Group Ltd. navigates the complexities of international trade agreements and sanctions. These factors significantly influence commodity flow and pricing, impacting the company's trading activities. For example, in 2024, sanctions on Russian oil reshaped global supply chains, affecting Mercuria's operations. The company must continuously adapt to shifting trade dynamics and sanctions regimes, which can restrict market access and affect partnerships. In 2025, anticipate further disruptions from evolving geopolitical landscapes.

Political Support for Energy Transition

Governmental backing and incentives for renewable energy significantly influence Mercuria's investment choices and overall strategy. The company is channeling a substantial amount of its new investments into renewables and transitional energy sources, mirroring the worldwide push for decarbonization. This strategic shift is a direct response to political pressures and supportive policies. For instance, in 2024, the US government allocated over $400 billion for clean energy initiatives.

- The Inflation Reduction Act of 2022 supports this.

- Mercuria's investments align with these government policies.

- Decarbonization efforts are global.

Relationship with Governments and National Oil Companies

Mercuria Energy Group Ltd. actively collaborates with national oil companies and governments globally for trading and investment. These relationships are vital for accessing resources and markets. Political stability and government policies significantly influence Mercuria's operational success and profitability. Consider that in 2024, geopolitical events have impacted energy markets.

- Mercuria's trading volume in 2024 was approximately 2.5 million barrels per day.

- The company has partnerships in over 50 countries.

- Regulatory changes in key markets impact Mercuria's strategies.

Political factors are key for Mercuria. Geopolitical risks affect prices and supply. Governments support renewables, influencing investments. Trade laws and sanctions also shape trading, like in 2024.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Geopolitics | Oil price volatility, supply chain issues | War in Ukraine; 2.5M bpd trading |

| Trade Policies | Compliance, penalties; market shaping | EU GSP regulations; US energy policy shift |

| Renewable Energy | Investment decisions; strategic shifts | US allocated $400B+ for clean energy. |

Economic factors

Mercuria Energy Group Ltd. faces commodity price volatility. This directly impacts their financial performance. Price swings are driven by supply/demand, geopolitics, and market sentiment. In 2024, crude oil prices saw fluctuations, impacting trading outcomes. Effective hedging and risk management are crucial for navigating these market changes.

Global economic health, including inflation and interest rates, strongly affects commodity demand and trading opportunities. Rising resource costs and monetary tightening create challenges for Mercuria's growth. In 2024, global inflation is projected at 5.9%, impacting energy prices. Interest rate hikes by central banks, like the US Federal Reserve, also affect trading.

Mercuria's trading operations heavily rely on financing and strong bank ties. Securing credit, like its Samurai loans, is crucial for working capital and growth. In 2024, Mercuria secured a $1.5 billion revolving credit facility. Market liquidity impacts trade execution costs. The company's financial stability is vital.

Emerging Market Growth

Mercuria Energy Group strategically targets emerging markets for growth, focusing on infrastructure and partnerships to capitalize on rising energy demands. These markets offer significant potential for expanding trading volumes and strengthening its global footprint. For example, in 2024, emerging markets accounted for 45% of global energy consumption growth. Mercuria's investments align with forecasts predicting a 60% increase in energy demand from these regions by 2030. This strategic approach is expected to drive substantial revenue increases.

- 45% of global energy consumption growth in emerging markets (2024).

- 60% projected increase in emerging market energy demand by 2030.

Competition in the Commodity Trading Sector

Mercuria Energy Group Ltd. faces fierce competition in commodity trading. This competition includes giants like Glencore and Vitol. Intense rivalry, especially in LNG and carbon trading, squeezes profit margins.

- Mercuria's revenue in 2023 was approximately $150 billion.

- Glencore's revenue in 2023 was about $227 billion.

- Vitol's 2023 revenue was around $400 billion.

Economic factors heavily influence Mercuria Energy Group Ltd. The company faces commodity price volatility; in 2024, crude oil saw fluctuations. Global economic health, including inflation at 5.9% and interest rates, shapes commodity demand. Strong financing like the $1.5 billion credit facility is essential.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Commodity Prices | Directly affects financial performance | Oil price swings, impacting trading |

| Inflation & Interest Rates | Impacts demand & trading | Inflation: 5.9%; US Fed rate hikes |

| Financing & Liquidity | Crucial for operations & growth | $1.5B credit facility |

Sociological factors

Public perception significantly impacts Mercuria. The energy sector faces intense scrutiny regarding environmental and social responsibility. A 2024 survey showed 70% of consumers prefer eco-friendly firms. Failing to meet these expectations can damage Mercuria's reputation. Ethical conduct and human rights are crucial for maintaining stakeholder trust.

Societal expectations increasingly push companies to embrace Corporate Social Responsibility (CSR) and sustainability. Mercuria addresses these demands by prioritizing sustainability initiatives. For example, in 2024, Mercuria allocated $500 million towards renewable energy projects.

Mercuria, as a global energy trader, navigates diverse labor markets and human rights landscapes. They emphasize local hiring in operational communities, showing social impact awareness. The company implements policies to address human rights, ensuring ethical standards across its operations. In 2024, such practices are increasingly critical for stakeholder trust and regulatory compliance. These efforts reflect a commitment to responsible business conduct.

Community Engagement and Development

Mercuria Energy Group Ltd.'s operations span numerous regions, necessitating constant interaction with local communities. Positive community relations are crucial for Mercuria's social license to operate. Initiatives like local hiring and sponsorships can significantly enhance its reputation. For instance, in 2024, Mercuria invested $15 million in community development projects globally.

- Community engagement is essential for social license.

- Local hiring and sponsorships boost reputation.

- In 2024, Mercuria invested $15 million in projects.

Workforce Diversity and Inclusion

Mercuria, as a global energy trader, likely encounters societal pressures to promote workforce diversity and inclusion. A diverse workforce can offer various perspectives, enhancing innovation and decision-making. Companies with strong DEI programs often see improved employee satisfaction and retention rates. Data from 2024 indicates that companies with diverse leadership teams tend to outperform those without.

- In 2024, companies with strong DEI initiatives saw a 15% increase in employee satisfaction.

- Diverse teams are 35% more likely to outperform their competitors.

- Mercuria's commitment to DEI can enhance its brand reputation.

Public perception highly influences Mercuria's success in the energy sector. Ethical and sustainable practices are now crucial due to rising stakeholder expectations and increased regulatory scrutiny. In 2024, companies prioritizing Corporate Social Responsibility saw up to a 20% improvement in brand perception.

| Sociological Factor | Impact on Mercuria | 2024 Data Point |

|---|---|---|

| Public Perception | Affects reputation and stakeholder trust | 70% consumers prefer eco-friendly firms. |

| CSR & Sustainability | Drive investment and operational decisions | Mercuria invested $500M in renewables in 2024. |

| Community Engagement | Essential for social license and reputation | $15M invested in community projects in 2024. |

Technological factors

The digitalization of trading and operations is reshaping Mercuria's approach. Advanced data analytics can refine risk management and streamline supply chains. This is vital in a sector where margins are often slim. In 2024, the adoption of AI in trading increased by 15% among major commodity firms. Mercuria can benefit from these tech-driven efficiencies.

Mercuria is heavily invested in energy transition tech. They're funding firms focused on renewables, storage, and recycling minerals. This tech focus drives their low-carbon goals. In 2024, global investment in energy transition reached $1.77 trillion.

Mercuria relies on sophisticated trading platforms to execute trades efficiently. These platforms enable real-time risk management across commodity markets. Adapting to new trading technologies is crucial for Mercuria's competitiveness. In 2024, algorithmic trading accounted for about 60% of all U.S. equity trading volume, highlighting the importance of advanced tech.

Cybersecurity and Data Protection

Mercuria Energy Group Ltd. faces significant technological hurdles, particularly in cybersecurity and data protection. The company's dependence on digital platforms for trading makes it vulnerable to cyberattacks, potentially leading to financial losses and reputational damage. A recent report indicated a 30% rise in cyberattacks targeting energy firms in 2024, emphasizing the urgency of robust security measures. Protecting sensitive data and operational infrastructure is essential for maintaining business continuity and stakeholder trust.

- Cybersecurity threats targeting the energy sector increased by 30% in 2024.

- Data breaches can lead to significant financial losses and reputational damage.

- Investment in cybersecurity infrastructure is crucial for business continuity.

- Compliance with data protection regulations is essential.

Technological Innovation in Supply Chains

Technological innovation is critical for Mercuria's supply chain. It focuses on optimizing logistics, inventory, and commodity transportation. Investing in tech solutions can boost efficiency and cut costs. For example, the global supply chain software market is projected to reach $21.7 billion by 2025.

- Blockchain technology enhances transparency and security in commodity trading.

- AI and machine learning can predict demand and optimize inventory levels.

- Real-time tracking systems improve the monitoring of goods in transit.

Mercuria leverages tech to digitize trading and boost efficiency. Energy transition tech investments and advanced trading platforms are key focuses. However, cybersecurity threats pose a risk.

Mercuria uses innovation in its supply chain. Blockchain, AI, and real-time tracking improve this aspect. Investment in cybersecurity is very important, particularly to minimize data breaches.

| Tech Aspect | Mercuria's Focus | 2024/2025 Data |

|---|---|---|

| Digitalization | Trading & Ops | AI trading use increased by 15%. |

| Energy Transition | Renewables, storage | $1.77T in global investment (2024). |

| Cybersecurity | Data Protection | 30% rise in cyberattacks in 2024. |

Legal factors

Mercuria Energy Group Ltd. faces intricate international trade law compliance, covering imports, exports, and tariffs across various operational jurisdictions. Strict adherence is crucial to avoid legal repercussions. In 2024, global trade disputes impacted energy prices significantly. For example, the EU's carbon border tax affected petroleum product imports. The company must stay updated.

Mercuria must adhere to global financial regulations. This includes accounting principles and transparency. Compliance with anti-financial crime laws is essential. In 2024, regulatory fines for non-compliance hit record highs. Proper reporting maintains operational legitimacy.

Mercuria Energy Group Ltd. operates under stringent global sanctions and anti-money laundering regulations. The company maintains a robust compliance program, regularly updated to meet evolving legal standards. In 2024, penalties for non-compliance in the energy sector reached record highs, with fines exceeding $5 billion globally. Mercuria's focus on rigorous procedures aims to minimize risks related to illicit financial practices.

Contract Law and Dispute Resolution

Mercuria Energy Group Ltd. operates globally, making it heavily reliant on contracts for its commodity trading activities. Contract law complexities across various regions necessitate meticulous attention to legal frameworks. Effective dispute resolution mechanisms are crucial for mitigating potential financial losses from contractual disagreements. In 2024, the global commodities market saw approximately $20 trillion in transactions, highlighting the significant financial stakes involved.

- Compliance with international trade laws is essential.

- Adherence to specific contractual clauses is critical.

- Effective negotiation skills are vital for resolving disputes.

- Litigation can be extremely costly, averaging $100,000 to $500,000 per case.

Environmental Regulations and Standards

Mercuria Energy Group Ltd. faces stringent environmental regulations. The company must comply with rules on emissions, pollution, and conservation. Compliance affects operational expenses and needs investment in cleaner methods. The industry sees increasing environmental standards, especially concerning greenhouse gas emissions. These regulations can significantly influence Mercuria's financial performance and strategic planning.

- In 2024, the EU's Emissions Trading System (ETS) saw carbon prices around €80-€100 per ton, impacting energy companies' costs.

- Mercuria's investments in renewable energy projects are increasing, with a 15% rise in green energy portfolio in 2024.

- Compliance costs for environmental regulations rose by 8% for Mercuria in 2024, necessitating strategic adjustments.

Mercuria must navigate trade laws, financial rules, and environmental standards. Compliance with trade and financial regulations, including sanctions and anti-money laundering rules, is non-negotiable. Contracts are central; effective negotiation and dispute resolution are critical for protecting investments. These factors significantly affect financial outcomes and strategic decisions.

| Legal Area | Compliance Issue | Financial Impact (2024) |

|---|---|---|

| Trade Laws | Tariffs, Import/Export | EU Carbon Border Tax: Affects petroleum imports. |

| Financial Regulations | AML, Financial Crime | Fines in energy sector: exceeding $5B globally. |

| Environmental Rules | Emissions, Conservation | EU ETS carbon price: €80-€100 per ton. |

Environmental factors

Climate change is a major factor in the global energy transition, driving the shift from fossil fuels to cleaner sources. Mercuria actively invests in renewables and low-carbon solutions. In 2024, renewable energy investments hit $300 billion globally. Mercuria aims to increase its green energy portfolio by 20% by 2025. This strategic move aligns with a sustainable future.

Mercuria Energy Group Ltd. must adhere to diverse environmental rules in its operational regions. These regulations cover emissions, waste, and biodiversity. Compliance is crucial to evade penalties and retain operational licenses.

Mercuria's commodity trading and transportation activities have environmental impacts. They're focused on cutting greenhouse gas emissions. In 2024, they aimed to improve supply chain sustainability. This includes initiatives to reduce emissions and support cleaner energy.

Biodiversity and Natural Climate Solutions

Mercuria recognizes the importance of biodiversity and invests in nature-based solutions. This includes forest preservation and reforestation to address environmental health and ensure business sustainability. These initiatives are part of a broader effort to integrate environmental considerations into their operations. Recent data shows that nature-based solutions could provide over 30% of the cost-effective climate mitigation needed by 2030.

- Investment in forest carbon projects: $100 million by 2024.

- Target: 50,000 hectares of forest under conservation by 2025.

- Offsetting 1.5 million tons of CO2 emissions through these projects.

Resource Scarcity and Sustainability of Supply Chains

Resource scarcity and supply chain sustainability are critical environmental factors for Mercuria. The company's commodity trading activities expose it to environmental risks. Mercuria must manage the environmental impact of its operations. This includes assessing supply chain sustainability. Specifically, in 2024, the global demand for critical minerals surged by 20%, highlighting the urgency of sustainable sourcing strategies.

- Mercuria's operations face environmental risks.

- Supply chain sustainability is a key concern.

- The company must manage its environmental impact.

- Demand for critical minerals surged in 2024.

Environmental factors greatly shape Mercuria's strategy. Climate change drives their renewable energy investments, aiming for a 20% increase by 2025. The group focuses on emission reduction and sustainable supply chains, impacting commodity trading and transportation. Resource scarcity and biodiversity also impact their operations.

| Initiative | Goal | Data (2024) | Target (2025) |

|---|---|---|---|

| Renewable Energy Investment | Increase portfolio | $300B (Global) | 20% growth in Green Energy |

| Forest Carbon Projects | Invest | $100M invested | Conserve 50,000 hectares |

| Emissions Offset | Reduce CO2 | 1.5M tons offset | Reduce emissions further |

PESTLE Analysis Data Sources

The analysis incorporates data from governmental publications, financial institutions, and market research.