Microchip Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Microchip Technology Bundle

What is included in the product

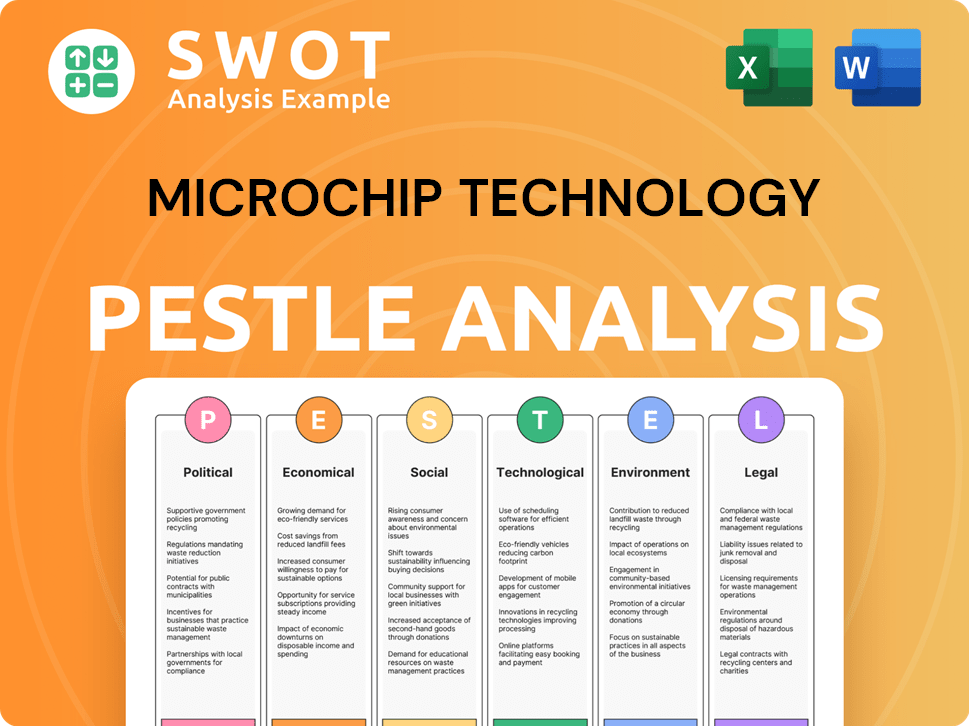

Analyzes how macro-environmental factors influence Microchip across six key areas: P,E,S,T,E,L.

A concise version that can be dropped into PowerPoints or used in group planning sessions.

Full Version Awaits

Microchip Technology PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. The Microchip Technology PESTLE Analysis you see now, detailing Political, Economic, Social, Technological, Legal, and Environmental factors, is what you will receive.

PESTLE Analysis Template

Explore how Microchip Technology navigates complex global forces with our PESTLE Analysis. Uncover the impact of political shifts, economic trends, and technological advancements on their strategy. We delve into social factors, legal regulations, and environmental concerns affecting their operations. This insightful analysis equips you with actionable intelligence for informed decision-making. Ready to gain a competitive edge? Download the full version now!

Political factors

Global political dynamics, including US-China trade tensions, affect the semiconductor industry. Export controls, like those from the US Department of Commerce, restrict market access. These policies impact companies like Microchip Technology. In 2024, the global semiconductor market is projected to reach $588 billion, influenced by these factors.

Government subsidies are reshaping the semiconductor landscape. The US CHIPS Act and EU Chips Act are key drivers. Microchip Technology has engaged with these initiatives. However, they paused their CHIPS Act application. In 2024, the US CHIPS Act allocated over $52 billion to boost domestic chip production.

Microchip Technology faces regulatory hurdles. It must adhere to international trade and technology export rules. This includes the Export Administration Regulations (EAR). Government procurement shifts also matter. For example, in 2024, the U.S. government increased scrutiny of semiconductor supply chains. This affects companies like Microchip that supply to government contractors.

Political Stability in Manufacturing Regions

Political stability profoundly impacts microchip production, heavily concentrated in Asia-Pacific, especially Taiwan and South Korea. These regions' political climates directly affect global supply chains. Any instability in these manufacturing hubs can disrupt production for firms like Microchip Technology. The Taiwan Strait situation remains a key concern.

- Taiwan accounts for over 90% of high-end chip manufacturing.

- South Korea is a major player in memory chips.

- Geopolitical tensions can lead to supply chain disruptions.

Government Investment in Key Sectors

Government investments significantly shape microchip demand, especially in defense, automotive, and 5G telecommunications. Increased government spending in these sectors boosts Microchip Technology's sales and market presence. Shifts in government priorities directly influence the company's strategic focus and financial outcomes. For example, the U.S. government's CHIPS and Science Act of 2022 allocated over $50 billion to boost domestic chip manufacturing, potentially benefiting Microchip Technology.

- U.S. defense spending in 2024 is projected to be around $886 billion, impacting chip demand.

- The global 5G infrastructure market is expected to reach $70 billion by 2025, further influencing demand.

Political factors, like trade wars, profoundly affect the semiconductor industry. Government subsidies through acts like the US CHIPS Act, totaling over $52 billion, also shape the market. Regulatory compliance, geopolitical stability in manufacturing hubs, and governmental investments, particularly in defense (projected $886B in 2024), influence Microchip Technology.

| Political Factor | Impact on Microchip | Data (2024/2025) |

|---|---|---|

| Trade Tensions | Affects market access and supply chains | Global semiconductor market projected to reach $588B in 2024 |

| Government Subsidies | Provides funding opportunities and shifts focus | US CHIPS Act allocated over $52B to domestic chip production |

| Geopolitical Stability | Risks to supply chains and production costs | Taiwan accounts for over 90% of high-end chip manufacturing |

Economic factors

The semiconductor industry is cyclical and highly susceptible to global economic shifts. Economic downturns decrease electronic device demand, affecting Microchip Technology's sales. In Q1 FY24, Microchip's net sales were $1.32 billion, down from $2.07 billion in Q1 FY23, indicating a challenging period. This reflects a slowing global economy and customer inventory corrections.

Managing inventory levels is crucial for Microchip Technology. High inventories in the supply chain can decrease orders, affecting production. Microchip has faced high inventory levels, prompting manufacturing restructuring. In Q1 2024, Microchip's inventory days were 168, reflecting these challenges. The company paused government subsidy applications because of these inventory issues.

The semiconductor sector demands substantial R&D and manufacturing investment. Economic health directly impacts companies' investment capabilities. Microchip Technology, for example, has adapted its capital spending due to economic shifts. In Q1 2024, Microchip's capital expenditures were $105.8 million, reflecting adjustments to market dynamics. This spending is critical for maintaining a competitive edge.

Currency Exchange Rates

Microchip Technology faces currency exchange rate risks due to its global operations. Fluctuations in exchange rates can significantly affect the cost of components and manufacturing. For instance, a stronger U.S. dollar can make Microchip's products more expensive in international markets. This impacts profitability and competitiveness, especially in regions like Asia and Europe, where a substantial portion of its revenue is generated.

- In fiscal year 2024, Microchip reported that currency fluctuations negatively impacted net sales by approximately $30 million.

- The Euro/USD exchange rate has been volatile, influencing the cost of goods sold.

- The company actively uses hedging strategies to mitigate these risks.

Consumer Spending and Demand

Consumer spending significantly influences microchip demand, especially for devices like smartphones and laptops. Consumer confidence and purchasing power directly impact this demand. The growing adoption of 5G technology further boosts this need. In 2024, global consumer electronics sales reached approximately $1.2 trillion.

- Demand for microchips is closely tied to consumer spending patterns.

- Consumer confidence levels directly affect purchasing decisions.

- 5G adoption is a key factor driving microchip demand.

- Consumer electronics sales reached $1.2T in 2024.

Economic factors significantly shape Microchip Technology's performance, especially in fluctuating global markets. Decreases in demand, mirroring economic downturns, directly impacted Q1 FY24 sales, which declined to $1.32 billion. Currency fluctuations continue to influence profitability, with impacts felt into 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Demand | Drives Sales | Consumer electronics sales: ~$1.2T |

| Currency | Affects Costs | Impact on sales: ~$30M negative |

| R&D and CapEx | Influence future prospects | Capital Expenditures: $105.8M |

Sociological factors

The rising popularity of smart devices and IoT fuels demand for Microchip's semiconductors. Global IoT spending reached $215.7 billion in 2024, expected to hit $253.8 billion by 2025. This trend boosts Microchip in consumer electronics and industrial sectors.

Consumers now demand constant tech advancements. This fuels the need for cutting-edge chips. Microchip Technology's strategy of quick product delivery meets these high expectations. In 2024, the semiconductor market grew, with a projected value of $580 billion. Microchip Technology's focus on innovation is key.

The semiconductor industry grapples with a significant workforce skills gap, especially in advanced engineering roles. This shortage could hinder Microchip Technology's innovation and manufacturing capabilities. According to a 2024 report, the industry needs to fill approximately 1 million jobs by 2030. Addressing this sociological challenge is critical for sustained growth.

Remote Work and Digital Transformation

Remote work and digital transformation fuel demand for semiconductors. This shift boosts the need for Microchip's products. The global remote work market is projected to reach $1.2 trillion by 2025. Microchip benefits from increased demand for its connectivity and computing solutions. Digital transformation spending is expected to hit $3.9 trillion in 2024.

- Remote work market projected to reach $1.2T by 2025.

- Digital transformation spending expected to be $3.9T in 2024.

Aging Population and Healthcare Technology

The world's aging population is significantly boosting the demand for healthcare technologies, creating a major growth area for microchip manufacturers. These chips are essential for advanced medical devices. The healthcare tech market is projected to reach $600 billion by 2025. This expansion offers semiconductor firms substantial opportunities.

- Global elderly population (65+) is expected to reach 1.6 billion by 2050.

- The medical device market is growing at about 5-7% annually.

- Microchips are vital in devices like pacemakers and glucose monitors.

The shift to remote work and digital tools amplifies semiconductor demand, benefiting Microchip's connectivity solutions, with the remote work market forecast at $1.2 trillion by 2025. Simultaneously, the demand for healthcare tech boosts the need for microchips, projected to reach $600 billion by 2025, offering Microchip growth opportunities.

| Sociological Factor | Impact | Data (2024/2025) |

|---|---|---|

| Remote Work | Increases Demand | $1.2T by 2025 (Remote Work Market) |

| Healthcare Tech | Growth Driver | $600B by 2025 (Healthcare Market) |

| Skills Gap | Industry Challenge | 1M Jobs Need Filling by 2030 |

Technological factors

Moore's Law, though slowing, still influences semiconductor miniaturization, resulting in smaller, more powerful chips. Microchip Technology focuses on smaller process nodes, vital for AI and autonomous vehicles. In 2024, the global semiconductor market reached ~$527 billion. Microchip's R&D spending was ~$700 million in FY24, reflecting their commitment to innovation.

The surge in AI and machine learning is fueling demand for advanced semiconductors. This boosts the need for specialized chips, driving innovation in microchip designs. Microchip Technology can capitalize on this by developing chips for AI applications.

The global expansion of 5G networks boosts demand for semiconductors. This impacts consumer electronics and telecom. Microchip Technology benefits from faster connectivity needs. In 2024, 5G adoption is expected to reach over 1.5 billion connections worldwide, fueling demand.

Development of New Materials and Architectures

Microchip Technology invests heavily in research and development, especially in novel materials and 3D stacking. This focus improves power efficiency and boosts transistor density, crucial for modern devices. Recent advancements aim to significantly enhance data transfer speeds. These innovations are vital for staying competitive in the evolving tech landscape.

- Microchip Technology's R&D spending was $1.5 billion in fiscal year 2024.

- 3D chip stacking can increase transistor density by up to 50%.

- New materials could reduce power consumption by 30%.

Increased Focus on Cybersecurity in Hardware

The rising connectivity of devices amplifies the need for robust cybersecurity in hardware. Microchip Technology must integrate advanced security features into its chip designs to combat evolving threats. In 2024, the global cybersecurity market is projected to reach $223.8 billion, reflecting this critical focus. This surge underscores the necessity for semiconductor firms to prioritize security.

- Cybersecurity market is projected to reach $223.8 billion in 2024.

- Increased need for advanced security features in chip design.

Technological advancements continue to drive microchip innovation. R&D investments by Microchip Technology hit $1.5B in FY24. The focus on advanced security, as the cybersecurity market hit $223.8B in 2024, is crucial. This involves both cutting-edge hardware & advanced power efficiency.

| Technological Factor | Impact on Microchip Technology | 2024 Data |

|---|---|---|

| Miniaturization | Smaller, more powerful chips | Global semiconductor market: ~$527B |

| AI and ML | Demand for advanced semiconductors | Microchip's R&D: ~$1.5B in FY24 |

| 5G Expansion | Increased connectivity needs | 5G adoption: ~1.5B connections |

Legal factors

Microchip Technology relies heavily on intellectual property protection, particularly patents, to safeguard its innovations in the semiconductor market. As of 2024, the company holds over 3,000 patents globally, a testament to its commitment to innovation. This extensive patent portfolio helps Microchip maintain a strong competitive edge by preventing rivals from replicating its technologies. Moreover, this strategy supports Microchip’s market position, allowing for sustained growth.

Microchip Technology faces intricate international trade regulations. These include export controls and sanctions, affecting its global operations. In 2024, the company's international sales accounted for over 80% of its total revenue, highlighting the impact of these regulations. Compliance requires significant resources and expertise. Any violations can lead to substantial penalties.

Microchip Technology's semiconductor products must comply with global safety standards. For example, automotive components require strict adherence to ISO 26262. Failing to meet these legal standards can result in significant penalties and market restrictions. The company must also navigate evolving regulations like the EU's RoHS directive, which impacts materials used in manufacturing. In Q1 2024, Microchip's legal and compliance costs were approximately $15 million.

Antitrust and Competition Laws

Microchip Technology must adhere to antitrust and competition laws, which aim to prevent monopolies and promote fair market practices. These laws are critical for ensuring that Microchip doesn't engage in activities that could stifle competition or harm consumers. Non-compliance can lead to significant legal and financial repercussions, including hefty fines and potential damage to the company's reputation. For instance, in 2024, the European Commission fined several companies for antitrust violations, with penalties reaching billions of euros.

- Antitrust laws prevent monopolies and unfair competition.

- Compliance is crucial to avoid legal issues and penalties.

- Non-compliance can result in substantial financial fines.

- Legal challenges can harm Microchip's reputation.

Data Privacy and Security Regulations

Data privacy and security regulations are critical for Microchip Technology. They must comply to protect user data, given the rise in data processed by microchips. The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are key. Non-compliance may lead to hefty fines.

- GDPR fines can reach up to 4% of global turnover.

- CCPA violations may cost up to $7,500 per record.

Microchip Technology must navigate global legal landscapes, including patent protection and compliance. Intellectual property, like its 3,000+ patents, safeguards its competitive edge, particularly as semiconductor market dynamics change. The company closely adheres to evolving safety standards and stringent data privacy regulations, avoiding severe penalties. For Q1 2024, legal and compliance expenses were roughly $15 million.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Patents | Protect innovations, competitive edge | Microchip holds 3,000+ global patents. |

| Trade Regulations | Affect global operations, require compliance | International sales accounted for 80%+ of revenue in 2024. |

| Compliance Costs | Adherence to safety, privacy standards | Q1 2024 compliance cost approx. $15M |

Environmental factors

The semiconductor industry faces increasing scrutiny regarding its environmental impact, particularly concerning energy, water usage, and chemical waste. Microchip Technology is responding to the pressure by implementing sustainable manufacturing practices. For example, the company has invested in water conservation, aiming to reduce its environmental footprint. According to recent reports, Microchip Technology is increasing its sustainable manufacturing practices by 15% in 2024 and plans to increase it up to 20% in 2025.

Energy efficiency is key for microchips, especially with AI's rising power demands. Optimizing chip energy use is vital. In 2024, the semiconductor industry consumed about 6% of global electricity. Reducing energy consumption is crucial. Efficiency improvements are driven by environmental concerns and cost savings.

The semiconductor industry significantly impacts waste management, particularly through e-waste from discarded electronics. Growing environmental concerns pressure companies to address product lifecycles, and reduce waste. Globally, e-waste generation reached 62 million tons in 2022. Semiconductor firms are exploring recycling and waste reduction strategies.

Use of Renewable Energy Sources

Microchip Technology actively pursues renewable energy to meet environmental targets. The semiconductor sector aims to cut carbon footprints by switching to green energy. Microchip has invested in solar projects to power its facilities. The company aims to decrease emissions through these initiatives.

- In 2024, Microchip Technology's sustainability report highlighted a 15% reduction in carbon emissions from its global operations through the adoption of renewable energy.

- Microchip has allocated $50 million towards renewable energy projects, including solar and wind power initiatives, as of early 2025.

- The company aims to source 50% of its electricity from renewable sources by the end of 2026.

Development of Environmentally Friendly Products

The push for eco-friendly electronics significantly impacts Microchip Technology. Consumers increasingly want sustainable products, boosting demand for energy-efficient chips. Microchip's tech is vital for electric vehicles and renewable energy, aligning with this trend. The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

- Demand for energy-efficient chips is rising.

- Microchip plays a role in EVs and renewables.

- Green tech market is expanding rapidly.

Microchip Technology's sustainability efforts focus on reducing environmental impact. The company is implementing renewable energy and water conservation strategies. These initiatives are driven by both environmental concerns and cost savings.

| Sustainability Aspect | Initiative | 2024/2025 Data |

|---|---|---|

| Renewable Energy | Investment in solar and wind projects. | $50M allocated by early 2025; aiming for 50% renewable electricity by 2026. |

| Carbon Emissions | Reduction strategies. | 15% reduction in carbon emissions in 2024. |

| Market Trends | Eco-friendly demand. | Green tech market projected to reach $74.6B by 2025. |

PESTLE Analysis Data Sources

This Microchip PESTLE relies on industry reports, government databases, and economic forecasts.