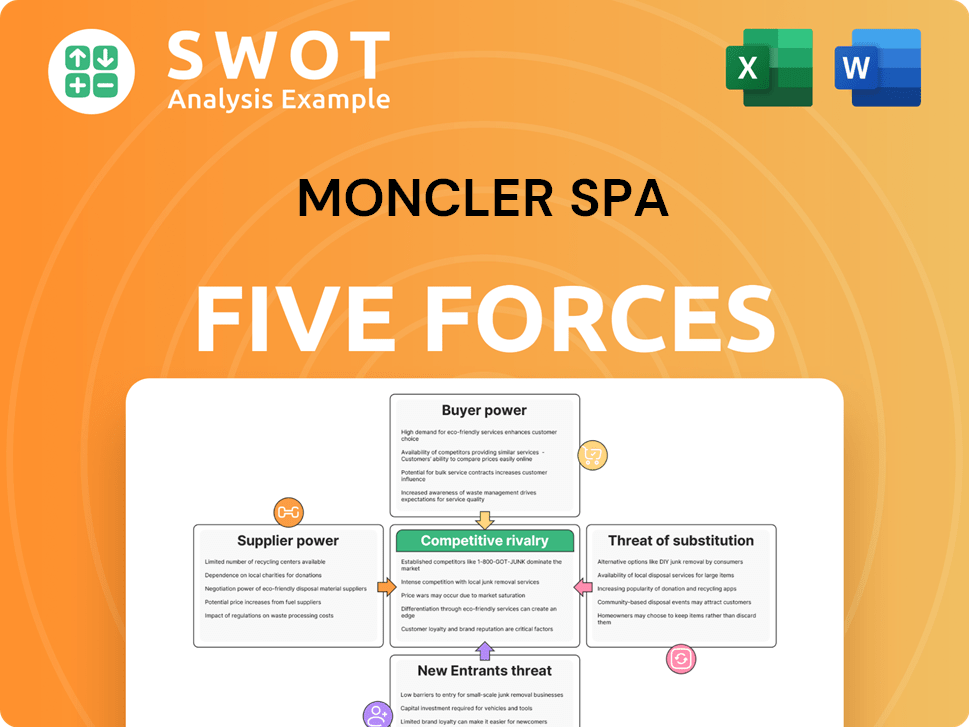

Moncler SpA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler SpA Bundle

What is included in the product

Examines competitive forces and their impact on Moncler's market position.

Instantly identify areas of vulnerability with a clear, color-coded risk rating.

Full Version Awaits

Moncler SpA Porter's Five Forces Analysis

This preview showcases the Moncler SpA Porter's Five Forces analysis you'll receive. It details competitive rivalry, supplier power, and more. Expect a clear, concise, and ready-to-use examination of the company. The insights provided are designed for immediate application. You will have instant access to this document after purchase.

Porter's Five Forces Analysis Template

Moncler SpA operates in a luxury market with strong brand power, influencing buyer behavior and pricing. The threat of new entrants is moderate, considering high barriers like brand reputation and capital. Supplier power is generally low due to diversified sourcing options. Substitute products, like other luxury apparel brands, pose a moderate threat. Competitive rivalry is intense, marked by established players and evolving consumer preferences.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Moncler SpA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Moncler's suppliers wield moderate power, especially those providing specialized materials like premium down, crucial for their products. Limited supplier options could lead to increased costs for Moncler. In 2023, Moncler's cost of sales was approximately €1.3 billion, highlighting supplier impact. Analyzing supplier concentration and material alternatives is vital.

Moncler's supplier power hinges on its reliance on exclusive contracts. These contracts can give suppliers leverage. For example, if Moncler depends on a few suppliers, its negotiating power decreases. In 2024, Moncler's cost of sales was 43.4% of revenue, showing supplier influence. Diversifying sourcing helps mitigate this.

Moncler's supplier power depends on switching costs. High costs, like finding suppliers meeting quality standards, boost supplier influence. In 2024, Moncler sourced materials from diverse suppliers. Analyzing these costs aids Moncler in reducing supplier dependence. For example, 2024's cost of goods sold was reported at €1.2 billion.

Supplier Power 4

Supplier power for Moncler is moderate, influenced by the luxury market's specifics. Suppliers' forward integration presents a risk, potentially bypassing Moncler. Monitoring this threat is crucial for maintaining market dominance. In 2024, Moncler's cost of goods sold (COGS) was approximately EUR 800 million. Suppliers' actions directly affect profitability.

- Forward integration risk: Suppliers could enter Moncler's market.

- Cost impact: Suppliers influence Moncler's COGS.

- Market Position: Suppliers actions could challenge Moncler's dominance.

- Strategic monitoring: Constant evaluation of supplier moves is essential.

Supplier Power 5

Moncler's supplier power is moderate, influenced by its reliance on specialized materials and manufacturing processes. The geographical distribution of suppliers, primarily in Italy, presents some concentration risk. Geopolitical events and trade regulations could impact raw material availability and costs. Diversifying the supply chain could mitigate these risks.

- Italy accounts for a significant portion of Moncler's manufacturing, with potential exposure to regional economic fluctuations.

- The luxury goods sector faces increasing scrutiny regarding supply chain ethics and sustainability, adding pressure on supplier relationships.

- Moncler's ability to source from multiple suppliers helps maintain some bargaining power.

- In 2024, the company continued to invest in supply chain transparency and traceability initiatives.

Moncler faces moderate supplier power due to specialized materials. Supplier influence is evident in cost of sales, which was about €1.3 billion in 2023. Strategic monitoring of supplier actions is crucial for maintaining market position and profitability.

| Aspect | Details |

|---|---|

| COGS 2024 | €1.2 billion |

| Cost of Sales 2024 as % of Revenue | 43.4% |

| Forward Integration Risk | Suppliers could compete |

Customers Bargaining Power

Customers' bargaining power is moderate, given many luxury brand options. Price sensitivity varies, influencing buyer power. Moncler combats this by differentiating its products. In 2024, Moncler's revenue reached approximately €3 billion.

Moncler's buyer power is influenced by customer concentration. A reliance on major retailers gives them leverage. In 2024, Moncler's direct-to-consumer sales strategy continues to grow. This shift reduces reliance on wholesale channels, improving pricing power.

Customers' access to information and price comparison websites boosts their bargaining power. Online reviews and social media shape perceptions and influence buying decisions. Moncler must manage its online reputation and offer competitive pricing to stay ahead. In 2024, Moncler's e-commerce sales grew, highlighting the importance of online presence. This indicates customer influence on brand strategies.

Buyer Power 4

Buyer power significantly impacts Moncler. Customers face low switching costs, as many luxury brands offer similar products. This enables customers to easily choose competitors. Moncler must focus on brand loyalty through quality, service, and exclusivity. In 2024, Moncler's sales were around €3 billion, showing customer influence.

- Low switching costs increase buyer power.

- Competitor availability is a factor.

- Brand loyalty is crucial for Moncler.

- 2024 sales highlight customer impact.

Buyer Power 5

Buyer power is moderate for Moncler. Economic conditions and consumer spending habits significantly influence this power. During downturns, customers become more price-conscious, potentially reducing spending on luxury items. Moncler must adapt marketing and pricing strategies to respond to these shifts.

- In 2024, the luxury market saw fluctuations due to global economic uncertainty.

- Price sensitivity increased among luxury consumers.

- Moncler's ability to maintain brand value is crucial.

- Strategic pricing and marketing are key.

Customer bargaining power for Moncler is moderate, influenced by diverse luxury options and price sensitivity. Access to information via the internet impacts buyer decisions. Moncler's 2024 revenue was roughly €3 billion, reflecting customer impact.

| Factor | Impact | Mitigation |

|---|---|---|

| Switching Costs | Low | Brand Loyalty |

| Competitors | Many | Differentiation |

| Price Sensitivity | High | Strategic Pricing |

Rivalry Among Competitors

Competitive rivalry is fierce in the luxury apparel market. Brands compete via innovation, marketing, and pricing. For Moncler, understanding rivals' strategies is key. In 2024, the global luxury goods market reached $360 billion, highlighting intense competition. Moncler's 2023 revenue was €2.6 billion, indicating its position among rivals.

The luxury apparel market features numerous competitors, heightening rivalry. A fragmented market structure, with many players, escalates competition. Moncler, to stand out, needs to focus on unique designs and quality. In 2024, the global luxury apparel market was valued at $178 billion.

Competitive rivalry at Moncler is significantly influenced by market growth. In 2024, the luxury outerwear market saw moderate growth, intensifying competition. Moncler must innovate and expand into new segments. This strategy helps maintain its market position and increase sales, as the global luxury market is projected to reach $500 billion by the end of 2024.

Competitive Rivalry 4

Competitive rivalry in the luxury outerwear market is influenced by product differentiation and brand loyalty. Moncler's strong brand recognition helps mitigate competition. However, the company must continuously innovate and invest in marketing. In 2024, Moncler's revenue reached €3.11 billion, showcasing its brand strength.

- Product innovation is key to maintaining a competitive edge.

- Brand loyalty helps to reduce price sensitivity.

- Marketing investments support brand positioning.

- Moncler's financial performance reflects its competitive position.

Competitive Rivalry 5

Moncler faces intense rivalry, significantly influenced by competitors' advertising and promotional spending. Aggressive marketing campaigns heighten competition and inflate expenses. In 2024, the luxury goods market saw a 10-15% increase in marketing budgets to stay competitive. Moncler must optimize its marketing expenditure. It needs to concentrate on effective, targeted strategies to maintain its market position.

- Luxury brands are increasing digital marketing spend by approximately 20% to reach consumers.

- Moncler's advertising costs were around 12% of revenue in 2023.

- Competitors like Canada Goose and Stone Island are also boosting their marketing.

- Effective strategies include influencer collaborations and personalized campaigns.

Moncler faces intense rivalry in luxury apparel. Competition is heightened by marketing efforts. Brands vie for market share. Innovation and brand strength are vital.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | Luxury market projected to hit $500B in 2024. | Intensifies competition. |

| Marketing Spend | Luxury brands boosted marketing budgets 10-15% in 2024. | Increases competitive pressures. |

| Moncler's Revenue | €3.11B in 2024 | Indicates brand strength. |

SSubstitutes Threaten

The availability of substitutes, like other luxury outerwear brands or cheaper options, is a moderate threat. Customers could choose brands with similar features but lower prices. For example, in 2024, brands like Canada Goose and Mackage offered competitive products. To justify its premium pricing, Moncler must emphasize its superior quality and brand value. In 2023, Moncler's gross margin was 76.9% showing its ability to maintain a strong pricing strategy.

Changing consumer preferences and fashion trends pose a threat to Moncler. Customers might opt for different styles. For instance, the shift toward athleisure has seen brands like Lululemon gain popularity. In 2024, Lululemon's revenue was $9.6 billion, reflecting this trend.

The threat from substitutes hinges on their price-performance ratio. Cheaper alternatives with similar functionality can lure customers away. Moncler must carefully balance pricing and performance to stay competitive. In 2024, the luxury outerwear market saw increased competition, with brands like Canada Goose and The North Face offering alternatives. Maintaining a strong brand image and product innovation is crucial for Moncler.

Threat of Substitution 4

The threat of substitutes for Moncler is influenced by the perceived value of alternatives, including other luxury brands and high-end retailers. Strong brand image and positive consumer perceptions of these substitutes can drive their adoption. Moncler needs to constantly reinforce its brand value to stay ahead. In 2024, the luxury goods market is projected to reach approximately $400 billion, showing the vast pool of alternatives.

- High-end fashion brands and retailers are key substitutes, with brands like Canada Goose and Gucci posing competitive threats.

- The perceived value and brand image of these substitutes are crucial to consumer choice.

- Moncler must focus on innovation, design, and marketing to maintain its competitive edge.

- Investment in brand building is essential to protect market share.

Threat of Substitution 5

The threat of substitutes for Moncler stems from tech advancements. New materials and manufacturing techniques could create superior alternatives. Moncler must innovate to avoid losing market share to these evolving options. Consider the rise of sustainable alternatives, which appeal to eco-conscious consumers. This requires strategic R&D investment to maintain a competitive edge.

- Technological advancements could introduce innovative substitutes.

- Materials with improved performance or sustainability pose a threat.

- Moncler must invest in R&D to stay ahead.

- Sustainable alternatives are gaining popularity.

Substitutes like Canada Goose and high-end retailers challenge Moncler. Their brand image and perceived value impact consumer choices. Continuous innovation in design and marketing is vital. The luxury goods market, valued at $400B in 2024, highlights the competitive landscape.

| Substitute Type | Impact | Mitigation |

|---|---|---|

| Luxury Brands | High; brand perception. | Innovation, design. |

| Tech Materials | Moderate; advanced materials. | R&D investment. |

| Sustainable Options | Growing; eco-conscious. | Eco-friendly designs. |

Entrants Threaten

The threat of new entrants to Moncler is low, thanks to significant barriers. Building a luxury brand requires substantial capital and years to cultivate brand recognition. Established distribution networks, like Moncler's, are difficult for newcomers to replicate. Moncler's strong brand and retail presence provide a competitive advantage. In 2024, Moncler's revenue reached €3.1 billion, highlighting its market strength.

Brand building and marketing costs pose substantial entry barriers. Creating a luxury brand demands significant, long-term investment. Moncler's brand equity offers a key competitive advantage. In 2023, Moncler spent €467 million on marketing. This high spending makes it difficult for new entrants to compete.

New entrants face significant hurdles in the luxury outerwear market. Accessing distribution channels and prime retail space is difficult. Moncler's strong relationships and control over key locations create a barrier. The company's distribution network is a key advantage. In 2024, Moncler's retail sales grew, demonstrating this strength.

Threat of New Entrants 4

New entrants face hurdles like regulations. Sticking to quality standards and trade rules costs money. Moncler's seasoned team and finances help it deal with these demands. In 2024, the fashion industry saw a rise in compliance costs, about 10-15% more. This impacts smaller brands more. Moncler's strong brand and supply chain give it an edge.

- Compliance costs rose 10-15% in 2024.

- Moncler has a strong brand.

- Moncler has a robust supply chain.

- New entrants struggle with these factors.

Threat of New Entrants 5

New entrants face challenges due to the potential for retaliation from existing players like Moncler. Established companies can use aggressive pricing and marketing to protect their market share. Moncler's strong brand and market position act as a significant deterrent for new competitors. This makes it harder for new companies to gain a foothold.

- Moncler's revenue for the year ended December 31, 2023, was €2.6 billion.

- The company's strong brand reputation enhances its ability to fend off new entrants.

- Aggressive marketing strategies would be a key tactic.

- High barriers to entry limit the threat.

Moncler faces a low threat from new entrants due to substantial barriers. High startup costs and established brand recognition make market entry difficult. New companies struggle to match Moncler's strong retail presence and brand equity.

| Factor | Impact | Moncler's Advantage |

|---|---|---|

| Brand Equity | High Cost | Strong brand, high marketing spend (€467M in 2023) |

| Distribution | Limited Access | Established network, prime retail locations |

| Regulations | Increased Costs (10-15% in 2024) | Strong supply chain, experienced team |

Porter's Five Forces Analysis Data Sources

Moncler's analysis employs financial statements, market reports, and competitor data. Key sources include company filings and industry publications. This ensures a data-driven assessment.