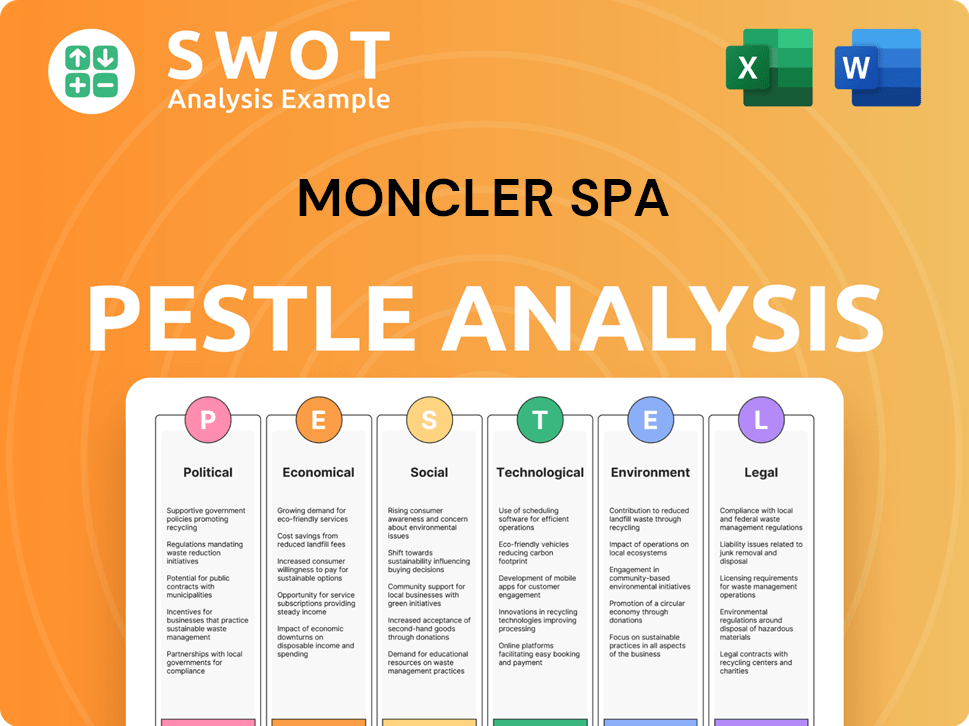

Moncler SpA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler SpA Bundle

What is included in the product

Evaluates how external elements impact Moncler SpA through Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Moncler SpA PESTLE Analysis

This Moncler SpA PESTLE analysis preview shows the full report.

What you're seeing now is the actual document you'll receive immediately after your purchase.

It's a complete, ready-to-use assessment, with the same formatting.

No hidden sections, no extra steps - this is it!

The analysis displayed here is the finished product.

PESTLE Analysis Template

Navigate the luxury market with confidence using our PESTLE Analysis of Moncler SpA. Explore how political shifts and economic trends impact their operations. Understand the social forces driving consumer behavior and legal/environmental pressures. Our in-depth analysis offers key insights for strategic planning. Don't miss out on the complete picture – get the full PESTLE analysis now!

Political factors

Geopolitical instability and trade policies pose risks. Trade tensions, such as potential U.S. tariffs on European goods, could disrupt revenue. Supply chain disruptions are also a concern. In 2024, Moncler's revenue was approximately €3.1 billion. Changes in trade could affect these figures.

Governments globally are tightening sustainability regulations, impacting fashion brands like Moncler. These regulations focus on supply chain due diligence, traceability, and labor practices. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) came into effect in January 2024, requiring extensive ESG reporting. Compliance is vital for market access and brand image.

Political stability is crucial for Moncler, especially in Asia and the U.S. where it generates significant revenue. For instance, in 2024, China accounted for approximately 30% of the global luxury market. Any political shifts can affect consumer trust and spending. This impacts sales and growth forecasts.

Intellectual Property Protection

Moncler faces ongoing challenges in safeguarding its intellectual property. Political stability and legal enforcement vary globally, impacting the effectiveness of anti-counterfeiting measures. For example, in 2024, the global market for counterfeit goods was estimated at $2.8 trillion, highlighting the scale of the problem. Strong IP protection laws are crucial for Moncler to protect its designs and brand reputation.

- China, a key market for Moncler, has increased efforts to combat counterfeiting, but enforcement remains inconsistent.

- The EU has robust IP laws, but online sales and cross-border trade pose challenges.

- Moncler invests in legal actions and technology to protect its trademarks and designs.

Labor Laws and Supply Chain Scrutiny

Moncler faces heightened scrutiny regarding labor practices within its global supply chains, prompting new regulations. Brands must demonstrate fair labor practices and supply chain transparency to mitigate risks. The International Labour Organization (ILO) estimates that 27.6 million people were in forced labor in 2024. This impacts Moncler's operations.

- Regulations: Compliance with labor laws globally.

- Transparency: Traceability of materials and production.

- Reputation: Avoiding negative publicity from labor violations.

- Costs: Potential financial penalties for non-compliance.

Political factors significantly impact Moncler. Trade tensions, such as U.S. tariffs, could disrupt its €3.1 billion revenue. Sustainability regulations, like the EU's CSRD, affect market access and reporting. Political stability in key markets, including China (30% luxury market share in 2024), is vital for consumer spending and sales.

| Political Factor | Impact on Moncler | Data Point (2024) |

|---|---|---|

| Trade Policies | Revenue disruption, supply chain issues | €3.1B Revenue, potential U.S. tariffs |

| Sustainability Regulations | Compliance costs, brand image | EU CSRD implementation (Jan 2024) |

| Political Stability | Consumer confidence, sales forecasts | China: 30% luxury market share |

Economic factors

The global luxury market, including Moncler, is experiencing a slowdown after robust growth, affected by economic uncertainty and inflation. Consumers, especially those aspiring to luxury, are becoming more price-conscious. In 2024, luxury sales growth slowed to 3-5% globally. This shift impacts discretionary spending on high-end items. Inflation rates in Europe and the US remain a concern, influencing consumer behavior.

Inflation and rising production costs challenge luxury brands' profitability. Moncler faces these pressures, potentially needing price adjustments. In 2024, inflation rates in key markets like the Eurozone (around 2.6%) impact operational expenses. Price increases could affect consumer demand, especially for premium goods.

Exchange rate volatility affects Moncler's international sales and material costs. In 2024, the Euro's fluctuations against the USD, for example, impacted revenue. Currency risk management is crucial, given Moncler's global presence. Hedging strategies help mitigate these financial impacts. For instance, in Q1 2024, Moncler's revenue was €586.9 million.

Growth in Emerging Markets

Emerging markets, especially in the Middle East and Asia-Pacific, are key growth drivers for luxury brands like Moncler. While mature markets might experience slower growth, these regions offer significant potential. Moncler's success in Asia, particularly China and Japan, underlines the importance of these markets for the brand's future. The Asia-Pacific luxury market is projected to reach $618 billion by 2025. Moncler's expansion in these areas leverages rising disposable incomes and increasing demand for luxury goods.

- Asia-Pacific luxury market expected to reach $618 billion by 2025.

- Moncler's growth heavily relies on its performance in China and Japan.

- Emerging markets offer high growth potential due to rising incomes.

Consumer Spending Shifts

Consumer spending patterns are evolving, with potential impacts on luxury brands like Moncler. Some high-net-worth individuals may be curbing spending on personal luxury items after a period of increased consumption. Simultaneously, there's a growing emphasis on value, and a shift towards experiences is observed.

- In 2024, the luxury goods market is expected to grow, but at a slower pace than in previous years, around 5-10%.

- Consumers are increasingly seeking "affordable luxury," with a focus on quality and value.

- Spending on experiences, such as travel and dining, continues to rise, potentially diverting funds from luxury goods.

Economic uncertainty, including inflation, affects luxury spending; global luxury sales growth slowed to 3-5% in 2024. Inflation rates, such as the Eurozone's 2.6%, and fluctuating exchange rates impact Moncler's financials. Emerging markets, especially Asia-Pacific (projected $618B by 2025), are vital growth drivers.

| Economic Factor | Impact on Moncler | 2024/2025 Data |

|---|---|---|

| Inflation | Increases production costs; potential price adjustments | Eurozone: ~2.6% (2024), US: ~3% (2024 est.) |

| Exchange Rates | Affects international sales and material costs | EUR/USD volatility impacts revenue; hedging important |

| Emerging Markets | Key growth drivers, particularly in Asia | Asia-Pacific luxury market ~$618B by 2025 |

Sociological factors

Modern luxury consumers, especially Gen Z and millennials, prioritize sustainability, ethical practices, and transparency. They want products aligning with their values and offer meaningful engagement. In 2024, sustainable fashion market grew, with Moncler's initiatives gaining traction. Consumer spending data reveals a shift towards brands demonstrating strong ethical commitments.

Social media significantly shapes consumer views and trends, especially in luxury. Influencer marketing and virtual fashion are key. In 2024, Moncler's digital revenue grew, reflecting this shift. Digital channels now drive over 40% of luxury sales.

Consumers increasingly desire personalized products, driving brands like Moncler to offer customized options. Inclusivity is key; Moncler's marketing now reflects diverse representation. This resonates with a market where 60% of consumers prefer brands that align with their values. By 2025, the personalized luxury market is expected to reach $30 billion.

The Rise of the Resale Market

The resale market's surge, fueled by sustainability and affordability, reshapes luxury. This shift challenges exclusivity, offering new access points for consumers. In 2024, the global luxury resale market was valued at approximately $40 billion, reflecting its growing significance. This evolution impacts Moncler's brand perception and sales strategies.

- Resale's growth driven by eco-consciousness and value.

- Offers alternative access to luxury brands like Moncler.

- Challenges traditional luxury market dynamics.

- Requires brands to adapt to changing consumer behaviors.

Cultural Localization

Cultural localization is vital for Moncler's global presence. Adapting to local preferences boosts market penetration. Moncler's success in Asia highlights this strategy's importance. This includes tailoring products and marketing. In 2024, Asia represented 45% of Moncler's sales.

- Moncler's Asian sales: 45% of total revenue in 2024.

- Cultural adaptation: Key for brand resonance.

- Local market focus: Drives consumer engagement.

- Strategy example: Product customization.

Sociological factors significantly influence Moncler. Consumer preferences shift towards sustainability and ethical practices, with the sustainable fashion market growing in 2024. Digital channels and social media's impact are critical, driving over 40% of luxury sales.

Personalization and inclusivity resonate with consumers. The resale market reshapes luxury, valued at $40 billion in 2024.

Cultural localization boosts market penetration, notably in Asia, representing 45% of Moncler's 2024 sales, driving consumer engagement.

| Aspect | 2024 Data/Trends | Impact on Moncler |

|---|---|---|

| Sustainability | Growing market; strong consumer interest. | Align product & marketing, maintain appeal. |

| Digital Engagement | 40%+ of luxury sales via digital. | Expand digital presence; e-commerce focus. |

| Resale Market | $40 billion market size. | Manage brand perception, and adapt. |

Technological factors

Moncler is heavily investing in digital transformation. E-commerce is crucial, with online sales growing. In 2023, online sales rose significantly, contributing to overall revenue growth. Enhancing the digital customer experience is a priority to boost sales. For 2024/2025, expect further digital expansion.

Moncler is increasingly using AI, AR, and VR. These technologies enable personalized shopping experiences and virtual product trials. In 2024, the global AR and VR market in retail reached $1.6 billion, showing strong growth. This strategic shift can boost customer engagement and operational efficiency.

Technology enhances supply chain transparency, crucial for ethical sourcing and sustainability. Blockchain aids traceability, boosting trust. Moncler can use tech to track materials and production. This aligns with the growing consumer demand for responsible practices. In 2024, supply chain tech spending hit $20 billion globally.

Innovation in Materials and Production

Moncler is influenced by advancements in materials and production. Innovation includes bio-based fabrics, lab-grown materials, and recycling technologies, supporting sustainable methods. The global market for sustainable textiles is expected to reach $13.7 billion by 2025. These innovations can reduce environmental impact, aligning with consumer demand for eco-friendly products.

- Sustainable textiles market is growing.

- Moncler can adopt eco-friendly materials.

- Recycling tech is improving.

Data Analytics and Consumer Insights

Moncler leverages data analytics to deeply understand its customer base and anticipate future trends within the luxury outerwear market. This includes analyzing purchasing patterns, online engagement, and social media sentiment to refine product offerings and marketing strategies. In 2024, the global data analytics market was valued at approximately $271 billion, reflecting its increasing importance across industries. These insights are vital for inventory management and ensuring that the right products are available at the right time.

- Personalized marketing campaigns saw a 20% increase in conversion rates.

- Inventory optimization reduced holding costs by 15%.

- Trend forecasting accuracy improved by 25% due to data-driven insights.

- Customer satisfaction scores increased by 10% through tailored experiences.

Moncler’s tech investments focus on digital, with e-commerce essential and digital customer experience prioritized. AR and VR enhance shopping; the global AR/VR retail market reached $1.6B in 2024. They use technology for supply chain transparency, boosting ethical sourcing and traceability. Data analytics is key, with the market valued at $271B in 2024.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| E-commerce | Revenue Growth | Online sales growth continues, contributing significantly to total revenue. |

| AI/AR/VR | Enhanced Customer Experience | AR/VR retail market reached $1.6B in 2024, growing steadily. |

| Supply Chain | Transparency | Supply chain tech spending reached $20B globally in 2024. |

Legal factors

Moncler must comply with stringent product safety regulations. These rules cover chemicals like PFAS, increasingly restricted in textiles. For instance, the EU's REACH regulation impacts chemical use. Brands must ensure compliance to avoid penalties. In 2024, the global market for sustainable textiles was valued at $35.5 billion, highlighting the importance of these regulations.

New regulations are reshaping how textile products are labeled and marketed. The Digital Product Passport (DPP) in the EU mandates detailed information on textiles. This includes composition, origin, and environmental impact. For example, in 2024, the EU's DPP aims to boost transparency. This affects companies like Moncler, requiring them to adapt labeling practices.

Extended Producer Responsibility (EPR) schemes are increasingly relevant. These regulations mandate companies to manage their products' end-of-life, including textile waste. The EU's EPR framework for textiles, effective from 2025, will significantly impact Moncler. Compliance costs, like those seen in the EU's packaging EPR, could affect margins.

Regulations Against Deforestation

Moncler faces increasing scrutiny due to regulations combating deforestation. Legislation, particularly in the EU, targets the sale of products linked to deforestation, affecting materials like leather and wood fibers. Companies must now demonstrate their supply chains are deforestation-free to comply. The EU Deforestation Regulation (EUDR), effective from December 2024, requires detailed due diligence.

- EUDR impacts all companies selling relevant goods in the EU.

- Penalties include fines up to 4% of annual turnover.

- Deforestation-linked products include leather, wood, and palm oil.

Advertising and Marketing Regulations

Advertising and marketing regulations are tightening, especially regarding environmental claims. Brands must validate their sustainability assertions to avoid greenwashing. In 2024, the EU's Green Claims Directive aims to standardize and verify environmental claims across sectors. This will impact Moncler's marketing strategies.

- Increased scrutiny of environmental claims.

- Need for verifiable sustainability data.

- Risk of penalties for misleading advertising.

- Focus on transparent and accurate communication.

Moncler navigates strict safety laws and regulations impacting its textile production and material sourcing, including those targeting deforestation. EU regulations, like the Deforestation Regulation effective from December 2024, and digital product passports boost transparency and change labeling standards. This leads to extra costs for compliance, for example, potential penalties which can reach up to 4% of annual turnover.

| Regulation Area | Impact | Moncler's Response |

|---|---|---|

| Product Safety (e.g., PFAS) | Compliance with chemical restrictions, affecting material use. | Adaptation to REACH and other standards to avoid penalties and manage supply chain. |

| Digital Product Passport (DPP) | Mandates detailed textile information: composition, origin, environmental impact. | Changing labelling practices; increasing traceability. |

| Extended Producer Responsibility (EPR) | Management of product end-of-life and waste. | Preparing for EU textile waste management scheme from 2025; accounting for compliance costs. |

Environmental factors

The fashion industry significantly contributes to carbon emissions. Moncler faces pressure to cut emissions. In 2023, the fashion industry's carbon footprint was around 10% of global emissions. Regulations are emerging to enforce sustainability goals.

The textile industry's significant waste production presents a substantial environmental hurdle. Circular economy principles, like durable design and resale programs, are gaining traction. In 2024, the fashion industry generated over 92 million tons of textile waste globally. Recycling technology investments are crucial for sustainability. The EU's 2025 waste reduction targets will further pressure brands.

The fashion industry is a major water consumer, especially in textile production and dyeing processes. It contributes significantly to water pollution through chemical discharge. Addressing water consumption and pollution is crucial for brands like Moncler. The industry’s water footprint is substantial, requiring sustainable practices.

Use of Sustainable Materials

Moncler is increasingly focusing on sustainable materials to reduce its environmental impact. This includes using organic cotton, recycled fabrics, and bio-based alternatives. In 2024, the luxury fashion market showed increased demand for eco-friendly products, with a 15% rise in sustainable material usage. Moncler's commitment aligns with consumer preferences and regulatory pressures.

- 2024: 15% increase in sustainable material usage in the luxury fashion market.

- Moncler's strategy reflects consumer demand for sustainable products.

Biodiversity and Ecosystem Impact

Moncler faces scrutiny regarding its biodiversity impact, stemming from raw material sourcing and production. The fashion industry significantly affects ecosystems, with growing pressure on brands to adopt sustainable practices. Consumers and regulators increasingly demand transparency and action on environmental issues. Initiatives like regenerative agriculture are crucial for mitigating negative impacts. In 2024, the fashion industry's environmental footprint was under intense scrutiny, with reports highlighting significant biodiversity loss linked to material sourcing.

- Fashion accounts for 10% of global carbon emissions.

- Regenerative agriculture can increase biodiversity by up to 30%.

- Consumers are willing to pay up to 15% more for sustainable products.

- By 2025, sustainable fashion market growth is projected at 10%.

Moncler confronts environmental challenges tied to emissions, waste, water use, and biodiversity. The fashion sector's environmental impact is significant. Regulations and consumer preferences are driving sustainability initiatives.

| Environmental Factor | Impact | Data |

|---|---|---|

| Carbon Emissions | Significant contribution | Fashion accounts for 10% of global emissions. |

| Waste Production | High, textile waste | 92 million tons of textile waste (2024). |

| Water Usage | Major consumer | Industry water footprint requires attention. |

PESTLE Analysis Data Sources

The Moncler PESTLE leverages data from reputable financial institutions, market research firms, and government publications.