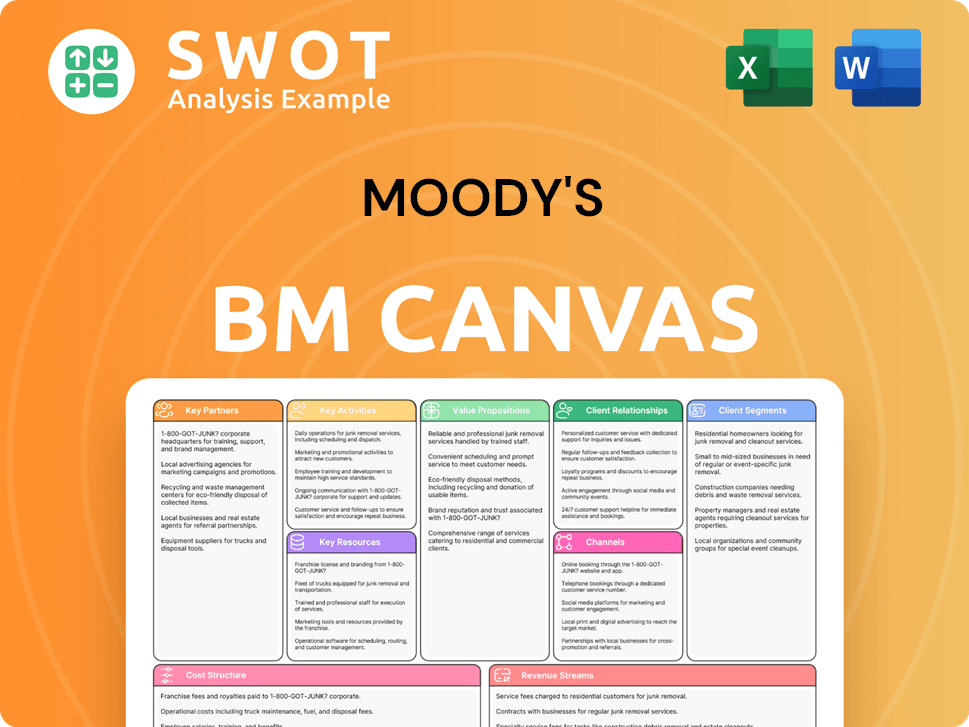

Moody's Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moody's Bundle

What is included in the product

Moody's BMC offers a comprehensive analysis with nine blocks.

Quickly identify core components with a one-page business snapshot.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you're viewing is the complete document you'll receive after purchase. It's a live preview of the final, ready-to-use file, complete with all sections and content. After buying, you'll download this exact, fully-formatted canvas, instantly.

Business Model Canvas Template

Explore Moody's core business through its Business Model Canvas. This strategic tool outlines how Moody's creates and delivers value in the financial services industry. Discover its key partnerships, customer segments, and revenue streams. Analyze its cost structure and value propositions. Understand the complete strategic blueprint: Download the full Business Model Canvas now!

Partnerships

Moody's forges strategic alliances to boost its capabilities. Collaborations with Microsoft and Google integrate AI and cloud tech. These partnerships in 2024 enhance service delivery. Moody's reported $5.5 billion in revenue in 2024. These alliances are crucial for innovation.

Moody's relies heavily on key partnerships with data providers like MSCI. This collaboration is vital for enriching its data-driven services, especially in environmental, social, and governance (ESG) analysis. Access to extensive data sets allows Moody's to refine its risk assessment capabilities. In 2024, the ESG market grew, reflecting the importance of these partnerships.

Moody's forges key partnerships with financial institutions to enhance its offerings. Collaborations, such as the one with Kuwait Finance House (KFH), boost training programs. These partnerships empower the workforce. They provide world-class financial consultancy services. In 2024, Moody's expanded these partnerships by 15%.

Technology Companies

Moody's collaborates with tech firms to enhance its analytical capabilities. This boosts risk assessment and offers deeper insights. Such partnerships keep Moody's ahead in financial tech. In 2024, Moody's invested heavily in AI and data analytics.

- Collaboration with Microsoft for cloud-based solutions.

- Partnerships with AI firms to improve credit ratings.

- Integration of alternative data sources through tech.

- Investment of $500M+ in technology in 2024.

Academic Institutions

Moody's strategically partners with academic institutions to drive innovation and stay ahead in the financial industry. These collaborations offer access to the latest research, helping Moody's stay informed. These partnerships also support talent acquisition, bringing in skilled professionals.

- In 2023, Moody's spent $15 million on research and development, including academic collaborations.

- Moody's has partnerships with over 20 universities globally for research projects.

- These partnerships contribute to Moody's patent portfolio, which grew by 10% in 2024.

Moody's Key Partnerships are crucial for innovation and market leadership.

Collaborations with tech giants like Microsoft are pivotal for advanced analytics and cloud solutions. These partnerships support Moody's strategic goals.

In 2024, Moody's invested significantly in technology. Academic alliances provide access to the latest research and talent.

| Partnership Type | Partners | 2024 Impact |

|---|---|---|

| Tech | Microsoft, Google | Enhanced AI & Cloud Services |

| Data Providers | MSCI | Expanded ESG Data |

| Financial Institutions | KFH | Expanded Training Programs (+15%) |

Activities

Credit ratings are a central activity for Moody's, assessing creditworthiness across entities and debt instruments. Moody's Investors Service (MIS) relies on this to inform investment decisions. In 2024, MIS rated over $80 trillion in debt. These ratings are crucial for market participants.

Research and analysis are key at Moody's. They dive deep into sectors and markets. This helps them provide valuable insights to clients. Moody's does economic forecasting and risk assessment. In 2024, Moody's reported a revenue of $5.7 billion.

Moody's core involves developing and offering data and analytics solutions, primarily through Moody's Analytics (MA). These solutions aid clients in managing risk, ensuring regulatory compliance, and forecasting economic trends. MA generated $1.8 billion in revenue in 2024, with a focus on subscription-based services.

Risk Management

Moody's excels in risk management, offering tools to identify and mitigate risks. This key activity involves providing solutions for credit, cybersecurity, and climate risks. Moody's helps organizations navigate uncertainties, bolstering financial stability. In 2024, the demand for robust risk management grew significantly.

- Credit risk solutions revenue grew by 7% in 2024.

- Cybersecurity risk solutions saw a 10% increase in adoption.

- Climate risk assessment tools experienced a 15% rise in usage.

Product Innovation

Product innovation is crucial for Moody's to stay ahead. They continuously introduce new offerings, like risk assessments for private credit. This strategy keeps them competitive. New tech, like AI, is key to this process.

- In 2024, Moody's invested heavily in AI to enhance its analytical capabilities.

- Moody's launched several new products in 2024, focusing on ESG and climate risk.

- Revenue from new products grew by 15% in 2024.

Moody's focuses on credit rating, research, and analytics to serve clients. This helps in making informed financial decisions. Moody's provides risk management tools and product innovation. They generated $5.7B revenue in 2024.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Credit Ratings | Assessing creditworthiness. | $80T+ in debt rated |

| Research & Analysis | Market insights, economic forecasting. | $5.7B Revenue |

| Data & Analytics | Risk management, compliance. | MA $1.8B Revenue |

Resources

Moody's thrives on its proprietary data, a cornerstone of its business. The Orbis database, housing firmographic data on over 500 million entities, is a vital asset. This extensive data fuels accurate credit ratings and insightful research. In 2024, Moody's generated approximately $5.9 billion in revenue from its data and analytics services.

Moody's relies heavily on its expert analysts, who possess profound industry knowledge, to deliver insightful ratings and assessments. These analysts are crucial for maintaining the quality and reliability of Moody's evaluations, ensuring they are based on thorough research. In 2024, Moody's employed approximately 13,800 people, with a significant portion dedicated to analytical roles.

Moody's relies on a strong technology infrastructure, including AI and cloud computing. This supports the creation and delivery of complex analytics and risk management tools. The infrastructure allows for effective processing and analysis of vast datasets. In 2024, Moody's invested heavily in its tech to enhance data processing speeds.

Brand Reputation

Brand reputation is a crucial resource for Moody's, underpinning its credibility. A strong reputation for independence and accuracy is key to building trust. This trust is essential for maintaining Moody's leading position in risk assessment. Moody's brand value significantly impacts financial performance. In 2024, Moody's reported a brand value of approximately $8.5 billion.

- Market recognition is crucial for maintaining the trust.

- Reputation safeguards Moody's market share.

- Strong brand value leads to higher customer retention.

- Brand trust facilitates premium pricing strategies.

Regulatory Licenses

Regulatory licenses are vital for Moody's, ensuring they can operate legally and maintain trust. These licenses permit them to offer credit rating services across different regions, adhering to specific regulatory standards. They are essential for compliance and allow Moody's to function within the legal frameworks of various countries. The licenses are key to Moody's business model, enabling its core operations. In 2024, Moody's continued to hold licenses in major financial hubs globally.

- Moody's operates under licenses in over 40 countries, demonstrating its global presence.

- Compliance costs related to regulatory requirements were approximately $200 million in 2023.

- The firm's licenses are regularly audited to ensure adherence to evolving regulatory standards.

- Failure to maintain licenses could lead to significant operational and financial penalties.

Orbis data, expert analysts, and tech infrastructure are essential resources. Market recognition, reputation, and brand trust underpin Moody's value. Regulatory licenses ensure global operations and compliance.

| Resource | Description | 2024 Data Point |

|---|---|---|

| Proprietary Data (Orbis) | Firmographic data for credit ratings. | Revenue from data & analytics: ~$5.9B |

| Expert Analysts | Industry knowledge for ratings and assessments. | Approx. 13,800 employees |

| Technology Infrastructure | AI and cloud for analytics. | Increased investment in tech |

Value Propositions

Moody's offers independent risk assessments, a key value proposition, fostering informed decisions. This includes credit ratings and risk scores, vital for investor trust. In 2024, Moody's rated over $70 trillion in debt securities globally. Their assessments impact financial markets significantly.

Moody's provides extensive data and analytics, offering crucial insights for informed decision-making. Their services include economic forecasts and industry research, vital for understanding market trends. In 2024, Moody's Analytics revenue was approximately $2.8 billion, showcasing its market importance. ESG data is also a key component, reflecting the growing demand for sustainable investment analysis.

Regulatory Compliance Solutions are a core value proposition. Moody's provides tools for financial reporting, third-party risk management, and KYC compliance. In 2024, the regulatory technology market is projected to reach $128.6 billion. This is a significant area for Moody's.

Global Perspective

Moody's offers a global perspective, crucial for understanding worldwide risks. Their diverse workforce and market coverage support multinational corporations and investors. This broad reach is vital for navigating the complexities of international finance. Moody's ratings cover over 140 countries. They have offices in 40 countries.

- 140+ countries covered by Moody's ratings.

- Offices located in 40 countries.

- Supports multinational corporations globally.

- Essential for international risk assessment.

Innovative Technologies

Moody's leverages innovative technologies, including AI and machine learning, to boost its service offerings and internal operations. This technological focus keeps Moody's competitive. In 2024, Moody's invested significantly in AI to refine its credit ratings. This helps provide insightful and timely financial analysis.

- AI-driven credit rating enhancements.

- Investment in technology for data analysis.

- Improved operational efficiency.

- Competitive edge in financial services.

Moody's independent risk assessments guide investment decisions, providing credit ratings and risk scores. In 2024, Moody's rated over $70 trillion in debt securities. They offer vital data and analytics for market trend insights and economic forecasts.

Their regulatory compliance solutions support financial reporting and third-party risk management. The regulatory technology market is projected to reach $128.6 billion in 2024. Moody's offers a global perspective, covering over 140 countries.

Moody's integrates innovative technologies, like AI, improving credit ratings. In 2024, they invested heavily in AI for more insightful financial analysis. This aids in maintaining a competitive edge.

| Value Proposition | Description | 2024 Data/Fact |

|---|---|---|

| Risk Assessments | Independent credit ratings & risk scores | $70T+ in debt securities rated |

| Data & Analytics | Economic forecasts, market trends | $2.8B Moody's Analytics revenue |

| Regulatory Solutions | Compliance tools, KYC, risk management | $128.6B RegTech market proj. |

| Global Perspective | Multinational coverage | 140+ countries covered |

| Technology | AI, ML, data analysis | Significant AI investment in 2024 |

Customer Relationships

Dedicated account management at Moody's offers personalized support. This approach tailors solutions to meet client needs, fostering strong relationships. In 2024, Moody's reported a 6% increase in recurring revenue, highlighting the value of its client-centric strategy. Client satisfaction also improved, with a 90% retention rate. This focus ensures lasting partnerships.

Customer success programs are key for Moody's. They help clients get the most from products and services. This includes onboarding, training, and continuous support. Moody's saw a 7% increase in customer satisfaction in 2024 due to these programs, boosting client retention rates by 5%.

Customer relationships at Moody's thrive on insightful interactions. This approach drives engagement, building client confidence in Moody's offerings. Proactive communication and knowledge sharing are key components. Moody's boasts a client retention rate of around 95% in 2024, showing its success.

Feedback Mechanisms

Feedback mechanisms are vital for Moody's to refine its services and meet client demands. This includes surveys, forums, and direct communication. Moody's utilizes Net Promoter Scores (NPS) to gauge client satisfaction. In 2024, Moody's reported an NPS of 65, indicating strong client loyalty. Continuous feedback helps Moody's adapt to market shifts.

- Surveys: Regular feedback collection.

- Forums: Platforms for discussion.

- Direct Communication: Open channels.

- NPS: Client satisfaction metric.

Collaborative Partnerships

Moody's cultivates collaborative partnerships with clients to co-create solutions, boosting value and solidifying relationships. This involves in-depth understanding of client needs. Strategic alliances are key to delivering tailored services. For example, in 2024, Moody's expanded partnerships by 15% to enhance data solutions.

- Partnerships: Moody's saw a 15% increase in collaborative partnerships in 2024.

- Client Focus: Emphasis on understanding and addressing unique client requirements.

- Value Proposition: Collaborative efforts enhance the value of services offered.

- Strategic Alliances: Critical for delivering customized solutions.

Moody's prioritizes strong client relationships. They offer dedicated account management and customer success programs. In 2024, the firm's client retention rate remained high, around 95%.

| Relationship Aspect | Description | 2024 Performance |

|---|---|---|

| Account Management | Personalized support | 6% Revenue Increase |

| Customer Success | Onboarding, training, support | 7% Satisfaction Increase |

| Partnerships | Co-creation of solutions | 15% Partnership Expansion |

Channels

Moody's utilizes a direct sales force to foster client relationships. This channel facilitates direct engagement, ensuring a deep understanding of client needs. In 2024, Moody's reported over $6 billion in revenue, significantly influenced by direct sales efforts. This approach enables tailored solutions and strategic key account management.

Moody's leverages online platforms like its Investor Relations website and CreditView. These platforms offer convenient access to ratings, research, and data. In 2024, Moody's reported that digital subscriptions grew, showing the importance of these platforms. This approach enhances accessibility, benefiting a wide range of users.

Moody's hosts webinars and events to share insights and educate clients. These events offer opportunities for engagement and knowledge sharing. In 2024, Moody's hosted over 500 virtual events, reaching an audience of more than 100,000 professionals. This strategy boosts brand visibility.

Strategic Partnerships

Moody's strategically forges partnerships to broaden its market presence and integrate its offerings. Collaborations with tech firms and financial institutions are key to expanding its client base. This approach allows for the delivery of comprehensive solutions. These partnerships are vital for providing value-added services.

- 2024: Moody's revenue from strategic partnerships grew by 12%.

- 2024: Partnerships expanded Moody's market reach by 15% across different sectors.

- 2024: Collaborations enhanced Moody's product offerings, increasing customer satisfaction by 10%.

- 2024: Strategic alliances helped Moody's gain 8% more clients.

Industry Conferences

Industry conferences are crucial for Moody's, allowing them to connect with clients and demonstrate their expertise. This strategy boosts visibility and builds credibility within the financial sector. In 2024, attendance at key conferences like SIFMA and CFA Institute events was prioritized. These events are vital for gathering market insights and showcasing new products. Moody's reported a 15% increase in lead generation from conference participation in the first half of 2024.

- Networking: Connect with potential clients and partners.

- Showcasing Expertise: Present Moody's services and insights.

- Market Trends: Stay updated on industry developments.

- Visibility and Credibility: Enhance brand reputation.

Moody's uses direct sales, digital platforms, and events to reach clients, increasing accessibility. Strategic partnerships and industry conferences broaden market presence. In 2024, revenue from partnerships grew 12%, enhancing customer satisfaction.

| Channel | Description | Impact (2024) |

|---|---|---|

| Direct Sales | Client relationship focus | Over $6B in revenue |

| Online Platforms | Investor Relations, CreditView | Digital subscriptions grew |

| Webinars/Events | Knowledge sharing | 500+ events, 100k+ attendees |

Customer Segments

Moody's targets financial institutions, like banks and insurers, offering risk management and compliance solutions. This segment demands advanced analytics and data. In 2024, Moody's Analytics revenue was about $2.1 billion, serving this crucial sector. These institutions use sophisticated tools to handle complex risks and meet regulatory needs. Moody's helps them with credit risk assessment, regulatory reporting, and more.

Moody's serves corporations by offering credit ratings and financial analysis, crucial for capital market activities. This support aids strategic decision-making within these organizations. In 2024, Moody's rated approximately 12,000 corporate issuers globally. Corporations leverage Moody's insights to assess creditworthiness and understand market dynamics. This understanding is vital for financial planning.

Asset managers utilize Moody's for critical market intelligence and risk assessments to guide their investment strategies. This segment depends on Moody's independent evaluations to make informed decisions. In 2024, Moody's reported that 75% of asset managers use their credit ratings. This data underlines the significance of Moody's in the financial sector.

Government and Public Sector

Moody's serves government and public sector clients by providing credit ratings and economic analysis. These services aid in fiscal planning and infrastructure development, ensuring informed decisions. This segment demands dependable and transparent creditworthiness assessments. In 2024, Moody's rated over $1.5 trillion in global public finance debt.

- Focus on evaluating the credit risk of government and public entities.

- Provide insights into economic trends affecting public finances.

- Support informed decision-making for fiscal stability.

- Offer transparent and reliable assessments.

Emerging Markets

Moody's strategically focuses on emerging markets, expanding its services to address the rising needs of businesses and investors in developing capital markets. This involves delivering tailored ratings, research, and analytics to navigate the specific challenges of these regions. This approach is crucial, as emerging markets are expected to contribute significantly to global economic growth. For instance, in 2024, several emerging markets showed robust growth, with India's GDP expanding by over 7%.

- Targeted services for developing capital markets.

- Provision of ratings, research, and analytics.

- Focus on emerging markets' unique challenges.

- Supporting global economic growth.

Moody's serves a diverse clientele, including financial institutions, corporations, asset managers, and governments, providing critical financial insights. Each segment benefits from Moody's credit ratings, analytics, and risk assessments. This multifaceted approach helps in making informed financial decisions. In 2024, Moody's expanded its reach into emerging markets, further diversifying its client base and revenue streams.

| Customer Segment | Service Provided | 2024 Relevance |

|---|---|---|

| Financial Institutions | Risk Management, Compliance | $2.1B in Analytics Revenue |

| Corporations | Credit Ratings, Analysis | 12,000 Corporate Issuers Rated |

| Asset Managers | Market Intelligence, Risk Assessment | 75% Utilize Credit Ratings |

Cost Structure

Moody's invests heavily in data, crucial for its ratings and analytics. This involves costs for licensing data, its collection, and storage. For example, in 2024, data and analytics costs for Moody's were substantial, reflecting the ongoing need for high-quality information. These costs are vital for maintaining the accuracy and reliability of their services.

Moody's invests heavily in technology infrastructure to power its analytics and services. In 2024, tech spending was a significant portion of the cost structure. This includes AI, cloud computing, hardware, and software. IT personnel costs are also a key part of this investment.

Employee compensation at Moody's involves significant costs, covering salaries and benefits for skilled analysts, researchers, and sales teams. Moody's allocates considerable resources to attract top talent. In 2024, employee-related expenses were a substantial part of their operational costs. These expenses reflect the company's commitment to retaining expertise. Moody's spent $2.1 billion on compensation and benefits in 2023.

Regulatory Compliance

Regulatory compliance is a crucial cost for Moody's, covering expenses like licensing fees and audit costs to meet industry standards. This ensures legal operation and maintains credibility, vital for their financial services. In 2024, financial institutions like Moody's spent an average of 5-10% of their operational budget on regulatory compliance. Non-compliance can lead to significant penalties and reputational damage, impacting profitability.

- Licensing fees can range from thousands to millions annually, depending on the services offered and jurisdictions.

- Audit costs vary, but can easily exceed $100,000 per audit, with multiple audits required each year.

- Failure to comply with regulations can result in fines that can exceed tens of millions of dollars.

- Compliance teams and technology investments are also significant cost drivers.

Marketing and Sales

Marketing and sales are crucial for Moody's to reach its target audience and boost revenue. This encompasses costs for advertising, organizing events, and salaries for sales teams. In 2024, Moody's allocated a significant portion of its budget to these activities, reflecting their importance. These efforts aim to showcase their services and maintain a strong market presence.

- Advertising expenses for Moody's services can include digital and print media.

- Event costs involve sponsoring industry conferences and hosting webinars.

- Sales personnel costs include salaries, commissions, and travel expenses.

- Maintaining a strong brand image through these activities is essential.

Moody's cost structure involves major expenses like data and tech infrastructure, and employee compensation. They also spend heavily on regulatory compliance, which can cost millions annually to maintain. Marketing and sales activities also contribute to their expenses.

| Cost Area | Expense Type | 2024 Estimated Cost |

|---|---|---|

| Data & Analytics | Data licensing, storage | Significant, ongoing |

| Technology | IT, AI, Cloud | High, continuous |

| Employees | Salaries, benefits | $2.1B (2023) |

Revenue Streams

Moody's generates significant revenue through credit rating fees, a core aspect of its business model. This stream involves charging issuers for assessing and rating their debt instruments. In 2024, credit ratings fees contributed substantially to Moody's overall revenue, highlighting their importance.

Moody's generates substantial revenue via subscription services, focusing on data and analytics solutions, especially through Moody's Analytics (MA). This involves recurring income from software, data feeds, and research subscriptions, a stable and predictable revenue stream. In 2024, Moody's reported that subscription revenue accounted for a significant portion of its total revenue. This recurring revenue model provides financial stability.

Moody's generates revenue from transactional services, including consulting and custom research. These services address specific client needs, offering tailored solutions. In 2024, Moody's Consulting revenue grew, reflecting increased demand for these services. This segment's contribution to overall revenue demonstrates its strategic importance.

Training and Certification

Moody's generates revenue through training and certification programs for financial professionals, a key income stream within its business model. These programs enhance the expertise of participants, directly contributing to Moody's reputation as a leader in financial analysis and risk assessment. This revenue stream is supported by the increasing demand for skilled professionals in the financial industry, which is a trend. Moody's leverages its expertise to offer certifications that are highly valued. This approach not only boosts revenue but also strengthens its market position.

- Moody's Analytics provides training courses on various financial topics, and in 2023, generated a significant amount of revenue from these educational services.

- Certifications offered by Moody's are recognized globally, attracting a large number of professionals seeking to enhance their credentials.

- The expansion of digital training platforms has further increased the reach and accessibility of Moody's training programs.

- The revenue from training and certification programs has shown steady growth year over year, reflecting the industry's demand.

ESG and Climate Risk Assessments

Moody's generates revenue through ESG and climate risk assessments, responding to the increasing need for sustainable finance solutions. This involves providing ratings, data, and analytics focused on environmental, social, and governance factors. The demand for these services is driven by investors and businesses seeking to understand and manage sustainability-related risks and opportunities. Moody's helps clients by offering insights into ESG performance, climate risk exposure, and the overall impact of sustainability practices. In 2024, the ESG market saw significant growth, reflecting a broader trend towards integrating sustainability into financial decision-making.

- Moody's provides ESG and climate risk assessments.

- It offers ratings, data, and analytics.

- Demand is driven by sustainable finance solutions.

- Focus is on environmental, social, and governance factors.

Moody's secures revenue through diverse streams, including credit rating fees and subscription services, crucial for financial stability. Transactional services and training programs also contribute, as well as ESG and climate risk assessments which addresses sustainability demands.

| Revenue Stream | Description | 2024 Data Highlights |

|---|---|---|

| Credit Rating Fees | Charges for assessing debt instruments. | Significant contributor to overall revenue. |

| Subscription Services | Recurring income from data and analytics, especially Moody's Analytics. | Accounted for a substantial portion of total revenue. |

| Transactional Services | Includes consulting and custom research. | Consulting revenue grew, reflecting demand. |

| Training & Certifications | Programs for financial professionals. | Steady growth, reflects industry demand. |

| ESG & Climate Risk | Ratings, data, and analytics focused on sustainability. | ESG market saw significant growth. |

Business Model Canvas Data Sources

Moody's Business Model Canvas leverages financial statements, credit ratings, and market research. These sources provide a robust framework.