Moody's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moody's Bundle

What is included in the product

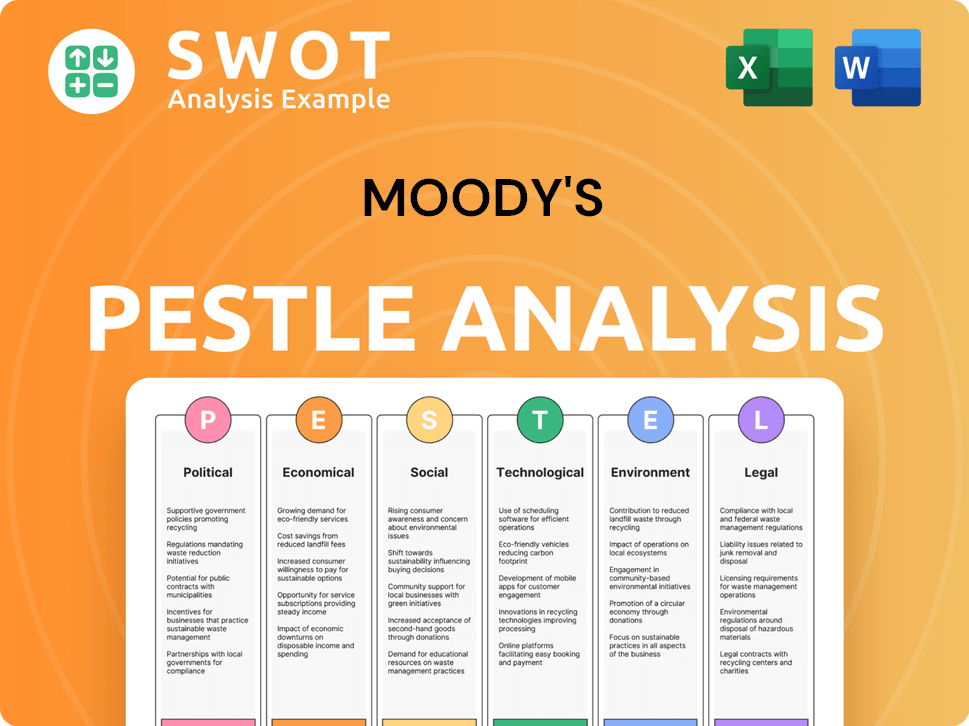

Explores macro-environmental factors affecting Moody's: Political, Economic, Social, Tech, Environmental, Legal.

Highlights key opportunities and threats within a dynamic landscape, assisting strategy development.

Preview the Actual Deliverable

Moody's PESTLE Analysis

This preview showcases the Moody's PESTLE Analysis document. The presented content and formatting reflect the complete analysis.

No hidden sections—what you see here is exactly what you’ll download.

After purchase, this identical, fully realized file becomes yours immediately.

You’ll receive the precise version displayed for your convenience.

Ready-to-use, comprehensive and insightful – instantly after buying!

PESTLE Analysis Template

Our Moody's PESTLE Analysis delves into the external factors affecting the company. We examine political, economic, social, technological, legal, and environmental influences. These insights are crucial for understanding market dynamics. Use our analysis to anticipate future challenges and opportunities. Gain a strategic advantage by understanding the complete picture. Access the full report for comprehensive, actionable intelligence.

Political factors

Military conflicts and geopolitical tensions disrupt credit markets and economic activity. These tensions can impact debt and securities issuance. Trade policies and sanctions regimes are also affected, creating a complex regulatory environment. Moody's expects geopolitical risks to persist in 2025, increasing operational risks for banks. For example, in 2024, global military expenditure reached $2.44 trillion, illustrating the scale of these risks.

Changes in government policies, including fiscal and monetary adjustments, greatly influence credit conditions and economic growth. For example, the U.S. federal debt reached over $34 trillion in early 2024, reflecting fiscal policies' impact. New administrations bring shifting priorities, affecting sectors; for instance, the Inflation Reduction Act of 2022 has reshaped energy markets. Regulatory changes and divergence pose operational and compliance hurdles; the EU's Digital Services Act is a prime example of this trend.

Political polarization complicates policymaking, potentially increasing government debt. Weak governance can negatively affect policy effectiveness. In 2024, the U.S. government debt hit $34 trillion, reflecting fiscal challenges. Weak institutions heightened political risk. Social polarization is on the rise.

Trade Policies and Tariffs

Changes in trade policies, such as tariffs, significantly affect industries by altering demand, costs, and supply chains. For example, the U.S. imposed tariffs on $360 billion of Chinese goods. This can lead to lower cargo volumes at ports and reduced profitability for businesses. Consequently, consumers face higher prices, influencing credit risk evaluations.

- U.S. tariffs on Chinese goods totaled $360 billion.

- Ports may see decreased cargo volumes due to trade restrictions.

- Businesses could experience reduced profitability.

- Consumers might face higher prices.

Sanctions and Financial Crime

Sanctions, spurred by global events, force financial institutions to adapt swiftly, ensuring compliance with evolving regulations and enforcement. Financial crime risks increase with the misuse of legal entities and digital finance growth, demanding enhanced due diligence. For example, in 2024, the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) imposed $345 million in penalties. These actions highlight the need for robust compliance.

- FinCEN imposed $345 million in penalties in 2024.

- Evolving sanctions landscapes.

- Enhanced due diligence is crucial.

Political factors significantly influence credit markets and business operations. Government policies, including fiscal adjustments, shape economic growth, with U.S. debt exceeding $34 trillion in early 2024. Trade policies like tariffs on $360 billion of Chinese goods by the U.S. affect various sectors.

Geopolitical tensions and sanctions pose operational risks. For instance, FinCEN imposed $345 million in penalties in 2024 due to financial crimes. Polarization and governance issues also contribute to increased political risk.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Fiscal Policy | Influence on credit conditions | U.S. debt > $34T |

| Trade Tariffs | Affects industries | US tariffs on Chinese goods - $360B |

| Sanctions/Penalties | Operational risks, compliance | FinCEN penalties - $345M |

Economic factors

Steady global economic growth, coupled with potentially lower interest rates, generally boosts cash flows and improves credit conditions. However, economic growth is moderating in areas like the Eurozone, where GDP growth for 2024 is projected around 0.8%. Despite possible interest rate cuts, financing costs will likely stay elevated compared to pre-2020. The U.S. Federal Reserve's projected rate cuts in 2024 might not fully offset these higher costs.

Inflation and monetary policy are key economic factors. In 2024, many central banks, including the U.S. Federal Reserve, are navigating inflation. The Fed's actions impact global markets. Lower inflation can lead to lower interest rates. This could reduce financing costs for businesses.

High government debt and deficits are concerning, especially with potential interest rate hikes. Political divisions can hinder effective solutions. The U.S. national debt surpassed $34 trillion in early 2024. This impacts fiscal health and investor confidence.

Industry-Specific Economic Headwinds

Industry-specific economic headwinds present unique challenges. Higher education faces declining enrollment and financial stress; Moody's projects a negative outlook for the US higher education sector in 2024. The automotive industry confronts structural issues from the shift to EVs. These issues can affect creditworthiness.

- US higher education sector's negative outlook.

- Automotive industry transition to EVs.

Financing Conditions and Debt Servicing

Financing conditions are expected to vary; some areas might see improvements, while others, like certain states, could struggle with access. High external debt servicing needs, especially in foreign currencies, present sovereign risks. For example, countries with substantial foreign-denominated debt face greater vulnerability. According to the IMF, global debt reached \$235 trillion in 2023.

- Global debt-to-GDP ratio: approximately 250% in 2024.

- Emerging markets: often have higher debt servicing costs.

- US interest rates: impact borrowing costs globally.

- Currency fluctuations: can increase debt burdens.

Economic factors involve growth, inflation, and interest rates impacting financial conditions globally. In 2024, the Eurozone anticipates 0.8% GDP growth, with U.S. facing rate cuts. Elevated government debt, hitting $34 trillion in the U.S. by early 2024, affects fiscal health.

| Factor | Details | Impact |

|---|---|---|

| Global Growth | Moderating, especially in Eurozone | Alters cash flows and credit. |

| Inflation | Central banks' responses vary. | Affects interest rates and business costs. |

| Government Debt | U.S. debt over $34T in early 2024 | Influences investor confidence and credit. |

Sociological factors

Demographic shifts, like aging populations and shrinking labor forces, present long-term economic challenges. These changes affect growth and strain government finances. For example, in Japan, the labor force is projected to shrink by 0.7% annually through 2030. This necessitates adjustments across sectors.

Social risks, amplified by the pandemic, continue to influence credit ratings. Elevated domestic political risk can intensify social polarization, potentially impacting stability. For instance, in 2024, social unrest cost several countries billions in lost productivity and infrastructure damage. Policy effectiveness suffers in highly polarized environments, as seen in recent legislative gridlocks.

Consumer behavior is changing. There's more demand for convenience, digital solutions, and value. This forces financial institutions to adapt how they interact with customers. Younger generations now use social media for financial info. In 2024, digital banking users increased by 15%.

Student Activism and Governance Concerns in Education

Student activism and concerns about governance are significant sociological factors impacting the education sector. These issues can lead to increased operational and legal expenses for educational institutions. Additionally, they may damage the reputation and financial stability of these institutions. For example, in 2024, there were approximately 1,500 reported student protests across U.S. universities, resulting in an estimated $50 million in extra security and legal fees.

- Increased Legal Costs: Lawsuits related to student activism rose by 20% in 2024.

- Reputational Damage: A survey in late 2024 showed a 10% drop in prospective student applications at universities affected by major protests.

- Financial Impact: Moody's has downgraded the outlook for several universities due to governance issues.

Labor Practices and Supply Chains

Policymakers and investors are increasingly focused on labor practices within supply chains, which can increase operational and compliance costs for businesses. Companies face regulatory and reputational risks due to these practices. This growing scrutiny is critical for credit assessments. For example, in 2024, the US Department of Labor found violations in over 500 supply chain audits.

- Increased compliance costs are expected to rise by 10-15% in 2025 due to new regulations.

- Reputational damage can lead to a 20-30% drop in stock value.

- Social factors are now weighted at 15% in credit ratings.

Sociological factors significantly shape business environments. Rising social polarization and unrest continue to affect stability, increasing costs and risks. Changing consumer behavior drives a need for digital solutions.

Scrutiny of labor practices within supply chains leads to higher compliance costs and potential reputational damage. This intensifies the impact on credit ratings and investment decisions.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Social Unrest | Increased costs & risks | Losses estimated in billions |

| Consumer Behavior | Demand for digital services | Digital banking up 15% (2024) |

| Supply Chain Labor | Compliance & reputational risks | Compliance cost increase 10-15% (2025) |

Technological factors

AI is increasingly integrated into sectors like education and finance. This boosts efficiency but raises cybersecurity, ethical, and data privacy concerns. For example, the global AI market is projected to reach $200 billion by 2025. Advancements in AI will create user-friendly products, but also increase cyberattacks. The cost of cybercrime is expected to hit $10.5 trillion annually by 2025.

Cybersecurity threats are escalating, with attackers focusing on larger entities and leveraging AI for more complex attacks. This increases risks to essential systems and infrastructure, necessitating stronger cybersecurity measures. Globally, cybercrime costs are projected to reach $10.5 trillion annually by 2025, highlighting the urgency. Increased cybersecurity spending, which reached $214 billion in 2024, is crucial.

Digital transformation fuels the global economy, with digital finance rapidly expanding. Fintech investments hit $51.3B in H1 2024. Digital assets and blockchain offer new avenues, yet risk management is crucial. The rise of digital finance reshapes traditional banking models. Cyberattacks cost financial institutions billions annually.

Technology Adoption and Digital Tools in Financial Services

The financial sector is increasingly reliant on digital technology, impacting credit profiles and customer interactions. Online tools and apps are crucial for managing finances, enhancing decision-making confidence. Fintech adoption continues to grow, with global investments reaching $171 billion in 2024. This shift is driven by the convenience and accessibility of digital financial solutions.

- Digital financial services are expected to serve 2.5 billion people by 2025.

- Mobile banking users are projected to hit 2.2 billion by 2024.

- The global fintech market is estimated to reach $324 billion by the end of 2024.

Data Privacy and Security Issues

Technological advancements amplify data privacy and security concerns. Financial institutions face increasing pressure to safeguard sensitive information, impacting their social factor in ESG assessments. Addressing these challenges is crucial to mitigate regulatory and reputational risks. In 2024, data breaches cost companies an average of $4.45 million globally. Investing in robust cybersecurity measures is essential.

- Data breaches cost companies an average of $4.45 million globally in 2024.

- Financial institutions must prioritize data protection.

- Cybersecurity is a critical investment for risk mitigation.

Technological advancements shape finance via AI, digital transformation, and cybersecurity concerns. The fintech market is set to hit $324 billion by end-2024, spurring digital financial services that could serve 2.5 billion by 2025. Cybercrime costs will reach $10.5 trillion annually by 2025, necessitating more spending on data security.

| Aspect | Details |

|---|---|

| AI Market | Projected to hit $200 billion by 2025 |

| Cybercrime Cost | $10.5 trillion annually by 2025 |

| Fintech Market | Estimated $324 billion by end-2024 |

Legal factors

Regulatory oversight significantly impacts Moody's operations. The Dodd-Frank Act in the US and EU regulations govern CRAs. These rules aim for transparency and accountability. Moody's faces potential liabilities under these laws. In 2024, regulatory fines for CRAs totaled over $100 million globally.

Financial institutions must navigate a complex regulatory landscape. This includes sanctions, AML, CFT, and beneficial ownership rules. In 2024, penalties for non-compliance reached billions globally. Reputational damage can be severe. Staying compliant is critical for financial health.

The legal landscape is shifting with stricter ESG regulations globally. The Corporate Sustainability Reporting Directive (CSRD) and EU Deforestation Regulation mandate detailed sustainability reporting, which increases operational costs. Companies face higher compliance expenses and potential risks tied to environmental and labor issues. For example, the CSRD will affect around 50,000 companies.

Legal Challenges to Regulations

Legal challenges to regulations are increasing, which is a trend that might push for more guidance and frameworks instead of new rules. This shift can introduce uncertainty, requiring companies to be adaptable. For example, in 2024, the U.S. Supreme Court is hearing cases that could impact federal agency powers, potentially reshaping regulatory landscapes. Companies must stay informed and flexible.

- Increased legal challenges to regulations.

- Shift towards guidance and frameworks.

- Uncertainty and the need for adaptability.

- Impact of Supreme Court cases on federal agencies.

Jurisdictional Authority and Enforcement Actions

Regulatory agencies are set to reinforce their jurisdictional authority, impacting financial institutions. Enforcement and rulemaking procedures are expected to intensify, increasing scrutiny. Financial institutions could face regulatory actions from more authorities. These actions will focus on ensuring compliance with a range of regulations. For instance, in 2024, the SEC brought over 800 enforcement actions.

- SEC enforcement actions in 2024 totaled over 800 cases.

- Increased focus on compliance with sanctions is expected.

- Financial institutions should anticipate more regulatory oversight.

Legal factors present several challenges for financial institutions in 2024 and 2025. Increased regulatory scrutiny, with over 800 SEC enforcement actions in 2024, demands heightened compliance efforts. Evolving regulations and legal challenges, especially from U.S. Supreme Court rulings, create uncertainty, pushing the need for adaptability.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Increased Scrutiny & Costs | Over $100M in CRA fines globally (2024) |

| ESG Regulations | Reporting Mandates & Risks | 50,000+ companies affected by CSRD |

| Legal Challenges | Uncertainty & Adaptability | Supreme Court cases reshaping regulatory landscapes (2024-2025) |

Environmental factors

Climate change intensifies extreme weather, posing physical risks like floods and wildfires. These events affect sectors such as real estate and agriculture, potentially increasing credit risk. For example, in 2024, insured losses from natural disasters reached $60 billion. Such risks are increasingly factored into financial assessments. The IPCC's 2024 report highlights rising global temperatures.

The shift to a low-carbon economy creates transition risks and chances. This involves greater investment in green tech and clean energy. In 2024, global green bond issuance reached ~$500 billion. Policy backing and falling costs in these sectors are expected.

Stricter environmental rules on plastics, emissions, and deforestation are raising business costs. Companies face higher expenses to comply with these regulations. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM) started in 2023, impacting imports. Businesses must adapt to these changes.

Water Management Challenges

Water management is turning into a key environmental concern, especially for water-intensive sectors like data centers. Increased water consumption can lead to public criticism, posing a credit risk for companies. For example, in 2024, data centers in water-stressed areas faced increased scrutiny. This can affect operational costs and reputation.

- Water scarcity is a growing global issue, with over 2 billion people facing water stress.

- Data centers can use millions of gallons of water annually for cooling purposes.

- Companies are increasingly investing in water-efficient technologies to mitigate risks.

- Public awareness and activism around water usage are on the rise.

Integration of Environmental Risks into Credit Analysis

There's a rising trend for credit rating agencies and financial institutions to include environmental risks in their credit analysis. This is due to growing regulations and the acknowledgment of how environmental factors affect finances. Moody's, like other agencies, is adapting to these changes. They are incorporating environmental considerations into their risk management. This helps in better assessing creditworthiness.

- In 2024, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations gained more traction, pushing for environmental risk disclosures.

- Moody's has enhanced its methodologies to include climate risk assessments, impacting ratings across various sectors.

- Financial institutions are increasing investments in ESG (Environmental, Social, and Governance) data and analytics platforms.

Environmental risks include physical climate hazards causing financial impacts like the $60 billion in insured losses in 2024. Transition to a low-carbon economy, with $500 billion in green bonds in 2024, brings new opportunities. Stricter environmental rules, exemplified by the EU's CBAM, and water scarcity, impacting data centers, drive costs.

| Aspect | Details | Impact |

|---|---|---|

| Physical Risks | Extreme weather, climate change | Increased credit risk, real estate & agriculture vulnerability |

| Transition Risks | Low-carbon economy shift, green tech | Opportunities, investment needs, regulatory impacts |

| Regulatory Risks | Environmental regulations (plastics, emissions) | Higher business costs, adaptation required |

PESTLE Analysis Data Sources

The analysis uses diverse data: government stats, global databases (IMF), industry reports, and trend forecasts. It combines current insights for accuracy and relevance.