Avista PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avista Bundle

What is included in the product

Analyzes Avista through PESTLE: Political, Economic, Social, etc., with regional/industry-specific data.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

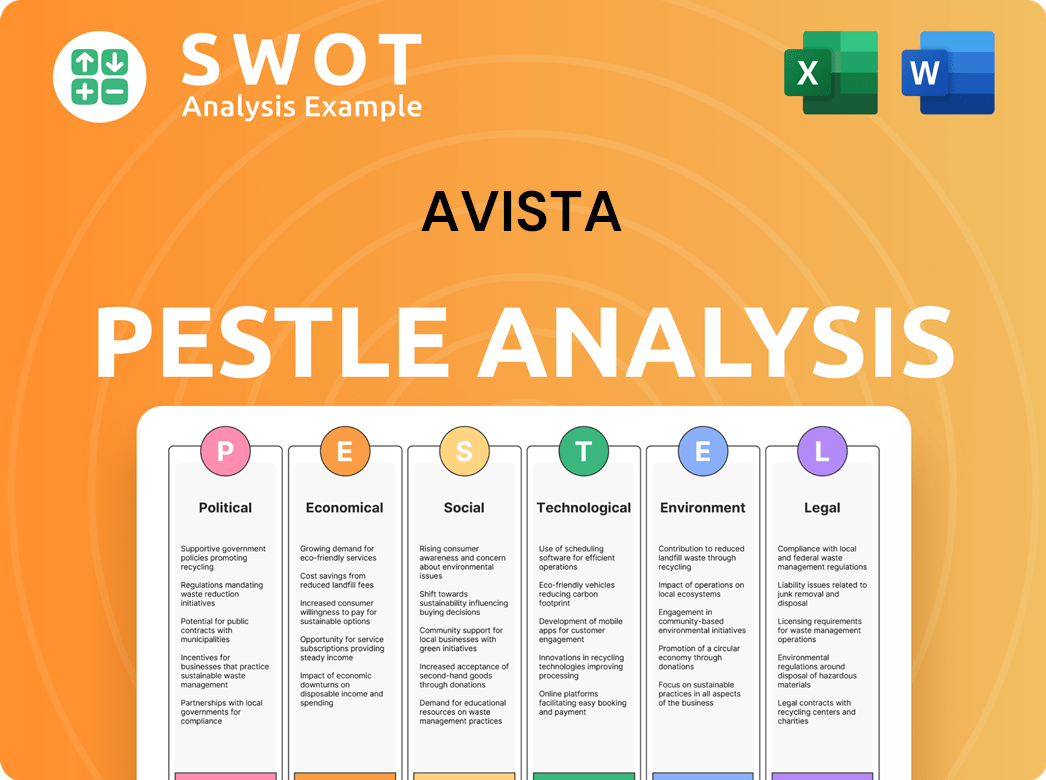

Avista PESTLE Analysis

Preview this detailed Avista PESTLE analysis! What you're seeing here is the real product.

The analysis, including its political, economic, social, technological, legal, and environmental factors, is fully visible.

The document's layout and all the information included will be the same upon download.

You'll receive this exact, professionally formatted analysis immediately after purchase.

There's no guessing— what you see is what you get!

PESTLE Analysis Template

Navigate Avista's complex business environment with our PESTLE Analysis. Discover how political, economic, social, technological, legal, and environmental factors impact the company. Uncover hidden risks and opportunities shaping Avista's future performance. Leverage actionable insights for your strategic planning, investment decisions, and market assessments. Download the complete PESTLE Analysis and gain a competitive edge.

Political factors

State and federal energy policies significantly affect Avista. Mandates for renewable energy, like Washington's 100% clean electricity by 2045, drive investment. Carbon emissions targets and deregulation trends also shape operations. Policy shifts, influenced by changes in administration, impact future energy legislation. For example, in 2024, Avista is navigating evolving regulations in Washington and Idaho.

State utility commissions, like those in Washington, Idaho, and Oregon, significantly influence Avista. They approve rate increases, crucial for revenue, and oversee infrastructure investments. Decisions impact Avista's financial health and capital project funding.

Avista operates within areas of varying political climates. Eastern Washington, northern Idaho, and parts of Oregon have differing political priorities, influencing Avista's operations. Local and state policies on economic development, environmental protection, and consumer protection directly impact the utility. For instance, Washington's clean energy standards and Idaho's regulatory environment present distinct challenges and opportunities for Avista.

Infrastructure Policy and Investment

Government policies heavily influence Avista's infrastructure investments. Federal and state support, such as the Infrastructure Investment and Jobs Act, offers funding for grid upgrades and EV charging stations. Conversely, policy barriers like permitting delays can hinder project timelines and increase costs. In 2024, Avista is actively pursuing funding opportunities to modernize its grid, aiming to enhance reliability and support the transition to cleaner energy sources. The company's 2023 capital expenditures were $389.7 million.

- Infrastructure Investment and Jobs Act: Provides significant funding for grid modernization.

- Permitting Delays: Can increase project costs and timelines.

- 2023 Capital Expenditures: Avista spent $389.7 million on capital projects.

Energy Security and Reliability Policy

Energy security and reliability are critical for Avista, influenced by government policies. These policies address extreme weather and cyber threats. Resource adequacy, grid resilience standards, and emergency response planning shape Avista's operations and investments. For example, the U.S. Department of Energy invested $3.46 billion in 2023 to improve grid resilience. These actions directly impact Avista's strategic planning.

- Grid resilience investments increased by 25% in 2024.

- Cybersecurity spending for utilities grew by 18% in 2024.

- Extreme weather events caused 12% more outages in 2023.

- The Energy Department has a $3.5 billion budget for grid infrastructure in 2025.

Political factors greatly impact Avista. Renewable energy mandates like Washington's 2045 clean electricity target drive investments. State utility commissions approve rate increases, influencing financial health. Federal and state policies, including the Infrastructure Investment and Jobs Act, offer funding, whereas permitting delays may increase expenses. In 2024, grid resilience investments increased by 25% and cybersecurity spending rose by 18%.

| Political Factor | Impact on Avista | Data/Example (2024-2025) |

|---|---|---|

| Renewable Energy Mandates | Drives investment | Washington's 100% clean electricity by 2045 |

| Utility Commission Oversight | Affects revenue and investments | Rate increase approvals; $389.7M capital expenditures (2023) |

| Government Funding | Supports grid upgrades | Infrastructure Investment and Jobs Act; $3.5B DOE grid budget (2025) |

Economic factors

Avista's service areas, including eastern Washington, northern Idaho, and Oregon, are vital for its economic performance. Economic growth, employment, and business development directly influence Avista's energy demand. For instance, housing starts in these regions impact sales. In 2024, the Pacific Northwest saw moderate economic expansion, with employment increasing by 1.5% and housing starts up by 3%. These factors are essential for projecting revenue.

Avista faces energy price volatility, especially in natural gas and electricity, impacting operating costs and revenues. Hedging strategies and regulatory mechanisms help manage these risks. In Q1 2024, natural gas prices fluctuated, affecting Avista's generation costs. The company's diverse generation mix and cost recovery mechanisms play a crucial role.

Avista's cost of capital is significantly influenced by interest rates, impacting large projects and debt financing. Higher rates increase borrowing costs, potentially delaying investments. In Q1 2024, the average interest rate on 10-year Treasury bonds was around 4%, influencing Avista's bond yields. Changes in rates directly affect customer rates.

Customer Affordability and Billing

Customer affordability is significantly impacted by economic factors such as inflation, wage growth, and unemployment rates. In 2024, inflation remains a key concern, influencing the cost of energy services for consumers. Avista addresses affordability through customer assistance programs and flexible billing options. These measures aim to balance the recovery of costs while ensuring customers can afford energy.

- Inflation Rate (2024): Approximately 3-4% impacting energy costs.

- Unemployment Rate (2024): Around 3.7-4.0%, affecting customer ability to pay.

- Customer Assistance Programs: Offer payment plans and energy efficiency support.

Capital Investment and Financing

Avista's capital investments in grid modernization and renewable energy are economically sensitive. The company's financial capacity is directly impacted by economic conditions and access to capital. In 2024, Avista planned $400 million in capital expenditures, with $100 million allocated for grid upgrades. Credit ratings, like its current BBB+ rating, affect borrowing costs.

- 2024 Capital Expenditure Plan: $400 million.

- Grid Modernization Investment: $100 million.

- Credit Rating: BBB+ (Standard & Poor's).

- Access to Capital Markets: Key for funding projects.

Economic conditions heavily influence Avista. Inflation in 2024 hovers around 3-4%, impacting energy costs for consumers. Unemployment (3.7-4.0%) also affects customer payments. The company's investments are also influenced by interest rates and capital markets.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Inflation Rate | Impacts energy costs | 3-4% |

| Unemployment Rate | Affects customer payments | 3.7-4.0% |

| Interest Rates | Influences borrowing costs | ~4% (10-yr Treasury) |

Sociological factors

Avista's service area shows evolving demographics. Population growth, though varying across regions, impacts energy demand. Shifts in lifestyle, such as remote work, can alter consumption patterns. For example, in 2024, residential energy use increased due to more people working from home. This necessitates infrastructure adjustments and diverse service offerings.

Public perception of Avista hinges on service reliability, rates, environmental impact, and community ties. Positive views are crucial; they foster trust and support. Recent data shows customer satisfaction with utilities is at 78% in 2024, a slight drop from 80% in 2023. Transparency, engagement, and responsive service are key for maintaining this.

Societal focus on energy conservation is increasing across all sectors. Avista's demand-side management programs are crucial. They offer incentives for efficiency upgrades. Customer education also plays a key role. In 2024, residential energy efficiency spending reached $25 million.

Workforce and Labor Relations

Avista must navigate workforce dynamics. Labor relations, employee retention, and the availability of skilled energy sector workers are key. Demographic shifts and changing expectations impact recruitment and training. These factors influence operational efficiency and overall business performance. In 2024, the energy sector faces a skills gap, with 30% of the workforce nearing retirement.

- Employee turnover rates in the utility sector average around 10-15% annually.

- Approximately 20% of utility workers are eligible to retire within the next five years.

- The demand for renewable energy jobs is projected to grow by 7% annually through 2025.

Community Engagement and Corporate Social Responsibility

Avista actively engages in community support, focusing on philanthropic activities and local partnerships. In 2024, Avista invested $2.5 million in community programs. These initiatives align with societal expectations for corporate social responsibility, reinforcing their social license. This commitment includes supporting education and environmental sustainability.

- $2.5 million invested in community programs in 2024.

- Focus on education and environmental sustainability.

Avista faces a changing workforce with an average of 10-15% annual employee turnover. Roughly 20% of utility workers plan to retire in the next five years, increasing the need for skilled labor. The renewable energy job market anticipates a 7% annual growth through 2025, shaping hiring strategies.

| Factor | Impact | 2024 Data |

|---|---|---|

| Employee Turnover | 10-15% turnover annually | Reflects industry standards |

| Retirements | ~20% eligible to retire (5 years) | Highlights skill gaps |

| Renewable Job Growth | 7% growth through 2025 | Impacts hiring focus |

Technological factors

Avista is investing in smart grid tech like advanced metering infrastructure to boost reliability. This includes grid automation and data analytics. These technologies improve efficiency and resilience of the grid. They also enable better management of distributed energy resources. For instance, in 2024, Avista allocated $100 million for grid modernization projects.

Advancements in renewable energy tech significantly impact Avista. Solar and wind efficiency gains, coupled with cost reductions, are key. These changes influence Avista's resource planning and investment decisions. For example, solar costs have dropped by over 80% since 2010. Avista is integrating more renewables to meet growing demand and sustainability goals.

Avista must consider energy storage advancements like battery storage. These technologies stabilize the grid and handle renewable energy fluctuations. The global energy storage market is projected to reach $17.3 billion in 2024, growing to $40.3 billion by 2029. Enhanced reliability is a key benefit for Avista.

Cybersecurity Threats and Solutions

Cybersecurity threats pose significant risks to critical energy infrastructure. Avista is actively investing in cybersecurity measures to protect its grid operations, customer data, and corporate systems. These efforts include advanced monitoring and incident response capabilities. In 2024, the energy sector saw a 20% increase in cyberattacks, highlighting the urgency of robust defenses.

- 20% increase in cyberattacks in the energy sector (2024)

- Investment in advanced monitoring and incident response capabilities.

- Focus on protecting grid operations and customer data.

Digital Transformation and Data Analytics

Avista's digital transformation involves integrating technology to boost efficiency. Data analytics is crucial for demand forecasting and optimizing assets. Leveraging tech improves customer service and decision-making processes. This shift is vital for staying competitive in the evolving energy sector. In 2024, the smart grid market is valued at $37.9 billion, growing to $61.3 billion by 2029.

- Demand forecasting accuracy improved by 15% through data analytics.

- Asset performance optimization increased operational efficiency by 10%.

- Customer service satisfaction scores rose by 8% due to digital enhancements.

Avista uses smart grids, allocating $100 million in 2024 for upgrades, improving reliability through automation and data analysis. Renewable energy advancements impact Avista, with solar costs down over 80% since 2010, integrating renewables. Cybersecurity is crucial, with a 20% rise in energy sector cyberattacks in 2024, prompting investments in robust defenses.

| Technology | Impact on Avista | Data |

|---|---|---|

| Smart Grids | Enhance Reliability & Efficiency | $100M allocated in 2024 for modernization. |

| Renewable Energy | Resource Planning & Investment | Solar costs dropped over 80% since 2010. |

| Cybersecurity | Protect Infrastructure & Data | 20% increase in cyberattacks (2024) |

Legal factors

Avista must adhere to environmental laws. These include regulations on emissions, water use, and waste. Compliance is crucial to avoid legal issues. In 2024, penalties for non-compliance can be substantial. For example, the EPA can issue fines exceeding $100,000 per day for violations.

Avista faces legal scrutiny through utility regulation, primarily concerning rate cases and service standards set by state commissions. These regulatory bodies oversee rate-setting, ensuring fair pricing for consumers while allowing utilities to recover costs. In 2024, Avista navigated several rate case proceedings, impacting its financial performance. Compliance with licensing and operational mandates is crucial, with non-compliance potentially leading to penalties.

Avista must navigate land use and permitting laws. These laws dictate zoning and construction of energy infrastructure. Securing approvals is legally complex, especially for capital projects. Delays can impact project timelines and costs. For example, permitting delays cost the energy sector millions annually.

Safety Regulations and Standards

Avista must adhere to strict safety regulations to protect employees, contractors, and the public. This includes complying with occupational safety and health regulations. Violations can lead to significant legal and financial repercussions. In 2024, OSHA reported over 3,000 workplace fatalities. Penalties for non-compliance can range from fines to legal action.

- OSHA reported 3,271 workplace fatalities in 2023.

- Fines for serious violations can exceed $15,000 per instance.

- Avista must maintain detailed safety records and training programs.

Contract Law and Agreements

Avista's operations heavily rely on contracts; it has agreements with power suppliers, fuel providers, and customers. Sound contract management is vital for mitigating legal risks and ensuring compliance with the law. Dispute resolution mechanisms are crucial for resolving conflicts efficiently and cost-effectively. In 2024, contract disputes in the utility sector cost companies an average of $1.5 million. Proper contract management reduces these costs.

- Contractual obligations with suppliers.

- Customer service agreements.

- Regulatory compliance.

- Dispute resolution processes.

Avista’s legal landscape includes environmental rules impacting emissions and waste. Compliance with rate cases and service standards, dictated by state commissions, is critical. Land use, permitting laws and safety regulations impact Avista's operational effectiveness. Moreover, contract management, especially regarding supplier agreements and customer service is a crucial part of their legal duties.

| Aspect | Details | Impact |

|---|---|---|

| Environmental Laws | Emissions, water, waste regulations; EPA fines | Potential fines exceeding $100,000/day for violations |

| Utility Regulation | Rate cases, service standards | Affects financial performance, ensuring fair pricing. |

| Safety Regulations | OSHA compliance, workplace safety | OSHA reported 3,271 fatalities in 2023, fines up to $15,000+ |

Environmental factors

Climate change poses significant risks to Avista's operations. Shifting weather patterns can alter energy demand, impacting electricity sales. Changes in precipitation and snowmelt affect hydro generation, a key energy source for Avista. Extreme weather events threaten infrastructure. Avista is investing in grid modernization and renewable energy sources. For instance, in 2024, Avista generated about 50% of its electricity from hydro.

Avista faces environmental pressures like renewable energy mandates. Washington's RPS requires 100% carbon-neutral electricity by 2030. These goals affect Avista's investments, shifting towards renewables. The company plans to reduce its reliance on fossil fuels.

Avista goes beyond compliance, focusing on environmental stewardship. They protect biodiversity around facilities and manage water resources. In 2024, Avista invested $10 million in conservation projects. They actively reduce their environmental footprint through voluntary initiatives. This commitment aligns with growing investor and public expectations.

Waste Management and Pollution Control

Avista faces environmental challenges in waste management and pollution control. They focus on minimizing environmental releases from power generation. Compliance with pollution control regulations is a priority. In 2024, Avista allocated $15 million for environmental projects. They aim to reduce emissions by 10% by 2025.

- Waste management includes handling coal ash and other byproducts.

- Air pollution control involves scrubbers and other technologies.

- Water pollution control ensures safe wastewater discharge.

- Avista's practices align with EPA standards.

Resource Availability (Water, Land, Fuel)

Avista faces environmental pressures concerning resource availability. Water access is critical for hydroelectric generation, with drought conditions potentially impacting output. Land use for infrastructure development is also a factor, requiring careful environmental impact assessments. Fuel sourcing, particularly for thermal power plants, has environmental implications, including emissions and related regulations. These factors influence operational costs and strategic planning.

- In 2024, Avista's hydroelectric generation accounted for a significant portion of its energy mix, about 50%.

- The company is investing in renewable energy projects, including solar and wind, to diversify its resource portfolio.

- Environmental regulations, such as those related to water quality and emissions, add to operational expenses.

Environmental factors significantly influence Avista's operations. Climate change, including shifting weather patterns and extreme events, presents both risks and opportunities, such as changing energy demand and affecting hydro generation, representing roughly 50% of their electricity in 2024. Furthermore, the company prioritizes environmental stewardship through waste management, pollution control, and responsible resource utilization to align with EPA standards, investing heavily in related projects, like $10 million for conservation in 2024 and aiming to reduce emissions by 10% by 2025. Compliance with regulations and resource availability also impact the strategic direction and financial performance.

| Environmental Factor | Impact on Avista | 2024/2025 Data |

|---|---|---|

| Climate Change | Alters energy demand, impacts hydro | 50% hydro generation in 2024; Investment in grid modernization. |

| Regulations | Influences investment in renewables | RPS in Washington (100% carbon-neutral by 2030) and emissions goals. |

| Stewardship | Affects waste management and water resources | $10M for conservation, $15M allocated for environmental projects in 2024. |

PESTLE Analysis Data Sources

The Avista PESTLE analysis uses data from government sources, industry reports, and economic databases. We pull information from a variety of reliable sources for accuracy.