Nestlé Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nestlé Bundle

What is included in the product

Nestlé's BCG Matrix analyzes product portfolio, guiding investment, holding, or divestiture strategies.

Data-driven insights to inform strategy and streamline decision-making.

Delivered as Shown

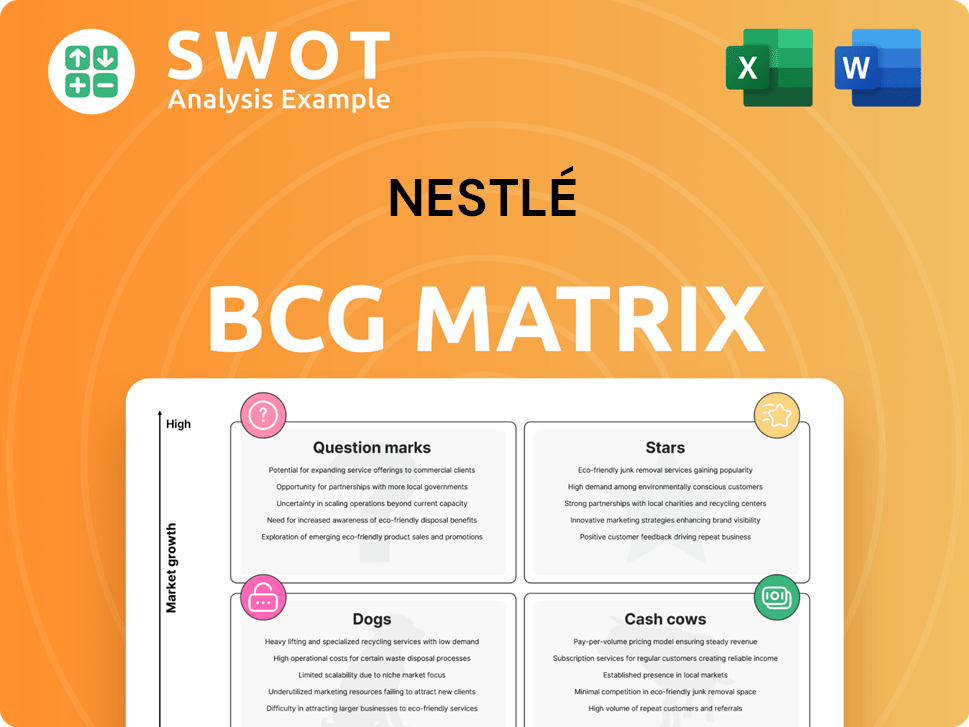

Nestlé BCG Matrix

This Nestlé BCG Matrix preview is identical to the downloadable file. Get the complete analysis, ready to use immediately, and included in the full report upon purchase.

BCG Matrix Template

Nestlé's diverse portfolio, from coffee to pet food, presents a fascinating case study. The BCG Matrix helps visualize how these products perform in the market. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Understanding this allows for strategic resource allocation. Analyzing Nestlé's specific product placements offers actionable insights. Curious to learn where KitKat and Nespresso fit? Get the full BCG Matrix report for detailed quadrant analysis and strategic recommendations.

Stars

Nescafé, a flagship brand for Nestlé, shines as a Star within the BCG Matrix. It capitalizes on the growing global coffee market, projected to reach $120.8 billion in 2024. Nestlé's strategic investments in marketing and product innovation, like new ready-to-drink options, fuel Nescafé's growth. The brand's strong performance is supported by a global market share of approximately 22% in the instant coffee category, indicating its robust position.

Purina Pro Plan, a premium pet food, excels in key markets. It benefits from pet owners' demand for quality nutrition. In 2024, Nestlé's pet care sales grew, with Purina contributing significantly. This aligns with a market trend, making it a strong performer.

KitKat, a Star in Nestlé's portfolio, demonstrates robust growth. In 2024, KitKat sales increased, fueled by innovative flavors and marketing. Its global presence and consistent performance solidify its Star status. KitKat's success is evident in its leading market share within the confectionery sector, making it a key growth driver for Nestlé.

Nestlé Waters

Nestlé Waters, including Perrier and San Pellegrino, is a star within Nestlé's BCG Matrix. These brands enjoy high market share in the expanding bottled water sector. They capitalize on the rising demand for health-conscious drinks. Nestlé's sustainability efforts further enhance their appeal.

- Global bottled water market was valued at over $300 billion in 2024.

- Nestlé Waters brands have strong brand recognition and loyalty.

- Focus on premium and flavored water segments boosts growth.

- Sustainability initiatives are key for long-term success.

Maggi

Maggi, a star within Nestlé's BCG matrix, shines brightly, particularly in emerging markets. Its strong presence is fueled by affordable pricing and distribution efforts. Maggi's adaptability to local preferences solidifies its status as a key culinary player. Nestlé reported a 7.2% organic growth in 2024, with emerging markets contributing significantly.

- Strong brand presence in emerging markets.

- Adaptability to local tastes.

- Affordable pricing strategies.

- Significant contribution to Nestlé's growth.

Stars, like Nescafé and KitKat, represent Nestlé's high-growth, high-share brands.

These brands benefit from significant investment and strong market positions.

Their success drives overall revenue and profitability.

| Brand | Market Share (Approx. 2024) | Key Strategy |

|---|---|---|

| Nescafé | 22% (Instant Coffee) | Innovation, Marketing |

| KitKat | Leading (Confectionery) | Flavor, Global Presence |

| Maggi | Significant | Emerging Markets, Affordability |

| Nestlé Waters | Strong | Premium, Sustainability |

Cash Cows

Nido, a key part of Nestlé's portfolio, is a strong cash cow brand. It is particularly robust in emerging markets, benefiting from a loyal consumer base. Despite potential market slowdowns, Nido's consistent demand and strong brand recognition ensure steady cash flow. In 2024, Nido's sales in key regions contributed significantly to Nestlé's overall revenue.

Nestlé has a strong position in the coffee creamer market. While facing competition, the creamer segment offers stable revenue. In 2024, the global coffee creamer market was valued at approximately $7.5 billion. This market is characterized by moderate growth. The steady demand makes it a Cash Cow within Nestlé's portfolio.

Felix, a key part of Nestlé's portfolio, is a Cash Cow. The brand, popular in Europe and Asia, sees stable growth. In 2024, Nestlé's pet care sales hit CHF 18.8 billion, reflecting Felix's contribution. Its established market presence and brand loyalty drive consistent cash flow.

Friskies

Friskies, a prominent pet food brand under Nestlé, is categorized as a Cash Cow. It boasts a significant market share, particularly in regions like Latin America and Asia. This brand consistently generates substantial cash flow due to its established presence and loyal customer base. Friskies supports Nestlé's overall financial stability within the pet care sector.

- Global pet food sales reached approximately $116 billion in 2024.

- Nestlé's pet care segment, including Friskies, saw organic growth of 8.4% in 2024.

- Latin America's pet food market is experiencing rapid growth.

- Friskies contributes to the overall profitability of Nestlé.

NAN Infant Formula

NAN Infant Formula, a cornerstone of Nestlé's portfolio, thrives as a Cash Cow due to its consistent revenue generation. It benefits from strong demand, especially in Asia, solidifying its position in the infant nutrition market. The brand's reputation for high quality and nutritional benefits guarantees a reliable income stream. Even with market fluctuations, NAN maintains its status as a Cash Cow, demonstrating its financial stability.

- Sales in Asia: Accounted for a significant portion of Nestlé's infant formula sales in 2024.

- Market Share: NAN held a leading market share in several key Asian countries.

- Revenue Growth: The brand experienced steady revenue growth, contributing to Nestlé's overall financial performance.

- Consumer Preference: NAN's popularity among parents reflects its perceived value and trustworthiness.

Cash Cows like NAN and Felix provide consistent revenue for Nestlé. These brands, with strong market presence, ensure steady cash flow. In 2024, pet care and infant nutrition sales were key revenue drivers.

| Brand | Category | Key Feature |

|---|---|---|

| NAN | Infant Formula | Consistent Demand |

| Felix | Pet Food | Brand Loyalty |

| Nido | Milk Powder | Market Presence |

Dogs

In Nestlé's BCG Matrix, underperforming frozen meal businesses, particularly in North America, are considered Dogs. These units face challenges like price wars and shifting consumer tastes, leading to market share declines. For instance, in 2024, the frozen food category saw a slight dip in sales volume. This necessitates divestiture or strategic overhauls.

In 2024, some of Nestlé's dairy offerings, such as certain yogurts, showed slower growth. These products may be classified as "Dogs" in the BCG matrix. This is due to shifts in consumer tastes and a crowded market. Strategic options include restructuring or divestiture. The dairy segment's overall performance might influence decisions.

In North America, Nestlé's coffee creamer market share faced challenges in 2024, influenced by intense competition. These regional struggles, potentially classified as "Dogs," demand strategic solutions. For example, in 2023, the coffee creamer market in the US was estimated at $3.2 billion. This suggests the need for revised marketing or product strategies.

Winding Down Businesses

In Nestlé's BCG Matrix, "Dogs" represent business units with low market share in slow-growing industries. The 2023 closure of Nestlé's frozen meals business in Canada exemplifies this strategy, aiming to reduce involvement in underperforming areas. This move aligns with divesting from businesses that no longer fit their strategic goals. Such decisions free up resources for more promising ventures.

- Nestlé divested its frozen meals business in Canada.

- This aligns with reducing exposure to underperforming segments.

- The goal is to reallocate resources to high-growth areas.

- This is a typical example of a "Dog" in the BCG Matrix.

Nestea

Nestea, a product of Nestlé, currently finds itself in the "dog" quadrant of the BCG matrix. This designation reflects its declining market share, a consequence of consumer preference shifts towards healthier beverage alternatives. Turnaround strategies for such products are often costly and rarely successful. In 2024, Nestlé might consider divestiture to reallocate resources.

- Market share decline due to health trends.

- Expensive turnaround plans are typically ineffective.

- Divestiture is a potential strategic move.

In the BCG matrix, "Dogs" are low-growth, low-share businesses. Declining market share, like Nestea's, leads to this classification. Divestiture becomes a strategic option to free resources. In 2024, Nestea's performance may reflect this position.

| Product | Market Share | Strategy |

|---|---|---|

| Nestea | Declining | Divestiture |

| Frozen Meals | Low | Divestiture |

| Coffee Creamer | Challenged | Restructure |

Question Marks

Vital Pursuit is a new brand from Nestlé, targeting consumers using GLP-1 weight loss medications. This brand taps into a high-growth market segment, but its market share is still uncertain. Nestlé will need substantial investment to establish Vital Pursuit. In 2024, the global weight loss market was valued at over $254 billion.

Nescafé Ice Roast is a Question Mark in Nestlé's BCG Matrix, indicating a product in a growing market but with a low market share. The cold coffee market is experiencing significant growth, with sales in 2024 estimated at $1.5 billion. To increase its market share, Nestlé needs to invest in marketing and distribution, aiming to capture a larger portion of the expanding market.

Nestlé's plant-based products fall under the question mark category in the BCG matrix. The company is investing heavily to capitalize on rising consumer demand for sustainable and healthy food options. Plant-based sales grew by 20% in 2023, though they still represent a smaller portion of overall revenue. This category requires significant investment for wider market penetration.

Gerber Baby Food Smoothies

Gerber baby food smoothies are a new product, aiming at health-focused parents. It's a growing market, but the current market share needs boosting. Investment is needed to solidify its standing.

- Market growth: The baby food market is expected to reach $80.7 billion by 2028.

- Nestlé's position: Nestlé's infant nutrition sales were CHF 9.2 billion in 2023.

- Investment need: New product launches require significant marketing and distribution spending.

New Product Launches in Emerging Markets

New product launches in emerging markets, like confectionery or culinary innovations, are strategic moves by Nestlé. These initiatives aim for growth but face potential low initial market share. Success hinges on effective investment and marketing to resonate with consumers and broaden market presence. For instance, in 2024, Nestlé invested heavily in expanding its product lines in Southeast Asia, focusing on local tastes. However, these launches often require patience, as market penetration can take time.

- Focus on local preferences in emerging markets is crucial for Nestlé's success.

- Strategic investments and marketing are essential for building brand recognition.

- Gaining consumer acceptance and expanding market presence is the ultimate goal.

- Nestlé's ventures in Southeast Asia in 2024 are a prime example of this strategy.

Question Marks in Nestlé's portfolio are products in growing markets but with low market shares, requiring strategic investments. These include new brands like Vital Pursuit, Nescafé Ice Roast, and plant-based products. Successful Question Marks need substantial marketing and distribution to gain market presence, illustrated by Gerber smoothies and expansions in Southeast Asia.

| Product Category | Market Growth (2024) | Nestlé's Strategy |

|---|---|---|

| Plant-Based | 20% sales growth (2023) | Investment in marketing & distribution |

| Cold Coffee | $1.5 billion (2024) | Expand product lines and market presence |

| Baby Food | $80.7B by 2028 (expected) | Marketing & brand building |

BCG Matrix Data Sources

The BCG Matrix relies on diverse sources like financial reports, market analyses, and industry insights, guaranteeing accuracy in Nestlé's portfolio assessments.