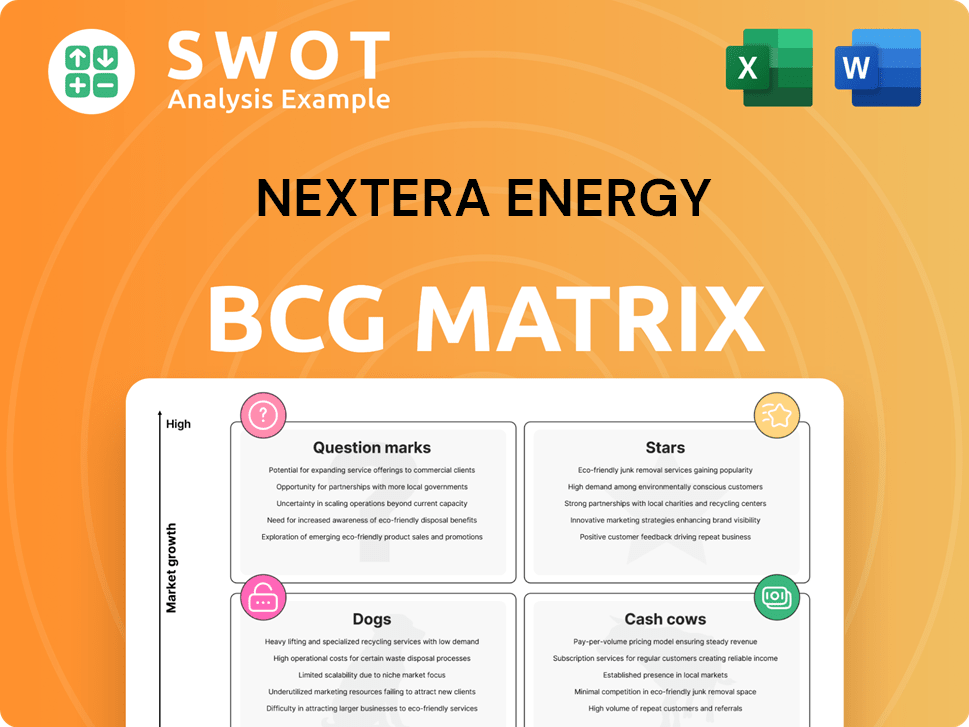

NextEra Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Bundle

What is included in the product

Tailored analysis for NextEra's product portfolio across the BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, providing an easily shareable BCG Matrix.

Delivered as Shown

NextEra Energy BCG Matrix

The BCG Matrix preview showcases the identical report you'll gain upon purchase, a fully formatted and analysis-ready document. This is the definitive NextEra Energy strategic tool, immediately available without watermarks or hidden content. Download it instantly to enhance your strategic planning or investor presentations.

BCG Matrix Template

NextEra Energy's BCG Matrix offers a glimpse into its diverse portfolio. See how its renewable energy projects stack up against traditional power generation. Understand which segments are driving growth and which need strategic attention. This sneak peek only scratches the surface.

The complete BCG Matrix reveals the full picture, with detailed quadrant placements. Gain insights into strategic recommendations and a roadmap to smart decisions. Buy the full report for a complete breakdown!

Stars

NextEra Energy Resources, a key part of NextEra Energy, leads in renewable energy. In 2024, it operated over 30,000 MW of renewable capacity. This includes wind and solar projects across North America. The company's focus on innovation and expansion keeps it at the forefront.

NextEra Energy is a global leader in battery storage, a key growth area. As of 2024, NextEra has over 3.6 GW of battery storage projects in operation or under construction. This includes co-locating battery storage with renewable energy projects to enhance grid stability. NextEra's focus on battery storage positions it well for future growth.

Florida Power & Light (FPL), a key part of NextEra Energy, is the largest U.S. electric utility. It serves over 5 million customer accounts, benefiting from Florida's growing population. FPL's investments in infrastructure and grid improvements enhance reliability. In 2024, NextEra's regulated utility, including FPL, saw strong earnings.

Innovation and Technology

NextEra Energy aggressively pursues innovation to maintain its competitive edge in renewables. They allocate substantial resources to R&D, ensuring they remain at the vanguard of clean energy technology. A key focus is leveraging AI and data analytics for faster transmission development. This approach is vital for efficiently integrating new renewable projects into the grid. In 2024, NextEra's R&D spending reached $380 million.

- R&D Spending: $380 million in 2024.

- Focus: AI and data analytics for transmission.

- Goal: Integrate renewable projects efficiently.

Geographic Expansion

NextEra Energy's "Stars" status in the BCG matrix reflects its aggressive geographic expansion strategy. The company actively seeks growth opportunities in promising markets globally, aiming to boost its market share and customer base. This expansion is fueled by strategic acquisitions and organic project development. For instance, in 2024, NextEra invested billions in new renewable energy projects across several states, demonstrating its commitment to growth.

- Focus on emerging markets.

- Strategic acquisitions.

- Organic project development.

- Increased market share.

NextEra Energy's "Stars" status is marked by aggressive geographic expansion.

In 2024, the company invested billions in new renewable projects.

This growth strategy increases its market share and customer base.

| Expansion Type | Focus | 2024 Activity |

|---|---|---|

| Geographic | Emerging Markets | Investment in new renewable energy projects |

| Acquisitions | Strategic | Multiple acquisitions |

| Development | Organic Projects | Billions invested in renewable projects |

Cash Cows

NextEra's established wind and solar farms, acting as cash cows, leverage economies of scale and high utilization. These assets provide steady cash flow with minimal additional investment. Anticipated efficiency gains are 2% for wind and 4.5% for solar. NextEra generated $6.2 billion in net income in 2024, demonstrating strong profitability.

NextEra Energy's regulated utility operations, primarily through Florida Power & Light (FPL), are a cash cow due to their stable revenue. FPL's investments in grid enhancements boosted reliability. Favorable regulatory decisions support earnings. FPL's 2024 capital expenditures were about $8.8 billion.

NextEra Energy's Long-Term Power Purchase Agreements (PPAs) form a crucial part of its "Cash Cows." NextEra Energy Resources boasts a significant PPA backlog, ensuring stable revenue. These PPAs mitigate market price risks, a key benefit. Decarbonization efforts drive the growth of these agreements. In 2024, NextEra had a backlog of over $50 billion.

Infrastructure Investments

NextEra Energy's infrastructure investments are a cash cow. They plan to invest about $120 billion in energy infrastructure over the next four years. This boosts the efficiency and reliability of existing assets, creating strong cash flow. These investments offer steady returns with moderate growth.

- NextEra Energy's 2024 capital expenditures are projected to be between $25.5 and $28.5 billion.

- These investments focus on regulated utility and renewables projects.

- The company aims to expand its renewable energy portfolio.

- They focus on improving energy transmission and distribution networks.

Scale and Diversification

NextEra Energy's vast renewable energy presence in North America is a key strength. Their diverse mix of wind and solar assets boosts cost efficiency and reduces risks. This scale and diversification give them a significant competitive advantage in the market. The company's 2024 earnings were strong due to these factors.

- NextEra Energy's renewable energy capacity is over 60 GW.

- They operate in over 30 states, diversifying their geographic risk.

- In 2024, renewable energy projects represented 70% of new investments.

- Their diversified portfolio helps manage fluctuating energy prices.

NextEra Energy's "Cash Cows" include established wind/solar farms, delivering steady cash flow with minimal extra investment, where efficiency gains are anticipated. Regulated utility operations, particularly Florida Power & Light (FPL), ensure stable revenue and boost reliability. Long-Term Power Purchase Agreements (PPAs) with over $50B backlog in 2024 offer secure revenue streams and mitigate market risks.

| Financial Aspect | Details | 2024 Data |

|---|---|---|

| Net Income | Financial Performance | $6.2B |

| FPL Capital Expenditure | Grid enhancements | ~$8.8B |

| PPA Backlog | Revenue Assurance | >$50B |

Dogs

NextEra Energy Partners divested its natural gas pipeline assets to prioritize renewable energy investments. These pipelines, like the ones sold to Kinder Morgan for $1.8 billion in 2024, offered limited growth. The company's strategic shift includes selling Meade Pipeline Co. in 2025. This move aligns with NextEra's focus on expanding its renewable energy portfolio.

Legacy fossil fuel plants, such as older coal-fired facilities, represent a "dog" in NextEra's portfolio. These plants often have high operational costs and environmental risks. In 2024, NextEra continued to reduce its coal exposure. This aligns with the company's strategy to transition towards cleaner energy sources.

Non-Strategic International Ventures, in NextEra Energy's BCG matrix, could include underperforming international projects. These ventures, with potentially low market share and limited growth prospects, might not align with NextEra's core strategy. Divestiture could be the most strategic move. For instance, in 2024, NextEra's international revenues represented a small fraction of its total, signaling a possible area for strategic realignment.

Underperforming Merchant Power Plants

Underperforming merchant power plants, facing challenges in the market, are categorized as Dogs in NextEra Energy's BCG matrix. These plants, potentially with low utilization rates, struggle with profitability. NextEra's focus on decarbonization, targeting zero carbon emissions by 2045, influences decisions regarding these assets. This strategic shift impacts their long-term viability. In 2024, NextEra Energy reported a decrease in revenue from its merchant power generation segment.

- Merchant plants face market competition.

- Low utilization rates impact cash flow.

- Decarbonization strategy is key.

- Revenue decline in 2024.

Outdated Technologies

Outdated technologies at NextEra Energy, classified as Dogs, include inefficient or costly equipment needing upgrades or replacement. These assets can be a drag on financial performance. NextEra's focus on smart meters and grid diagnostics, utilizing data lakes and machine learning, highlights this. By 2024, NextEra had invested billions in grid modernization.

- Inefficient equipment drags financial performance.

- Requires significant investment for upgrades or replacement.

- NextEra invests in smart meters and grid diagnostics.

- Utilizes data lakes and machine learning for energy grid management.

Dogs in NextEra's portfolio include underperforming assets with low growth potential. These encompass legacy fossil fuel plants and outdated technologies. The company has strategically reduced exposure to these assets in 2024, such as the decline in merchant power segment revenue.

| Category | Description | 2024 Data |

|---|---|---|

| Fossil Fuel Plants | High operational costs, environmental risks | Reduced coal exposure |

| Merchant Power Plants | Low utilization, market challenges | Revenue decline |

| Outdated Tech | Inefficient, costly, needing upgrades | Grid modernization investments |

Question Marks

NextEra Energy is venturing into green hydrogen production, tapping into a market projected to reach $147.5 billion by 2028. This area shows high growth potential but currently faces cost and scalability hurdles. The company needs strategic investments and partnerships to navigate this evolving landscape. For example, the current cost of green hydrogen is $5-7/kg, aiming to decrease to $2/kg by 2030.

NextEra Energy's investment in carbon capture technologies is a question mark in its BCG matrix. This area is high-growth but currently has an uncertain market share. The need for zero-carbon emissions in the United States drives this technology. It requires exploring emerging technologies like direct air capture, with projects possibly costing billions. For instance, the Petra Nova project, a carbon capture facility, cost roughly $1 billion.

NextEra Energy is venturing beyond conventional battery storage, exploring innovative energy storage solutions. These advancements could reshape the energy sector, though they encounter technical and financial obstacles. The company is investing in novel clean energy technologies to broaden its capabilities for future energy demands. For 2024, the global energy storage market is projected to reach $16.4 billion.

New Renewable Energy Technologies

NextEra Energy views investments in new renewable energy technologies, such as geothermal or advanced biofuels, as Question Marks. These technologies have high growth potential but also carry significant risks and require substantial investment. In 2024, NextEra Energy invested $1.3 billion in new projects. NextEra Energy Resources actively monitors emerging technologies to assess their potential and strategic fit. This approach allows for informed decisions as these technologies mature.

- High growth potential, but uncertain returns.

- Requires significant capital investment.

- Focus on emerging technologies like geothermal.

- Strategic assessment of long-term viability.

International Expansion in New Markets

International expansion for NextEra Energy falls into the "Question Mark" category of the BCG Matrix. This signifies high growth potential in new international markets, but also carries significant risks. Identifying opportunities for growth and development is key for increasing market share and reaching new customers. The company's strategy involves careful evaluation and strategic allocation of resources to maximize returns in these ventures.

- NextEra Energy's international investments are aimed at expanding its renewable energy footprint.

- These investments are often in emerging markets with high growth prospects.

- The company faces uncertainties related to regulatory, economic, and political risks.

- NextEra Energy carefully assesses each market to determine the potential for success.

NextEra Energy's ventures categorized as "Question Marks" in the BCG Matrix are characterized by high growth potential but uncertain outcomes. These investments require significant capital and a strategic approach to navigate associated risks.

For instance, international expansion efforts need careful evaluation to maximize returns amid regulatory and economic uncertainties. The company's focus is on emerging technologies and markets to assess their long-term viability.

| Category | Description | Example |

|---|---|---|

| Carbon Capture | High growth potential; uncertain market share | Petra Nova project ($1B cost) |

| New Energy Storage | Reshaping sector with hurdles | 2024 Market: $16.4B |

| Intl. Expansion | High growth; significant risks | Emerging markets |

BCG Matrix Data Sources

This BCG Matrix is built upon verified market analysis, using company financials, industry reports, and expert projections for actionable insights.