NextEra Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Bundle

What is included in the product

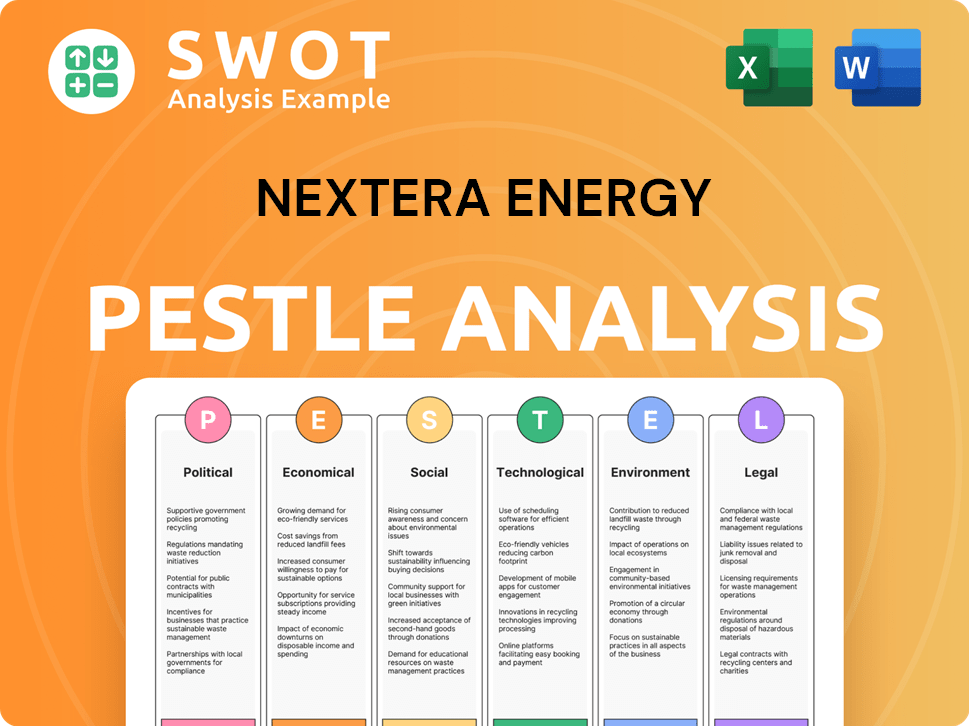

Analyzes NextEra Energy through Political, Economic, Social, Tech, Environmental, and Legal lenses.

A comprehensive analysis, it quickly identifies threats and opportunities for faster strategic decision-making.

Full Version Awaits

NextEra Energy PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This NextEra Energy PESTLE Analysis covers political, economic, social, technological, legal, and environmental factors. Analyze each facet thoroughly within. Download this complete, ready-to-use analysis immediately after purchase. This detailed document will be ready to go.

PESTLE Analysis Template

Navigate NextEra Energy's complex landscape with our PESTLE analysis. Explore how political changes, economic shifts, social trends, technological advancements, legal frameworks, and environmental factors influence its performance. Understand the company's external opportunities and threats. This detailed analysis empowers strategic decision-making for investors and analysts alike. Download the full version for comprehensive insights.

Political factors

NextEra Energy thrives on government incentives. The Inflation Reduction Act offers vital tax credits. These boost wind and solar project profitability. Policy shifts can alter project viability. For instance, in Q1 2024, NextEra reported $5.7 billion in renewable energy investments, heavily reliant on these incentives.

NextEra Energy faces regulatory scrutiny, especially in Florida. Decisions by the Federal Energy Regulatory Commission (FERC) and state bodies directly affect its operations. Rate structures and investment strategies are heavily influenced by these regulations. In 2024, FPL invested billions in infrastructure projects, reflecting regulatory impacts.

NextEra Energy heavily invests in political engagement and lobbying. In 2023, the company spent approximately $5.9 million on lobbying efforts. This advocacy supports policies that promote renewable energy and favorable regulations. Their goal is to create a beneficial environment for their business and enhance long-term value.

Permitting Processes

Permitting processes significantly affect NextEra Energy's projects. Delays can increase costs and impact project timelines. Streamlining these processes is crucial for financial planning and operational efficiency. NextEra's ability to navigate these regulations directly influences its growth.

- The U.S. permitting process can take several years.

- Costs of delays can range from millions to billions of dollars.

- NextEra actively engages with policymakers to advocate for efficient permitting.

Geopolitical Factors

Geopolitical factors introduce risks to NextEra Energy, impacting supply chains, energy markets, and infrastructure security. These factors can disrupt operations and financial performance. For instance, geopolitical instability can elevate the costs of materials. In 2024, NextEra Energy faced increased supply chain costs due to global events.

- Supply chain disruptions can increase operational costs.

- Geopolitical events can impact energy market prices.

- Infrastructure security is vulnerable to geopolitical risks.

NextEra's political landscape centers on government incentives and regulations, key to its profitability. They spent about $5.9M on lobbying in 2023, targeting policies. Permitting delays pose financial risks, amplified by geopolitical factors affecting supply chains.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Government Incentives | Affects project profitability | Q1 2024: $5.7B in renewable energy investment (influenced by tax credits from the Inflation Reduction Act). |

| Regulatory Scrutiny | Influences operations and investment strategies | FPL invested billions in infrastructure projects in 2024 (reflecting regulatory impacts). |

| Political Engagement/Lobbying | Shapes policy favorable to renewable energy. | NextEra spent about $5.9 million on lobbying efforts in 2023. |

Economic factors

NextEra Energy is heavily investing in renewables, with capital expenditures (CAPEX) planned. In 2024, they spent billions on projects. High CAPEX can strain finances short-term. Access to affordable capital is essential; 2024 interest rates impact this.

Favorable market conditions significantly boost NextEra Energy's growth, especially in wind and solar. The demand for clean energy is rising, supported by policies like the Inflation Reduction Act. Solar costs have dropped by about 85% since 2010, making projects economically viable. NextEra's Q1 2024 earnings highlighted this trend, with strong renewable energy project additions.

Rising interest rates pose challenges to NextEra Energy's financing costs and growth. The company heavily relies on debt, with approximately $65 billion in outstanding debt as of early 2024. Interest rate locks are crucial for managing these risks. In Q1 2024, NextEra reported a net interest expense of $761 million. Higher rates could impact future convertible equity portfolio financings.

Customer Demand and Affordability

NextEra Energy prioritizes delivering affordable and reliable energy, especially through its subsidiary, Florida Power & Light (FPL). Customer demand is significantly influenced by energy costs and affordability, which are key considerations for the company's operations. FPL's focus on keeping energy bills low directly impacts customer satisfaction and retention. NextEra's strategies are designed to balance providing essential services with managing costs efficiently.

- FPL's typical residential customer bill is about 30% below the national average.

- NextEra aims to maintain competitive rates while investing in infrastructure.

- The company monitors and adjusts to shifts in customer demand and economic conditions.

Asset Valuation and Market Performance

NextEra Energy's asset valuation and market performance are sensitive to economic conditions. Market downturns can diminish the value of investments, including nuclear decommissioning funds. For instance, a 10% decrease in market performance could significantly impact the company's financial health. This is particularly relevant as the company manages substantial assets.

- Nuclear decommissioning funds are crucial for long-term financial stability.

- Market volatility directly affects the value of these funds.

- Poor market performance could lead to financial strain.

- NextEra must manage its investments carefully.

NextEra Energy faces financial impacts from high capital expenditures, with substantial investments planned for 2024 and beyond. The company's financing costs are influenced by fluctuating interest rates, affecting its debt-heavy operations; early 2024, debt stood at about $65 billion. Market performance and economic shifts also critically influence asset valuation, impacting decommissioning funds and overall financial stability.

| Factor | Impact | Data Point |

|---|---|---|

| Capital Expenditure | High short-term financial strain | Billions spent in 2024 on renewable projects. |

| Interest Rates | Affects financing costs & growth | Q1 2024 net interest expense: $761 million. |

| Market Performance | Influences asset valuation | Decommissioning fund value change based on market. |

Sociological factors

Public demand for clean energy is a major factor for NextEra. There's rising public support for renewables. Climate change awareness influences consumer behavior. In 2024, renewable energy capacity additions hit record highs. NextEra's focus aligns with this growing trend, potentially boosting its market share and profitability.

NextEra Energy's projects heavily rely on community backing. Public opinion, support, and possible resistance to new infrastructure can affect project schedules and expenses. Gaining local acceptance is crucial for project success. In 2024, community engagement costs averaged $10 million per project. Public perception directly influences investment decisions.

NextEra Energy significantly impacts society through job creation and workforce development. In 2024, the company employed over 15,000 people. Attracting and retaining skilled workers is critical; the company invests in training programs. The average employee tenure is about 8 years, reflecting a stable workforce.

Customer Satisfaction and Value Proposition

NextEra Energy prioritizes customer satisfaction through reliable service and cost-effective energy solutions. FPL's strong performance in customer satisfaction reflects this commitment. Social and economic factors significantly influence customer perception of value. These factors can affect energy consumption patterns and expectations for service quality.

- FPL consistently scores high in customer satisfaction surveys.

- Economic conditions impact energy affordability.

- Social trends influence energy usage habits.

Corporate Social Responsibility and Sustainability Perception

NextEra Energy's dedication to sustainability and corporate social responsibility shapes its public image. Environmental and social performance reporting is critical for investors and the public. NextEra's ESG efforts are reflected in its stock performance and stakeholder trust. As of late 2024, the company has invested billions in renewable energy projects. These projects boost its ESG ratings, attracting socially responsible investors.

- NextEra's ESG score is a key factor for investors.

- The company actively reports on its environmental impact.

- Stakeholder relationships are improved through CSR.

- Investment in renewables enhances its public image.

NextEra aligns with growing public support for renewables; climate change awareness influences consumer behavior. Community backing impacts project timelines and costs; average community engagement cost in 2024 was $10M per project. NextEra’s social impact includes job creation and customer satisfaction, reflected in FPL's high scores.

| Factor | Impact | Data |

|---|---|---|

| Public Demand | Boosts market share | 2024: Record renewables added |

| Community Relations | Affects project success | Engagement cost: $10M |

| Social Impact | Influences Perception | 15,000+ employees (2024) |

Technological factors

Technological progress in wind, solar, and battery storage significantly influences NextEra Energy. These innovations boost efficiency and cut expenses, broadening clean energy options. For instance, in 2024, NextEra's solar projects saw a 15% efficiency jump. Also, battery storage costs decreased by 10% due to better tech.

NextEra Energy's grid modernization investments are critical. They focus on improving reliability and integrating distributed energy resources. This involves smart grid tech and advanced control systems. In 2024, NextEra allocated approximately $7 billion to grid infrastructure upgrades. This includes smart meters and grid automation, enhancing efficiency and resilience.

NextEra Energy heavily invests in battery storage tech, crucial for grid reliability and renewable energy integration. Battery storage capacity in the U.S. is expected to reach 75 GW by 2029, with significant growth in Florida where NextEra operates. This technology supports the company's long-term strategy to expand renewable energy projects. In Q1 2024, NextEra's capital expenditures were approximately $3.6 billion, with a portion allocated to battery storage.

Emerging Clean Energy Technologies

NextEra Energy is actively involved in emerging clean energy technologies, primarily focusing on green hydrogen to achieve its zero-carbon emissions target. In 2024, NextEra committed over $1 billion to renewable energy projects, including hydrogen initiatives. The company aims to scale up its green hydrogen production capacity significantly by 2030. This strategic move aligns with the growing demand for sustainable energy solutions and government incentives.

- Investment of $1B+ in renewable energy projects.

- Targeted scale-up of green hydrogen production by 2030.

- Focus on meeting growing demand for sustainable energy.

- Leveraging government incentives for green initiatives.

Digitalization and Data Analytics

NextEra Energy heavily relies on digitalization and data analytics to boost operational efficiency and strategic planning. They use advanced analytics to predict equipment failures, reducing downtime and maintenance costs. In 2024, NextEra invested $1.5 billion in digital infrastructure. This investment has led to a 10% improvement in operational efficiency across their renewable energy projects.

- Predictive maintenance reduced unplanned outages by 15%.

- Data analytics improved energy output forecasting accuracy by 8%.

- Smart grid technologies enhanced grid stability and reliability.

- Cybersecurity measures protect critical infrastructure.

Technological advancements are key for NextEra. Their projects in solar saw a 15% efficiency boost in 2024, improving operations. Grid modernization is a focus, with $7B allocated for upgrades. Battery storage investments, expected to reach 75 GW by 2029, support their strategy.

| Technology Area | 2024 Initiatives | Impact/Benefits |

|---|---|---|

| Solar Efficiency | 15% Efficiency jump | Reduced costs, boosted output |

| Grid Modernization | $7B allocated to upgrades | Improved reliability and efficiency |

| Battery Storage | Increased capacity | Enhanced renewable integration |

Legal factors

NextEra Energy faces stringent environmental regulations at federal and state levels, covering air and water quality and wildlife protection. Compliance demands substantial annual investment. For example, in 2023, NextEra spent approximately $400 million on environmental compliance. The company anticipates similar spending in 2024 and 2025 to maintain its operational licenses.

NextEra Energy faces ongoing legal challenges from evolving energy market regulatory frameworks. The company actively monitors and adapts to regulatory changes impacting the energy sector. In 2024, the company spent approximately $50 million on legal and regulatory compliance. This includes adapting to new policies regarding renewable energy standards.

Infrastructure projects often encounter legal hurdles concerning land disputes and environmental impact assessments, which can significantly delay project timelines. Legal battles over right-of-way acquisitions are another common challenge, particularly in areas with complex property ownership. For instance, in 2024, NextEra Energy faced legal challenges that delayed the completion of certain projects by an average of 6-12 months. Managing these legal proceedings requires dedicated resources and strategic planning.

Nuclear Regulatory Requirements

NextEra Energy faces stringent legal demands due to its nuclear power operations, primarily through the Nuclear Regulatory Commission (NRC). Compliance involves detailed environmental impact statements and rigorous licensing procedures. These regulations dictate operational safety and environmental protection protocols. The company must adhere to evolving standards to maintain its nuclear licenses. Costs associated with compliance were approximately $400 million in 2024.

- NRC oversight ensures operational safety and environmental responsibility.

- Environmental impact statements are crucial for nuclear facility operations.

- Licensing procedures are essential for legal operation.

- Compliance costs are a significant operational expense.

Tax Laws and Incentives

Changes in tax laws and incentives significantly influence NextEra Energy. For example, the extension of the Investment Tax Credit (ITC) and Production Tax Credit (PTC) for renewable energy projects in the US, as part of the Inflation Reduction Act, provides substantial financial benefits. This legislation, enacted in August 2022, offers long-term stability for clean energy investments.

- ITC can cover up to 30% of the cost of solar projects.

- PTC provides a per-kilowatt-hour tax credit for wind and other renewable energy sources.

- NextEra Energy's financial statements reflect these impacts directly.

NextEra Energy faces complex legal challenges related to environmental and regulatory compliance. It spends considerable amounts on environmental compliance, approximately $400 million annually. Legal disputes and nuclear regulations also demand substantial resources and compliance efforts.

| Legal Area | Compliance Cost (2024) | Impact |

|---|---|---|

| Environmental Regulations | $400M | Licensing, Operational Requirements |

| Legal/Regulatory | $50M | Renewable Energy Standards |

| Nuclear Compliance | $400M | NRC, Licensing |

Environmental factors

NextEra Energy faces significant risks from climate change, especially in areas vulnerable to extreme weather. This includes potential damage to its infrastructure and higher operational costs due to events like hurricanes. For example, in 2023, Florida experienced a record number of named storms, impacting energy operations. Climate change intensifies these challenges, increasing the frequency and severity of such events.

NextEra Energy is committed to slashing carbon emissions. The company is investing heavily in renewable energy sources. As of 2024, NextEra has a significant renewable energy portfolio. They aim for real zero emissions. This shift impacts their financial strategies.

NextEra Energy's growth hinges on renewable energy. They have a large wind and solar presence across the U.S. In 2024, NextEra added ~2,700 MW of renewable capacity. This expansion aligns with the increasing demand for clean energy, driven by environmental concerns and government incentives.

Environmental Stewardship and Conservation

NextEra Energy prioritizes environmental stewardship, integrating it into its operations. They focus on protecting endangered species and managing waste responsibly. In 2024, NextEra invested \$1.5 billion in environmental projects. This commitment reflects their dedication to sustainability.

- \$1.5 billion invested in 2024 for environmental projects.

- Focus on endangered species and waste management.

Water Usage and Management

Water availability and management are critical environmental factors for NextEra Energy, particularly for its power generation facilities. The company must comply with stringent water quality regulations across its operational areas. In 2024, NextEra's water consumption was approximately 150 billion gallons, primarily for cooling purposes at its power plants. Effective water resource management is essential for operational efficiency and regulatory compliance.

- Water consumption is a significant operational cost.

- Compliance with water quality regulations is mandatory.

- Water scarcity can impact plant operations.

NextEra Energy's operations are significantly influenced by environmental factors, including climate change, renewable energy goals, and water management. Extreme weather events, like the record number of named storms in Florida in 2023, pose operational risks. Their focus on cutting carbon emissions and expanding renewable capacity, with about 2,700 MW added in 2024, impacts strategy and investment.

| Environmental Factor | Impact | 2024 Data |

|---|---|---|

| Climate Change | Infrastructure damage, operational costs | Record storms impacted operations |

| Renewable Energy | Growth driver, investment focus | ~2,700 MW renewable capacity added |

| Water Management | Operational efficiency, regulatory compliance | ~150 billion gallons of water consumption |

PESTLE Analysis Data Sources

This PESTLE Analysis uses diverse sources like government reports, financial news, industry publications and environmental studies.