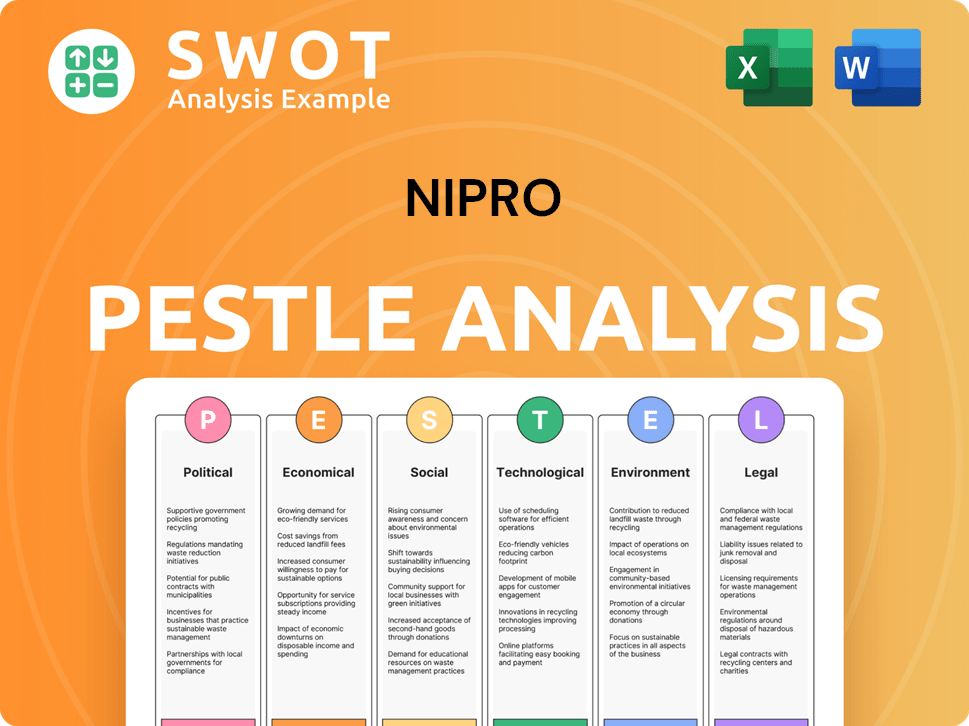

Nipro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nipro Bundle

What is included in the product

Analyzes Nipro through Political, Economic, Social, Technological, Environmental & Legal factors.

Supports clear identification of the primary and secondary factors influencing decision-making. Identifies market gaps & guides the strategic thinking process.

What You See Is What You Get

Nipro PESTLE Analysis

This preview shows the complete Nipro PESTLE Analysis report.

What you see is what you'll get - a fully formatted, professional document.

The analysis displayed is the same file ready for immediate download after purchase.

No hidden parts, just a thorough, usable strategic tool.

PESTLE Analysis Template

Uncover how Nipro is navigating the complex landscape of external forces. Our PESTLE analysis reveals the political, economic, social, technological, legal, and environmental factors impacting their business.

This analysis provides a comprehensive understanding of Nipro's challenges and opportunities. Gain key insights into market trends and risks, helping you make informed decisions.

This is ideal for strategic planning and market research. Access deep-dive insights you can't afford to miss.

Download the full analysis and start making smarter decisions today!

Political factors

Government healthcare policies heavily influence Nipro. Policy shifts affect medical device and pharmaceutical operations. Product approvals, pricing, and market access are all impacted. The Centers for Medicare & Medicaid Services (CMS) projects U.S. healthcare spending to reach $7.7 trillion by 2028. Adapting to these changes is vital for Nipro's strategy.

Nipro, with its global presence, faces political risks. Instability can disrupt manufacturing and supply chains. For instance, political unrest in a region could delay product distribution. Political risk assessments are crucial for business continuity. In 2024, political risks impacted supply chains globally.

Changes in international trade agreements and tariffs significantly influence Nipro's operational costs. For example, a 10% tariff on imported raw materials could increase production costs. This directly impacts product pricing and market competitiveness. Monitoring trade policies is crucial; recent data shows tariff adjustments by major trading partners.

Government Funding for Healthcare and R&D

Government funding significantly impacts Nipro's operations. Increased healthcare and R&D funding can boost demand for medical devices and pharmaceuticals, offering growth opportunities. Conversely, funding cuts may hinder sales and innovation, affecting Nipro's R&D efforts and market expansion. For example, in 2024, the U.S. government allocated \$48.7 billion to the National Institutes of Health (NIH) for biomedical research, which can indirectly benefit Nipro. These factors influence Nipro's strategic decisions and financial performance.

- U.S. NIH budget for biomedical research in 2024: \$48.7 billion.

- Funding levels directly influence demand for Nipro's products.

- Changes in funding affect R&D and market growth strategies.

Regulatory Environment for Medical Devices and Pharmaceuticals

Nipro faces a stringent regulatory environment globally, impacting product development, manufacturing, and marketing. Compliance with evolving regulations is crucial for market access and product approvals. The global medical device market is projected to reach $671.4 billion by 2025. Navigating complex regulatory pathways is essential. In 2024, the FDA approved 110 new medical devices.

- The medical device market is expected to reach $671.4 billion by 2025.

- FDA approved 110 new medical devices in 2024.

Political factors significantly shape Nipro's operations globally, influencing supply chains, costs, and regulatory landscapes. Government healthcare policies impact medical device and pharmaceutical sectors. Instability, trade policies, and funding shifts create operational challenges and opportunities.

| Aspect | Impact on Nipro | 2024-2025 Data/Example |

|---|---|---|

| Healthcare Policies | Affects product approval, pricing, market access | CMS projects U.S. healthcare spending at $7.7T by 2028. |

| Political Risks | Disrupts manufacturing, supply chains | Political unrest globally impacted supply chains. |

| Trade Agreements/Tariffs | Impacts operational costs, competitiveness | 10% tariff increase raises production costs. |

| Government Funding | Influences demand, R&D, and innovation | U.S. NIH allocated $48.7B to biomedical research in 2024. |

Economic factors

Nipro, operating globally, faces currency exchange rate risks. Fluctuations impact sales revenue and profit margins. For instance, a stronger yen could boost reported profits when converting foreign earnings. In 2024, currency volatility remains a key financial consideration. Hedging strategies are crucial for Nipro.

Global economic growth and stability are critical for Nipro. The International Monetary Fund (IMF) projected global growth at 3.2% in 2024 and 3.2% in 2025. Economic downturns, as seen during the 2008 financial crisis, can significantly impact healthcare spending. Conversely, stable economies, like those in North America, support higher demand for Nipro's products. Nipro's financial performance is directly linked to global economic health.

Inflation, affecting raw materials and operational costs, poses a challenge for Nipro. Deflation could decrease product prices, potentially reducing revenue. In 2024, Japan's inflation rate was around 2.8%, impacting manufacturing expenses. Effective pricing and cost control are crucial. Monitoring these economic factors is vital for Nipro's financial planning.

Interest Rates

Interest rates are crucial for Nipro, impacting borrowing costs for R&D, manufacturing, and acquisitions. Higher rates can raise financial expenses, potentially squeezing profits. Conversely, lower rates make investments more appealing, supporting growth strategies. Changes in interest rates significantly influence Nipro's financial planning and expansion decisions. For instance, the Bank of Japan's recent rate hikes, although modest, could influence Nipro's financial strategy.

- The Bank of Japan raised its key interest rate to 0.1% in March 2024, the first increase since 2007.

- Nipro's debt levels could be affected by these changes, potentially impacting profitability.

- Lower interest rates could make expansion projects more affordable.

Disposable Income and Healthcare Spending

Disposable income and healthcare spending significantly affect Nipro's product demand. Rising disposable incomes and increased healthcare spending generally boost demand for medical devices and pharmaceuticals. For instance, in 2024, global healthcare spending reached approximately $10 trillion. Nipro's market potential is directly influenced by these economic factors, especially in regions with growing economies and healthcare investments.

- Global healthcare spending in 2024 was around $10 trillion.

- Higher disposable income often leads to increased healthcare spending.

- Nipro's market success is linked to these economic trends.

Nipro faces currency risks, especially with the fluctuating yen; hedging strategies are vital for managing these impacts. Global economic growth, projected at 3.2% in 2024/2025, significantly influences Nipro's performance. Inflation and interest rates affect operational costs and borrowing, impacting profitability and expansion. Healthcare spending and disposable incomes, crucial demand drivers, are influenced by economic trends.

| Economic Factor | Impact on Nipro | 2024/2025 Data |

|---|---|---|

| Currency Exchange Rates | Affects revenue and profit margins. | Yen fluctuations, hedging is important. |

| Global Economic Growth | Influences demand for products. | IMF projected 3.2% growth in 2024/2025. |

| Inflation & Interest Rates | Impacts operational and borrowing costs. | Japan's inflation ~2.8% in 2024, BOJ raised rates. |

Sociological factors

Many countries face aging populations, increasing age-related diseases and demand for medical solutions. This trend boosts the need for dialysis and infusion therapies, vital for Nipro. For example, Japan's elderly population is around 30%, creating a substantial market. Nipro can capitalize on this demographic shift.

Rising health consciousness and lifestyle shifts are reshaping the medical product market. Demand for preventative care and chronic condition management is surging, with a projected 10% annual growth in the global health and wellness market by 2025. Nipro must adapt its offerings to meet these evolving needs. This includes focusing on products that support proactive health management and address lifestyle-related diseases.

Healthcare access varies globally, impacting medical device and pharmaceutical use. Improved infrastructure can boost Nipro's market, with Asia-Pacific seeing significant growth. In 2024, global healthcare spending reached $10 trillion, projected to hit $12 trillion by 2025. Nipro's distribution strategies must adapt to regional healthcare access differences.

Awareness and Acceptance of Medical Technologies

Public awareness and acceptance of medical technologies are crucial for Nipro. Educational programs help build trust among healthcare professionals and patients, essential for market adoption. Nipro's success hinges on market willingness to embrace its innovations. The global medical device market is projected to reach $671.4 billion by 2025.

- Patient education and physician training are key for technology acceptance.

- Positive clinical trial results and endorsements boost confidence.

- Regulatory approvals and clear guidelines ease adoption.

- Focus on safety and efficacy is critical for market trust.

Cultural Beliefs and Practices Related to Health

Cultural beliefs significantly shape healthcare choices. In Japan, traditional medicine holds sway, influencing product acceptance. Nipro's success hinges on understanding these preferences. Consider that globally, traditional medicine use is rising; in 2024, it represented a $433.2 billion market.

- Cultural understanding is vital for product adoption.

- Traditional medicine's influence is a key factor.

- Market data shows a growing global interest.

- Nipro must adapt to regional health beliefs.

Sociological factors like aging populations, especially in countries like Japan (30% elderly), drive demand for Nipro's dialysis products. Health consciousness, boosted by lifestyle changes, increases the focus on preventative care, mirroring a 10% annual growth forecast by 2025 in global wellness markets. Cultural beliefs significantly influence healthcare choices and Nipro's adoption rates; traditional medicine held a $433.2 billion market share in 2024.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Higher demand for dialysis | Japan's elderly: 30% |

| Health Consciousness | Demand for preventive care increases | Global wellness growth by 2025: 10% |

| Cultural Beliefs | Shapes healthcare choices | Traditional med market: $433.2B (2024) |

Technological factors

Rapid advancements in medical device tech, like artificial organs and vascular intervention, significantly affect Nipro. Nipro needs to invest in R&D to stay competitive in this evolving landscape. Innovation is key for Nipro to offer cutting-edge products. The global medical devices market is projected to reach $671.4 billion by 2024. Staying ahead of tech is crucial.

Nipro benefits from tech advancements in pharma manufacturing. Sterile filling, lyophilization, and analytical techniques are key. These boost product quality and cut costs. Investing in tech impacts Nipro's manufacturing. In 2024, the global pharmaceutical manufacturing market was valued at $878.4 billion, with expected growth.

Technological advancements in pharmaceutical packaging, like enhanced barrier properties and drug-container compatibility, are vital for Nipro PharmaPackaging. Innovation in materials science is key for maintaining drug stability and safety, which is crucial for the pharmaceutical industry. Nipro's success relies on these packaging innovations; in 2024, the global pharmaceutical packaging market was valued at $107.6 billion. The market is projected to reach $138.7 billion by 2029.

Integration of Digital Technologies in Healthcare

The healthcare sector is increasingly adopting digital technologies, influencing Nipro's operations. Telemedicine, remote monitoring, and EHRs are changing how products are used. Nipro must adapt its devices and pharmaceuticals to a digitally connected environment. This transformation offers chances and difficulties. The global telehealth market is projected to reach $266.8 billion by 2027.

- Telemedicine adoption is growing rapidly, with a 38% increase in virtual care visits reported in 2023.

- The remote patient monitoring market is expected to hit $1.7 billion by 2025.

- By 2024, over 90% of hospitals use electronic health records.

Automation and Manufacturing Technologies

Nipro's embrace of automation and advanced manufacturing is crucial for enhancing efficiency and reducing costs. Investments in these technologies drive product consistency and quality improvements. This strategic move optimizes manufacturing operations, boosting production capacity and cost-effectiveness. Automation is a key element in Nipro's competitive strategy.

- In 2024, the global pharmaceutical automation market was valued at $6.8 billion.

- By 2025, this market is projected to reach $7.5 billion.

- Nipro's capital expenditure in automation rose by 12% in the last fiscal year.

- The implementation of robotics reduced labor costs by 15% in one of Nipro's major plants.

Technological advancements continuously reshape Nipro's operations, influencing its product offerings and manufacturing processes. Investments in R&D are critical, especially with the global medical devices market at $671.4 billion in 2024. Digital health integration is another key factor.

Pharma packaging is vital, with a projected market value of $138.7 billion by 2029. Automation is also important. Automation market was $6.8 billion in 2024.

| Aspect | Details | Impact on Nipro |

|---|---|---|

| Medical Devices | Global market reached $671.4B (2024) | Requires R&D investment for new devices. |

| Pharma Packaging | $107.6B (2024) to $138.7B (2029) | Innovation in materials science is crucial. |

| Automation | $6.8B (2024) growing to $7.5B (2025) | Enhances efficiency and reduces costs. |

Legal factors

Nipro faces stringent healthcare regulations globally. Compliance demands adherence to product safety, efficacy, and manufacturing standards. Failure to comply can result in significant penalties and operational disruptions. In 2024, the healthcare compliance market was valued at $47.8 billion, and it's projected to reach $86.5 billion by 2029. This underscores the importance of robust legal strategies.

Product liability laws vary across regions, posing legal risks for Nipro if its medical devices or pharmaceuticals are defective. Nipro must maintain stringent quality control and promptly address product issues. In 2024, product recalls cost pharmaceutical companies an average of $20 million. Product safety and quality are crucial for avoiding lawsuits.

Nipro heavily relies on intellectual property (IP) to protect its innovations. Securing patents and trademarks globally is vital for Nipro's competitive edge. The company's R&D investments, which reached approximately $400 million in fiscal year 2024, are safeguarded by these legal measures. Navigating international IP laws, particularly in key markets like the US and Japan, is essential for Nipro to prevent infringement and maintain its market position.

Labor Laws and Employment Regulations

Nipro faces legal obligations regarding labor laws and employment regulations across its global operations. Compliance is essential for managing human resources effectively and maintaining a positive reputation. These laws dictate working conditions, wages, benefits, and employee rights, varying significantly by country. Non-compliance can lead to legal penalties and reputational damage.

- In 2024, global labor law violations cost companies billions in fines.

- Nipro's HR department must stay updated on changing regulations.

- Compliance ensures fair treatment and avoids legal issues.

Anti-corruption and Bribery Laws

Nipro, operating globally, must adhere to anti-corruption and bribery laws, including the Foreign Corrupt Practices Act (FCPA). This entails upholding ethical business practices and robust internal controls to prevent corruption. In 2024, the DOJ and SEC continued to actively enforce FCPA, with penalties reaching millions. Non-compliance can lead to severe legal and reputational damage, impacting market access and investor confidence. Maintaining transparency and ethical conduct is crucial for Nipro's legal standing and long-term success.

- The FCPA allows for penalties of up to $25 million for corporations.

- Individual executives can face fines and imprisonment.

- Compliance programs are essential for mitigating risks.

Nipro must navigate complex healthcare regulations globally to ensure product safety and compliance. The company faces risks from varying product liability laws, necessitating stringent quality control to prevent recalls. Protecting its innovations through intellectual property rights, along with adherence to labor laws and anti-corruption measures, is also crucial.

| Legal Aspect | Key Compliance Focus | Financial Impact (2024) |

|---|---|---|

| Healthcare Regulations | Product safety, efficacy | Compliance market $47.8B |

| Product Liability | Quality control, issue resolution | Avg. recall cost $20M/company |

| Intellectual Property | Patents, trademarks globally | R&D investment $400M |

Environmental factors

Nipro's operations face environmental regulations on emissions, waste, and hazardous substances. Compliance is crucial to avoid penalties and legal issues. The company is committed to reducing its environmental footprint. In 2024, environmental compliance costs accounted for 2% of Nipro's operational expenses. Nipro invested $15 million in green initiatives.

Nipro faces growing pressure to adopt sustainable practices. This includes efficient resource management, like water and energy, and exploring renewable energy. Sustainable operations can cut costs and boost its image. In 2024, Nipro aimed to reduce emissions and water use. For example, Nipro's 2023 Sustainability Report indicated a 5% reduction in water usage across its global operations.

Nipro must manage waste from manufacturing and packaging responsibly. Effective recycling programs reduce landfill waste and conserve resources. Nipro aims to exceed recycling standards. In 2024, the global medical waste recycling market was valued at $1.2 billion, projected to reach $1.8 billion by 2029, with a CAGR of 8.4%.

Climate Change and Extreme Weather Events

Climate change and extreme weather pose significant risks to Nipro's operations. These events can disrupt supply chains and damage manufacturing facilities, potentially leading to production delays. Nipro must develop resilience strategies to mitigate these environmental risks to ensure business continuity. Climate change also presents operational challenges.

- In 2024, the World Bank estimated that climate-related disasters cost the global economy over $200 billion.

- A 2024 report by Swiss Re highlighted that extreme weather events caused $108 billion in insured losses globally.

- Nipro's facilities in areas prone to flooding or hurricanes could face significant disruption.

Packaging Sustainability

Packaging sustainability is increasingly vital in pharma. Nipro PharmaPackaging must innovate with eco-friendly materials. Meeting customer demands and regulations is key. Sustainable packaging supports Nipro's environmental goals. The global sustainable packaging market is projected to reach $435.4 billion by 2027.

- Market growth in sustainable packaging is rising.

- Nipro needs to adopt innovative packaging.

- Regulatory compliance is a key factor.

- Environmental efforts are crucial.

Environmental factors significantly impact Nipro. Stricter regulations and sustainable practices are essential. Waste management and climate risks demand attention.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Compliance | Costs, legal risks | Compliance costs: 2% op. exp.; Green init. inv.: $15M. |

| Sustainability | Cost savings, brand image | 5% water use reduction (2023); Packaging market: $435.4B (2027). |

| Climate Risks | Supply chain disruption | Disaster costs: $200B (World Bank); Insured losses: $108B (Swiss Re). |

PESTLE Analysis Data Sources

Our Nipro PESTLE relies on data from industry reports, financial databases, government statistics, and scientific publications, offering comprehensive insights.