Novo Nordisk PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Novo Nordisk Bundle

What is included in the product

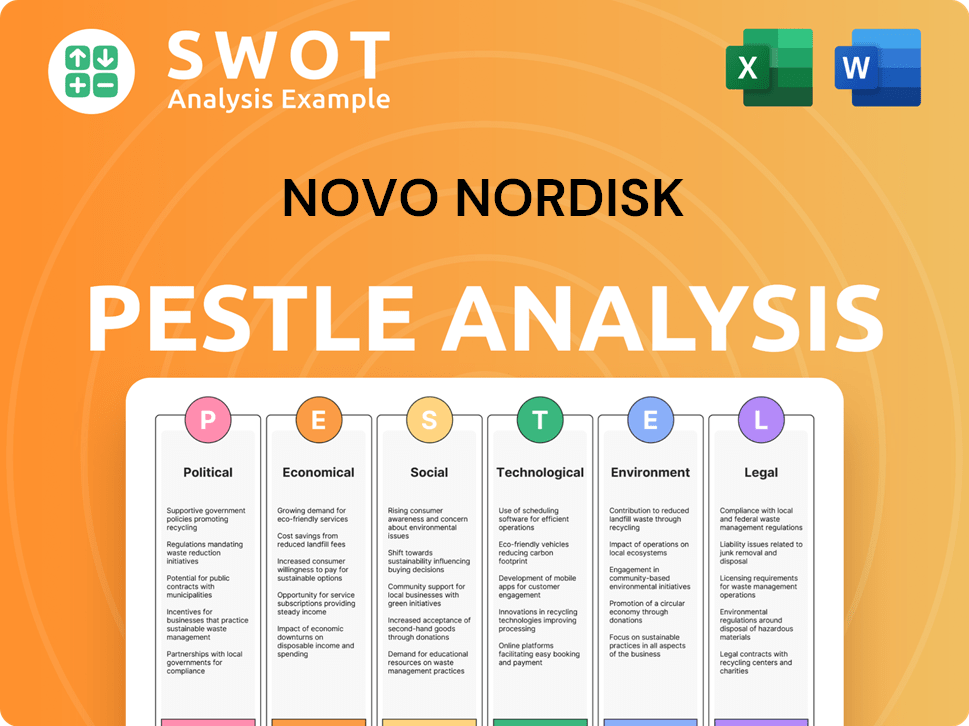

Examines Novo Nordisk through PESTLE factors: Political, Economic, Social, Technological, Environmental, and Legal.

A concise version of the PESTLE, quickly referenced for easy briefing or internal comms.

Same Document Delivered

Novo Nordisk PESTLE Analysis

This Novo Nordisk PESTLE Analysis preview accurately reflects the final, downloadable document.

See the full scope of factors analyzed, including political, economic, social, technological, legal, and environmental elements.

The content presented in the preview is the complete, ready-to-use file available after purchase.

Enjoy this detailed overview as it is a complete version.

PESTLE Analysis Template

Uncover Novo Nordisk's strategic landscape with our PESTLE Analysis. Examine political pressures, economic trends, and technological advances shaping the pharmaceutical giant. Understand societal shifts and legal complexities impacting its operations.

Our analysis equips you to anticipate challenges, spot growth opportunities, and refine your strategic planning. This essential guide is perfect for investors and business analysts alike. Download the full report now!

Political factors

Government healthcare policies shape Novo Nordisk's global operations. Drug pricing and reimbursement policies in key markets like the US and Europe influence revenue. For example, the Inflation Reduction Act in the US impacts drug pricing. Novo Nordisk faces varying market access challenges across different countries. Regulatory changes can affect the company's profitability and market share.

Governments and payers push to lower healthcare costs, creating pricing pressure on drugs. Novo Nordisk faces this, especially in the US. In 2024, US net sales for diabetes care grew, but pricing remained a challenge. Negotiations with Medicare and pharmacy benefit managers are critical for market share.

Geopolitical instability poses risks to Novo Nordisk's supply chains and trade. For instance, disruptions in key regions could hinder the distribution of their products. In 2024, trade tensions impacted pharmaceutical companies globally, with potential tariff changes affecting costs. Ongoing political shifts can significantly alter the financial landscape for Novo Nordisk.

Government Support for R&D and Innovation

Government backing for R&D and innovation significantly impacts Novo Nordisk. Political decisions shape funding for healthcare research, directly influencing drug development. Supportive policies can accelerate clinical trials and market approvals for new treatments. Conversely, reduced funding may slow progress, affecting the company's long-term growth. In 2024, the US government allocated $48.6 billion for the National Institutes of Health (NIH), supporting various biomedical research projects.

- Government grants and tax incentives can reduce R&D costs.

- Political stability is crucial for long-term investment in research.

- Changes in healthcare regulations may affect drug pricing and access.

Political Stability and Healthcare Reforms

Political stability is crucial for Novo Nordisk's operations and investments across various countries. Healthcare reforms and legislative changes can significantly impact the company. Governments' actions directly influence the demand and accessibility of Novo Nordisk's products, affecting the healthcare market. For example, in 2024, the U.S. government's Inflation Reduction Act continues to reshape drug pricing.

- The Inflation Reduction Act (2022) allows Medicare to negotiate drug prices, potentially impacting Novo Nordisk's revenue in the U.S.

- Political instability in certain regions could disrupt supply chains and market access, as seen in some emerging markets.

- Healthcare policies in countries like Germany and Japan influence the pricing and reimbursement of diabetes treatments.

Political factors strongly influence Novo Nordisk's profitability and market access globally.

Government policies, like drug pricing regulations, directly impact revenue, especially in major markets such as the U.S. and Europe, as demonstrated by the Inflation Reduction Act's effects. Geopolitical stability also poses crucial risks.

Government backing and funding for R&D affects drug development and market approvals.

| Political Factor | Impact | Example (2024-2025) |

|---|---|---|

| Drug Pricing Regulations | Revenue & Market Access | Inflation Reduction Act: Medicare price negotiations |

| Geopolitical Instability | Supply Chain Disruptions | Trade tensions impacting pharmaceutical trade. |

| R&D Funding | Innovation and Growth | U.S. NIH's $48.6B support biomedical research |

Economic factors

Global economic conditions significantly impact healthcare spending and, subsequently, pharmaceutical demand. Robust economic growth typically boosts affordability and access to medications. Conversely, economic downturns can lead to reduced healthcare budgets. For instance, in 2024, global healthcare spending is projected to reach $10.1 trillion, influenced by varying economic performances across regions.

Novo Nordisk, operating globally, faces currency exchange rate risks. The US dollar's performance versus the Danish Krone directly affects reported financials. For instance, a stronger dollar can boost reported sales. In Q1 2024, currency had a positive impact on sales growth.

The increasing prevalence of chronic diseases, like diabetes and obesity, is a major economic driver for Novo Nordisk. This boosts demand for their drugs and expands the market. The International Diabetes Federation estimates that 537 million adults had diabetes in 2021, a number projected to reach 783 million by 2045. This supports Novo Nordisk's growth.

Competition and Market Dynamics

Novo Nordisk operates in a fiercely competitive pharmaceutical landscape, facing significant rivals like Eli Lilly and Sanofi. This competition directly influences pricing decisions and the distribution of market share. The introduction of competitive products, such as Eli Lilly's Zepbound, escalates market rivalry, potentially affecting Novo Nordisk's financial performance. In 2024, Eli Lilly's Mounjaro, a competitor to Novo Nordisk's Ozempic, generated $5.16 billion in sales, highlighting the intensity of the competition.

- Increased competition from companies like Eli Lilly and Sanofi.

- Impact on pricing strategies and market share.

- Launch of competing products, such as Zepbound.

- Eli Lilly's Mounjaro sales of $5.16 billion in 2024.

Supply Chain and Manufacturing Costs

Supply chain and manufacturing costs significantly influence Novo Nordisk's operational expenses. Fluctuations in raw material prices, energy costs, and labor rates directly affect the production of pharmaceuticals. Economic and geopolitical events can disrupt supply chains, leading to increased costs and potential shortages of essential components. For instance, the pharmaceutical industry faced a 20% rise in manufacturing costs in 2022 due to supply chain issues.

- Raw material price volatility, impacting production costs.

- Geopolitical events causing supply chain disruptions.

- Energy price fluctuations affecting manufacturing expenses.

- Labor cost increases influencing overall operational costs.

Economic elements strongly influence Novo Nordisk. Global healthcare spending, reaching $10.1T in 2024, shapes pharmaceutical demand.

Currency exchange rates impact financials; a strong USD can boost sales. Also, competition with companies like Eli Lilly and Sanofi is substantial, affecting pricing.

Supply chain dynamics, involving raw materials and labor, also affect operations.

| Factor | Impact | Data |

|---|---|---|

| Healthcare Spending | Influences demand | $10.1T projected global spend in 2024 |

| Exchange Rates | Affects reported financials | USD vs. DKK; Q1 2024 positive impact |

| Competition | Impacts market share | Eli Lilly's Mounjaro $5.16B in 2024 sales |

Sociological factors

The aging global population drives a surge in chronic diseases, boosting demand for Novo Nordisk's diabetes and obesity treatments. Globally, the number of adults with diabetes is projected to reach 643 million by 2030. Lifestyle changes, including poor diets, also fuel these health trends, increasing market need. In 2024, the global obesity market is valued at over $25 billion.

Growing health awareness and patient advocacy significantly impact Novo Nordisk. Increased health consciousness drives demand for diabetes and obesity treatments, core to their portfolio. Patient advocacy groups pressure for drug access and affordability. For example, in 2024, global obesity drug sales reached $6 billion, highlighting this trend. Patients actively manage health, influencing treatment choices.

Sociological factors significantly affect Novo Nordisk's operations. Access to healthcare, health literacy, and cultural beliefs influence patient diagnosis and treatment adherence. Novo Nordisk must tailor strategies, considering these factors. In 2024, global healthcare spending reached $10.5 trillion, underscoring the importance of access. Patient support programs are crucial for ensuring adherence; in 2023, adherence rates varied greatly by region, from 40% to 80%.

Obesity Stigma and Recognition as a Disease

Societal views on obesity, evolving from a lifestyle issue to a recognized chronic disease, are crucial. This shift impacts public health policies, insurance coverage, and patient behavior. Reducing stigma is key to better healthcare access. The global obesity rate is projected to reach 18% by 2025.

- Obesity prevalence is increasing globally.

- Stigma reduction improves healthcare access.

- Insurance coverage is impacted by disease recognition.

- Public health policies are being updated.

Demand for Personalized Medicine and Digital Health

Societal shifts towards personalized medicine and digital health significantly impact Novo Nordisk. Patients now expect tailored treatments and digital tools. This drives innovation in product development and service delivery. For instance, the global digital health market is projected to reach $660 billion by 2025.

- Personalized medicine market size in 2024 was $485.2 billion.

- Digital health market expected to reach $660 billion by 2025.

- Novo Nordisk invests in digital health for diabetes management.

Sociological factors like health awareness and patient advocacy greatly impact Novo Nordisk's market. Increased health consciousness drives demand, as global obesity rates are set to hit 18% by 2025. Reduced stigma enhances access, while personalized medicine gains traction.

| Factor | Impact | Data |

|---|---|---|

| Health Awareness | Boosts demand | $6B obesity drug sales in 2024 |

| Patient Advocacy | Influences policy | 643M diabetics by 2030 (projected) |

| Personalized Medicine | Drives innovation | $660B digital health market by 2025 (est.) |

Technological factors

Novo Nordisk benefits from tech advancements. AI and machine learning speed up drug discovery. In 2024, the company invested heavily in R&D, with expenditures exceeding $5 billion. This boosted efficiency, helping them find new drug candidates and improve their R&D pipeline. This is crucial for staying ahead in the pharmaceutical industry.

Novo Nordisk heavily invests in technological advancements for drug delivery. This includes developing advanced injection pens and exploring oral formulations for GLP-1 therapies. These innovations aim to improve patient convenience and adherence to treatment plans. In 2024, Novo Nordisk allocated approximately $2.5 billion to R&D, with a significant portion dedicated to these areas. This strategy is vital for maintaining its market leadership.

The surge in digital health, like continuous glucose monitors and apps, is changing how diseases are managed. Novo Nordisk can use these tools to offer comprehensive patient and professional solutions. In 2024, the global digital health market was valued at $235 billion, showing strong growth.

Manufacturing Technologies and Efficiency

Novo Nordisk leverages technological advancements in manufacturing. Continuous manufacturing and automation boost efficiency and reduce costs in pharmaceutical production. These technologies also enhance the quality of their products. The company invests to meet growing demand and stay competitive in the market.

- In 2023, Novo Nordisk invested $1.5 billion in expanding its manufacturing capacity.

- Automation has reduced production time by 20% in some areas.

- Continuous manufacturing is expected to increase production output by 15%.

Emerging Therapies and Treatment Approaches

Technological advancements are driving new therapies for chronic diseases, like triple agonists and stem cell therapies. Novo Nordisk must lead in R&D to stay competitive. In 2024, Novo Nordisk's R&D spending reached DKK 24.1 billion. Staying current helps maintain its market position.

- Novo Nordisk's R&D spending in 2024 reached DKK 24.1 billion.

- Focus on triple agonists and stem cell therapies.

- Constant innovation is necessary.

Novo Nordisk uses tech to boost drug discovery, spending over $5 billion in 2024 on R&D. They innovate drug delivery with advanced pens and oral treatments. Digital health, valued at $235B in 2024, is key for patient solutions.

Automation improves manufacturing, reducing production time by 20%. Investments ensure Novo Nordisk stays competitive.

| Area | Tech | Impact (2024) |

|---|---|---|

| R&D | AI, Machine Learning | $5B+ Investment |

| Drug Delivery | Injection pens, Oral formulations | $2.5B R&D Allocation |

| Manufacturing | Automation, Continuous Manufacturing | $1.5B Investment (2023) |

Legal factors

Novo Nordisk faces strict legal hurdles. They must navigate global pharmaceutical regulations for drug development, manufacturing, and sales. Regulatory approvals are essential for market access; for example, in 2024, the FDA approved Wegovy for cardiovascular risk reduction. Maintaining these approvals is a continuous process, impacting operational costs. Regulatory compliance significantly influences Novo Nordisk's market entry and product lifecycle.

Patent laws are crucial for safeguarding Novo Nordisk's intellectual property, especially its diabetes and obesity treatments. These protections grant market exclusivity, crucial for recouping R&D investments. In 2024, patent litigation remains a key risk, as seen with Ozempic and Wegovy. Any adverse legal outcomes or changes in regulations could significantly affect Novo Nordisk’s revenue and competitive edge.

Novo Nordisk faces stringent data privacy regulations like GDPR and HIPAA. These laws dictate how they handle patient data. Non-compliance can lead to hefty fines and reputational damage. In 2024, GDPR fines reached over €1 billion, highlighting the risks. Maintaining patient trust is crucial.

Anti-kickback and Anti-corruption Laws

Novo Nordisk adheres to anti-kickback and anti-corruption laws globally, crucial for ethical operations. Non-compliance risks severe legal penalties and reputational harm. In 2024, the company faced increased scrutiny regarding pricing practices.

- In 2023, the company's revenue reached DKK 232.6 billion.

- The Foreign Corrupt Practices Act (FCPA) and similar laws are strictly followed.

- Compliance programs include regular audits and employee training.

Drug Pricing Legislation and Litigation

Novo Nordisk faces legal challenges regarding drug pricing, including those related to the 340B Drug Pricing Program in the US. These challenges could impact the company's pricing strategies and revenue. The legal landscape requires careful navigation to maintain profitability. Recent litigation and legislation directly affect their market access and financial performance. For instance, the 340B program debate continues to evolve, with potential impacts on discounts.

- 340B Program: Ongoing legal and legislative battles impact pricing.

- Pricing Strategies: Legal challenges can force adjustments to pricing models.

- Revenue Impact: Litigation can directly affect Novo Nordisk's financial results.

Novo Nordisk operates under rigorous global regulations, essential for drug development and market access. Patent laws are vital, protecting their intellectual property, yet present litigation risks, such as those faced in 2024 over Ozempic. The company meticulously complies with data privacy laws like GDPR, as fines can reach billions, and also follows anti-corruption measures. Challenges exist concerning drug pricing, which influence Novo Nordisk's profitability, with legal battles directly impacting their pricing models.

| Regulatory Aspect | Legal Risk | Impact |

|---|---|---|

| Drug Approval | FDA, EMA Compliance | Affects market entry, costs |

| Patent Litigation | Ozempic, Wegovy disputes | Impacts revenue, competition |

| Pricing Practices | 340B Program, price controls | Alters pricing, reduces profit |

Environmental factors

Climate change concerns pressure pharmaceutical firms like Novo Nordisk to cut emissions. Novo Nordisk aims for net-zero emissions across its value chain. In 2023, they reduced CO2 emissions by 40% compared to 2019. They've invested $2.5B in sustainable operations.

Pharmaceutical manufacturing often demands significant water use, leading to environmental concerns. Regulations are tightening regarding water scarcity and pollution. Novo Nordisk actively works to cut water consumption. In 2024, they reported a focus on improving wastewater treatment. The company is committed to sustainable water practices.

Novo Nordisk faces waste management challenges due to its pharmaceutical production. The industry contributes to plastic waste, notably from items like injection pens. A shift towards circular economy models is underway. This includes boosting recycling and sustainable packaging. In 2024, the global pharmaceutical waste market was valued at $11.8 billion.

Sustainable Sourcing and Supply Chain Environmental Impact

Novo Nordisk's supply chain environmental impact is a significant factor. They focus on sustainable sourcing of raw materials and reducing transportation emissions. This involves collaborating with suppliers to adopt eco-friendly practices. In 2023, Scope 3 emissions represented a major portion of their carbon footprint. They aim to reduce these emissions by 2030.

- In 2023, Novo Nordisk reported that ~85% of their total carbon footprint came from Scope 3 emissions.

- Novo Nordisk has a target to achieve net-zero emissions across its value chain by 2045.

- The company is working with suppliers to reduce emissions, with a focus on renewable energy and sustainable materials.

Environmental Regulations and Reporting

Novo Nordisk faces environmental regulations impacting manufacturing, emissions, and waste. The company needs to report its environmental performance transparently, due to increasing sustainability demands. In 2024, Novo Nordisk invested DKK 5.5 billion in environmental initiatives. This included waste reduction and renewable energy programs. They aim for zero environmental impact by 2045.

- Compliance with environmental regulations is crucial for operations.

- Transparent reporting builds stakeholder trust.

- Focus is on waste reduction and renewable energy.

- Novo Nordisk targets zero environmental impact by 2045.

Environmental factors significantly influence Novo Nordisk, mainly due to climate change and water use. In 2023, the company reported Scope 3 emissions accounted for ~85% of its carbon footprint. Novo Nordisk aims for net-zero emissions by 2045, investing heavily in sustainable practices.

| Aspect | Details | Financial Impact (2024) |

|---|---|---|

| Carbon Footprint | Targets include reducing Scope 3 emissions and renewable energy use. | Novo Nordisk invested DKK 5.5 billion in environmental initiatives. |

| Water Usage | Focus is on wastewater treatment and water conservation. | Regulations tightening; water scarcity impacting operations. |

| Waste Management | Shifting to circular economy and reducing plastic waste. | The global pharmaceutical waste market valued at $11.8B. |

PESTLE Analysis Data Sources

Novo Nordisk's PESTLE draws data from WHO, national health orgs, financial institutions, market reports & publications.