Nomura Research Institute Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nomura Research Institute Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs.

What You See Is What You Get

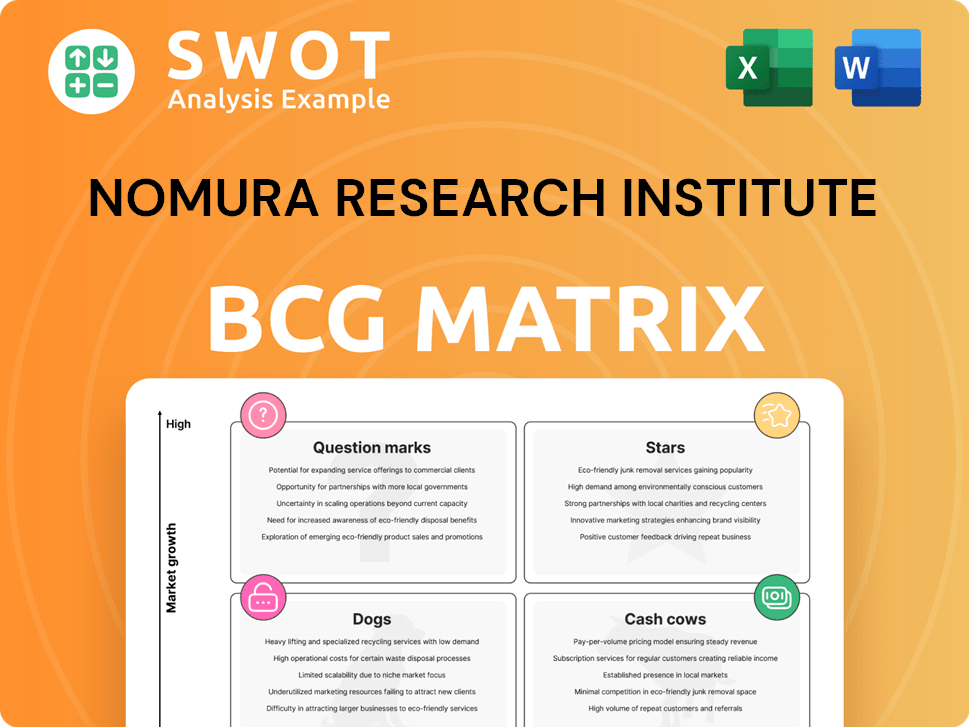

Nomura Research Institute BCG Matrix

This is the full Nomura Research Institute BCG Matrix you'll receive. The preview mirrors the final downloadable file—a complete, actionable document ready for your strategic planning.

BCG Matrix Template

Uncover Nomura Research Institute's portfolio strategy with a glimpse of its BCG Matrix. See how their offerings are classified: Stars, Cash Cows, Dogs, or Question Marks. This snapshot provides a glimpse into their market positioning.

The full BCG Matrix report offers deep dives, detailed quadrant assignments, and actionable strategic advice. Understand the company's strengths and weaknesses instantly.

Purchase the complete report for a full breakdown, plus data-driven recommendations to inform your own investment strategies. Get instant access to strategic insights!

Stars

Nomura Research Institute (NRI) is set to launch its Financial AI Platform in 2025, focusing on data security and sovereignty, critical for financial institutions. This platform aims to generate new revenue streams by integrating AI into IT solutions within NRI's data centers. The platform is supported by NRI's data scientists and AI experts, ensuring effective implementation. In 2024, the AI market in finance was valued at approximately $10.5 billion, reflecting its growing importance.

Nomura Research Institute (NRI) prioritizes digital transformation, boosting its financial performance. This focus is evident in its Medium-term Management Plan (2023-2025). NRI's revenue and profitability have steadily grown, reflecting the success of its strategic initiatives. In fiscal year 2024, NRI reported a 7.2% increase in consolidated net sales. Digital transformation enhances business across sectors.

Nomura Research Institute (NRI) excels in consulting services, a "Star" in its BCG matrix. They offer insight-driven research and managed services, supporting operational needs. In 2024, NRI's consulting revenue grew by 12% in the U.S. and Latin America. They assist with innovation strategies, hypothesis quantification, and digital resource co-creation.

Financial IT Solutions

Nomura Research Institute's (NRI) Financial IT Solutions are a star in its BCG matrix. These solutions are trusted in the securities industry, especially in Japan, serving leading brokers. NRI provides system integration, consulting, and IT management across various sectors. Financial IT focuses on securities, banking, and insurance, offering crucial services.

- NRI's IT solutions are a standard in Japan's securities industry.

- Services include system integration and consulting for financial firms.

- Focus on securities, banking, and insurance businesses.

- Offers system consulting, development, and operational services.

Global IT Services

Nomura Research Institute (NRI) is strategically expanding its global IT services. This growth includes mergers and acquisitions, particularly in Australia, targeting its core IT service business. The company aims for over ¥250 billion in sales by fiscal 2030, fueled by North American expansion. NRI offers research, consulting, and IT solutions globally, with offices across Asia, North America, and Europe.

- NRI's global IT services are a key growth area.

- Expansion includes mergers and acquisitions in Australia.

- Target sales for fiscal 2030 are over ¥250 billion.

- NRI provides comprehensive IT solutions worldwide.

NRI's "Stars" in the BCG matrix include consulting and IT solutions, crucial for growth. Consulting services saw a 12% revenue increase in the Americas in 2024. Financial IT solutions are standard in Japan's securities sector.

| Business Area | Performance in 2024 | Strategic Focus |

|---|---|---|

| Consulting | 12% Revenue Growth (Americas) | Innovation strategies, digital resource co-creation. |

| Financial IT Solutions | Dominant in Japan Securities | System Integration, IT management, and consulting. |

| Global IT Services | Expansion through acquisitions. | Targeting ¥250B+ sales by 2030. |

Cash Cows

Nomura Research Institute (NRI) provides system integration services, collaborating with top tech providers. Their offerings span system development, maintenance, and IT helpdesk support. They integrate custom solutions, such as enterprise customer confirmation tools. In 2024, the global IT services market is projected to reach $1.4 trillion.

Nomura Research Institute (NRI) offers robust IT platform services. These services encompass IT infrastructure, system management, and sophisticated IT solutions, including data center operations and network construction. In 2024, the IT services segment contributed significantly to NRI's revenue, reflecting strong demand. Managed security services and customized solutions cater to diverse client needs.

Nomura Research Institute (NRI) offers BPO services, focusing on financial institutions. They provide IT solutions, including system consulting and development. This includes securities, banking, and insurance. In 2024, the financial services BPO market reached $35 billion.

Research and Consulting Division

Nomura Research Institute's (NRI) Research and Consulting Division, a cash cow, provides expertise in the U.S. and Latin America. This division offers industry trend analysis, company research, and business strategy development. In 2024, the consulting market in the Americas was valued at approximately $160 billion. NRI supports governments and corporations in launching offices, identifying partners, and facilitating M&A.

- Expertise across various industries in the U.S. and Latin America.

- Offers industry trend analysis, company research, corporate structure design, and business strategy development.

- Collaborates with governments and multinational corporations.

- Supports mergers and acquisitions.

Cybersecurity Monitoring and Consulting

NRI SecureTechnologies, Ltd., a subsidiary of Nomura Research Institute, excels in cybersecurity, offering Managed Security Services, penetration testing, and Managed Detection and Response. They tailor solutions to client needs, regardless of their cybersecurity maturity. This focus has positioned them as a cash cow in the BCG matrix. Their cybersecurity monitoring and consulting services ensure a stable market presence.

- NRI's revenue in the cybersecurity sector is projected to grow, with the global cybersecurity market expected to reach $345.7 billion in 2024.

- Managed Security Services are a significant revenue driver, with the MSS market valued at over $28 billion in 2023.

- Penetration testing and consulting services contribute to recurring revenue streams, boosting their cash flow.

- NRI's strategic focus on customized solutions helps maintain a competitive edge in the rapidly evolving cybersecurity landscape.

Cash Cows represent established, profitable business units with low growth potential, generating substantial cash flow. NRI's Research and Consulting Division and NRI SecureTechnologies, Ltd. fit this profile, generating consistent revenue streams.

In 2024, the global cybersecurity market is expected to reach $345.7 billion, supporting their status. The financial services BPO market reached $35 billion, and the consulting market in the Americas was valued at $160 billion.

| Business Unit | Market | 2024 Market Size (Approx.) |

|---|---|---|

| Research & Consulting | Americas Consulting | $160 Billion |

| NRI SecureTechnologies | Global Cybersecurity | $345.7 Billion |

| BPO Services | Financial Services BPO | $35 Billion |

Dogs

Traditional system development, though still essential, struggles to compete with the growth of innovative solutions. These projects may not promise significant returns compared to newer ventures. Legacy systems risk becoming "dogs" if not updated or integrated with modern tech. In 2024, the IT services market grew by 5.8%, with legacy modernization accounting for a smaller share.

Some consulting areas, like those lacking digital integration, face lower growth and profitability. Services misaligned with market trends may decline in value. If consulting services don't boost revenue or growth, they become dogs. For example, in 2024, traditional HR consulting saw a 5% drop in demand, compared to a 15% rise in digital transformation consulting.

Segments clinging to old IT infrastructure, missing out on new tech, face tough competition. Outdated platforms lose appeal. Data centers not optimized for efficiency and scalability become dogs. In 2024, spending on legacy systems decreased, highlighting a shift toward modern solutions.

Stagnant Geographic Markets

Stagnant geographic markets, as per the Nomura Research Institute BCG Matrix, present challenges. Operations in slow-growth regions, like parts of Europe, may underperform compared to dynamic markets such as the Asia-Pacific region. Businesses in areas facing economic headwinds, such as the UK in 2024 with a projected GDP growth of only 0.7%, could struggle. Some segments may be classified as dogs if they fail to boost overall revenue or profitability significantly. For instance, IT spending growth in North America slowed to 4.9% in 2023, compared to 6.6% in 2022.

- Slow Growth: European economies, with limited growth.

- Economic Headwinds: UK projected GDP growth of 0.7% in 2024.

- Revenue Impact: Segments failing to boost overall revenue.

- IT Spending: North America IT spending growth slowed to 4.9% in 2023.

Non-Strategic Alliances

Non-strategic alliances, like those failing to create expected synergies, can be liabilities. Companies risk wasting resources when collaborations don't align with strategic goals. Partnerships that don't generate value are essentially "dogs," draining resources. For example, in 2024, 15% of strategic alliances failed to meet their objectives, according to a McKinsey study.

- Lack of Synergy: Alliances failing to create expected benefits.

- Misaligned Goals: Partnerships not supporting strategic objectives.

- Resource Drain: Wasted investments in unproductive collaborations.

- Value Generation: Inability to produce significant returns.

Dogs are business segments with low market share in slow-growth markets. They often struggle to generate profits or require significant resources to maintain. These segments may include legacy IT systems, outdated consulting services, or operations in stagnant geographic regions.

A prime example is found in certain geographic markets that underperform due to slow expansion and sluggish economic growth. As stated by the Nomura Research Institute BCG Matrix, in 2024, traditional HR consulting saw a decline of about 5% in demand.

Dogs in non-strategic alliances can also be a liability. For instance, according to a 2024 McKinsey study, about 15% of strategic alliances failed to meet their objectives.

| Category | Characteristics | 2024 Example/Data |

|---|---|---|

| Stagnant Markets | Low growth, limited expansion potential | UK GDP growth projected at 0.7% |

| Outdated Services | Failing to generate high returns or revenue | HR consulting demand dropped by 5% |

| Non-Strategic Alliances | Lack of synergy and misaligned goals | 15% of alliances failed to meet objectives |

Question Marks

Nomura Research Institute's (NRI) 'Financial AI Platform' launch is a notable step, yet the broader AI integration across all service lines is still developing. Continuous investment and adaptation are key for successful AI implementation across sectors. The market share and overall impact of these new AI applications are currently uncertain. In 2024, AI spending in the financial sector is projected to reach $15.9 billion, indicating significant growth potential, but success hinges on effective strategies.

Nomura Research Institute's (NRI) substantial investment in North America is a question mark due to uncertain success. Securing a large market share depends on successful acquisitions and integration strategies. The North American market's competitiveness poses a challenge. In 2024, NRI's global revenue was ¥735.8 billion, with North America contributing a smaller portion.

While NRI is focused on digital transformation, its success in specific industries outside of finance remains a question mark. Tailoring solutions requires continuous innovation. The market share and impact in healthcare and manufacturing are still uncertain. For example, digital health spending is projected to reach $660 billion by 2024 globally.

Sustainable Finance Initiatives

Nomura Research Institute (NRI) is exploring sustainable finance, but its future is uncertain. ESG services' success hinges on investor interest and demand. Currently, the market share and returns from these initiatives are under scrutiny. The path forward involves navigating evolving regulations and market dynamics.

- NRI's sustainable finance efforts are relatively new.

- ESG-related services' profitability is still developing.

- Market acceptance of sustainable investments is crucial.

- Financial returns on these initiatives are not yet fully realized.

New Business Models

Nomura Research Institute (NRI) is currently venturing into new business models, such as co-creation initiatives with its clients. However, the scalability and profitability of these new models remain under evaluation. Successful execution of these models hinges on strong client relationships and effective collaboration strategies. The actual market share and the overall financial impact of these new ventures are still subject to uncertainty.

- NRI's strategic shift includes exploring collaborative business models.

- Scalability and profitability are key considerations for the new models.

- Strong client relations are crucial for the successful implementation.

- Market share and financial outcomes are yet to be determined.

NRI's ventures into new business models and co-creation face uncertain outcomes. Scalability and profitability assessments are ongoing. Successful client relationships and effective collaboration are essential, with market share and financial impacts still evolving. In 2024, consulting services revenue is projected at $187.7 billion globally.

| Aspect | Consideration | Impact |

|---|---|---|

| New Business Models | Scalability and Profitability | Uncertainty on financial returns |

| Client Collaboration | Relationship and Strategy | Impact on market share |

| Market Dynamics | Competition and Revenue | Projected $187.7B consulting revenue in 2024 |

BCG Matrix Data Sources

The Nomura Research Institute BCG Matrix utilizes financial reports, market analysis, and industry data to create actionable strategies.