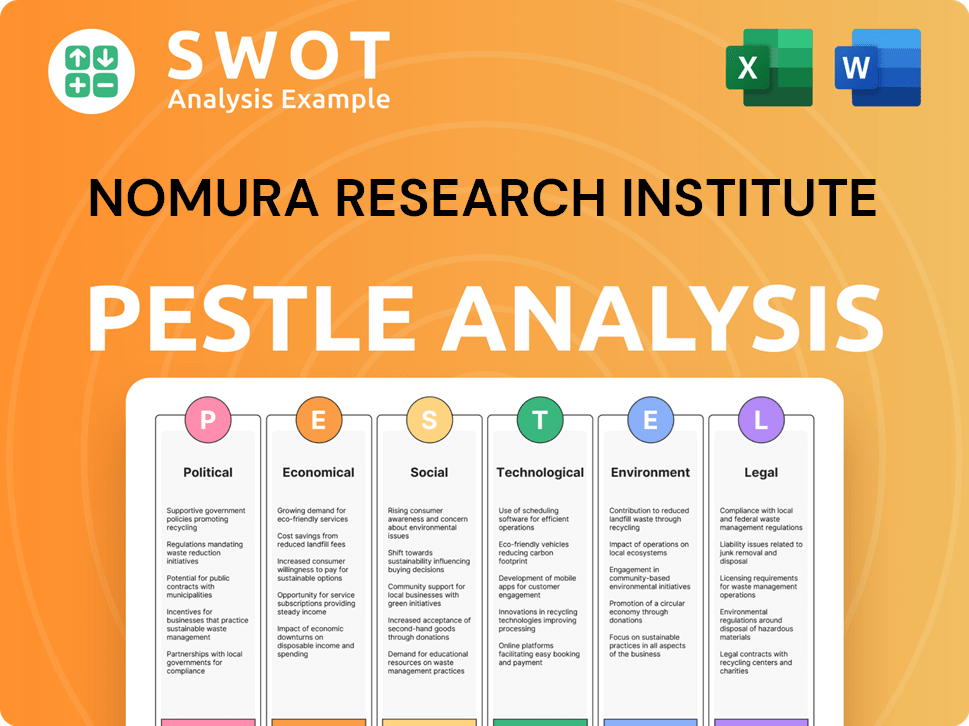

Nomura Research Institute PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nomura Research Institute Bundle

What is included in the product

Explores the Nomura Research Institute's macro-environment through PESTLE: Political, Economic, Social, Technological, Environmental, and Legal factors.

Easily shareable summary format ideal for quick alignment across teams or departments.

Full Version Awaits

Nomura Research Institute PESTLE Analysis

The preview is the full Nomura Research Institute PESTLE analysis. The structure and information are identical.

This document will be yours immediately after your purchase.

You're seeing the complete, ready-to-use final report here.

It’s fully formatted and professionally structured.

Get the same, comprehensive file!

PESTLE Analysis Template

Navigate Nomura Research Institute's market dynamics with precision. Our PESTLE Analysis examines the forces reshaping its industry. Uncover political, economic, social, technological, legal, and environmental factors at play. These insights help you forecast opportunities and challenges effectively. Make data-driven decisions and enhance your market position now. Gain the clarity you need, buy the full PESTLE analysis today.

Political factors

Government regulations are key for Nomura Research Institute (NRI). They influence operations, compliance, and service offerings. Changes in Japan’s financial regulations and those of other countries where NRI operates are crucial. For example, the Financial Services Agency (FSA) in Japan regularly updates its guidelines. In 2024, the FSA increased scrutiny on cybersecurity within financial institutions.

Japan's Economic Security Promotion Act and similar legislation directly influence NRI's operations. These laws dictate how NRI manages data and offers services, especially in areas requiring stringent digital sovereignty. Compliance is crucial; otherwise, NRI risks operational disruptions. For instance, in 2024, compliance costs for such regulations increased by 7%.

Government policies on sustainability and decarbonization, such as Japan's GX Implementation Council, are pivotal. These initiatives, including green transformation, directly impact demand for NRI's ESG consulting services. For example, Japan's commitment to reduce greenhouse gas emissions by 46% by 2030 fuels this demand. NRI's involvement in these areas represents a significant business opportunity.

International Relations and Trade Policies

Geopolitical instability and shifting trade policies significantly influence Nomura Research Institute's (NRI) global activities. Trade tensions, such as those between the US and China, can disrupt supply chains and client projects. For instance, in 2024, the US-China trade volume was around $660 billion, impacting consulting needs. Changes in these relations directly affect cross-border projects and demand for NRI's services.

- US-China trade volume in 2024: approximately $660 billion.

- Impact: Potential disruptions to supply chains and client projects.

Public Sector Consulting Opportunities

Nomura Research Institute (NRI) leverages political factors by consulting with governments on social issues, creating opportunities. Governments prioritize and fund areas like declining birthrates, an aging population, and infrastructure development. These areas drive demand for NRI's consulting services. For example, in 2024, Japan allocated ¥5 trillion (approximately $33 billion USD) to address its declining birthrate.

- Government spending on social issues fuels NRI's consulting projects.

- Policy planning and implementation are key service areas.

- Aging populations and infrastructure development create demand.

Political factors significantly affect Nomura Research Institute's (NRI) operations. Regulations and policy changes in Japan and internationally drive compliance needs and service offerings. Geopolitical issues such as trade tensions and government spending on social matters are all significant factors. For example, in 2024, compliance costs increased by 7%.

| Factor | Impact | Data (2024) |

|---|---|---|

| Regulations | Compliance & Service needs | FSA updates, increased cybersecurity scrutiny |

| Geopolitics | Supply chain disruptions | US-China trade ≈ $660B, affecting projects |

| Gov. Spending | Consulting Projects | Japan's aging population, infra spending |

Economic factors

Monetary policies, set by central banks like the Bank of Japan, heavily impact financial markets. Interest rate adjustments and liquidity shifts influence investment and demand for financial IT solutions. Japan's interest rates are currently near zero, impacting borrowing costs. The BOJ's actions directly affect NRI's financial sector clients.

Economic downturns and global market fluctuations can hurt NRI's revenue, especially in its financial IT solutions and consulting. Market volatility might cause clients to cut IT spending and consulting projects. For example, in 2023, global IT spending grew by only 4.3%, a slowdown from previous years, potentially affecting NRI's business. This could lead to decreased profitability.

Inflationary pressures, fueled by rising energy costs and supply chain issues, pose challenges for Nomura Research Institute (NRI). These factors can increase NRI's operating expenses. For example, Japan's core CPI rose by 2.8% in March 2024. NRI's research offers insights into these economic trends.

Globalization and Cross-Border Capital Flows

Globalization and cross-border capital flows offer opportunities for Nomura Research Institute (NRI). NRI's services are relevant for international financial markets and cross-border transactions. Recent data shows global FDI flows reached $1.37 trillion in 2023. NRI's research on global trends is crucial.

- FDI inflows to developed economies increased by 14% in 2023.

- Emerging markets saw a 4% rise in FDI in 2023.

- NRI's expertise in global capital markets is in demand.

- Cross-border M&A activity is a key area for NRI.

Investment in Digital Transformation

Client investments in digital transformation are crucial for Nomura Research Institute (NRI). This includes cloud adoption and AI implementation, directly boosting demand for NRI's IT solutions. The rate of digital adoption across various industries significantly influences NRI's business growth trajectory. In 2024, global spending on digital transformation is projected to reach $3.9 trillion, with further growth expected in 2025.

- Digital transformation spending grew 17.6% in 2023.

- Cloud computing market is set to reach $1.6 trillion by 2025.

- AI market is expected to reach $200 billion by 2025.

Monetary policies by central banks impact markets; Japan's rates are near zero, affecting IT solutions investment. Economic downturns and global market fluctuations impact NRI, particularly its IT services. Digital transformation spending, expected to reach $3.9T in 2024, drives NRI's growth. Inflation and cross-border flows also pose challenges and offer opportunities.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Monetary Policy | Influences investment, borrowing | Japan's near-zero rates, affecting investment |

| Economic Downturns | Decreases IT spending | Global IT spending growth slowed to 4.3% in 2023 |

| Inflation | Increases operational costs | Japan's core CPI rose 2.8% (March 2024) |

| Digital Transformation | Drives IT solutions demand | Spending: $3.9T in 2024; cloud computing market: $1.6T by 2025 |

Sociological factors

Japan's aging population and shrinking labor force create challenges and opportunities. This demographic shift boosts demand for IT solutions and consulting. NRI's services address productivity, social security, and healthcare needs. Japan's over-65 population is projected to be 30% by 2025, impacting labor dynamics.

Changing social values are significantly impacting business strategies. Growing sustainability awareness boosts demand for ESG-related consulting. Nomura Research Institute (NRI) aligns with these expectations. In 2024, ESG assets hit $40 trillion globally. NRI's focus on social value resonates with these trends.

Nomura Research Institute (NRI) employs a diverse workforce, reflecting its global operations. In 2024, companies with strong diversity reported 19% higher revenue. NRI must foster inclusion. This boosts employee retention; diverse teams outperform. Consider that diverse teams are 35% more likely to outperform.

Changes in Consumer Behavior and Digital Adoption

Consumer behavior has shifted significantly, with more people engaging in online activities. This change affects Nomura Research Institute's (NRI) clients, especially in retail and finance. Digital adoption is crucial, and NRI's IT solutions help clients adapt.

- Global e-commerce sales reached $4.9 trillion in 2023 and are projected to hit $6.3 trillion in 2024.

- Mobile commerce accounts for over 70% of e-commerce sales.

- Financial services increasingly rely on digital platforms for customer interaction.

- NRI's solutions support clients in areas like digital transformation and cybersecurity.

Emphasis on Life Satisfaction and Well-being

Societal emphasis on life satisfaction and well-being significantly impacts corporate culture and employee expectations. For Nomura Research Institute (NRI), this means adjusting work styles and prioritizing employee well-being to boost productivity and attract talent. The World Happiness Report 2024 indicates a consistent focus on well-being globally. This shift necessitates a review of HR policies and workplace environments.

- Employee well-being programs can increase productivity by up to 12%.

- Companies with strong well-being cultures see a 25% reduction in employee turnover.

- Flexible work arrangements have increased in popularity, with 60% of employees preferring them.

- Mental health support is now a top priority for 70% of employees.

An aging population in Japan fuels the demand for IT solutions; focusing on productivity. Sustainability awareness and ESG investments shape strategies; ESG assets hit $40 trillion globally in 2024. Workplace diversity and well-being are key, increasing retention; companies with strong cultures see a 25% reduction in employee turnover.

| Factor | Impact on NRI | Data |

|---|---|---|

| Aging Population | Boosts IT and consulting demand. | Japan's over-65 population is projected to be 30% by 2025. |

| Sustainability Awareness | Drives ESG consulting services. | ESG assets hit $40T in 2024. |

| Employee Well-being | Impacts work culture and productivity. | Well-being programs boost productivity by 12%. |

Technological factors

Nomura Research Institute (NRI) heavily relies on cloud computing advancements. Their multicloud strategies are key to their IT solutions. NRI's focus includes using high-end GPUs. This allows them to provide advanced services. The global cloud computing market is expected to reach $1.6 trillion by 2025.

The rise of AI and machine learning is pivotal for NRI. In 2024, AI's impact on consulting and IT services grew significantly. NRI is integrating AI into services like legacy system upgrades and financial platforms. The firm's research in AI continues to expand. By 2025, expect further AI integration.

Blockchain technology and digital assets are reshaping financial markets. Nomura Research Institute (NRI) is actively involved in digital bond and securities settlement projects, exploring digital currency applications. The global blockchain market is projected to reach $94.08 billion by 2025. Digital assets offer new opportunities for efficiency and innovation in financial services. These advancements are part of a broader trend toward digital transformation.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical due to the heavy reliance on IT and cloud systems. Nomura Research Institute (NRI) focuses on security solutions to protect clients' digital transformations. The global cybersecurity market is projected to reach $345.4 billion in 2024. NRI's services help safeguard sensitive data.

- NRI offers comprehensive security services.

- The cybersecurity market is expanding rapidly.

- Data protection is essential for all businesses.

Evolution of IT Infrastructure and Networks

The ongoing advancement of IT infrastructure and networks, including the shift towards pervasive networks and high-speed internet, significantly affects the delivery and efficiency of Nomura Research Institute's IT services. NRI is involved in the IT infrastructure and network construction services. According to a 2024 report, the global IT infrastructure market is projected to reach $280 billion, highlighting the sector's substantial growth. This expansion underscores the importance of NRI's services in this evolving landscape.

Technological factors critically shape Nomura Research Institute's (NRI) operations.

The IT infrastructure market's value is projected to reach $280 billion in 2024, impacting NRI's services.

Cloud computing, crucial for NRI, is expected to hit $1.6 trillion by 2025, driving multicloud strategies.

| Technology | Market Size (2024) | Projected Market (2025) |

|---|---|---|

| Cloud Computing | -- | $1.6T |

| Cybersecurity | $345.4B | -- |

| Blockchain | -- | $94.08B |

Legal factors

Nomura Research Institute (NRI) faces stringent financial regulations in Japan and globally. These rules cover securities, banking, and asset management, affecting NRI's financial IT solutions and consulting services. For example, Japan's Financial Instruments and Exchange Act is a key regulation. In 2024, the Financial Services Agency (FSA) increased scrutiny on fintech firms, impacting NRI's compliance strategies.

Data privacy and protection laws are becoming stricter worldwide, compelling Nomura Research Institute (NRI) to align its IT solutions and consulting services with these regulations. Client data protection is now a crucial legal and operational demand, especially in regions like the EU with GDPR. For instance, in 2024, the average cost of a data breach globally was $4.45 million, highlighting the stakes involved. Staying compliant is essential for NRI to avoid hefty penalties and maintain client trust.

Nomura Research Institute (NRI) strictly adheres to anti-bribery and anti-corruption laws. Their Code of Conduct prohibits bribery, ensuring ethical business practices. This is particularly critical given the global landscape. In 2024, the OECD reported that corruption costs the global economy trillions annually.

Laws Related to Environmental Protection

Nomura Research Institute (NRI) must adhere to environmental laws, both in Japan and internationally. This includes regulations on greenhouse gas emissions and environmental impact assessments, directly influencing NRI's operations. Staying compliant is crucial for legal and reputational reasons, aligning with NRI's environmental policies. Non-compliance can lead to penalties and damage stakeholder trust, impacting financial performance.

- Japan's Environmental Basic Act mandates environmental protection.

- International standards like the Paris Agreement influence NRI's strategies.

- Recent data shows increasing regulatory scrutiny on corporate environmental practices.

Legal Frameworks for Digital Technologies

The legal landscape for digital technologies, including security tokens and digital currencies, is constantly changing, impacting Nomura Research Institute (NRI). NRI’s work in digital currency settlements requires careful navigation of these evolving legal frameworks. For example, in 2024, the global market for digital assets was estimated at $2.3 trillion, highlighting the importance of regulatory compliance.

NRI's proofs of concept for digital currency settlements must align with these regulations. These legal considerations are critical for project success and market acceptance.

Here's what to consider:

- Regulatory compliance is essential for digital asset projects.

- Legal frameworks vary significantly across different jurisdictions.

- Staying updated on evolving laws is a must for NRI.

- The legal environment directly influences NRI's strategic decisions.

Legal factors significantly shape Nomura Research Institute (NRI)'s operations, with financial regulations being crucial for its financial IT solutions and consulting. Data privacy is another major concern, and it impacts the industry; in 2024, data breaches cost around $4.45 million on average. Digital asset regulations are evolving, which demands that NRI stays updated with the latest legal developments.

| Regulatory Area | Impact on NRI | Recent Data (2024) |

|---|---|---|

| Financial Regulations | Compliance with rules for financial IT & consulting | FSA increased scrutiny on fintech firms |

| Data Privacy | Compliance with laws in data protection | Avg. cost of data breach: $4.45M |

| Digital Assets | Compliance & understanding of changing frameworks | Digital assets market size: $2.3T |

Environmental factors

Climate change is a major environmental factor shaping global policies and business strategies. Nomura Research Institute (NRI) actively participates in decarbonization and green transformation initiatives. For instance, global investments in the energy transition reached $1.77 trillion in 2023, a 16% increase. NRI offers consulting services to support these efforts.

Nomura Research Institute (NRI) must adhere to environmental regulations. NRI's environmental policy focuses on minimizing its footprint. In 2024, companies faced increased scrutiny. Penalties for non-compliance are rising; fines can reach millions. NRI's proactive stance is crucial for risk management.

Nomura Research Institute (NRI) prioritizes biodiversity conservation, aligning with global frameworks for sustainable bioresource use. Their commitment includes a biodiversity policy, demonstrating a proactive stance on environmental responsibility. In 2024, global biodiversity financing reached $200 billion, highlighting the financial significance. NRI utilizes its expertise to promote environmentally friendly initiatives, supporting biodiversity goals. The company's actions reflect growing investor and stakeholder focus on environmental, social, and governance (ESG) factors.

Resource and Energy Efficiency

Resource and energy efficiency is a key environmental factor for Nomura Research Institute (NRI) and its clients. NRI is actively working on improving energy efficiency and promoting the adoption of renewable energy sources in its operations. This commitment aligns with global sustainability goals and supports clients in their own environmental strategies. For example, in 2024, investments in renewable energy projects surged, with a 15% increase in global capacity.

- NRI's energy efficiency initiatives include implementing energy-saving technologies in its offices and data centers.

- The firm also encourages clients to adopt sustainable practices through its consulting services.

- The push for efficiency is driven by both environmental concerns and the potential for cost savings.

- The renewable energy market is projected to grow significantly, with forecasts predicting a 20% increase in investment by 2025.

Environmental Disclosure and Reporting

Environmental disclosure and reporting are increasingly vital for Nomura Research Institute (NRI). ESG reports showcase NRI's dedication to sustainability, crucial for stakeholder trust. In 2024, the global ESG market reached $35 trillion, reflecting growing investor interest. NRI's proactive disclosure of environmental data aligns with these trends.

- 2024: Global ESG market at $35 trillion.

- Growing investor demand for environmental data.

- NRI's proactive approach builds stakeholder trust.

Environmental factors, such as climate change and biodiversity, are crucial for Nomura Research Institute (NRI). NRI is committed to environmental responsibility, participating in decarbonization and conservation initiatives. Investments in the energy transition hit $1.77 trillion in 2023; global biodiversity financing was $200 billion in 2024.

| Key Area | NRI Focus | 2024 Data |

|---|---|---|

| Decarbonization | Green initiatives & consulting | Energy transition: $1.77T |

| Biodiversity | Biodiversity policy & ESG | Financing: $200B |

| Compliance | Environmental regulations | Penalties: Millions |

PESTLE Analysis Data Sources

The analysis incorporates data from the IMF, World Bank, government reports, and industry research, offering data-driven insights. We focus on macroeconomic trends.