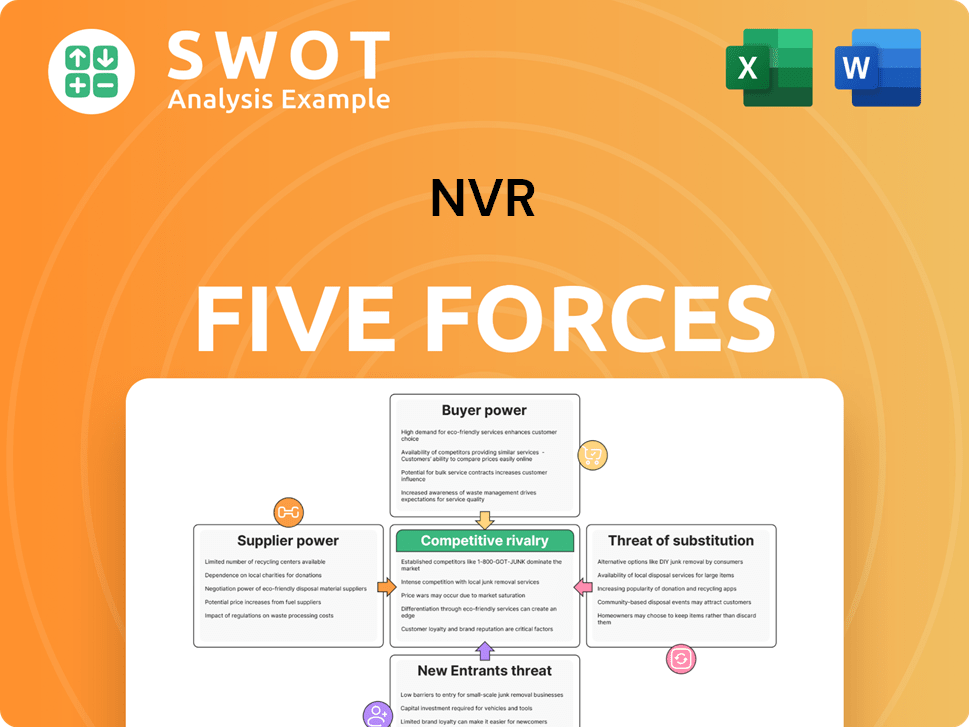

NVR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NVR Bundle

What is included in the product

Tailored exclusively for NVR, analyzing its position within its competitive landscape.

Duplicate tabs for different market conditions (pre/post regulation, new entrant, etc.)

Full Version Awaits

NVR Porter's Five Forces Analysis

This is the complete NVR Porter's Five Forces analysis. The preview displays the same, ready-to-use document you'll receive immediately upon purchase.

Porter's Five Forces Analysis Template

NVR's industry faces a complex competitive landscape, where the power of buyers, suppliers, and potential new entrants are constantly in play. The intensity of rivalry among existing competitors, along with the threat of substitutes, shapes the firm's strategic choices. Understanding these five forces is critical for assessing NVR's long-term profitability and market position. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore NVR’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

NVR's bargaining power of suppliers is moderate. The company sources from various suppliers like lumber, concrete, and appliance manufacturers. The power of these suppliers is kept in check because NVR can switch between them. In 2024, the cost of building materials fluctuated, but NVR's ability to use different suppliers helped it manage these costs. The availability of alternatives limits supplier influence.

Lumber is a key expense for NVR. Price swings in lumber directly affect NVR's earnings. Suppliers with substantial timber holdings or efficient mills can wield power. In 2024, lumber prices have seen volatility. This impacts NVR's cost structure.

NVR's local supplier relationships vary by region. Strong ties can stabilize pricing, but create dependencies. Local suppliers' market knowledge gives them a negotiation edge. In 2024, NVR's cost of revenue was approximately $7.9 billion, indicating supplier cost impact. These relationships influence NVR's operational efficiency and profitability.

Component standardization

The degree to which NVR uses standardized components significantly impacts supplier power. NVR's ability to use widely available, standardized components reduces its dependence on specific suppliers, thus lessening supplier power. However, if NVR relies on custom or specialized components, supplier power increases due to fewer alternatives.

- Standardized components often lead to lower costs due to competition among suppliers; in 2024, the average cost reduction from using standard components was about 10-15% in the electronics industry.

- Custom components can lead to higher prices and potential supply chain disruptions; in 2024, supply chain issues increased the cost of custom components by 5-10%.

- NVR's strategic sourcing decisions greatly influence this dynamic, with a focus on standardization where feasible.

- This approach allows for negotiation leverage and mitigates risks associated with relying on a single supplier.

Supply chain resilience

NVR's supply chain resilience is key to managing supplier power. A strong supply chain, including a diverse supplier base and efficient logistics, can lessen the effect of supplier disruptions or price hikes. Investing in technology for the supply chain and risk management boosts resilience. In 2024, NVR's focus on supply chain efficiency was evident in its operational strategies.

- Diversifying the supplier base helps reduce dependence on any single supplier, lessening the risk of supply disruptions.

- Efficient logistics and inventory management can minimize the impact of supplier delays or cost increases.

- Supply chain technology can improve visibility and responsiveness to supply issues.

- Risk management strategies help anticipate and prepare for potential supply chain disruptions.

NVR's supplier power is moderate due to diverse sourcing. Lumber costs, a key factor, fluctuate, impacting earnings. Local supplier relationships influence pricing and operational efficiency. Standardized components and a resilient supply chain help manage costs and risks.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Lumber Prices | Direct cost impact | Up 7% YoY (Q3 2024) |

| Cost of Revenue | Supplier influence | $7.9B approx. |

| Standardization | Lower costs | Savings up to 15% |

Customers Bargaining Power

Homebuyers wield considerable bargaining power, especially with numerous housing choices available. They can easily compare prices, features, and locations. Factors like interest rates significantly influence affordability and negotiation dynamics. In 2024, mortgage rates averaged around 7%, impacting buyer leverage. NVR faces this challenge in a competitive market.

Homebuyers show high price sensitivity, particularly first-timers. Minor price changes significantly affect buying choices. In 2024, rising interest rates increased this sensitivity. NVR needs to finely balance pricing against perceived value to draw in and keep customers.

Customers now expect personalized homes, impacting NVR. Customization, a competitive edge, complicates operations. In 2024, NVR's gross profit margin was about 25%, showing the need for efficient management. Managing these demands is critical to maintain profitability. NVR must balance unique requests with cost control.

Market transparency

Market transparency significantly impacts customer bargaining power. Online real estate portals and readily available data empower buyers. They can research and assess market trends. This increased knowledge allows for more effective price negotiations. NVR must adapt to this environment.

- Zillow's 2024 data shows a 6% increase in website traffic, indicating increased buyer activity.

- The National Association of Realtors reported a 5.8% decrease in existing home sales in 2024, suggesting a more competitive market for sellers.

- Redfin's 2024 data shows that 65% of buyers used online resources to find properties.

- According to a 2024 study, buyers who researched online negotiated prices down by an average of 3%.

Incentives and concessions

NVR, like other homebuilders, uses incentives to attract customers. These incentives, such as upgrades or help with closing costs, can boost sales. However, these offers cut into the company's profit margins, which is a critical trade-off. NVR needs to be smart about these incentives to balance attracting buyers with keeping profits healthy.

- In Q3 2023, NVR's gross profit margin was 24.7%, slightly down from 25.4% in Q3 2022, indicating some pressure on profitability.

- Incentives like mortgage rate buydowns have become more common due to fluctuating interest rates.

- NVR's ability to manage and adjust incentive programs effectively is crucial for maintaining profitability in a competitive market.

- NVR's focus on a build-to-order model helps to manage costs and tailor incentives more precisely.

Homebuyers' bargaining power remains strong with easy price comparisons and customization expectations. In 2024, online resources and market transparency further empowered buyers. NVR addresses this with incentives, balancing customer attraction and profit margins.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Mortgage rates averaged ~7% |

| Market Transparency | Increased Buyer Power | Zillow traffic +6% |

| Incentives Impact | Margin Pressure | NVR's gross profit margin ~25% |

Rivalry Among Competitors

The homebuilding sector is highly competitive, featuring many companies fighting for customers. This leads to tight pricing and increased marketing efforts. In 2024, top builders like DR Horton and Lennar continued to dominate, increasing competition. This competitive environment pushes for constant innovation in home designs and features.

Homebuilders fiercely battle for market share across different locations. Pricing, land, and product differences are key. In 2024, NVR's revenue was approximately $9.2 billion. Their market position hinges on strengths and execution. NVR's focus is on strategic land acquisitions.

Product differentiation in the homebuilding sector, like NVR's, is key. Builders aim to stand out via design, amenities, and features, though homes are fundamentally similar. NVR's brands, such as Ryan Homes, offer some differentiation by targeting specific market segments. In 2024, energy-efficient features and smart home tech saw increased demand. This creates competitive advantages, as evidenced by NVR's 2024 revenue reaching $10.3 billion.

Marketing and branding

Marketing and branding are vital for NVR to stand out in a competitive market and attract homebuyers. NVR has invested heavily in advertising and online presence to build brand awareness and generate leads. A strong brand reputation allows NVR to command premium pricing and foster customer loyalty. In 2024, NVR's marketing expenses were approximately $300 million, reflecting its commitment to brand-building.

- Marketing expenses in 2024: ~$300 million

- Focus: Advertising, online presence, and community outreach

- Goal: Build brand awareness and generate leads

- Result: Premium pricing and customer loyalty

Land acquisition strategies

Land acquisition is a critical competitive factor for NVR. The company faces rivalry from other builders in securing prime land at favorable prices. Land availability directly influences NVR's growth potential and market share. Strategic land acquisition and development efforts are crucial for maintaining a competitive advantage in the homebuilding sector.

- In 2024, NVR's land and lot portfolio was valued at approximately $5.5 billion.

- NVR's land acquisition spending in 2024 was around $2.7 billion, reflecting its focus on securing future development sites.

- The homebuilding industry faces intense competition for land, impacting profitability and expansion.

- NVR’s land acquisition strategy includes options and controlled land positions to manage risk.

Competitive rivalry in homebuilding is fierce, with numerous firms vying for market share. This intense competition leads to price wars and extensive marketing. Strategic land acquisition and product differentiation, like those seen with NVR, are crucial for staying ahead.

| Metric | Details |

|---|---|

| NVR Revenue (2024) | $10.3 billion |

| NVR Marketing Expenses (2024) | $300 million |

| NVR Land and Lot Portfolio (2024) | $5.5 billion |

SSubstitutes Threaten

Rental apartments and houses serve as key substitutes for homeownership, impacting NVR's market position. Economic downturns and high-interest rates in 2024, with rates around 7%, can make renting more appealing. Lifestyle choices, such as flexibility, also drive rental demand. NVR must analyze rental market dynamics, where the national average rent was approximately $1,379 in December 2024, to adjust its strategies and stay competitive.

Existing homes present a strong substitute, influencing NVR's market position. Resale homes compete directly on price and location, impacting demand for new builds. In 2024, existing home sales volume was around 4.1 million, signaling substantial competition. NVR must emphasize new homes' benefits, like modern features and warranties, to attract buyers.

Renovations and remodeling pose a threat to new home sales. Homeowners might opt to upgrade their current homes. In 2024, home renovation spending is projected to reach $498 billion. This trend impacts demand for new constructions. NVR must monitor renovation spending closely.

Alternative housing options

Alternative housing options present a threat to NVR, as they provide substitutes for traditional single-family homes. These include manufactured homes and co-housing, which may attract different demographics. NVR must assess the appeal of these alternatives to adjust its offerings and maintain market share. Understanding these substitutes is crucial for strategic planning and product development.

- Manufactured homes accounted for 9.5% of new single-family homes sold in 2024.

- Co-housing communities have seen a steady rise in popularity, with about 100 new communities forming between 2020-2024.

- The average cost of a manufactured home is significantly lower than a traditional home, around $100,000 in 2024.

Delayed homeownership

The threat of substitutes in NVR's market includes delayed homeownership, which can significantly impact demand. Many potential homebuyers are postponing purchases due to rising interest rates and economic uncertainties. This shift reduces immediate demand for new homes, affecting NVR's sales volume. To mitigate this, NVR could adapt by offering more affordable housing options or attractive financing.

- In 2024, U.S. home sales decreased, reflecting affordability challenges.

- Rising mortgage rates contributed to a slowdown in the housing market.

- NVR can offer incentives to attract potential buyers.

The threat of substitutes for NVR includes rentals, existing homes, renovations, and alternative housing. Each option competes with new home sales by offering different price points, features, or lifestyle choices. Economic factors, like interest rates (averaging 7% in 2024), and market dynamics influence consumer decisions.

| Substitute | Description | 2024 Data |

|---|---|---|

| Rentals | Apartments and houses | Avg. rent: $1,379 |

| Existing Homes | Resale properties | Sales volume: 4.1M |

| Renovations | Home upgrades | Spending: $498B |

| Alternative Housing | Manufactured homes, etc. | 9.5% of sales |

Entrants Threaten

The homebuilding sector demands substantial capital for land, construction, and marketing. This high capital intensity deters new entrants. NVR, with its strong financial backing, holds a significant edge. In 2024, the average cost of a new single-family home in the US was around $400,000. This financial commitment makes it challenging for newcomers to compete. NVR's established resources further strengthen its market position.

Large homebuilders like NVR leverage economies of scale, gaining advantages in purchasing materials, construction processes, and marketing efforts. These efficiencies enable them to offer competitive pricing while sustaining profitability. In 2024, NVR's gross profit margin was approximately 25%, reflecting these operational benefits. New entrants often face challenges in replicating these cost structures.

The homebuilding industry faces significant regulatory hurdles, including zoning laws, building codes, and environmental regulations. These regulations can be complex and time-consuming for new companies to navigate. NVR's established expertise and experience in compliance provide a competitive advantage. For example, in 2024, the average cost to comply with regulations added approximately 25% to the cost of a new home.

Brand recognition

NVR benefits from robust brand recognition and customer loyalty, a key advantage in the homebuilding market. New entrants face significant challenges in building a comparable reputation, which takes years and substantial investment. NVR's established brand translates into a competitive edge, making it difficult for newcomers to swiftly capture market share. In 2024, NVR's strong brand helped maintain solid sales figures despite market fluctuations.

- Established brands reduce the threat from new entrants.

- Building a brand takes substantial time and resources.

- NVR's brand offers a competitive advantage.

- Customer loyalty supports NVR's market position.

Land availability

The availability of land is a significant barrier to entry in the homebuilding sector. New entrants often face challenges in acquiring prime land for development. NVR's success is partially due to its strong land acquisition strategies. These strategies include established relationships, which provide a competitive edge over new entrants.

- Land acquisition is crucial for homebuilders.

- New entrants may struggle to compete for land.

- NVR's existing connections offer an advantage.

- Land acquisition strategies impact competitive positioning.

New homebuilders face high capital costs and regulatory hurdles. Economies of scale give existing firms like NVR an edge in pricing and operations. Strong brands and land acquisition strategies further protect established builders from new competition. In 2024, the residential construction sector saw significant consolidation, with larger firms increasing their market share.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Capital Costs | High barrier to entry | Average US new home cost ~$400k |

| Regulatory Compliance | Complex and costly | Added ~25% to home cost |

| Brand Recognition | Competitive advantage | NVR maintained solid sales |

Porter's Five Forces Analysis Data Sources

NVR's analysis utilizes SEC filings, industry reports, and financial data, along with competitor strategies. It includes macroeconomic indicators and market analysis for depth.