NVR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NVR Bundle

What is included in the product

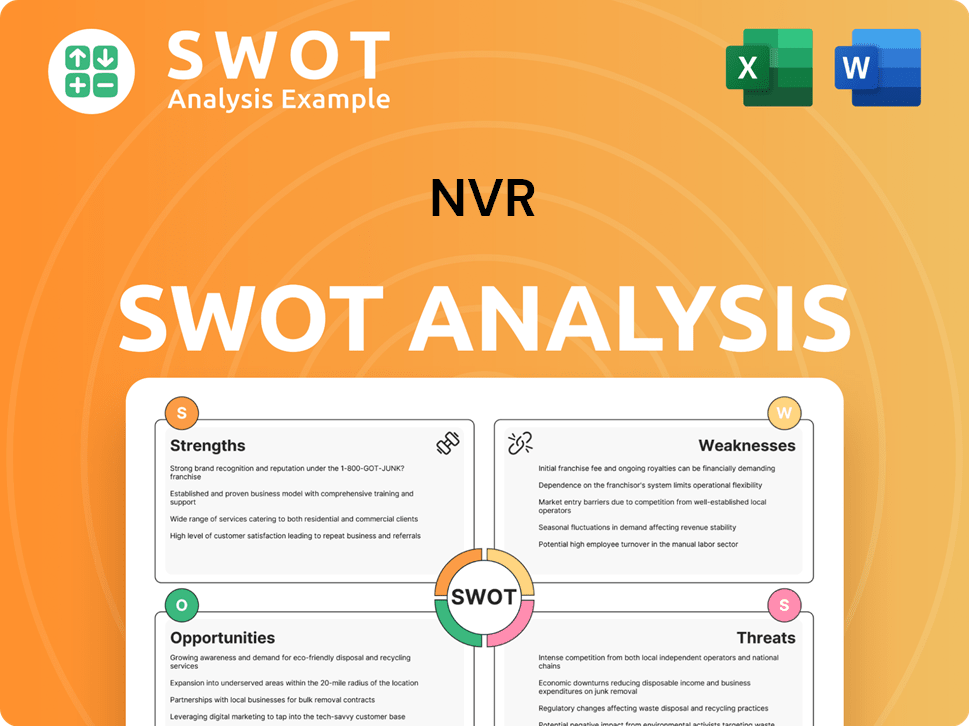

Analyzes NVR’s competitive position through key internal and external factors.

Facilitates focused discussion by clearly visualizing strategic factors.

Preview the Actual Deliverable

NVR SWOT Analysis

This SWOT analysis preview is exactly what you get post-purchase.

It’s the full document, no omissions or differences.

You'll have immediate access to the complete, in-depth version.

Use the same detailed analysis after your purchase.

Get the full, editable report now!

SWOT Analysis Template

Our analysis highlights NVR's strengths: their efficient business model & strong financials. Weaknesses include geographical concentration & supply chain risks. Opportunities involve market expansion & product innovation. Threats encompass economic downturns & rising competition. This preview scratches the surface.

Dive deep into NVR's strategic landscape with our full SWOT analysis. You’ll get a research-backed, editable breakdown, perfect for planning & market understanding—available instantly.

Strengths

NVR showcased strong financial performance in 2024. The company reported impressive revenue and net income figures. NVR also maintains a strong liquidity position. This financial stability supports operations and future growth. Data from 2024 shows NVR with a healthy financial standing.

NVR's land option strategy is a key strength. This method minimizes capital tied up in land. In 2024, NVR's land and land development spending was around $2.5 billion. This lowers risk compared to outright land ownership. Partnering with developers helps secure favorable financing.

NVR's integrated model merges homebuilding with mortgage banking. NVR Mortgage offers services to homebuyers. In 2024, this integration helped NVR achieve a 20% gross margin. This approach streamlines the buying process. It also boosts revenue.

Operational Efficiency

NVR's operational efficiency is a key strength, achieved through stringent cost control and efficient construction. This allows NVR to maintain strong gross profit margins. For instance, in Q1 2024, NVR reported a gross profit margin of 24.4%. This efficiency supports profitability even amid market fluctuations.

- Focus on cost management.

- Efficient inventory control.

- Streamlined construction processes.

- Competitive gross profit margin.

Geographic Presence and Market Focus

NVR's strength lies in its strategic geographic presence, operating in 36 metropolitan areas across 16 states and Washington D.C. This targeted approach allows NVR to concentrate on specific markets, building brand recognition and operational efficiencies. The company's focus on the Mid-Atlantic, East Coast, and Southeast regions provides a strong foundation for growth. This focused strategy has historically contributed to strong financial results.

- Presence in key growth areas.

- Local market expertise.

- Strong brand recognition.

- Operational efficiency.

NVR’s strengths include robust financial health and strategic land acquisition. Efficient operations and a combined homebuilding and mortgage banking model boost margins. Its targeted geographic focus yields strong brand recognition and efficiency.

| Strength | Details | Data |

|---|---|---|

| Financial Performance | Strong revenue and net income. | 2024 revenue up, with 20% gross margin. |

| Land Strategy | Land option strategy. | 2024 land and land dev. ~$2.5B. |

| Integrated Model | Homebuilding & mortgage banking | Boosted revenue and streamlined buying. |

Weaknesses

NVR faces challenges as recent financial results show declining new orders. The backlog, representing homes sold but not yet settled, is also shrinking. This decrease signals a possible slowdown in revenue growth. For example, in Q1 2024, new orders decreased by 16% year-over-year. This trend could impact future profitability.

NVR faces pressure on gross profit margins. Higher lot costs and pricing pressures contribute to this. The gross profit margin was 23.6% in Q1 2024, down from 24.4% in Q1 2023. This decline indicates profitability challenges.

NVR faces rising order cancellation rates, a concerning trend. In 2024, cancellations may have edged up due to economic unease. This can directly hit revenue, as seen in past market downturns. Higher rates suggest buyer hesitancy, possibly from interest rate hikes.

Sensitivity to Interest Rate Changes

NVR's sensitivity to interest rate changes is a key weakness. As both a homebuilder and mortgage lender, NVR's profitability is directly affected by interest rate movements. Rising interest rates can significantly decrease housing affordability, potentially leading to a slowdown in sales and revenue. This vulnerability underscores the importance of understanding and managing interest rate risks.

- In Q1 2024, NVR's new orders decreased by 16% year-over-year, partly due to higher mortgage rates.

- The average 30-year fixed mortgage rate was around 7% in early 2024, impacting buyer demand.

- NVR's financial results in 2024 will likely reflect these challenges.

Reliance on Developer Relationships

NVR's land option strategy is vulnerable due to its dependence on strong developer relationships. These partnerships are crucial for securing finished lots, which are essential for NVR's business model. The difficulty in finding and maintaining these relationships at scale could hinder NVR's expansion into new markets. This reliance introduces a layer of risk related to the availability and terms of these developer agreements. For instance, in 2024, approximately 70% of NVR's homes were built on land acquired through options agreements, underscoring this dependence.

- Developer relationships are key to NVR's land strategy.

- Expansion could be limited by the ability to replicate these partnerships.

- The availability of finished lots is critical for NVR's operations.

- In 2024, option agreements were a key component of NVR's land acquisition.

NVR’s declining new orders and shrinking backlog may lead to lower future revenue. Reduced gross profit margins and rising cancellation rates also signal profitability issues. Its dependence on interest rates and land option strategies pose significant operational risks.

| Weakness | Description | Data |

|---|---|---|

| Declining Orders | New orders decreasing | Q1 2024: -16% YoY |

| Margin Pressure | Gross profit margins are down | Q1 2024: 23.6% vs. 24.4% YoY |

| Interest Rate Sensitivity | Profitability affected by rate moves | 30-year mortgage rate ~7% in 2024 |

Opportunities

NVR benefits from a projected rise in new home demand in 2025. Single-family housing starts are expected to increase. This is due to a construction shortage. NVR can capitalize on this to boost sales. In Q1 2024, NVR's new orders increased, showing positive trends.

NVR has a key opportunity in affordable housing. The market increasingly wants smaller, affordable single-family homes. In 2024, the median sales price for new homes was around $430,000, reflecting this demand. NVR can target first-time buyers by offering homes in lower price brackets. This strategy can boost sales volume and market share.

Forecasts hint at potential mortgage rate decreases or stabilization in 2025. This could enhance housing affordability, boosting buyer demand. Lower rates would significantly benefit NVR's homebuilding and mortgage banking sectors. For example, the average 30-year fixed mortgage rate was around 7% in early 2024, with projections for a dip by late 2025.

Growth in Mortgage Origination Volume

The Mortgage Bankers Association anticipates a rise in overall mortgage origination volume in 2025. NVR Mortgage is strategically positioned to leverage this expansion. This could boost its closed loan production and revenue. In 2024, total mortgage origination volume was approximately $2.2 trillion, with expectations of growth in 2025.

Geographic Expansion

NVR can explore geographic expansion. This involves entering new metropolitan areas. Successful moves boost market share and revenue. NVR's 2024 revenue reached $9.9 billion. New areas offer growth potential.

- Target new markets strategically.

- Leverage existing developer relationships.

- Aim for revenue growth in new areas.

NVR can benefit from the rising demand for new homes expected in 2025. Affordable housing, with a median sales price around $430,000 in 2024, presents another key opportunity. Forecasted mortgage rate stabilization by late 2025 will also boost demand.

| Opportunity | Details | Financial Impact (Estimate) |

|---|---|---|

| Increased Demand | Rise in new home demand due to housing shortage. | Boost to sales and revenue growth. |

| Affordable Housing | Targeting first-time buyers with lower-priced homes. | Increase in sales volume and market share. |

| Mortgage Rate Impact | Potential rate decreases boosting affordability. | Increase in buyer demand and loan origination. |

Threats

Forecasts suggest a possible economic slowdown and rising unemployment in 2025. This could erode consumer confidence, potentially decreasing demand for new homes. The National Association of Home Builders reported a decline in builder confidence in early 2024, reflecting these concerns. Such economic uncertainty poses a significant threat to NVR's sales and profitability.

Continued affordability challenges pose a threat. High prices, even with rate decreases, deter buyers. This can suppress demand. NVR's cancellation rates could rise. In Q1 2024, the median home price was $393,500, impacting affordability.

NVR faces threats from supply chain disruptions. Fluctuations in land and material costs affect construction expenses and profit margins. Supply chain concentration for essential materials amplifies these risks. In 2024, the industry saw material cost volatility impacting homebuilders. Increased lumber prices in Q1 2024, for example, affected margins.

Increased Competition

The homebuilding sector faces fierce competition, with major players like Lennar and D.R. Horton also seeking to capture market share. This heightened competition could result in price wars, potentially squeezing NVR's sales volume and profit margins. For instance, the Housing Market Index (HMI) showed a slight decrease in builder confidence in early 2024, indicating a tougher environment. This is further substantiated by the fact that new home sales dipped by 4.2% in February 2024, signaling a challenging climate.

- Increased competition from other builders.

- Potential pricing pressure due to market dynamics.

- Impact on NVR's sales volume and margins.

- Challenging climate indicated by recent market data.

Regulatory and Political Factors

NVR faces threats from regulatory and political factors. Changes in federal housing policies, zoning laws, and other regulations can affect operations. Political uncertainty and policy shifts introduce risks to the housing market. For instance, the Federal Reserve's actions in 2024 and 2025, like interest rate adjustments, directly influence mortgage rates and buyer affordability, potentially slowing sales. Fluctuations in government subsidies, such as those for first-time homebuyers, also impact demand.

- Interest rate changes can significantly impact mortgage rates and buyer affordability.

- Government subsidies for homebuyers can affect demand.

- Changes in zoning laws can affect development.

Economic downturns, as forecasted for 2025, may slash consumer confidence and reduce home demand, impacting sales. Rising interest rates or changes in housing policies pose risks to NVR. Stiff competition, particularly from large builders like Lennar and D.R. Horton, may decrease margins.

| Threats | Impact | 2024/2025 Data |

|---|---|---|

| Economic Slowdown | Reduced Demand | Builder Confidence down. New home sales dipped by 4.2% in February 2024. |

| Regulatory Changes | Operational Constraints | Federal Reserve Actions affecting mortgage rates. |

| Competition | Margin Pressure | Lennar, D.R. Horton gaining market share. |

SWOT Analysis Data Sources

The NVR SWOT analysis leverages financial reports, market research, and industry expert opinions for data-backed assessments.