Shenzhen Overseas PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Overseas Bundle

What is included in the product

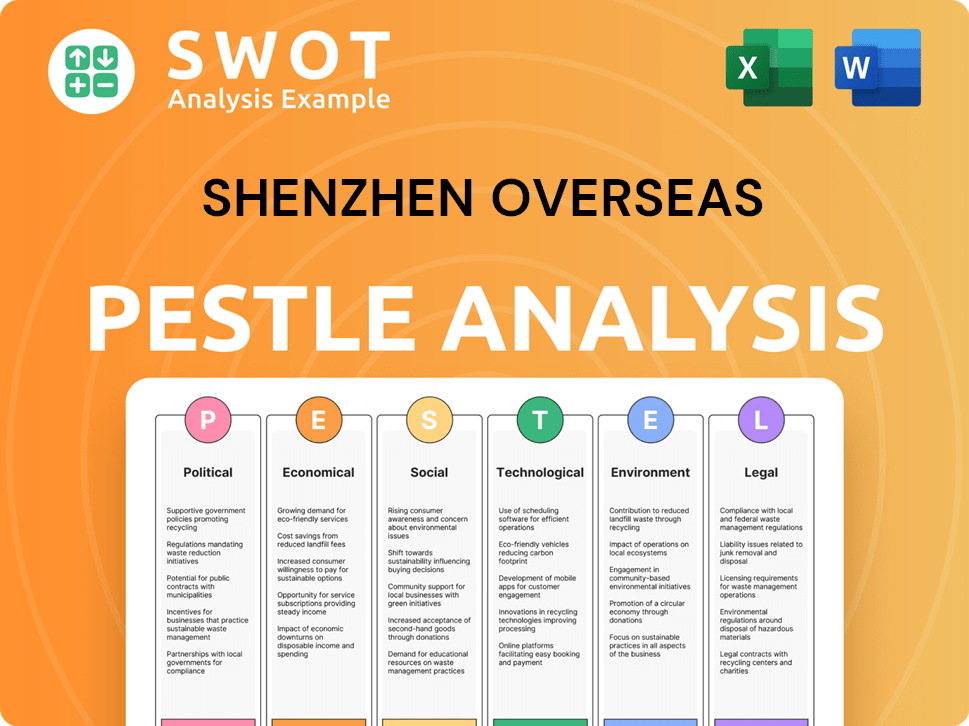

Analyzes external factors impacting Shenzhen Overseas across Political, Economic, Social, etc. dimensions.

Provides a concise version suitable for integration into presentations or quick strategy sessions.

Same Document Delivered

Shenzhen Overseas PESTLE Analysis

What you see is what you get! This preview showcases the complete Shenzhen Overseas PESTLE Analysis.

The detailed insights, structure, and formatting are fully representative of the final report.

Upon purchase, you'll receive this exact document instantly, ready to use.

No edits, no hidden content – just the complete analysis you see here.

Start exploring now and make informed decisions!

PESTLE Analysis Template

Explore the forces shaping Shenzhen Overseas's path with our detailed PESTLE analysis. We examine the political climate, economic trends, social shifts, technological advancements, legal regulations, and environmental factors influencing the company. Uncover strategic opportunities and anticipate potential risks. Get the full PESTLE analysis for in-depth insights now!

Political factors

The Chinese government actively supports tourism via policies. These include boosting domestic consumption and attracting international visitors. For example, visa-free policies are expanding. In 2023, China's tourism revenue reached approximately $1.07 trillion. This government support significantly impacts Shenzhen Overseas Chinese Town Co., Ltd.

The Chinese government heavily regulates the real estate sector, impacting Shenzhen Overseas Chinese Town Co., Ltd. (OCT). Regulations on leverage and debt management directly affect OCT's property ventures. For instance, in 2024, new measures aimed to stabilize the market. These changes present both hurdles and chances for OCT. The sector's value in 2024 was around 20 trillion USD.

Geopolitical shifts, especially with key tourism sources, directly affect international tourist flows to China. For instance, tensions with countries like the US could reduce visitor numbers. This impacts Shenzhen Overseas Chinese Town Co., Ltd.'s hotels and tourism businesses. In 2024, international tourist arrivals in China were around 30 million, a rise from 2023, but still below pre-pandemic levels.

Regional Development Strategies

Shenzhen's growth is significantly shaped by regional development strategies. The Guangdong-Hong Kong-Macao Greater Bay Area initiative, where Shenzhen is a key player, fosters new tourism and real estate ventures. Government policies drive infrastructure improvements and economic activities within the region. These initiatives aim to boost cross-border collaboration and economic integration.

- The Greater Bay Area's GDP reached approximately $2 trillion in 2023.

- Shenzhen's GDP growth in 2024 is projected to be around 6%.

- Infrastructure investment in the GBA increased by 8% in 2024.

Political Stability and Governance

Political stability and effective governance are crucial in Shenzhen. China's political landscape directly impacts business predictability. Any shifts in leadership or policy can introduce significant risks for investments. The Chinese government's focus on stability is evident in its economic policies.

- China's GDP growth was 5.2% in 2023, reflecting the government's stability-focused approach.

- Shenzhen's ranking in governance efficiency is consistently high within China, supporting business confidence.

China's policies, like expanded visa-free travel, drive tourism growth; 2023 tourism revenue hit $1.07 trillion. Government regulation of real estate affects Shenzhen OCT's ventures. Geopolitical factors impact tourism; international arrivals rose to about 30 million in 2024.

| Political Factor | Impact on OCT | 2024 Data |

|---|---|---|

| Tourism Policies | Increased Tourism Revenue | International Tourist Arrivals: ~30M |

| Real Estate Regulation | Affects Property Ventures | Real estate sector value: ~$20T |

| Geopolitical Relations | Affects Tourist Flows | China's GDP Growth: 5.2% (2023) |

Economic factors

China's economic growth directly influences consumer spending in Shenzhen. In 2024, China's GDP growth is projected around 5%, impacting disposable income. Slowing growth and deflationary pressures, as seen with a -0.3% CPI in February 2024, can curb demand for leisure and real estate.

The real estate market's health, including property prices and investment, significantly impacts Shenzhen Overseas Chinese Town Co., Ltd. In 2024, property prices in Shenzhen experienced fluctuations, with some areas seeing modest gains while others faced declines. Investment levels have adjusted due to market stabilization efforts. Housing demand remains a crucial factor, influenced by economic conditions and government policies. The property market's downturn and subsequent stabilization attempts are pivotal economic considerations for the company.

Tourism's rebound is key for Shenzhen's economy. Domestic tourism in China saw a robust recovery in 2023, with spending up significantly. International travel is also picking up, though slower. Experiential travel is trending; businesses must adapt to this shift.

Inflation and Deflationary Pressures

Inflation and deflation significantly influence Shenzhen's economic landscape. Operating costs and pricing strategies are directly affected by these pressures. Low consumer price inflation has been observed recently, yet future price changes are crucial. This impacts consumer purchasing power and business profitability.

- China's CPI rose 0.3% year-on-year in March 2024.

- Shenzhen's manufacturing PMI reflects cost pressures.

- Changes in global commodity prices affect local businesses.

Investment and Financing Environment

Shenzhen's investment and financing environment is pivotal for business operations. The availability and cost of capital, influenced by interest rates and investor confidence, directly affect project viability. As of early 2024, China's interest rates, set by the People's Bank of China, fluctuated, impacting borrowing costs for businesses. Government debt levels also play a role, influencing overall market stability and investor sentiment.

- PBOC's benchmark lending rate: around 3.45% in early 2024.

- China's government debt-to-GDP ratio: approximately 77% in 2023.

- Foreign Direct Investment (FDI) in China: decreased in 2023.

Shenzhen's economy relies on China's growth; a projected 5% GDP increase in 2024 influences local spending.

Real estate prices and tourism significantly impact Shenzhen; property fluctuations and a domestic tourism surge in 2023 show importance.

Inflation, deflation, and investment conditions shaped business operations; China's CPI rose 0.3% YOY in March 2024; the PBOC lending rate was about 3.45% in early 2024.

| Economic Factor | Data Point | Impact |

|---|---|---|

| China's GDP Growth | Projected 5% in 2024 | Influences consumer spending and investment |

| Shenzhen Property Market | Fluctuating prices | Affects business investment |

| China's CPI | 0.3% YoY increase (March 2024) | Reflects the inflation/deflation impact |

Sociological factors

Changing consumer preferences, especially among younger generations, are reshaping the tourism sector. This shift towards unique experiences, cultural tourism, and digital integration requires adaptation. Shenzhen Overseas Chinese Town Co., Ltd. must tailor its offerings to meet these evolving demands. In 2024, digital tourism spending in China reached $150 billion, highlighting the need for digital integration.

Shenzhen's ongoing urbanization boosts its population, increasing demand for real estate and entertainment. In 2024, Shenzhen's population reached over 17.7 million, reflecting this trend. An aging population impacts property and tourism preferences. For example, spending on recreation and entertainment in China is expected to grow to $750 billion by 2025.

Shenzhen's cultural tourism sector is booming, with a focus on heritage. Overseas Chinese Town Co. Ltd. can capitalize on this. In 2024, cultural tourism contributed significantly to Shenzhen's GDP. Preserving historical sites is key to attracting visitors. This boosts both the local economy and cultural pride.

Social Trends in Leisure and Recreation

Shenzhen's leisure and recreation scene is evolving. Broad social trends, including digital nomadism, influence tourism. The demand for diverse travel experiences is rising. This impacts theme park and tourism complex utilization. In 2024, China's domestic tourism revenue reached ~$7 trillion yuan.

- Themed entertainment market in China is projected to reach $7.7 billion by 2025.

- Over 60% of Chinese tourists prefer customized travel experiences.

- Shenzhen saw over 150 million domestic tourists in 2024.

- The average spending per tourist in Shenzhen is ~$1,500 yuan.

Public Health and Safety Concerns

Public health events, like disease outbreaks, can severely affect Shenzhen's tourism and hospitality sectors. The SARS outbreak in 2003, for instance, caused a sharp decline in tourism, with a significant drop in hotel occupancy rates. Ensuring visitor safety is paramount for maintaining consumer trust and operational stability. The city's response to health crises directly influences its economic resilience.

- In 2023, Shenzhen saw a 15% increase in tourism compared to 2022, but health concerns remain a factor.

- The Shenzhen government has invested $50 million in 2024 to enhance public health infrastructure.

- Hotel occupancy rates in Shenzhen fell by 10% during the 2020 COVID-19 pandemic.

Shifting consumer tastes emphasize unique cultural and digital experiences in tourism. Shenzhen's growing population drives demand for real estate and entertainment; 2024's population exceeded 17.7 million. Cultural tourism and heritage preservation are key to attracting visitors and boosting the economy.

Leisure trends and digital nomadism influence tourism, boosting demand for diverse experiences. Health crises impact tourism, requiring safety measures for operational stability and trust; 2024 saw $50 million in government health investment.

| Aspect | Details | Data |

|---|---|---|

| Consumer Trends | Preference for unique experiences, digital integration. | Digital tourism spending in China: $150B (2024). |

| Demographics | Urbanization and aging population impact preferences. | Shenzhen Population: 17.7M+ (2024), Entertainment spending $750B (2025 est.) |

| Cultural Tourism | Focus on heritage, driving economic growth. | Shenzhen domestic tourists: 150M+ (2024). |

Technological factors

The tourism sector is rapidly digitizing, using online platforms, mobile tech, and data analytics. Shenzhen Overseas Chinese Town Co., Ltd. must adopt these trends. In 2024, online travel sales hit $756.5 billion globally, showing digital's power. Embrace tech to boost competitiveness and enhance guest experiences.

Shenzhen's real estate leverages tech. Smart buildings and online transactions are growing. PropTech investments hit $1.6B in 2024. This can boost efficiency. Consider tech for customer service.

Shenzhen's theme parks and tourism are evolving through technology. 5G, AI, IoT, and VR/AR are creating immersive experiences. These innovations boost the appeal of cultural tourism. China's VR/AR market reached $2.8 billion in 2024, expected to grow. This tech integration offers efficiency gains too.

Data Security and Privacy

Data security and customer privacy are paramount in Shenzhen's digital landscape. Meeting stringent data protection laws is crucial for businesses. The city saw a 25% rise in cyberattacks in 2024, emphasizing the need for robust security measures. Building consumer trust hinges on safeguarding personal information.

- Cybersecurity spending in China is projected to reach $34.6 billion by 2025.

- Shenzhen's tech companies must comply with the Cybersecurity Law of the People's Republic of China.

Technological Infrastructure Development

Shenzhen's robust technological infrastructure, including extensive 5G coverage and high-speed internet, is crucial. This supports digital tourism and smart city projects, enhancing operational efficiency. Shenzhen boasts over 70,000 5G base stations, with 5G user penetration exceeding 70% by late 2024. This facilitates advanced applications and services.

- 5G user penetration: Over 70% by late 2024.

- 5G base stations: Over 70,000 in Shenzhen.

Technological advancements are reshaping Shenzhen Overseas' tourism and real estate. Digital integration drives tourism's competitiveness; PropTech investments hit $1.6B in 2024. Cybersecurity, with $34.6B spending projected by 2025, and data protection are critical, demanding compliance and robust security.

| Technology Area | Impact | Shenzhen Data |

|---|---|---|

| Digital Tourism | Boosts competitiveness and guest experience | Online travel sales hit $756.5B in 2024 |

| PropTech | Enhances efficiency in real estate | $1.6B in PropTech investments in 2024 |

| Cybersecurity | Ensures data security and compliance | $34.6B projected spending by 2025 |

Legal factors

Shenzhen Overseas Chinese Town Co., Ltd. (OCT) must adhere to China's tourism laws. This includes regulations for cultural and tourism markets. Travel agency operations are also heavily regulated. Hotel standards and compliance are crucial, affecting OCT's business. In 2024, the tourism sector saw increased regulatory scrutiny.

Shenzhen's real estate sector is shaped by property development, sales, and management laws. Changes in land use policies and financing are crucial. Consumer protection laws also play a significant role. As of early 2024, new regulations aim to stabilize housing prices. The Shenzhen housing market saw approximately 40,000 new homes sold in 2023.

Consumer protection laws in Shenzhen, updated through early 2024, are crucial. These laws safeguard consumer rights in both tourism and real estate sectors. Compliance is vital for maintaining trust and preventing legal problems. For instance, the Shenzhen Consumer Council handled over 100,000 consumer complaints in 2023, highlighting the importance of adherence.

Foreign Investment Laws and Regulations

Shenzhen, as a hub for international business, must navigate China's foreign investment laws. These laws govern how foreign entities can invest in or partner with local companies. In 2024, the Foreign Investment Law and its related regulations are still in effect. This impacts how companies attract international capital or form collaborations.

- Foreign Investment Law (2020): Sets the framework for foreign investment, promoting fair competition.

- Negative List: Specifies sectors where foreign investment is restricted or prohibited.

- Investment Incentives: Shenzhen offers incentives to attract foreign investment in specific sectors.

- Compliance and Enforcement: Strict enforcement of laws; companies must comply with regulations.

Environmental Regulations and Compliance

Shenzhen's environmental regulations significantly affect businesses in construction and tourism. Companies must comply with strict emission standards and waste management rules. Failure to do so can lead to hefty fines and reputational damage. The city's focus on sustainability is increasing compliance costs.

- China's environmental protection expenditure in 2023 was approximately $140 billion USD.

- Shenzhen's air quality has improved, but compliance remains crucial.

- Tourism sites must adhere to environmental guidelines to protect natural resources.

Shenzhen businesses, including OCT, must adhere to diverse legal factors.

Tourism, real estate, and foreign investment are strictly regulated, influencing operations. In 2024, consumer protection remains a key focus.

Environmental regulations increase costs but also drive sustainable practices. In 2023, the Shenzhen Consumer Council addressed over 100,000 complaints, highlighting legal impacts.

| Legal Area | Impact on OCT | Data Point (2023/2024) |

|---|---|---|

| Tourism Laws | Operational Compliance | Tourism market regulation increased (2024) |

| Real Estate | Property Development | 40,000 new homes sold (2023) |

| Consumer Protection | Trust and Liability | 100,000+ consumer complaints (2023) |

Environmental factors

Environmental consciousness is rising, affecting Shenzhen's tourism and real estate. Businesses face pressure to be eco-friendly. Shenzhen aims for green development, with initiatives like electric vehicle adoption. In 2024, Shenzhen invested heavily in environmental projects, with over $10 billion allocated to green initiatives.

Tourism in Shenzhen affects the environment through resource use and waste, particularly from theme parks and hotels. Sustainable tourism is crucial. In 2024, Shenzhen saw over 150 million tourist visits. Waste management costs rose by 10% due to tourism. Sustainable practices are key for long-term success.

Climate change poses significant risks for Shenzhen's tourism. Rising sea levels and extreme weather events could damage coastal attractions and infrastructure, potentially decreasing tourism revenue. Shenzhen should incorporate climate resilience into its planning, such as investing in infrastructure that can withstand floods and storms. In 2024, the city experienced several extreme weather events. For example, in September 2024, Typhoon Saola caused about $100 million in damage to infrastructure.

Resource Management and Conservation

Shenzhen's approach to resource management and conservation is crucial for its hospitality and tourism sectors. Efficient management of resources like water and energy directly impacts operational costs and supports environmental sustainability. Conservation efforts can boost a company's environmental reputation and attract eco-conscious travelers. The city's focus on green initiatives influences business practices.

- Shenzhen aims to reduce carbon emissions by 45% by 2030.

- Hotels are encouraged to adopt energy-efficient technologies.

- Water conservation measures are being implemented across the city.

Pollution Control and Waste Management

Shenzhen's environmental regulations and public expectations for pollution control and waste management significantly affect real estate and tourism projects. Compliance with these standards is crucial for obtaining permits and ensuring operational sustainability. In 2024, the city intensified its efforts, aiming for a 5% reduction in industrial pollutant emissions. Effective waste reduction strategies are essential.

- Stringent enforcement of environmental protection laws.

- Increased investment in green technologies and infrastructure.

- Public awareness campaigns promoting waste reduction.

- Targets for recycling rates and waste diversion from landfills.

Environmental factors profoundly shape Shenzhen’s tourism and real estate, with green practices becoming essential. Investments in green initiatives topped $10 billion in 2024. Climate change presents risks, evidenced by $100 million in damage from Typhoon Saola in September 2024. Regulations drive sustainability, influencing business and attracting eco-conscious travelers.

| Aspect | Impact | Data |

|---|---|---|

| Green Investment | Supports sustainable practices | >$10B in 2024 |

| Extreme Weather Damage | Infrastructure costs, tourism disruptions | $100M damage (Typhoon) |

| Emission Reduction | Environmental compliance | -5% industrial emissions in 2024 |

PESTLE Analysis Data Sources

This Shenzhen analysis uses official government publications, economic reports, and market studies. Additional insights derive from industry analyses and academic research.