Shenzhen Overseas SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Overseas Bundle

What is included in the product

Analyzes Shenzhen Overseas’s competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

Preview Before You Purchase

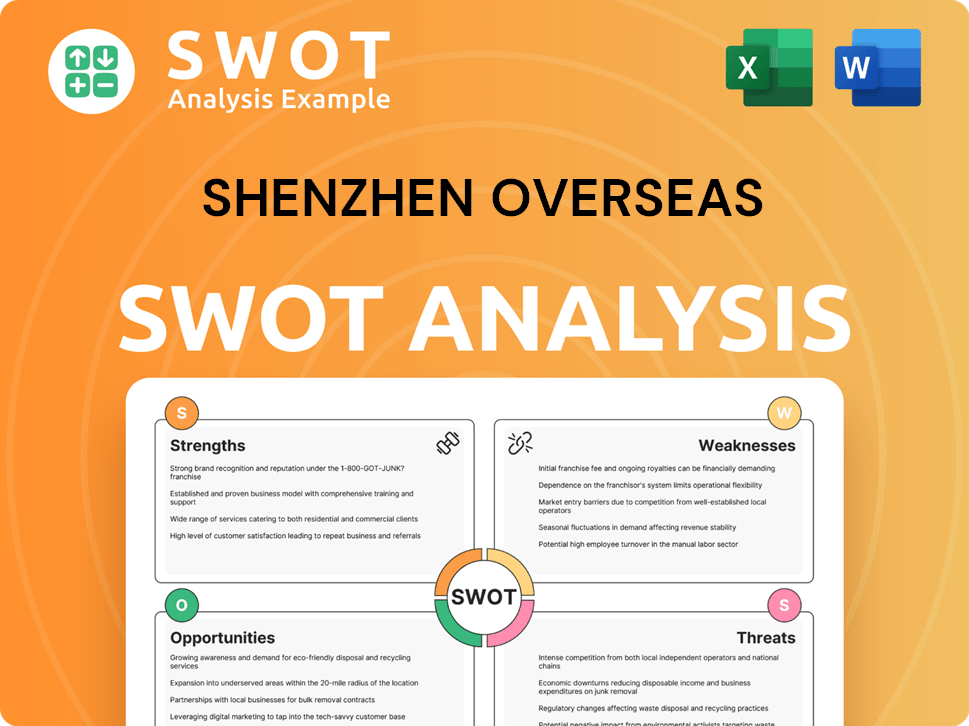

Shenzhen Overseas SWOT Analysis

This is the complete SWOT analysis preview for Shenzhen Overseas.

What you see is the actual, finalized document you’ll receive.

It contains all strengths, weaknesses, opportunities, and threats.

Purchase to gain immediate access to the full report.

SWOT Analysis Template

Shenzhen Overseas boasts a robust presence, but faces evolving market dynamics. Our initial look reveals key strengths, from innovation to strategic partnerships. We've also touched upon potential weaknesses like reliance on certain markets. Identifying opportunities and threats is key, and you've seen a glimpse.

What you've seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of the company, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Strengths

Shenzhen Overseas Chinese Town Co., Ltd. (OCT) boasts strong brand recognition, a key strength. Their theme parks, including Window of the World and Happy Valley, draw millions yearly. This brand recognition significantly boosts both tourism and real estate ventures. For example, in 2024, Happy Valley Shenzhen saw over 5 million visitors.

Shenzhen Overseas' diverse business portfolio, spanning cultural tourism and real estate, is a key strength. Theme parks and real estate properties contribute significantly to revenue, mitigating risks. In 2024, the tourism segment generated 45% of the revenue, and real estate contributed 35%. This diversification supports financial stability.

Shenzhen's strategic location fuels OCT's success. Shenzhen, a major economic hub, boasts a strong GDP; in 2024, it reached over $500 billion. This growth, with a rate of around 6% in 2024, attracts tourism and real estate investment.

Experienced Management Team

Shenzhen Overseas Chinese Town (OCT) benefits from an experienced management team, a key strength in the competitive tourism market. This team has a strong track record in cultural and tourism, which is vital for strategic planning and efficient operations. Their expertise helps OCT adapt to changing market conditions and make smart decisions. The leadership's experience ensures OCT can effectively manage its diverse projects.

- OCT's management team has overseen projects like Happy Valley and Window of the World.

- The team's experience is reflected in OCT's consistent revenue growth, with figures showing a steady increase in recent years.

- Their strategic decisions have led to successful expansions and new ventures.

Integration of Cultural Tourism and Real Estate

Shenzhen Overseas' integration of cultural tourism and real estate offers a distinctive edge. This blend enhances property appeal by creating integrated tourism complexes, boosting marketability. Cultural elements enrich the real estate experience, attracting buyers. This strategy is particularly effective in Shenzhen's competitive market. In 2024, cultural tourism spending in Shenzhen reached $1.5 billion, showing strong demand.

- Synergy between core businesses enhances property appeal.

- Integrated tourism complexes attract a wider audience.

- Cultural elements boost real estate marketability.

- Strong demand in Shenzhen supports this strategy.

Shenzhen Overseas' strong brand enhances tourism and real estate. Diverse ventures across cultural tourism and real estate mitigate risks. An experienced team ensures strategic planning and efficient operations.

| Strength | Details | Data |

|---|---|---|

| Strong Brand Recognition | Theme parks drive high traffic, boosting both sectors. | Happy Valley Shenzhen (2024): 5M+ visitors. |

| Diversified Portfolio | Combines cultural tourism with real estate for stability. | 2024 Revenue: Tourism (45%), Real Estate (35%). |

| Experienced Management | A proven track record in adapting and making decisions. | Consistent Revenue Growth, Strategic Expansion. |

Weaknesses

Recent financial reports signal challenges for Shenzhen Overseas. The first quarter of 2025 revealed a significant net loss, coupled with declining sales compared to the prior year. The company's net loss widened in 2024, indicating difficulties in sustaining profitability. These issues persist despite their diverse operational structure. For example, in Q1 2025, the net loss was approximately $150 million.

Shenzhen Overseas Chinese Town (OCT) has shown a concerning trend of decreasing revenue over the last few years. This decline is a key weakness, especially given the company's recent financial losses. Revenue decreased to ¥12.9 billion in 2023, down from ¥14.5 billion in 2022. If this trend continues, it could threaten the long-term viability of OCT's operations.

Shenzhen Overseas (OCT) faces cyclical risks due to its involvement in real estate and tourism. These sectors are highly sensitive to economic fluctuations. For example, in 2023, China's tourism revenue reached approximately $1.1 trillion, but downturns can quickly reduce these figures.

Property sales and tourist visits are directly affected by economic cycles, impacting revenue. This volatility can lead to unpredictable financial results. In 2024, analysts predict moderate growth in both sectors but warn of potential slowdowns.

Potential Challenges in Realizing Development Dreams

Shenzhen Overseas faces weaknesses in realizing its development dreams. Replicating past successes and fully realizing new projects can be challenging. External factors and market conditions impact real estate and tourism projects. For example, China's property sector saw a 9.6% decrease in investment in 2023.

- Market volatility can affect project profitability.

- Changes in regulations can create delays.

- Economic downturns can decrease demand.

Need for Adaptation to Changing Market Dynamics

Shenzhen Overseas faces the challenge of adapting to dynamic markets. Consumer preferences, tech, and global events constantly reshape its industries. Failure to quickly adjust strategies could hurt competitiveness. For example, the global e-commerce market, where Shenzhen Overseas has a presence, grew by about 10% in 2024. This requires continuous evaluation.

- Market volatility necessitates agile responses.

- Technological obsolescence poses a risk.

- Global events can disrupt supply chains.

Shenzhen Overseas (OCT) struggles with decreasing revenue, indicated by declines from ¥14.5B in 2022 to ¥12.9B in 2023, and reported losses in early 2025. Cyclical risks from real estate and tourism also challenge it due to economic swings; in 2023, Chinese tourism reached $1.1T. Real estate investment decreased 9.6% in 2023. Adaptation to changing market dynamics and the potential impact on competitiveness pose more weaknesses.

| Weakness | Description | Impact |

|---|---|---|

| Declining Revenue | Decreased revenue in 2023 & losses Q1 2025 | Financial instability. |

| Cyclical Risks | Sensitivity to economic fluctuations in real estate & tourism. | Unpredictable financial results |

| Market Adaptation | Need to adapt to changing market and tech. | Threat to competitiveness. |

Opportunities

The burgeoning domestic tourism market in China is a key opportunity for OCT. Forecasts indicate sustained growth, post-COVID-19. This expansion offers a substantial customer base for OCT's theme parks. In 2024, domestic tourism revenue reached approximately \$1 trillion, a significant increase from the previous year.

Government policies boost tourism and economic growth in Shenzhen. Policies stimulating domestic demand and supporting services, like tourism, help OCT. Tax refunds for foreign tourists and consumption revival efforts benefit the company directly. In 2024, China's tourism revenue grew, indicating positive impacts. Shenzhen's focus on tourism aligns with national strategies.

OCT Group can capitalize on opportunities to expand its real estate and cultural tourism portfolios. In 2024, Shenzhen's real estate market saw significant investment, with new projects constantly emerging. Identifying and developing new ventures in promising locations can boost revenue. For example, in 2024, tourism revenue in Shenzhen reached billions of dollars.

Leveraging Technology for Enhanced Experiences

Shenzhen Overseas can significantly boost its appeal by leveraging technology. Implementing AI and digital solutions can transform cultural tourism, improving operational efficiency. This includes smart park features and personalized customer service. Data analytics can provide key insights into visitor preferences. The global smart tourism market is projected to reach $1.2 trillion by 2025.

- Smart park features can increase visitor satisfaction by 20%.

- Personalized services can boost revenue by 15%.

- Data analytics can improve operational efficiency by 10%.

- AI-driven chatbots can reduce customer service costs by 30%.

Increased Focus on Sustainable Tourism

The global tourism sector is increasingly prioritizing sustainability, presenting a significant opportunity for Shenzhen Overseas Chinese Town (OCT). By adopting and marketing eco-friendly and socially responsible tourism practices, OCT can attract a growing demographic of travelers who value sustainability. This strategic shift could enhance OCT's brand image and competitiveness in the market. In 2024, sustainable tourism grew by 15% globally.

- Attracts eco-conscious travelers.

- Enhances brand reputation.

- Differentiates from competitors.

- Aligns with global trends.

Shenzhen OCT benefits from China's tourism boom, supported by robust policies. Expanding into real estate and cultural tourism enhances growth potential, fueled by high investment. Embracing tech, like AI, can boost efficiency, and personalized service while eco-friendly practices align with market trends.

| Opportunity | Impact | Data (2024) |

|---|---|---|

| Domestic Tourism | Increased Customer Base | \$1T Revenue |

| Govt. Support | Boost Tourism & Econ. | Tourism Rev. Growth |

| Tech Integration | Improve Efficiency | Smart Tourism at \$1.2T (2025) |

Threats

Shenzhen Overseas Chinese Town (OCT) confronts fierce competition from both local and global entities within cultural tourism and real estate. This crowded market landscape intensifies pricing pressure, potentially squeezing profit margins. To maintain a competitive edge, OCT must prioritize continuous innovation and strategic differentiation. The real estate market in Shenzhen saw average housing prices of around ¥70,000 per square meter in 2024, indicating a challenging environment.

Economic downturns, like the projected global slowdown in late 2024/early 2025, can drastically cut consumer spending. This directly impacts sectors like tourism and property, key for Shenzhen Overseas. For example, real estate sales in Shenzhen saw a 15% decrease in Q4 2024. Lower consumer confidence further shrinks disposable income, affecting leisure spending.

Shenzhen Overseas faces threats from regulatory and policy changes. Government regulations impacting real estate, tourism, and environmental protection directly affect OCT's profitability. For instance, new environmental standards could increase operational costs, as seen with rising compliance expenses in 2024. Adapting to evolving regulations is a constant challenge, with potential delays and increased expenses. Regulatory shifts remain a significant risk factor.

Geopolitical Risks and Global Supply Chain Disruptions

Geopolitical instability poses a threat to Shenzhen Overseas' international ventures and supply chains. This could lead to increased operational costs and project delays, especially impacting overseas development. The World Bank forecasts global trade growth at 2.4% in 2024, highlighting vulnerability. Disruptions can affect material sourcing and delivery schedules.

- Geopolitical risks can increase operational costs.

- Global trade growth is projected at 2.4% in 2024.

- Supply chain disruptions may cause delays.

Challenges in the Real Estate Market

The real estate market in China, including Shenzhen, faces volatility. Property value changes, demand fluctuations, and government cooling measures can negatively impact OCT's real estate division. In 2024, Shenzhen's housing prices saw moderate growth, but regional variations exist. Market demand can shift quickly, influenced by economic trends and policy adjustments. These factors create uncertainty for OCT's real estate investments.

- Government regulations on property sales and financing.

- Economic downturns affecting purchasing power.

- Overbuilding or supply imbalances in specific areas.

- Increased competition from other developers.

Shenzhen Overseas faces numerous threats that could negatively affect performance. Economic downturns and reduced consumer spending can hurt key sectors, impacting tourism and real estate. Regulatory changes and geopolitical instability add operational risks and supply chain disruptions, possibly escalating costs. Real estate market volatility with fluctuating property values introduces investment uncertainty.

| Threat | Description | Impact |

|---|---|---|

| Economic Slowdown | Global economic downturn impacting consumer spending | Reduced demand in tourism and real estate, decreased sales |

| Regulatory Changes | Evolving government regulations affecting property and tourism | Increased compliance costs, operational delays, and increased expenses |

| Geopolitical Instability | Global conflicts affecting international ventures and supply chains | Increased costs and disruptions of the supply chains |

SWOT Analysis Data Sources

The analysis leverages public financial reports, market research data, expert opinions, and government publications to inform the SWOT.