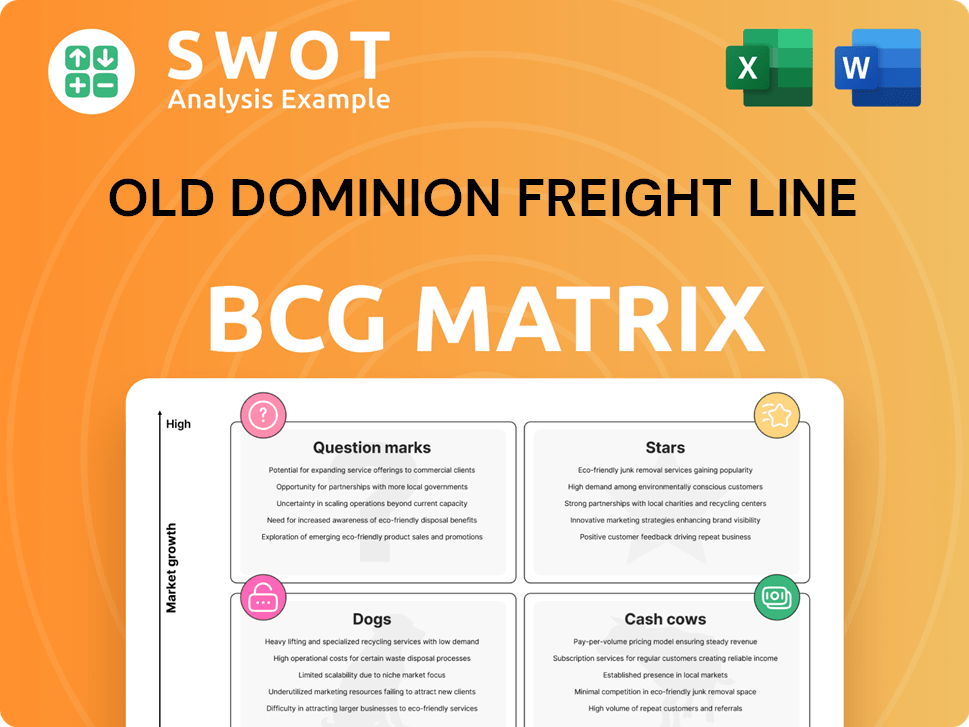

Old Dominion Freight Line Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Old Dominion Freight Line Bundle

What is included in the product

Tailored analysis for Old Dominion's product portfolio across BCG quadrants.

Clean, distraction-free view optimized for C-level presentation showcasing the strategic business units.

What You’re Viewing Is Included

Old Dominion Freight Line BCG Matrix

The preview showcases the complete BCG Matrix report you'll receive after purchase. This document, without alterations, is yours to download, analyze, and implement straight away.

BCG Matrix Template

Old Dominion Freight Line's BCG Matrix reveals the competitive landscape of its diverse service offerings. See which are thriving "Stars" in a growing market and which are the reliable "Cash Cows" funding future growth. Uncover "Question Marks" needing careful strategic attention and identify the underperforming "Dogs". Understanding these dynamics is crucial for smart resource allocation and strategic planning.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Old Dominion Freight Line excels in service, boasting a 99% on-time delivery rate in 2024. This high standard, along with a low cargo claims ratio, strengthens customer bonds. Such reliability boosts their market share, setting them apart. Their dedication to excellent service is a key factor in their strong reputation and customer loyalty, as reflected in their financial performance.

Old Dominion Freight Line continually invests in technology, like customer API integrations and freight tracking tools. This boosts efficiency and offers better transparency. Enhanced billing, scheduling, and visibility give shippers more flexibility. These tech-driven moves support risk management and workforce optimization.

Old Dominion's vast network, boasting over 260 service centers, is a cornerstone of its strategy. This extensive infrastructure supports efficient operations and nationwide coverage. In 2024, Old Dominion invested heavily in real estate to expand and enhance its network. This expansion strategy allows the company to manage growth and maintain service quality in key markets.

Financial Health and Stability

Old Dominion Freight Line (ODFL) displays robust financial health, weathering economic downturns effectively. The company's strong cash flow generation allows for continuous network and service enhancements. ODFL's disciplined yield management and cost controls drive profitable expansion, boosting shareholder value. In 2024, ODFL's operating ratio improved to 73.3%, reflecting efficient operations.

- Operating ratio improved to 73.3% in 2024.

- Demonstrates strong cash flow generation.

- Focus on yield management and cost control.

- Enhances shareholder value.

Union-Free Operation

Old Dominion's union-free status is a key strength, enhancing operational flexibility and cost control. This structure allows for quick adjustments to market changes and supports competitive pricing. The company's ability to offer high-quality service is bolstered by its union-free environment. For instance, in 2024, Old Dominion reported an operating ratio of approximately 74%, showcasing its efficiency.

- Operational Flexibility: Quick adaptation to market shifts.

- Cost Management: Helps maintain competitive pricing.

- Service Quality: Supports delivering high-quality services.

- Financial Efficiency: Contributes to strong operating ratios.

Old Dominion Freight Line (ODFL) is a "Star" within the BCG matrix, showing high growth and market share. They have demonstrated strong financial performance, as highlighted by their improved operating ratio, signaling efficient operations. The company's continuous investments and network expansions drive market dominance.

| Aspect | Details | Impact |

|---|---|---|

| Market Share | Significant and growing. | Leads to higher revenue and profitability. |

| Growth Rate | Above industry average. | Attracts investments and enhances market position. |

| Financial Health | Robust, with strong cash flow. | Enables continued investment and expansion. |

Cash Cows

Old Dominion's core LTL services, including regional and national offerings, are a cash cow, providing steady revenue. These services leverage a vast network and strong reputation. The LTL market offers pricing power and margin stability. In 2024, Old Dominion's revenue was approximately $6.3 billion, showcasing its financial strength.

Old Dominion's value-added services, such as container drayage and supply chain consulting, boost revenue and client ties. These services, including truckload brokerage, complement core LTL offerings. In 2024, these services contributed significantly to overall revenue. This enhances Old Dominion's customer value.

Old Dominion Freight Line (ODFL) has a robust market share. It has shown stability, even with economic uncertainty. Their focus on service quality has boosted market share. ODFL's success reflects its competitive edge. In 2024, ODFL's revenue reached $6.07 billion.

Capital Return Strategy

Old Dominion Freight Line's capital return strategy, focusing on dividends and share repurchases, highlights robust financial health and management's optimism. The company's strong cash flow fuels these shareholder-friendly actions, boosting investor appeal. This strategy underscores a commitment to enhancing shareholder value. In 2024, Old Dominion increased its quarterly dividend to $0.40 per share.

- Dividend increases reflect confidence.

- Share repurchases boost EPS.

- Strong cash flow supports returns.

- Attracts value-focused investors.

Focus on Industrial Segment

Old Dominion Freight Line's (ODFL) emphasis on its industrial segment, a key part of its less-than-truckload (LTL) shipments, offers a steady income source. ODFL's success in this area indicates possible economic gains. The industrial sector's solid base going into 2025 presents growth opportunities, fueled by nearshoring and infrastructure projects. In 2024, ODFL's revenue was approximately $6.5 billion.

- Industrial segment is a stable revenue source for ODFL.

- ODFL's outperformance in this segment shows potential for economic growth.

- Nearshoring and infrastructure updates drive growth in the industrial segment.

- In 2024, ODFL's revenue was about $6.5 billion.

Old Dominion's core LTL services and value-added offerings like container drayage act as cash cows. These services generate stable revenue due to a vast network and strong market position. The industrial segment, a key LTL component, provides a consistent income stream. In 2024, ODFL's revenue hit roughly $6.5 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total Revenue | $6.5 billion |

| Dividend | Quarterly Dividend | $0.40 per share |

| Market Share | Focus on LTL Market | Robust |

Dogs

Old Dominion Freight Line faces challenges due to its slow adoption of emission reduction targets. Competitors are actively integrating alternative vehicles, while Old Dominion lags. This could affect its competitiveness, especially with rising climate regulations. For instance, in 2024, the transportation sector saw increased scrutiny, with several states mandating zero-emission vehicle adoption. This situation highlights the need for Old Dominion to address sustainability concerns.

Old Dominion Freight Line faces risks from trade policy uncertainty, especially with its retail-focused clients. Declining ocean container imports, a key indicator, directly affect demand. The company's financial health is vulnerable to these external economic shifts. Changes in trade policies can significantly impact revenue and profitability. For instance, in 2024, import volumes fluctuated due to tariff adjustments.

Old Dominion Freight Line's recent financial data highlights a downturn. Revenue and earnings per share (EPS) have decreased compared to the previous year, signaling economic hurdles. This decline may limit the company's investment capacity. The decrease in revenue is mainly due to fewer LTL tons per day, pointing to volume issues.

Increased Operating Ratio

Old Dominion Freight Line's (ODFL) operating ratio has increased, signaling operational margin pressure from reduced revenue. This points to a need for better efficiency and cost control to preserve profitability. The rising operating ratio shows operating expense deleveraging due to lower revenue. In Q4 2023, ODFL's operating ratio was 76.6%, up from 72.8% in Q4 2022, reflecting these challenges.

- Operating ratio increase indicates margin pressure.

- Focus needed on efficiency and cost management.

- Deleveraging effect from lower revenue.

- Q4 2023 operating ratio was 76.6%.

Potential Impact of Amazon's LTL Service

Amazon's foray into the Less-than-Truckload (LTL) market could challenge Old Dominion Freight Line (ODFL), especially in retail. ODFL sees Amazon's entry more as an opportunity. However, market share and pricing require close monitoring. Increased competition might pressure pricing and profit margins.

- ODFL's revenue in Q3 2024 was $1.6 billion.

- Amazon's 2024 logistics spending is projected at $150 billion.

- LTL market growth is expected to be around 5% in 2024.

- ODFL's operating ratio improved to 73.9% in Q3 2024.

Dogs in the BCG matrix represent business units with low market share in a slow-growing market, often needing cash. Old Dominion, facing margin pressure and Amazon's entry, fits this profile to some extent. The company’s operating ratio climbed to 76.6% in Q4 2023, indicating challenges.

| Aspect | Details |

|---|---|

| Market Share | Potentially declining due to competition. |

| Market Growth | LTL market projected at 5% growth in 2024. |

| Cash Flow | Could be negative; requires investment. |

Question Marks

Old Dominion Freight Line (ODFL) could boost its market position by expanding expedited services, capitalizing on rising demand for speed. This strategic move necessitates investment in infrastructure and tech for reliable, efficient operations. The expedited shipping market is projected to reach $210 billion by 2024, reflecting customer preference for speed. ODFL's 2023 revenue was approximately $6.2 billion; expanding expedited services could increase revenue.

Old Dominion Freight Line (ODFL) could explore supply chain consulting. This strategy could attract customers needing logistics optimization. Building a strong consulting team and creating innovative solutions are crucial. ODFL's expertise can build deeper customer relationships. In 2024, ODFL's revenue was approximately $6.3 billion.

Strategic alliances could broaden Old Dominion's reach. Partnering with other carriers can target niche markets. This approach demands meticulous partner selection and strong teamwork. Alliances offer new markets and capabilities, boosting competitiveness. In 2024, Old Dominion's revenue was $6.2 billion.

Investment in Green Technologies

Old Dominion Freight Line (ODFL) may consider "Investment in Green Technologies" as a question mark in its BCG matrix. Investing in green transportation, like electric trucks, could attract eco-minded clients and meet new rules. This needs large investments and a long-term focus. The green logistics market is projected to hit $1.2 trillion by 2027.

- Significant capital expenditure needed for electric vehicles and infrastructure.

- Potential for higher operational costs initially due to technology and energy prices.

- Opportunity to tap into the growing market for sustainable logistics solutions.

- Risk of uncertain returns and evolving regulatory landscapes.

Targeting E-commerce Growth

Old Dominion Freight Line (ODFL) could target e-commerce growth, capitalizing on the industry's expansion by offering specialized Less-Than-Truckload (LTL) services. This strategic move would require operational and technological adjustments to meet the unique demands of online retailers. The e-commerce sector's surge fuels significant LTL market growth, creating opportunities for efficient, cost-effective solutions. E-commerce sales reached $1.1 trillion in 2023, up 7.4% year-over-year.

- E-commerce sales growth provides a substantial market for LTL services.

- Specialized LTL services can be tailored to meet the needs of online retailers.

- Adapting operations and technology is essential for handling e-commerce shipments.

- The LTL market benefits from the expansion of e-commerce.

Investment in Green Technologies is a question mark for Old Dominion Freight Line. This involves significant upfront costs for electric vehicles. The green logistics market is projected to reach $1.2 trillion by 2027.

| Aspect | Details | Financial Implication (2024 est.) |

|---|---|---|

| Investment Focus | Electric trucks, charging infrastructure. | High initial capital expenditure. |

| Market Opportunity | Growing demand for green solutions. | Potential for increased revenue and market share. |

| Challenges | Operational and regulatory hurdles. | Uncertainty and evolving compliance costs. |

BCG Matrix Data Sources

The ODFL BCG Matrix utilizes public financial data, market analysis, and industry reports for comprehensive insights.