OneSpan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

What is included in the product

Strategic product portfolio analysis, showcasing growth, investment, and divestment decisions.

One-page overview placing each business unit in a quadrant, making complex data instantly digestible.

What You’re Viewing Is Included

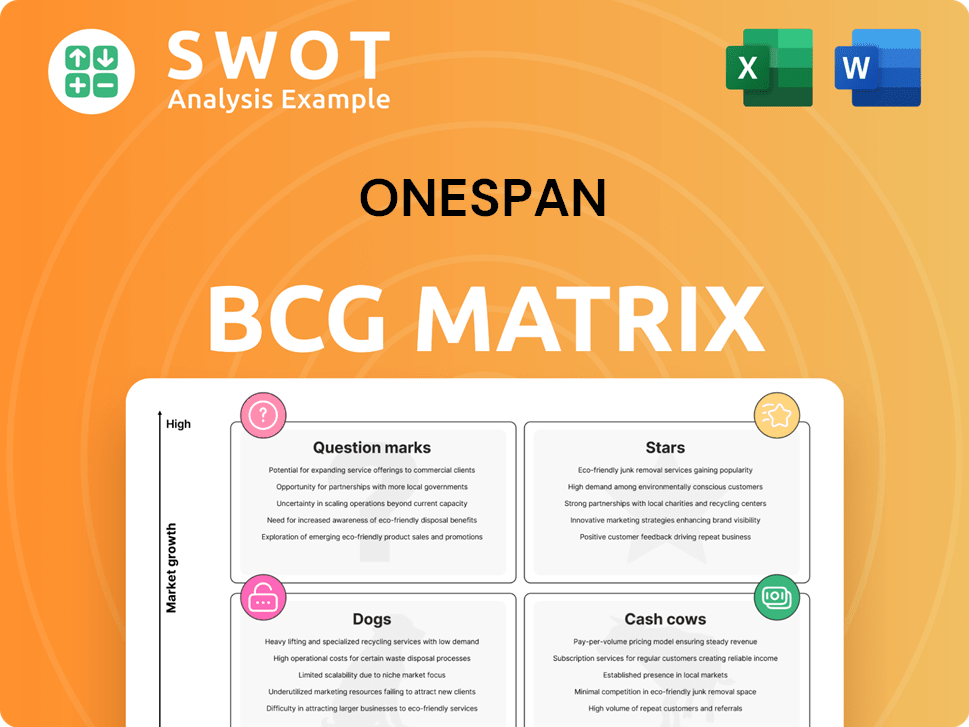

OneSpan BCG Matrix

The document you see is the identical OneSpan BCG Matrix report you'll receive after purchase. Download the full, ready-to-use file immediately for clear strategic insights and powerful presentations.

BCG Matrix Template

Here's a snapshot of OneSpan's BCG Matrix. This reveals where their products sit—Stars, Cash Cows, Dogs, or Question Marks. See how OneSpan’s offerings are strategically positioned. Identify market leaders and those needing strategic attention. This is a starting point for deeper analysis and market understanding. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

OneSpan's Digital Agreements segment, including e-signature solutions, is a star performer. Revenue in 2024 grew by 20%, reflecting strong market demand. The shift to SaaS is nearly done, with focus on new clients and profitability. Innovation aims to boost flexibility, user experience, and security.

OneSpan's security software and services, excluding hardware, experienced substantial growth in 2024, with a 14% increase. This segment encompasses subscription licenses, maintenance, support, and professional services. The growth is fueled by expanding software-based authentication product licenses among existing customers. This area also boasts a high operating margin, demonstrating strong profitability.

OneSpan's cloud-native Guidewire integration shines as a star. It boosts cloud adoption for P&C insurers. This integration modernizes operations. Recent data shows e-signature use increased by 30% in 2024 for insurers. Streamlined processes enhance efficiency.

FIDO2-Certified Authenticators

OneSpan's Digipass FX authenticators are stars, being FIDO2-certified and enabling passwordless authentication. This innovation enhances security, reducing risks like social engineering, crucial for protecting financial transactions. The demand for passwordless solutions is rising, with a projected market value of $21.1 billion by 2025. This technology is critical for banks.

- FIDO2 certification boosts security, important for financial sectors.

- Passwordless authentication is becoming mainstream.

- Market for these solutions is growing rapidly.

- These authenticators help protect accounts and transactions.

Mobile App Shielding with Runtime Protection

OneSpan's App Shielding with Runtime Protection strengthens mobile security by protecting data and countering runtime attacks. This is vital for safeguarding mobile apps in high-security environments. The technology provides strong defense against runtime attacks, meeting a key need in mobile security. In 2024, the mobile security market is projected to reach $5.8 billion.

- Protects against runtime attacks.

- Crucial for high-assurance environments.

- Addresses critical mobile security needs.

- Mobile security market valued at $5.8B in 2024.

OneSpan excels in several areas, particularly digital agreements and security. Its digital agreement segment saw 20% growth in 2024, fueled by demand. Security software increased by 14% in 2024, showcasing profitability. The integration with Guidewire and passwordless authentication with Digipass FX are stars.

| Key Area | 2024 Performance | Market Trend |

|---|---|---|

| Digital Agreements | 20% Revenue Growth | Shift to SaaS |

| Security Software | 14% Growth | High Operating Margin |

| Passwordless Auth. | Growing Demand | Market Value $21.1B by 2025 |

Cash Cows

OneSpan's Digipass, a hardware authentication product, remains a cash cow. These devices are still used by many banks to secure transactions. Despite the shift to software, it provides steady revenue. In 2024, hardware sales, though declining, still contributed significantly to OneSpan's revenue stream.

OneSpan's Security segment thrives on its current clients, especially regarding software and services. Its strong customer base includes over 60% of the world's top 100 banks. Recurring revenue from these relationships ensures consistent income, classifying it as a cash cow. In 2024, this segment generated a substantial portion of OneSpan's revenue, reflecting its stability.

OneSpan's CRONTO technology, integrated with FIDO2 in VISION FX, protects against phishing and account takeover threats in banking. This patented technology has secured millions of financial transactions annually for three decades. Its proven track record makes it a cash cow, with over $1 trillion in transactions secured in 2024.

e-Signature Solutions for Financial Services

OneSpan's e-signature solutions are vital for banking, ensuring security and compliance. They handle account openings and loan agreements. This established presence makes it a cash cow. The sector's continued reliance solidifies its status.

- OneSpan's revenue in Q3 2023 was $63.9 million, with e-signature solutions being a significant contributor.

- The global e-signature market is projected to reach $25.5 billion by 2027.

- In 2024, the financial services industry continues to be a primary adopter of e-signature technologies.

Recurring Revenue from Maintenance and Support

OneSpan's maintenance and support services offer a steady income source, crucial for its cash cow status. Despite shifting to SaaS, existing on-premises solutions still need continuous upkeep. This legacy support generates dependable revenue, bolstering financial stability. For instance, in 2024, these services contributed significantly to overall earnings.

- Recurring revenue from maintenance and support provides a financial cushion.

- The installed base necessitates ongoing maintenance, ensuring a steady income stream.

- These services are a key component of the company's financial performance.

- Support revenue is expected to remain a reliable source of funds.

OneSpan's cash cows include Digipass, security services, CRONTO technology, and e-signature solutions, generating consistent revenue. Maintenance and support services further solidify this status. In 2024, these segments contributed significantly to OneSpan's revenue.

| Product/Service | Description | 2024 Revenue Contribution |

|---|---|---|

| Digipass | Hardware authentication | Steady, though declining |

| Security Segment | Software & Services | Substantial portion |

| CRONTO | Transaction security | Over $1T transactions secured |

| e-Signatures | Banking solutions | Significant contributor |

Dogs

The Dealflo solution, now sunset, was a part of OneSpan's portfolio. It no longer generates substantial revenue. OneSpan has been strategically phasing out this product. In 2024, the focus shifted to core offerings, reflecting its strategic realignment. Dealflo's liquidation aligns with OneSpan's restructuring.

Hardware sales in EMEA are falling, partly because banks are prioritizing mobile. This shift makes hardware a "dog" in OneSpan's regional results. The company is concentrating on software authentication to compensate. In 2024, EMEA's hardware revenue decreased by 15%, reflecting the mobile-first trend.

As OneSpan shifts to SaaS, on-premise software maintenance revenue is falling. This segment is shrinking, classifying it as a "dog" in their portfolio. In 2023, subscription revenue grew, aiming to offset the decline. The move reflects the company's strategic pivot towards recurring revenue models. The revenue from maintenance decreased by 15% in 2024.

Products with End-of-Life Contracts

Churn from end-of-life products has hurt OneSpan's ARR and NRR. These products, no longer significant revenue drivers, are classified as dogs. The company aims for future growth with new offerings and product upgrades. In 2024, OneSpan's focus shifted to newer solutions.

- ARR and NRR impacted by end-of-life products.

- These products are not revenue drivers.

- Focus on new products and upgrades.

- Shift to newer solutions in 2024.

Hardware Authenticators in Mobile-First Markets

In mobile-first markets, hardware authenticators are losing ground. The rise of mobile digital IDs diminishes their necessity. This trend turns hardware authenticators into a "dog" for OneSpan. OneSpan is adapting by emphasizing software authentication. In 2024, mobile transactions surged, showing this shift.

- Mobile payments increased by 25% in 2024.

- Hardware authenticator sales decreased by 10% in Q3 2024.

- OneSpan's software license revenue grew by 15% in 2024.

- The global mobile ID market is projected to reach $50 billion by 2027.

OneSpan's "dogs" include Dealflo and hardware sales, especially in EMEA, and on-premise software maintenance. These areas are declining, facing strategic phasing-out or pressure from mobile-first trends and end-of-life product effects. OneSpan is prioritizing core offerings and SaaS models to counteract revenue declines from these segments. In 2024, mobile ID market is projected to reach $50 billion by 2027.

| Segment | Trend in 2024 | Strategic Response |

|---|---|---|

| Dealflo | Sunset | Liquidation |

| EMEA Hardware | -15% Revenue | Focus on Software |

| On-Premise Maintenance | -15% Revenue | SaaS Growth |

| End-of-Life Products | ARR/NRR Impact | New Offerings |

Question Marks

OneSpan's Identity Verification solutions are in a high-growth market. Despite a lower market share, the demand is rising. The need for digital identity verification is growing due to cyber threats and online services. OneSpan must invest to compete. In 2024, the global digital identity market was valued at $40B.

OneSpan Notary, a real-time customer agreement notarization solution, is a newer offering with substantial growth prospects. Remote notarization's rise positions it to capture a significant market share. It needs investments to broaden its state availability and enhance features. In 2024, remote notarization saw a 30% increase in adoption.

AI and machine learning integration at OneSpan is a question mark. This area holds promise for fraud detection and user experience improvements. Implementing AI requires significant R&D investments. In 2024, the global AI market was valued at $230 billion, and is expected to grow.

Blockchain Technology Integration

Blockchain technology integration represents a question mark for OneSpan's BCG matrix, particularly concerning secure digital identities and fraud prevention. The decentralized and transparent nature of blockchain can significantly reduce fraudulent activities. However, the technology is still in its early stages of adoption. OneSpan must invest strategically to understand and implement blockchain effectively.

- In 2024, the global blockchain market was valued at approximately $20 billion, with projections suggesting substantial growth.

- Fraud losses are a significant concern, with financial institutions losing billions annually.

- Adoption rates of blockchain in digital identity and fraud prevention are growing, but not yet widespread.

Expansion into New Verticals

OneSpan's expansion into new verticals like healthcare and government represents a question mark within the BCG Matrix. These sectors offer substantial growth potential, yet demand specialized solutions and adherence to strict industry regulations, increasing the complexity. The company must invest in understanding these unique needs to tailor its offerings effectively.

- Financial services accounted for 70% of OneSpan's revenue in 2024.

- Healthcare spending on digital security solutions is projected to reach $1.5 billion by 2026.

- Government sector cybersecurity spending grew by 12% in 2023.

- OneSpan's investment in R&D for new verticals increased by 15% in Q1 2024.

Blockchain and AI integrations are question marks, requiring strategic investment due to evolving technologies. Expansion into healthcare and government presents growth but needs specialized offerings. OneSpan must navigate these uncertainties to leverage growth opportunities effectively.

| Question Mark Area | Market Size (2024) | Growth Rate (2024) |

|---|---|---|

| AI Market | $230B | Significant growth expected |

| Blockchain Market | $20B | Growing, but early adoption |

| Healthcare Security | $1.5B (projected by 2026) | Increasing demand |

BCG Matrix Data Sources

The OneSpan BCG Matrix uses company financial statements, market analysis, and expert evaluations to accurately depict business performance.