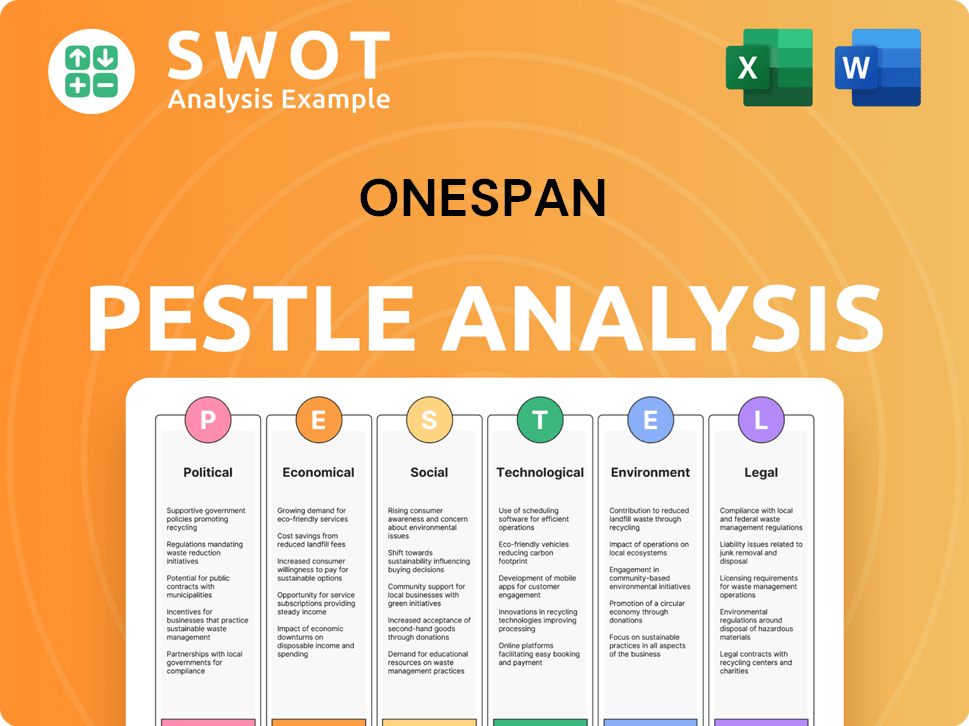

OneSpan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

What is included in the product

Provides a strategic assessment of how external influences impact OneSpan across six key sectors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

OneSpan PESTLE Analysis

This OneSpan PESTLE analysis preview is the complete document you’ll get. Its content and structure is the final file. Ready to download after payment. Everything here is fully formatted and professionally presented. No edits are needed.

PESTLE Analysis Template

Stay ahead of the curve with our focused PESTLE analysis of OneSpan. Uncover the key external factors influencing their strategies. Understand how politics, economics, and technology impact their performance. This ready-to-use report delivers critical market intelligence. Download the complete analysis now for a strategic advantage!

Political factors

Governments worldwide are tightening rules on data security and digital transactions, affecting OneSpan. As of late 2024, compliance costs for GDPR alone averaged $2 million annually for businesses. OneSpan, dealing with identity verification, faces these impacts head-on. Adhering to standards like GDPR and CCPA is critical for market access and operations.

OneSpan's global operations mean political stability is crucial. Instability can disrupt operations and impact customer spending. For example, changes in regulations in the EMEA region (35% of revenue in 2024) could affect business. Economic volatility due to political issues can also reduce investment in security solutions.

Government digitization initiatives, like those in the US, aiming for 100% digital service delivery, create opportunities for OneSpan. The global digital identity market, projected to reach $86.7 billion by 2027, fuels demand for OneSpan's secure solutions. Increased adoption of e-signatures, with a market value of $5.5 billion in 2023, further benefits the company. OneSpan's focus on secure digital agreements aligns well with these trends.

International Trade Policies and Tariffs

Changes in international trade policies and tariffs significantly affect OneSpan. Higher tariffs on hardware components, like those from China, increase costs. This impacts profitability and pricing across global markets. For example, in 2024, tariffs on certain electronic components rose by 10-15%. These adjustments can lead to strategic shifts.

- Tariff increases on key components can raise production costs.

- OneSpan might need to adjust pricing to maintain margins.

- Changes can influence market competitiveness.

Cybersecurity as a National Security Priority

Governments worldwide are elevating cybersecurity to a top national security concern, increasing budgets for advanced security solutions. This shift creates opportunities for companies like OneSpan, specializing in authentication and anti-fraud technologies. The U.S. government, for instance, allocated over $11 billion to cybersecurity in 2024, reflecting this trend. This increased focus translates to more government contracts and demand for OneSpan's services.

- U.S. cybersecurity spending in 2024: $11B+

- Increased government contracts for security firms.

- Focus on strong authentication and anti-fraud solutions.

Political factors significantly shape OneSpan's operational landscape. Stringent data security regulations globally, like GDPR, and increased cybersecurity budgets influence OneSpan's compliance and market opportunities. International trade policies and tariffs affect component costs and pricing strategies. Government digitization initiatives and heightened cybersecurity focus present growth prospects for OneSpan.

| Factor | Impact | Example (2024/2025) |

|---|---|---|

| Data Security | Compliance costs, market access. | GDPR compliance ~$2M annually. |

| Political Instability | Disrupted operations, spending changes. | EMEA revenue at 35%. |

| Government Initiatives | Increased demand for digital ID solutions. | Digital ID market: $86.7B by 2027. |

Economic factors

Macroeconomic conditions significantly shape customer behavior. Economic uncertainty, inflation, and possible recessions directly affect spending on security solutions. For example, in 2024, inflation rates hovered around 3-4% in many developed economies. This can influence OneSpan's financial performance.

OneSpan's global presence means currency fluctuations are a key risk. For example, in Q4 2023, unfavorable currency movements decreased revenue by $0.5 million. These fluctuations impact international sales revenue and operational costs. A strong U.S. dollar, for instance, can make OneSpan's products more expensive for international buyers.

OneSpan's move towards subscription-based revenue is a key economic factor. This shift from hardware to software is designed to boost Annual Recurring Revenue (ARR). In Q1 2024, OneSpan's software and services revenue increased, showing the impact of this change. The goal is to improve profitability margins.

Competitive Landscape and Pricing Pressure

The authentication and digital agreements markets are highly competitive. This intense rivalry can lead to pricing pressure, potentially affecting OneSpan's revenue and profitability. In 2024, the digital signature market was valued at $6.8 billion, with expected growth. OneSpan must strategize to maintain market share amid pricing adjustments.

- Competitive pressures can squeeze profit margins.

- Market growth offers opportunities to offset pricing impacts.

- OneSpan's pricing strategy must balance volume and profitability.

Tariff-Related Costs

Tariffs can affect OneSpan's profitability, especially in its hardware segment. While the company states minimal tariff exposure in Europe, this area demands continuous monitoring. In 2024, global trade tensions persist, potentially increasing costs for imported components or finished goods. These costs could squeeze margins if not managed effectively.

- Hardware sales contribute to a portion of OneSpan's revenue.

- Changes in import duties could inflate expenses.

- The EU market is crucial, though exposure is considered low.

- Monitoring is vital to mitigate any impacts.

Economic factors substantially impact OneSpan. Inflation and recession fears affect customer spending, potentially reducing demand for security solutions. Currency fluctuations, notably the strong U.S. dollar, can hinder international sales and increase expenses. As of late 2024, digital signature market was valued at $6.8B.

| Economic Factor | Impact on OneSpan | 2024/2025 Data Point |

|---|---|---|

| Inflation | Reduced customer spending, lower demand | Global inflation rates around 3-4% in 2024 |

| Currency Fluctuations | Affect international sales & costs | Q4 2023 currency movements reduced revenue by $0.5M |

| Market Competition | Potential pricing pressures | Digital signature market at $6.8B (2024), growth expected |

Sociological factors

The rise in digital adoption among both individuals and businesses fuels the demand for secure digital identities and transactions. Public trust in digital interactions is key, with 79% of consumers globally concerned about online fraud in 2024. OneSpan’s solutions bolster trust by preventing fraud and securing agreements. This is essential as digital commerce continues to grow, with an estimated 2.6 billion digital buyers worldwide in 2025.

Customer expectations for seamless, secure digital experiences are always changing. OneSpan must adapt its solutions to meet these evolving needs. This includes balancing strong security with user-friendly interfaces to boost customer satisfaction and adoption. In 2024, 78% of consumers prioritized ease of use in digital interactions.

Growing public awareness of cybersecurity risks fuels demand for strong security solutions. This trend, intensified by high-profile data breaches, pushes both individuals and organizations to seek better protection. In 2024, global cybersecurity spending reached $214 billion, a 10% increase from the previous year, highlighting this growing concern. OneSpan benefits from this increased focus, as businesses prioritize secure transactions and data protection.

Remote Work Trends

The rise of remote and hybrid work models significantly shapes business operations. This shift increases the importance of secure digital workflows, which boosts the necessity for robust identity verification. OneSpan benefits from this trend, as its solutions directly address these evolving needs.

- Remote work increased from 22% in 2022 to 30% in 2024.

- The global market for digital identity solutions is forecast to reach $30 billion by 2025.

Demographic Shifts and Digital Inclusion

Demographic shifts and digital inclusion initiatives significantly impact digital security solutions. OneSpan must adapt to accommodate diverse user needs, ensuring accessibility and usability across all demographics. For instance, the global elderly population, a growing demographic, requires user-friendly interfaces. According to the UN, the number of individuals aged 65 and over is projected to reach 1.6 billion by 2050. This necessitates inclusive design considerations.

- User-friendly interfaces are essential for digital inclusion.

- Accessibility features cater to diverse user abilities.

- Security protocols must protect all user groups.

- OneSpan needs to adapt to demographic changes.

Societal trends like increasing digital dependence and rising fraud concerns drive demand for secure solutions. Remote work models boost the need for digital workflows, creating opportunities for identity verification services. Adaptability to demographic changes, ensuring inclusivity, is crucial for digital solutions.

| Factor | Impact | Data |

|---|---|---|

| Digital Trust | Critical for adoption and user confidence | 79% of global consumers concerned about online fraud in 2024. |

| Remote Work | Drives demand for digital identity | 30% of the workforce works remotely in 2024, up from 22% in 2022. |

| Demographics | Inclusive design is a must | Digital identity market projected to be $30B by 2025 |

Technological factors

The cybersecurity field sees constant change, with new threats and defenses emerging regularly. OneSpan needs to innovate its solutions to beat cyber threats. In 2024, global cybersecurity spending is projected to reach $214 billion. This growth highlights the need for advanced security.

The shift to cloud-based solutions is a major technological factor for OneSpan. This trend influences product development and delivery. The company is moving to a cloud-focused tech stack. This enables more flexible and scalable solutions. In 2024, cloud computing spending is projected to reach $678.8 billion.

The rise of biometric technologies offers OneSpan opportunities to enhance its identity verification solutions. Globally, the biometric system market is projected to reach $86.6 billion by 2025. OneSpan must navigate privacy and security challenges. Data breaches involving biometric data increased by 28% in 2024. Integrating robust security is crucial.

Integration with Other Platforms

OneSpan's success hinges on how well its tech integrates with existing platforms. This is vital for user adoption, like with banking systems. Partnerships are key; for instance, OneSpan partners with Microsoft. In 2024, OneSpan's revenue was $268.2 million, showing the importance of these integrations.

- Successful integrations boost user adoption.

- Partnerships expand market reach.

- Revenue reflects integration impact.

Artificial Intelligence and Machine Learning

OneSpan can significantly boost its anti-fraud solutions by integrating Artificial Intelligence (AI) and Machine Learning (ML). These technologies enhance fraud detection and behavioral biometrics. In 2024, the global AI in cybersecurity market was valued at $22.5 billion, and is projected to reach $75.5 billion by 2029. Investing in AI/ML improves predictive capabilities and reduces false positives.

- AI/ML can boost fraud detection.

- Market growth is substantial.

- Enhances predictive capabilities.

Technological factors significantly shape OneSpan's trajectory. Cloud computing, with a 2024 spend of $678.8 billion, and biometric technologies ($86.6B market by 2025) offer critical growth avenues.

AI and ML integration, especially in fraud detection (global AI in cybersecurity at $22.5B in 2024), drive predictive accuracy. Successful technology integration, as shown by OneSpan's $268.2M revenue in 2024, boosts adoption.

| Tech Factor | Impact on OneSpan | Data |

|---|---|---|

| Cloud Computing | Influences product delivery. | $678.8B spending in 2024. |

| Biometrics | Enhances identity verification. | $86.6B market by 2025. |

| AI/ML | Improves fraud detection. | $22.5B in 2024. |

Legal factors

OneSpan must adhere to strict data protection laws like GDPR and CCPA, impacting how it handles customer data. These regulations necessitate strong data security and clear data handling. In 2024, data breaches cost companies an average of $4.45 million, highlighting the importance of compliance.

OneSpan operates within the highly regulated financial services sector, where compliance is paramount. This industry faces strict rules on security and digital transactions. OneSpan's offerings must align with these mandates to function within financial institutions. The global fintech market, where OneSpan is a player, is projected to reach $324 billion by 2026.

The legal landscape for electronic signatures and digital notarization is complex, varying significantly across different regions. OneSpan's digital agreement solutions are designed to comply with these varied legal standards to ensure their validity. For example, in 2024, the global e-signature market was valued at $5.5 billion and is projected to reach $25.5 billion by 2032.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

OneSpan's identity verification solutions are deeply intertwined with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations, crucial in the financial sector, mandate that businesses verify customer identities to prevent financial crimes. OneSpan's products directly assist organizations in complying with these rules, offering secure and efficient verification processes. The global AML market is projected to reach $16.4 billion by 2025.

- KYC compliance is essential for financial institutions.

- OneSpan offers solutions to meet regulatory demands.

- The AML market is growing rapidly.

Government Mandates for Strong Authentication

Government mandates significantly influence OneSpan's market position. Regulations like the EU's DORA, which mandates robust authentication, directly fuel the need for OneSpan's security solutions. This drives adoption and revenue growth for OneSpan, especially in regulated industries.

- DORA's impact is projected to affect thousands of financial institutions.

- OneSpan's revenue in 2024 reached $256.7 million.

- The global digital identity market is estimated to reach $80 billion by 2025.

OneSpan faces strict legal demands in data protection, financial sector regulations, and e-signature validity. Compliance with laws like GDPR and AML is critical for its operations, safeguarding customer data and preventing financial crimes. The e-signature market, valued at $5.5B in 2024, highlights the importance of legally compliant solutions.

| Legal Aspect | Impact on OneSpan | Data Point (2024/2025) |

|---|---|---|

| Data Protection | Compliance, security | Data breach cost: $4.45M (2024) |

| Financial Regulations | Compliance, market access | AML market forecast: $16.4B (2025) |

| e-Signatures | Legality, market demand | e-Signature market: $5.5B (2024) |

Environmental factors

OneSpan's hardware production, though decreasing, involves environmental impacts. Manufacturing processes, energy use, and electronic waste contribute to its footprint. Addressing these concerns is vital for sustainability. The global e-waste volume reached 62 million metric tons in 2022, highlighting the scale of the challenge.

OneSpan, as a cloud solutions provider, uses energy-intensive data centers. These centers significantly impact the environment. In 2023, data centers used approximately 2% of global electricity. The industry is shifting to more energy-efficient practices to reduce its footprint.

OneSpan's digital solutions cut paper use via electronic workflows and signatures. This supports environmental goals. The global e-signature market is expected to reach $55.7 billion by 2029, showing a shift. The adoption of digital agreements reduces waste. This is essential for sustainability.

Climate Change and Business Continuity

Climate change poses an indirect risk to OneSpan, primarily through its potential impact on business continuity. Extreme weather events, intensified by climate change, could disrupt operations for OneSpan, its clients, or its partners. Business continuity plans should account for these risks. For 2024, the National Oceanic and Atmospheric Administration (NOAA) reported over $1 billion in damages from severe weather events.

- Business interruption insurance claims increased by 20% in 2024 due to climate-related events.

- OneSpan's supply chain could be affected by disruptions in regions prone to extreme weather.

- Investment in climate resilience measures is becoming increasingly important for technology firms.

Customer and Investor Expectations Regarding ESG

Customer and investor focus on Environmental, Social, and Governance (ESG) criteria is growing. OneSpan's ESG efforts, even if small now, affect its image with clients and investors. A 2024 study showed ESG assets hit $40.5 trillion. ESG funds saw $120 billion inflows in Q1 2024. This matters for OneSpan.

- ESG considerations are increasingly important for investment.

- ESG performance can influence brand perception and valuation.

- Stakeholders expect transparency and commitment to ESG.

OneSpan faces environmental issues from hardware and data center operations, contributing to e-waste and energy use. Digital solutions mitigate paper use. Climate change and severe weather can indirectly impact business continuity, with disruptions affecting supply chains and leading to higher insurance claims. Growing ESG demands require OneSpan's attention to sustainability.

| Environmental Aspect | Impact | 2024 Data/Projections |

|---|---|---|

| Hardware & E-waste | Manufacturing impact | E-waste grew to over 62M metric tons (2022). |

| Data Centers | High energy use | Data centers used ~2% global electricity (2023). |

| Climate Risks | Business disruptions | $1B+ damages from U.S. severe weather events (2024). Business interruption insurance claims rose 20% (2024) due to weather-related events. |

PESTLE Analysis Data Sources

The OneSpan PESTLE Analysis integrates information from reputable financial reports, technology forecasts, governmental regulations, and market analysis.